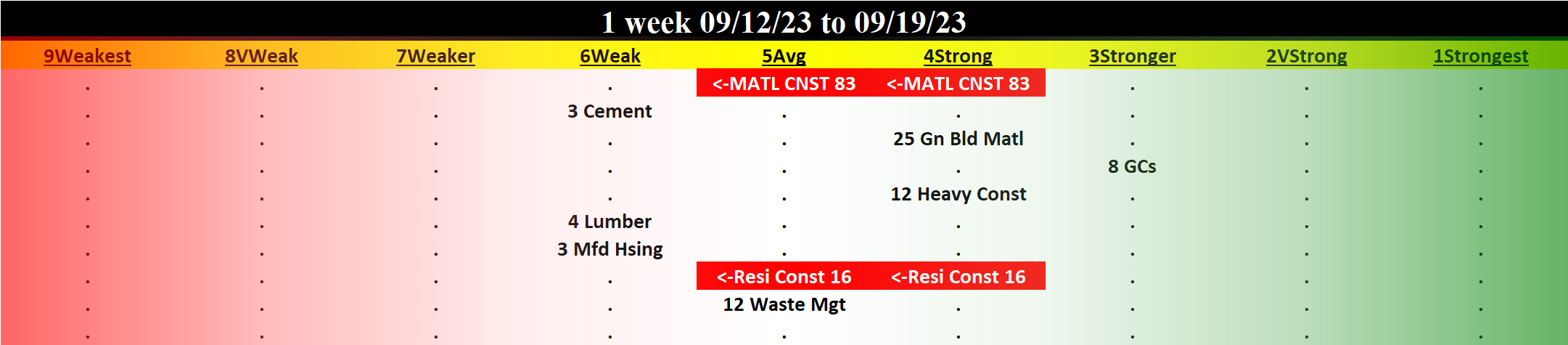

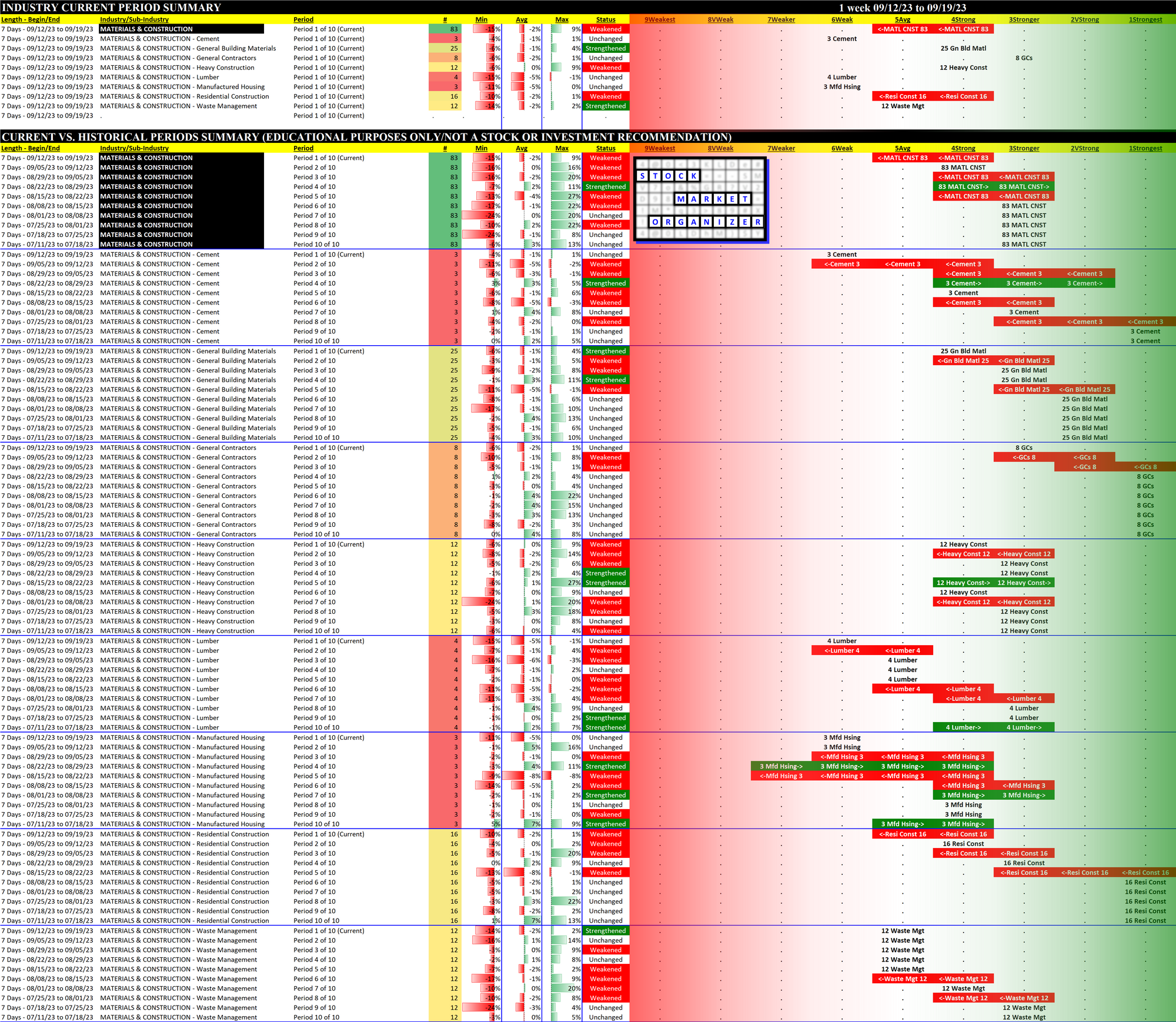

Materials & Construction 2023-09-19: DOWN -1 to AVERAGE strength rating (5th strongest of 9 levels), previous move was also DOWN

SUMMARY

Performance

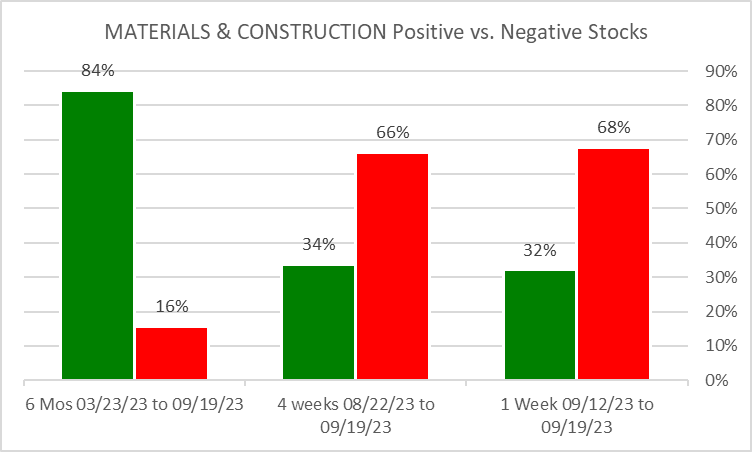

Bottom Line: weakened 2 strength levels in 3 weeks

Context:

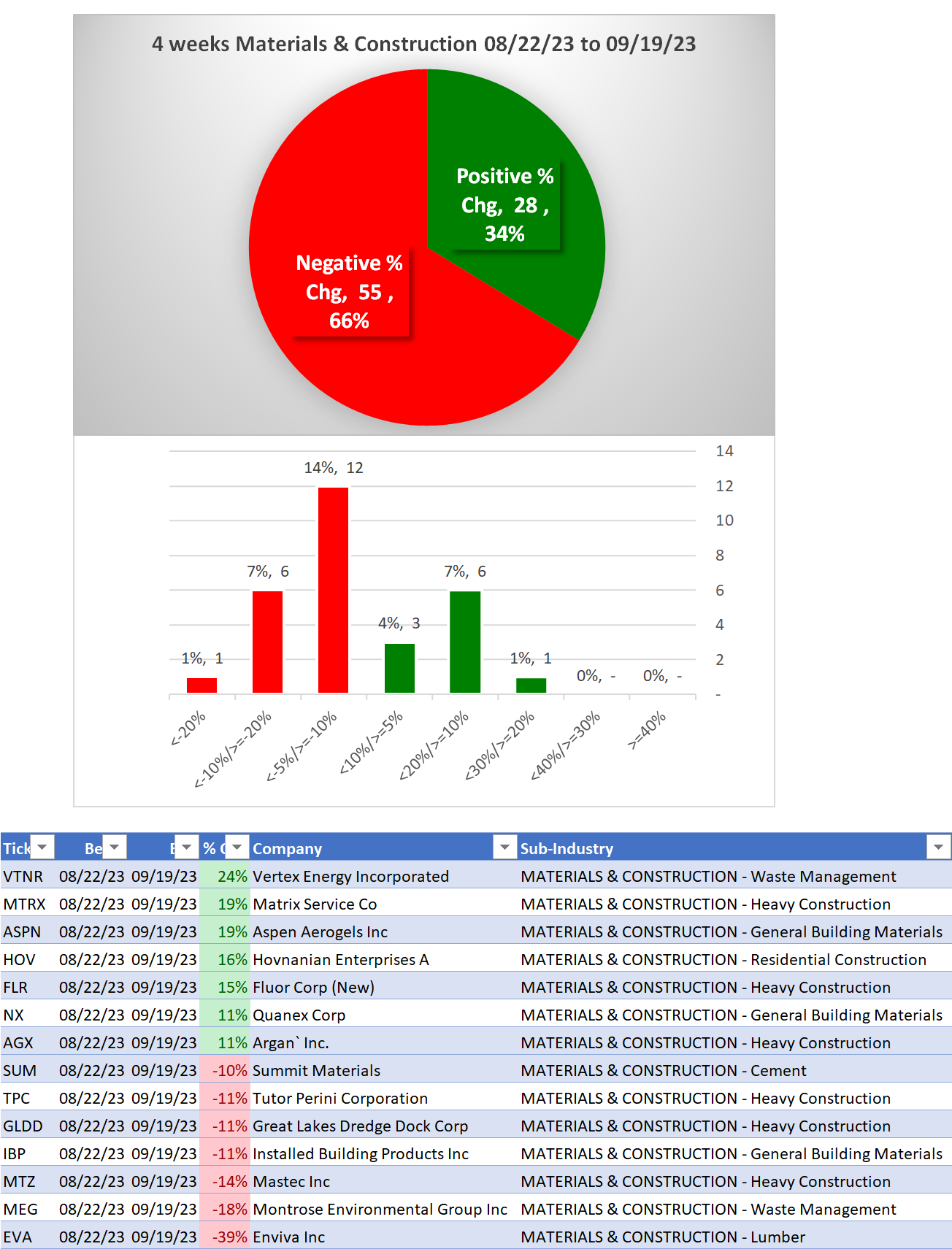

- weakening short/mid-term vs. longer-term.

- Positive stocks 1 week/4 weeks < 50% the 6 month total.

Other Notes:

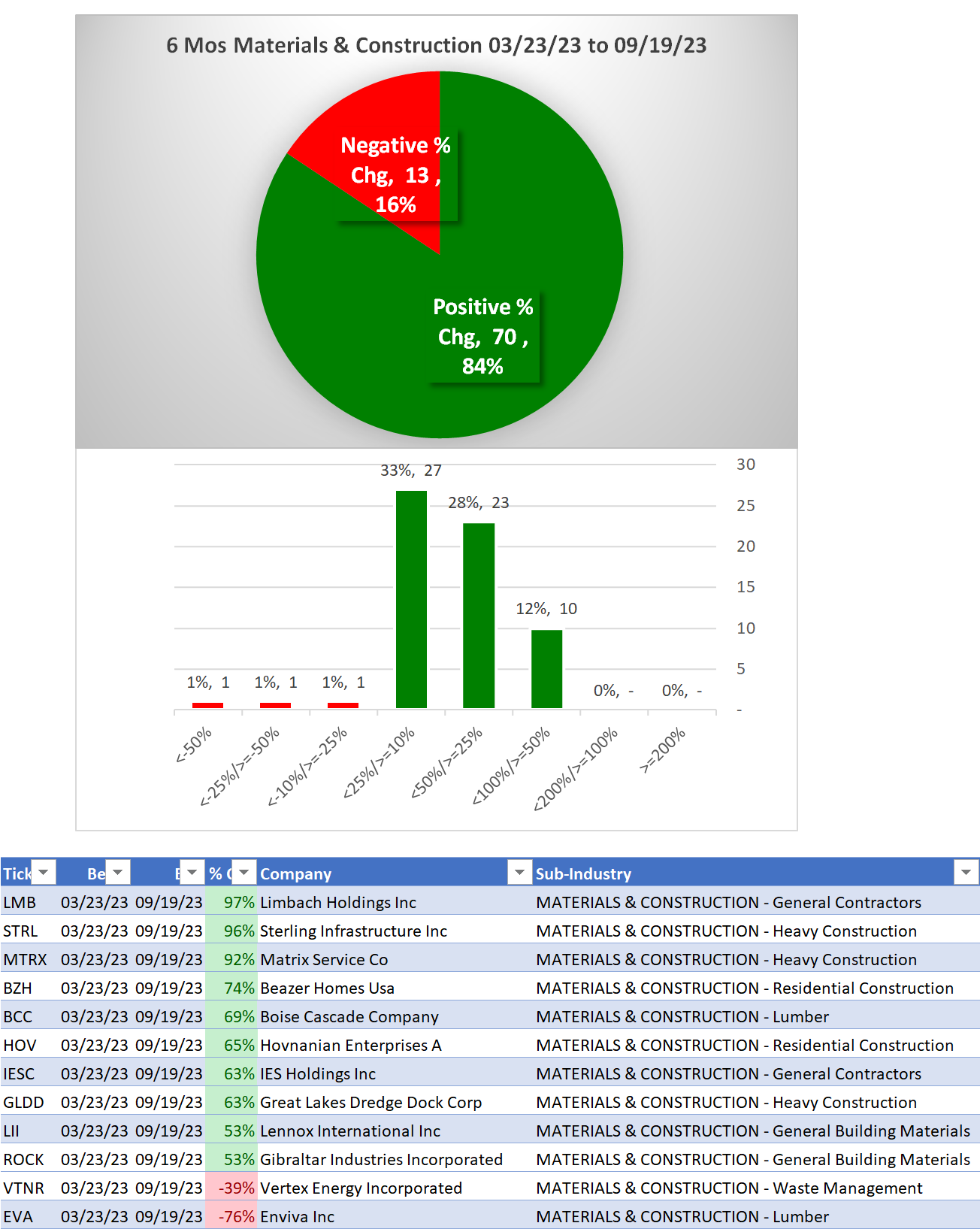

6 Months

LMB/Limbach Holdings Inc (General Contractors) +97%

STRL/Sterling Infrastructure Inc (Heavy Construction) +96%

MTRX/Matrix Service Co (Heavy Construction) +92%

VTNR/Vertex Energy Incorporated (Waste Management) -39%

EVA/Enviva Inc (Lumber) -76%

4 Weeks

VTNR/Vertex Energy Incorporated (Waste Management) +24%

MTRX/Matrix Service Co (Heavy Construction) +19%

ASPN/Aspen Aerogels Inc (General Building Materials) +19%

HOV/Hovnanian Enterprises A (Residential Construction) +16%

MEG/Montrose Environmental Group Inc (Waste Management) -18%

EVA/Enviva Inc (Lumber) -39%

1 Week

EVA/Enviva Inc (Lumber) -15%

Background

Largest/most material of 8 sub-industries (83 stocks total, average 10 stocks/sub-industry):

25 stocks General Building Materials

16 stocks Residential Construction

12 stocks Heavy Construction

12 stocks Waste Management

10 Biggest Market Cap stocks: WM, CARR, RSG, DHI, WCN, LEN, FAST, PWR, VMC, MLM

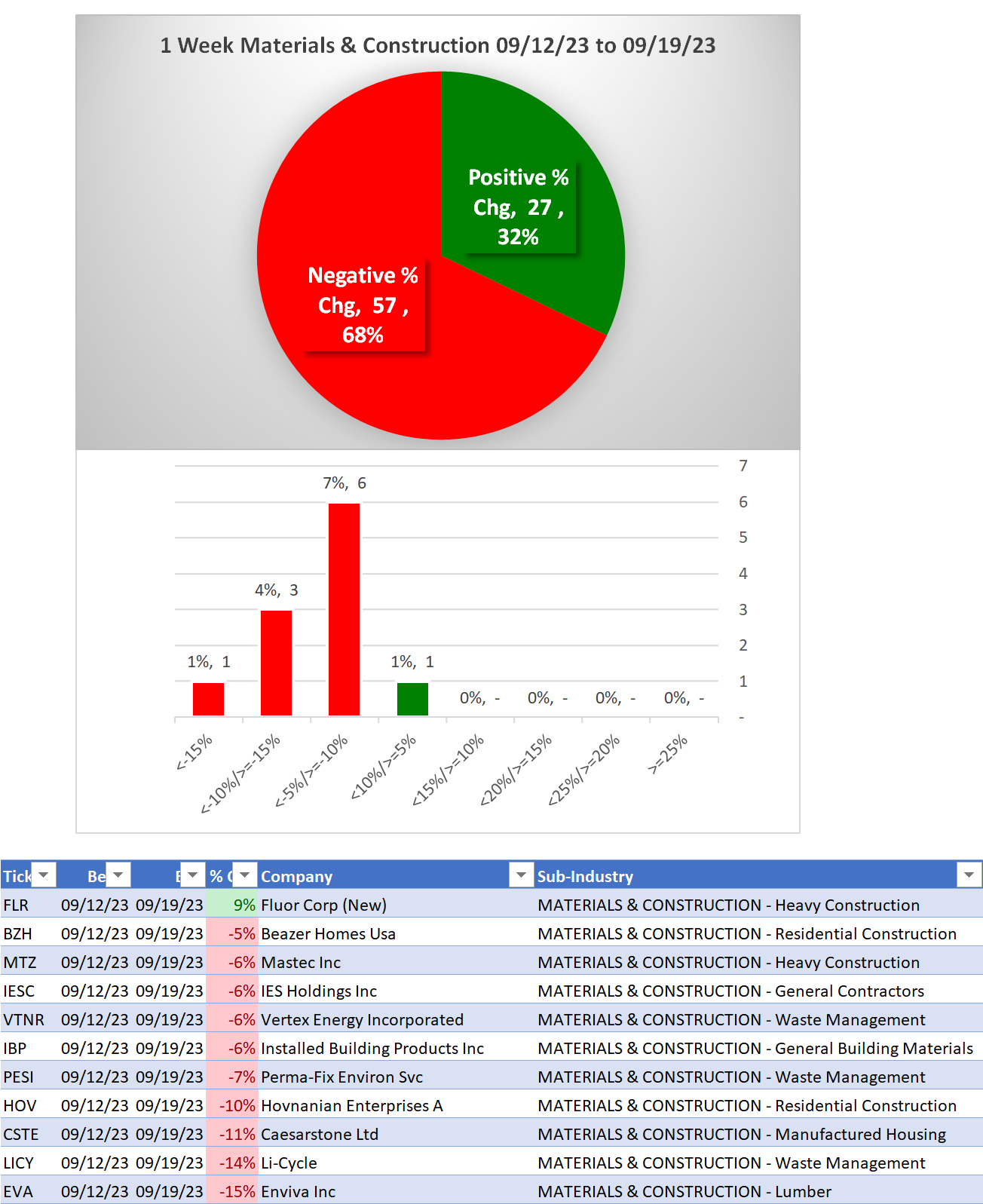

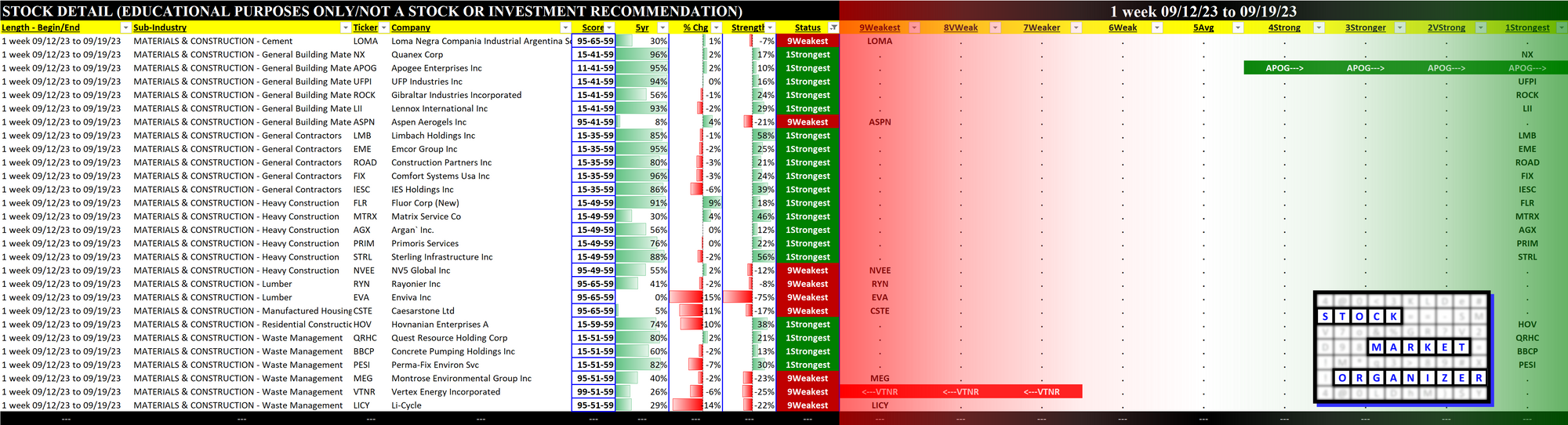

DETAIL: 1 Week Performance Review

Status

Strengthened: 0/8 sub-industries

Weakened: 1/8 sub-industries

Strongest at Stronger rating/3rd strongest of 9 levels:

8 stocks General Contractors

Weakest at Weak rating/6th strongest of 9 levels:

3 stocks Cement

4 stocks Lumber

3 stocks Manufactured Housing

Detail Charts: Sub-Industry and Stock

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

DETAIL: Lookbacks 6 Mos vs. 4 weeks vs. 1 Week

6 Mos Lookback

4 weeks Lookback

1 Week Lookback