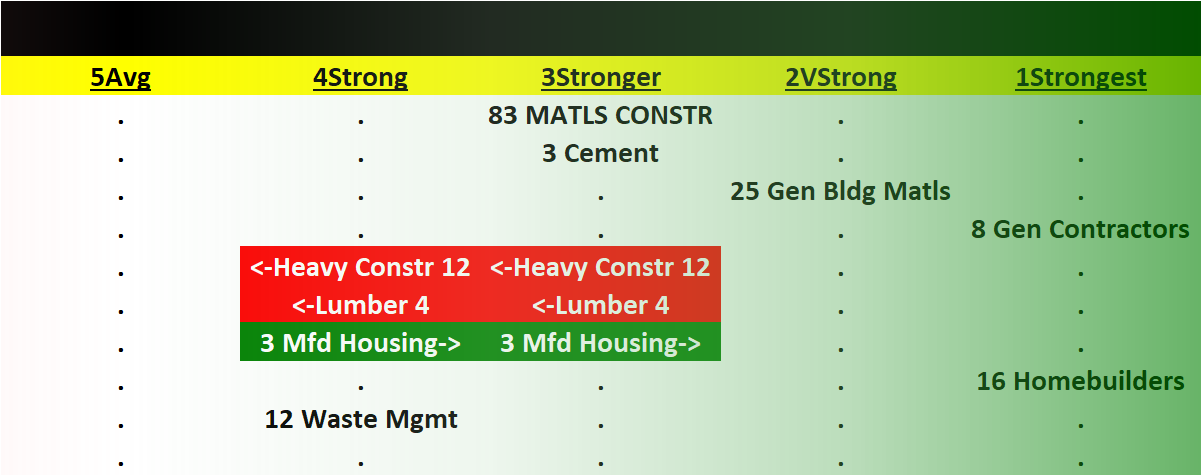

Materials/Construction incl. Homebuilders 2023-08-08: Unchanged at "Stronger" strength rating (3rd strongest of 9 levels), previous move was up

Previous review of homebuilders is here.

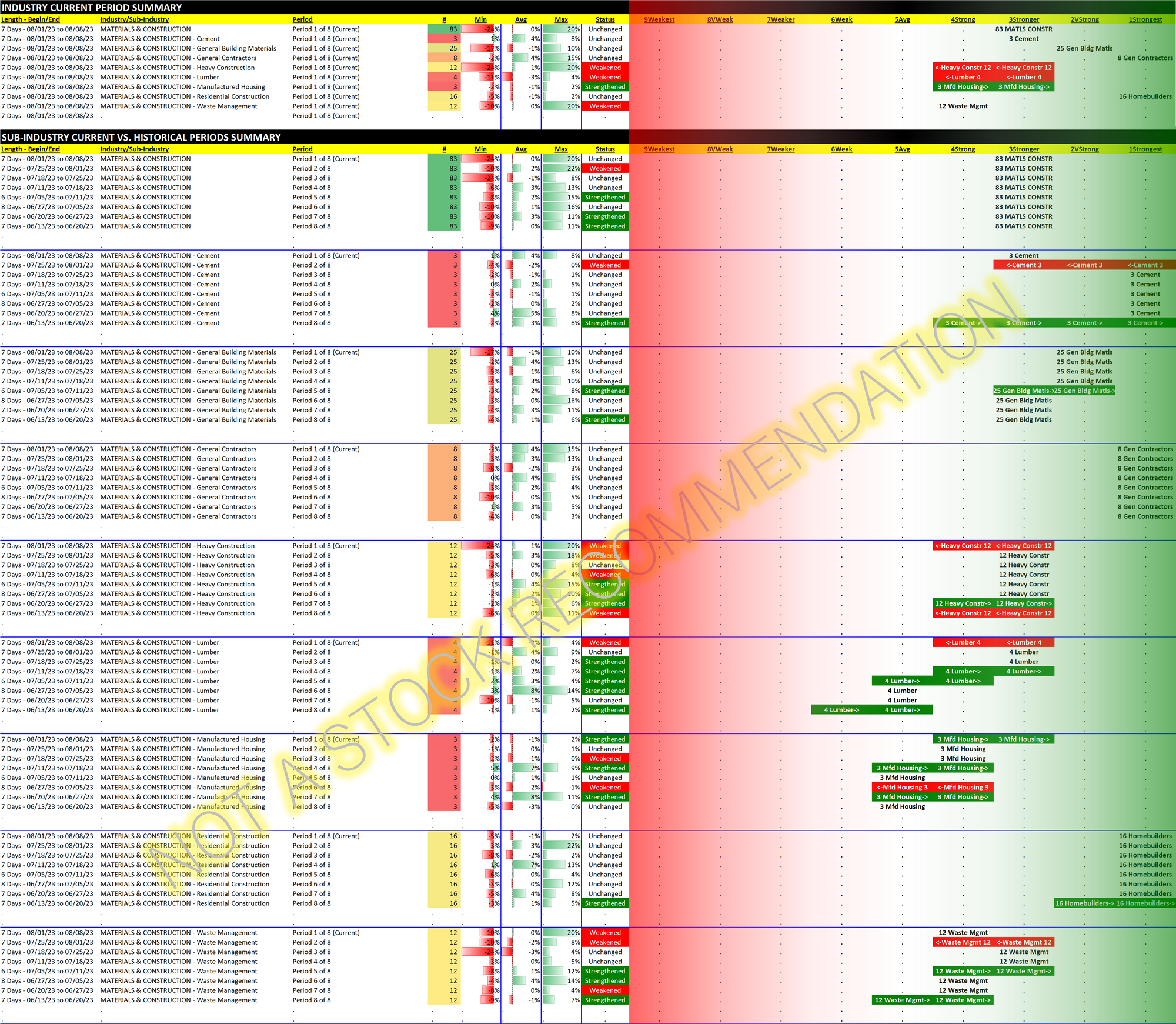

The industry has been unchanged at Stronger for the past 8 weeks. General Contractors has also been rated Strongest for 8 straight weeks.

The Residential Construction, or Homebuilders, sub-industry has been rated Strongest (the highest strength level) for 7 straight weeks, after rising to this level 8 weeks ago. All 16 of the underlying stocks are rated Strongest.

Does this mean it is time for them to reverse course, or can they keep going? Certainly both are possibilities. As we wait to find out, remember the phrase "the market can stay irrational for longer than you can remain solvent."

In my last review from July 25, 2023 I noted a then-recent headline "Finally Time To Short The Homebuilders Because It Doesn't Get Any Better." Since then, 6 of the 16 homebuilder stocks rose from 2% to 15% and the remaining 10 fell, recording changes from -0.2% (basically flat) to -6%.

The +15%er was BZH/Beazer Homes which jumped 28% July 28. It also had jumped 11% June 28. And 24% April 28. (May 28 was not a trading day. Wonder what is on tap for August 28, likely a dead-as-a-doornail market day overall as the last summer Monday?)

Note that Beazer has increased 211% since its September 30, 2022 bottom and year-to-date 2023 it is up 153%. Before its July 28 28% leap Beazer was up 187% from its 9/30/22 bottom. Is this a rational market?

Leaders and Laggards

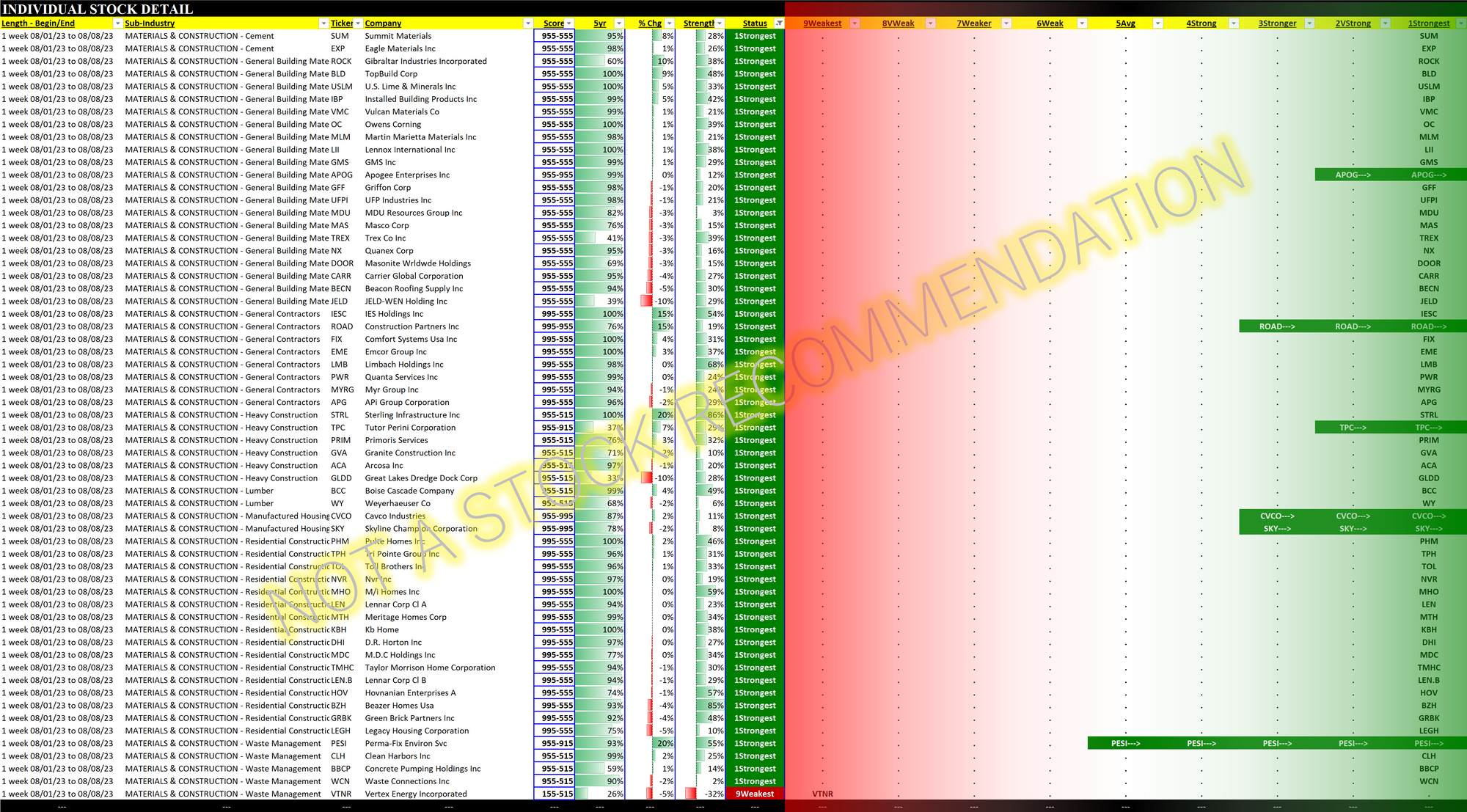

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.

Four weeks ago, there were no "Weakest" (Laggard) stocks in the Materials and Construction industry. Two weeks ago there was one, and this remains the case.