Market Rule: Believe the Market, not the Marketers (Value vs. Growth, a distinction without merit)

Especially when the market is in a dramatic downturn - the kind which first leads to widespread portfolio devastation and then to generational buying opportunities. Think back to February 19 through March 23, 2020 - practically everything imploded. Many by catastrophically large percentages (such as cruise lines).

C'mon - do you really think there is a material difference between returns for value and growth stocks? Or might there be just a little marketing spin there to add enough complication and convince you it is more complicated than it looks?

For my take, just look at the title of this post.

It does not have to be so complicated

Focus on strengthening and weakening (if you can). If you can't, visit this site.

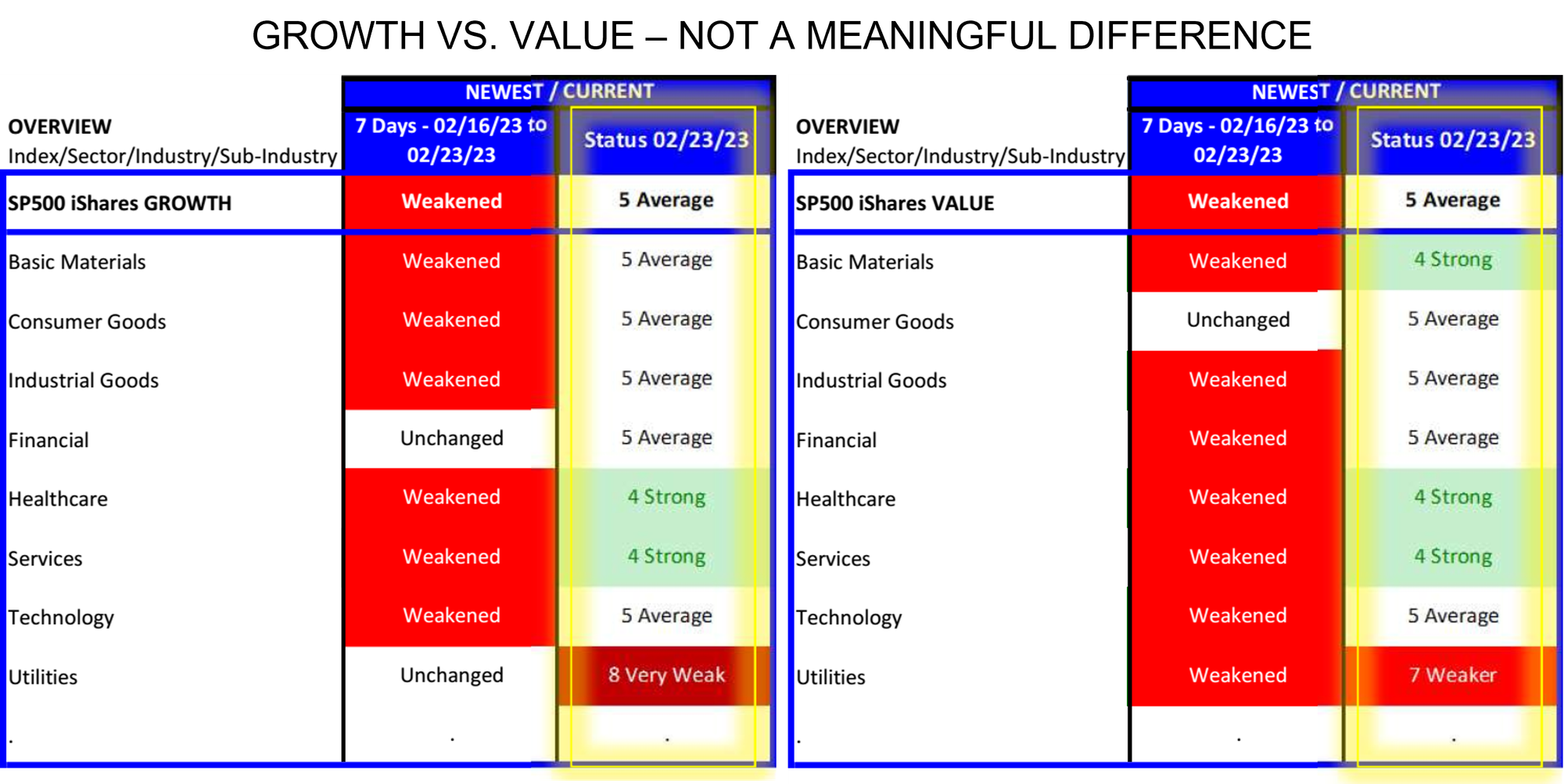

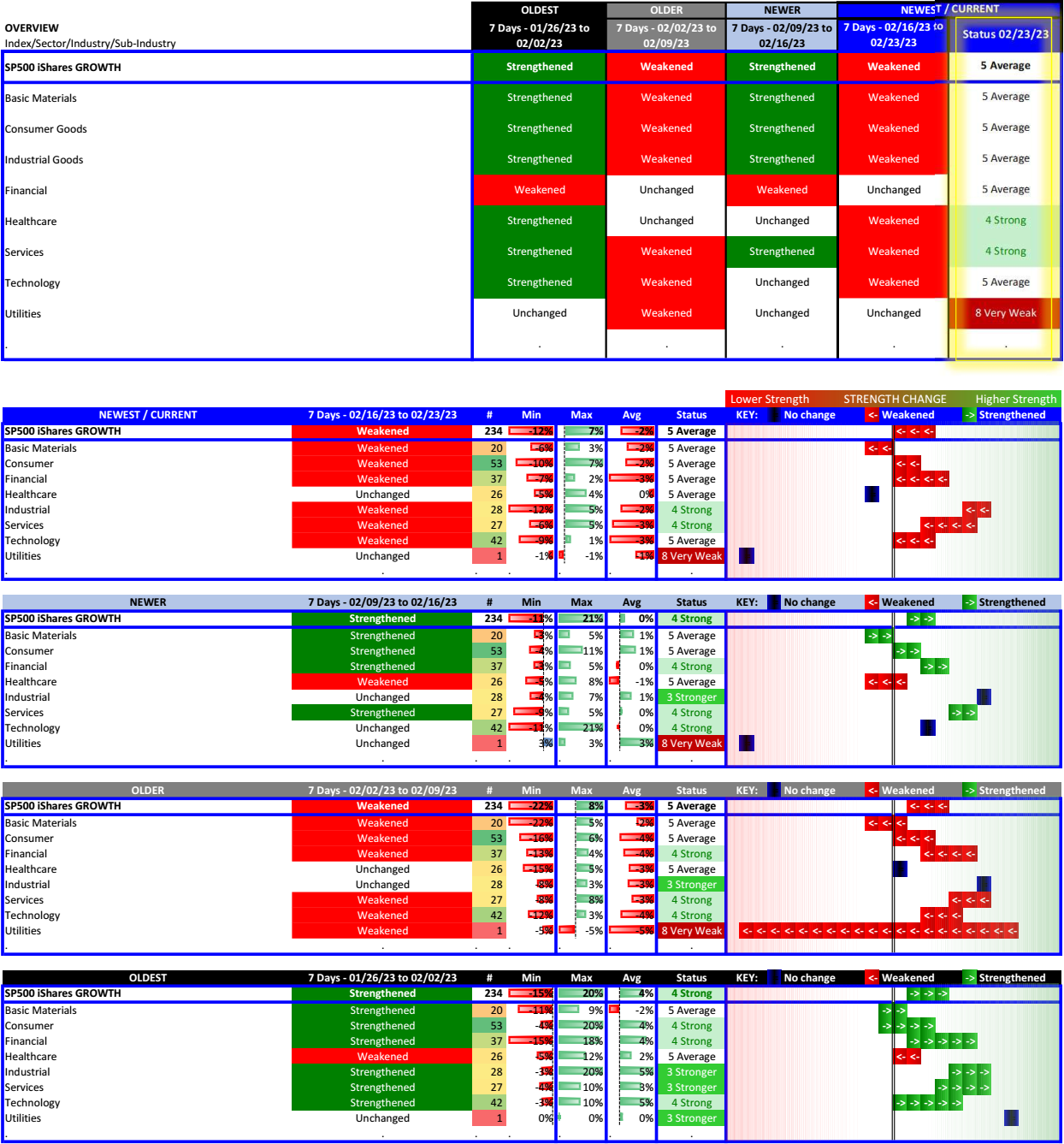

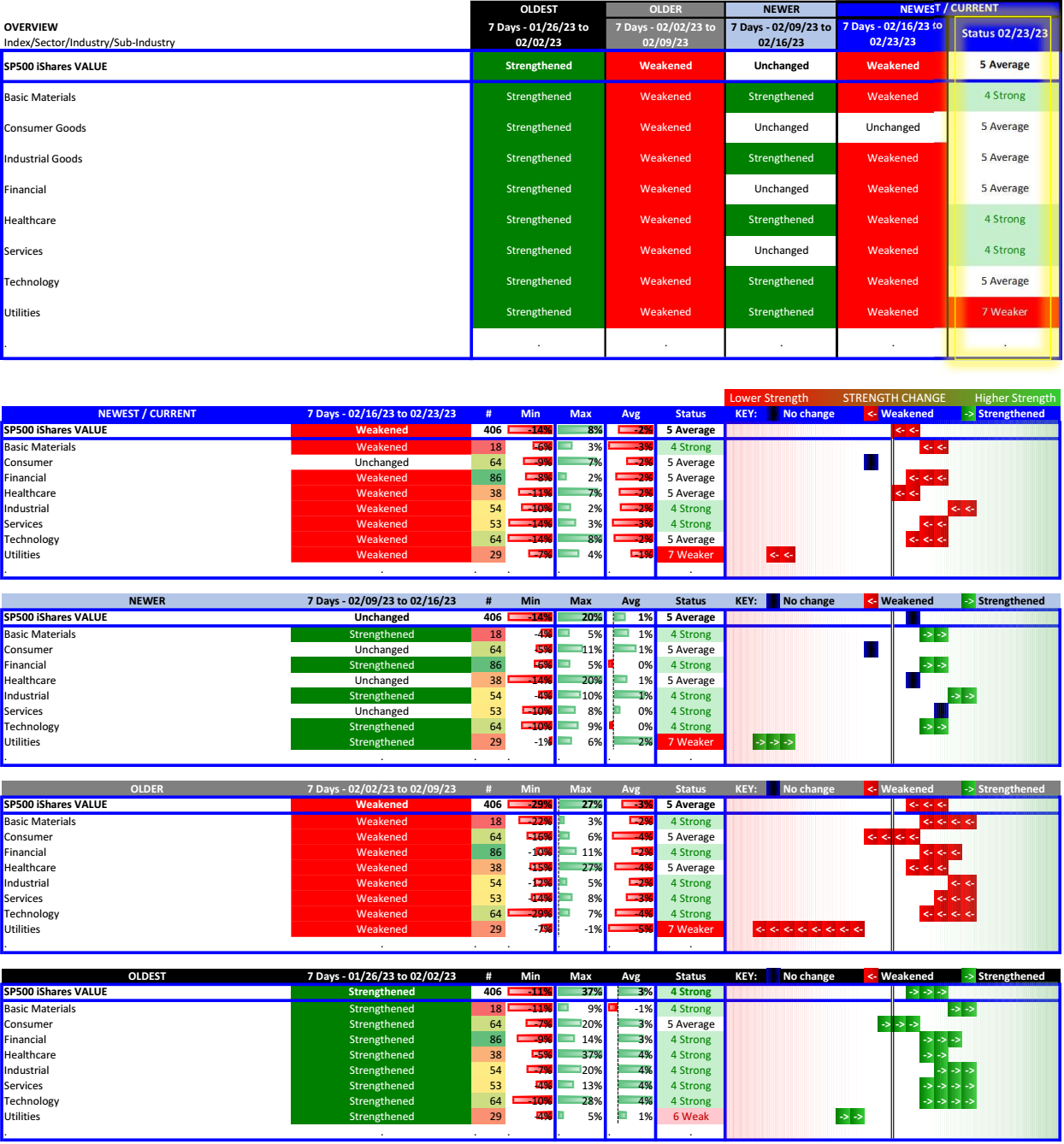

Take a look at the Growth and Value detail below over the past four weeks. These are based on analyses of the iShares S&P500 Growth ETF (ticker IVW) and iShares S&P500 Value ETF (ticker IVE). These reflect a stock-by-stock strengthening and weakening analysis aggregated into major sectors.

First, Growth:

Second, Value:

Clear conclusion: there aren't material differences between the two. The fingerprints match. Stock-by-stock strengthening and weakening analyses are effectively the same for both Growth and Value stocks.

What is the biggest bang for the buck analysis you can do?

Ask yourself: is there truly helpful information in distinguishing between Growth and Value? Or are you better off devoting precious time and brainpower to strengthening vs. weakening classifications?

It's your portfolio and time at stake here, choose carefully.

Puzzling

There are 132 stocks that are in both the iShares Growth and iShares Value ETFs. This is based on downloading the holdings from the iShares website. Why is there overlap? I don't know. Odd, yes? So which, if either, better reflects its purported mandate?