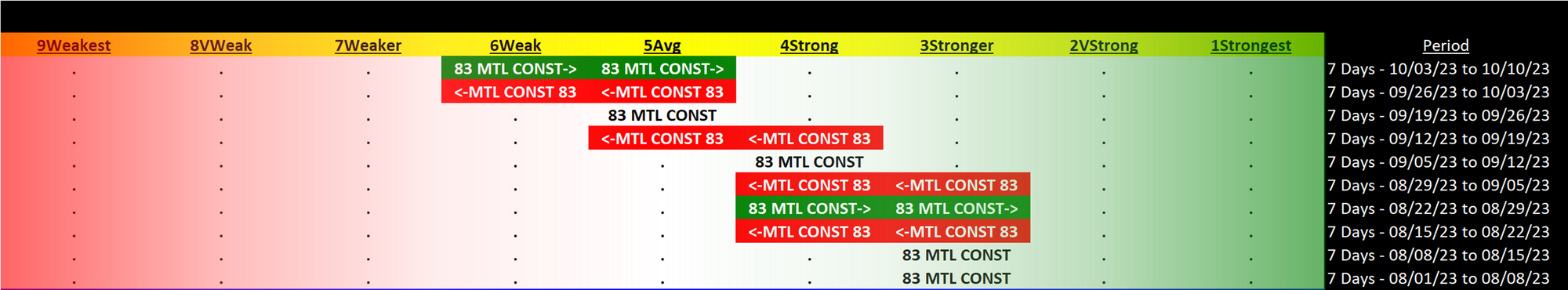

Materials & Construction 2023-10-10: UP +1 to AVERAGE strength rating (5th strongest of 9 levels), previous move was DOWN

TABLE OF CONTENTS

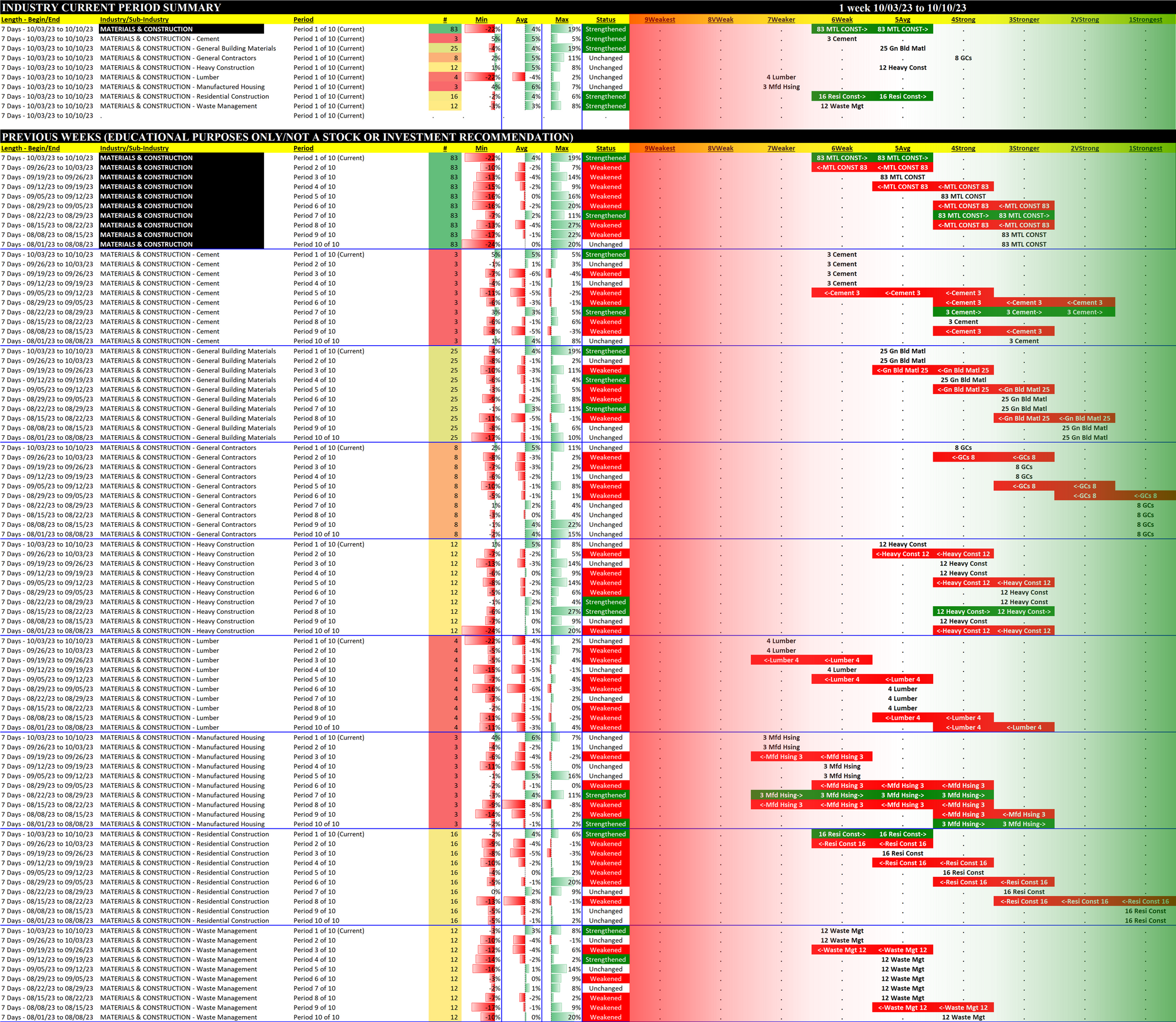

- INDUSTRY OVERVIEW

1A. Performance

1B. Background - SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

2B. Sub-Industries 10-Week Strengthening Analysis

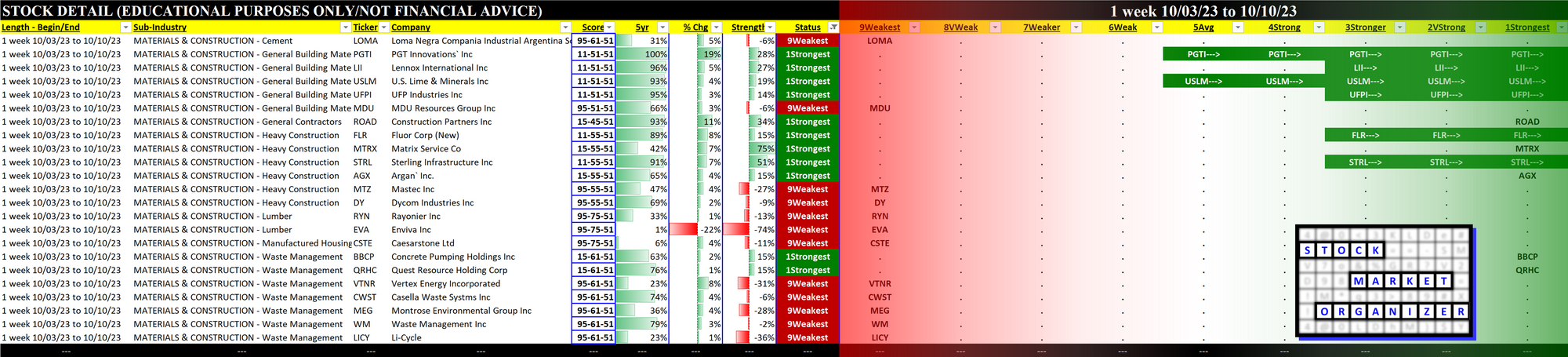

2C. Stocks 1 Week Strongest and Weakest - STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

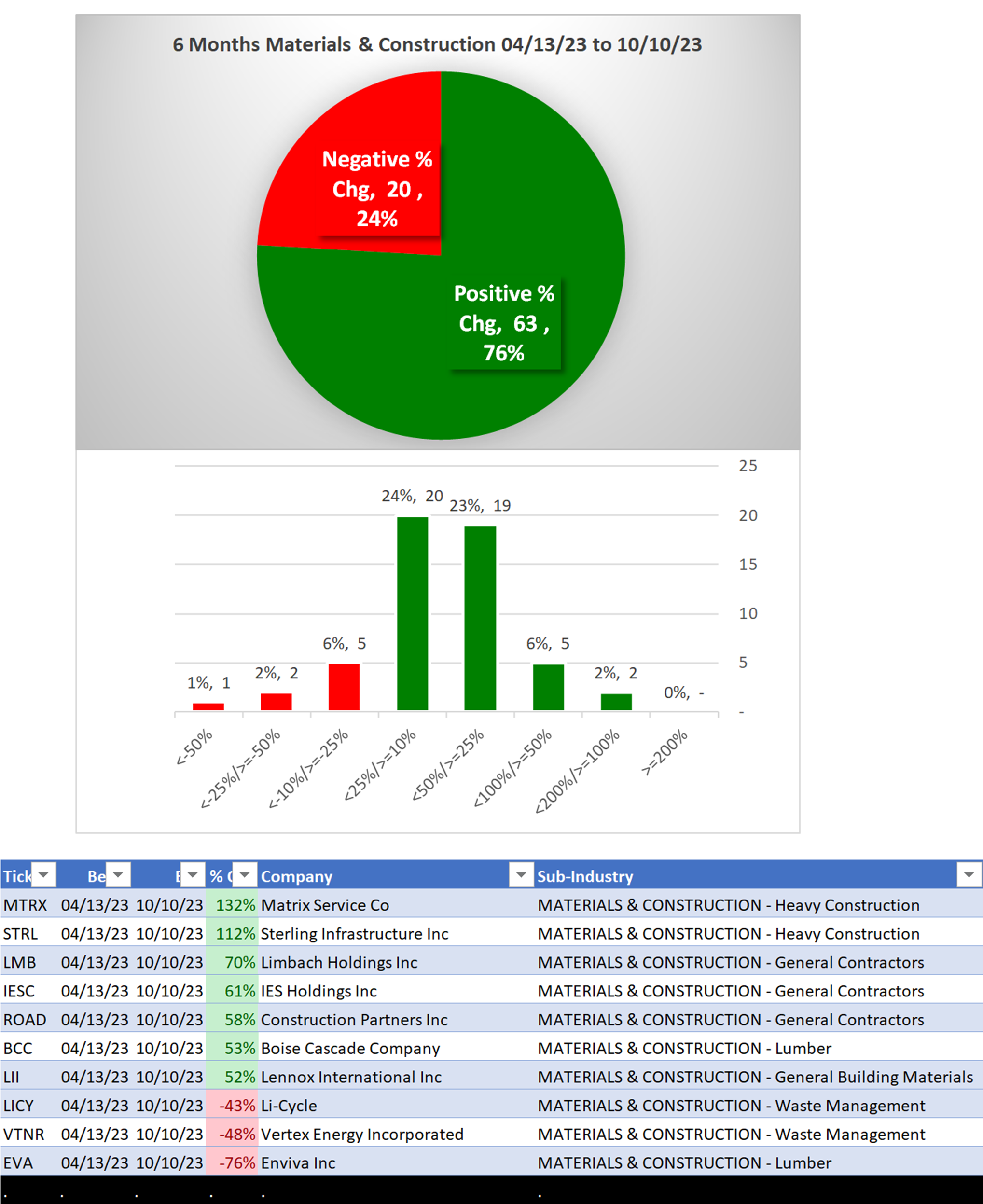

3A. Lookback 6 Months

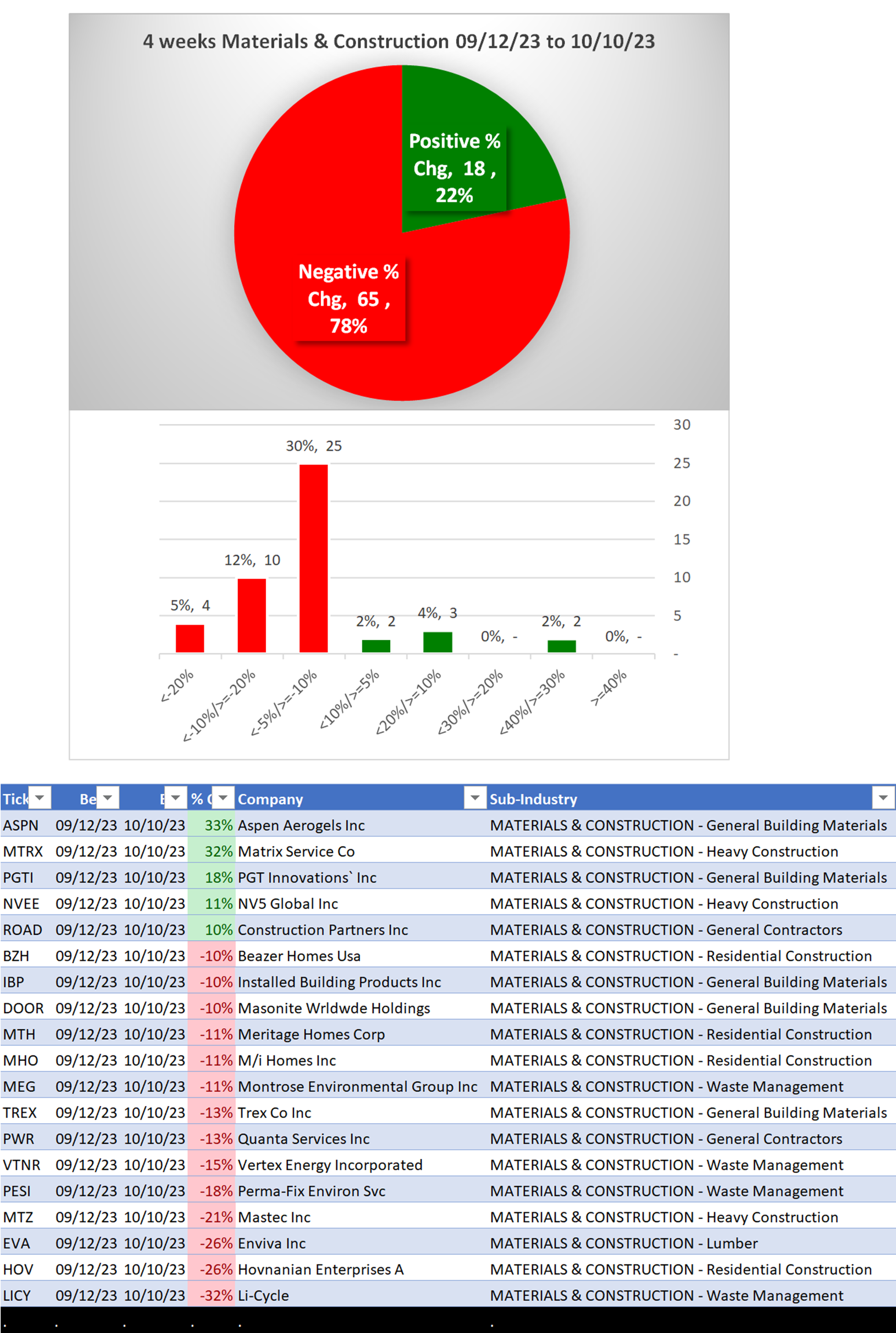

3B. Lookback 4 weeks

3C. Lookback 1 Week

1. INDUSTRY OVERVIEW

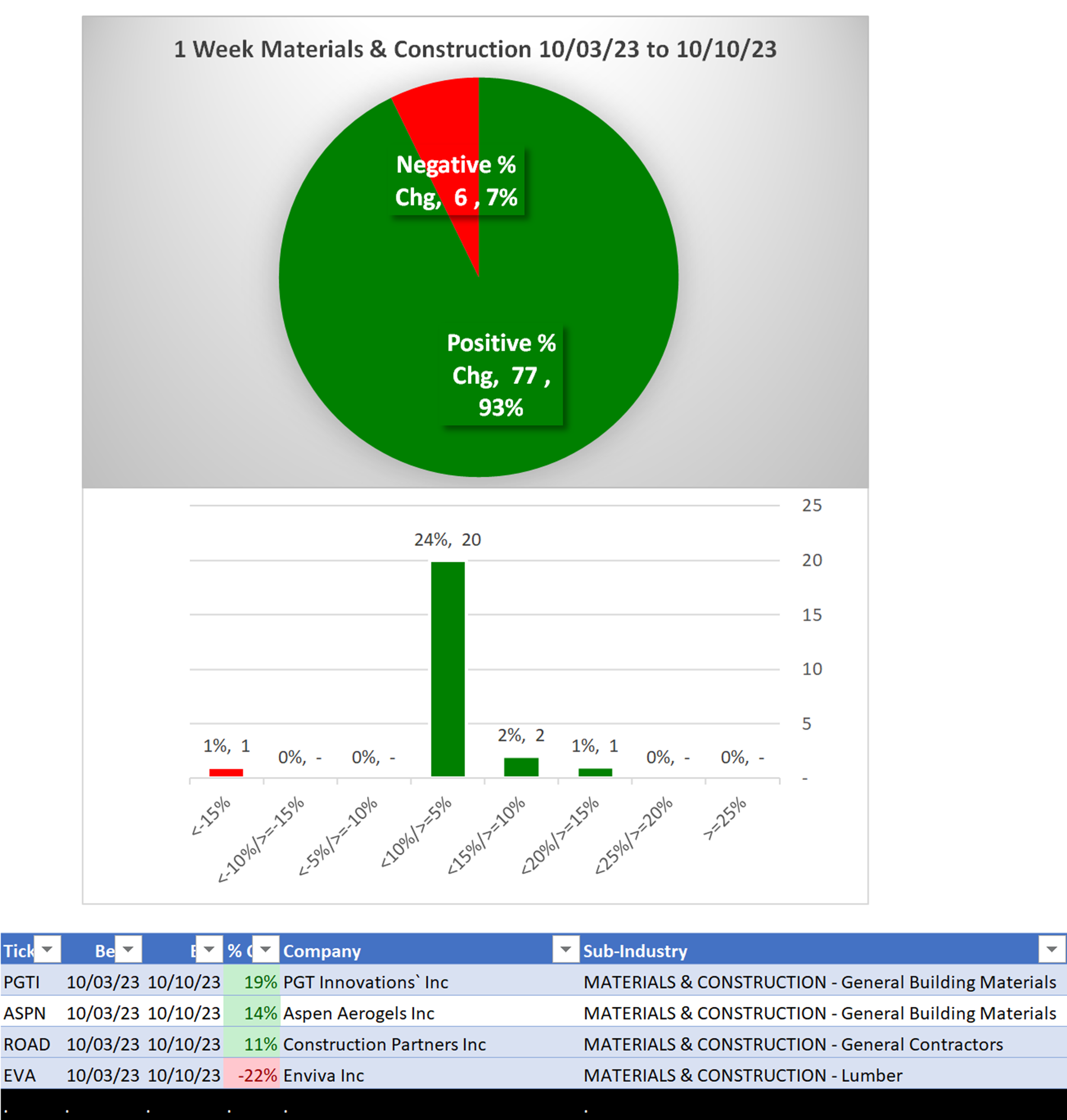

1A. Performance

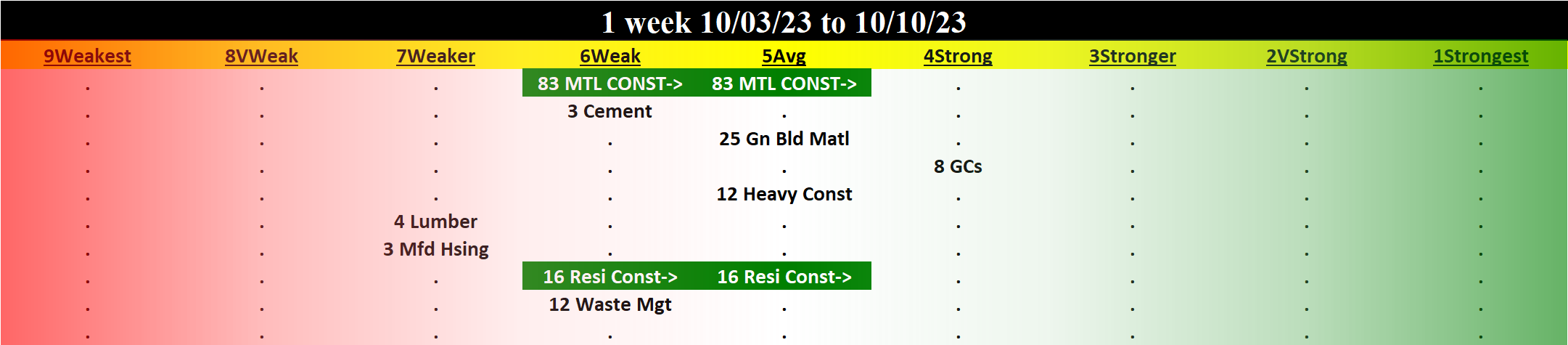

Past 10 Weeks Strengthening/Weakening week-by-week, per the following chart:

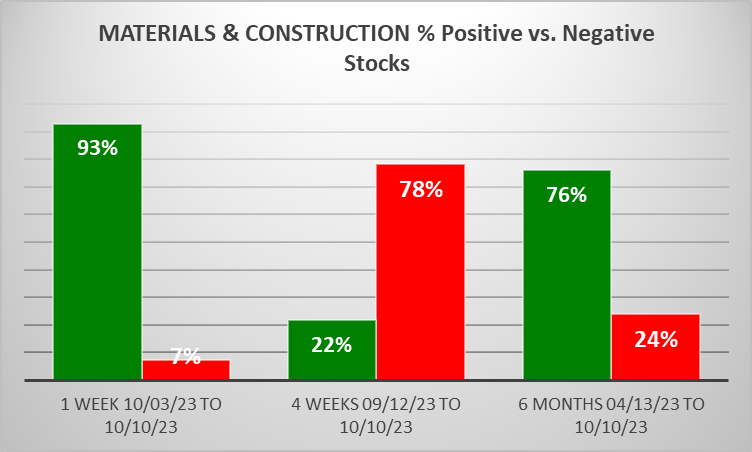

STRENGTHENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is HIGHER than both 4 weeks and 6 Months, per the following chart:

1B. Background

Largest of 8 sub-industries (83 stocks, average 10):

- General Building Materials (25 stocks)

- Residential Construction (16 stocks)

- Heavy Construction (12 stocks)

- Waste Management (12 stocks)

Top 10 by Market Capitalization:

WM/Waste Management Inc, CARR/Carrier Global Corporation, RSG/Republic Services Inc, DHI/D.R. Horton Inc, WCN/Waste Connections Inc, LEN/Lennar Corp Cl A, FAST/Fastenal Company, PWR/Quanta Services Inc, VMC/Vulcan Materials Co, MLM/Martin Marietta Materials Inc

2. SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

Strengthened: 1/8 sub-industries

Weakened: 0/8 sub-industries

STRONGEST at Strong rating/4th strongest of 9 levels:

- General Contractors (8 stocks)

WEAKEST at Weaker rating/7th strongest of 9 levels:

- Lumber (4 stocks)

- Manufactured Housing (3 stocks)

2B. Sub-Industries 10-Week Strengthening Analysis

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

2C. Stocks 1 Week Strongest and Weakest

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest have the least amount of overhead supply to dampen breakouts while

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

3. STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week