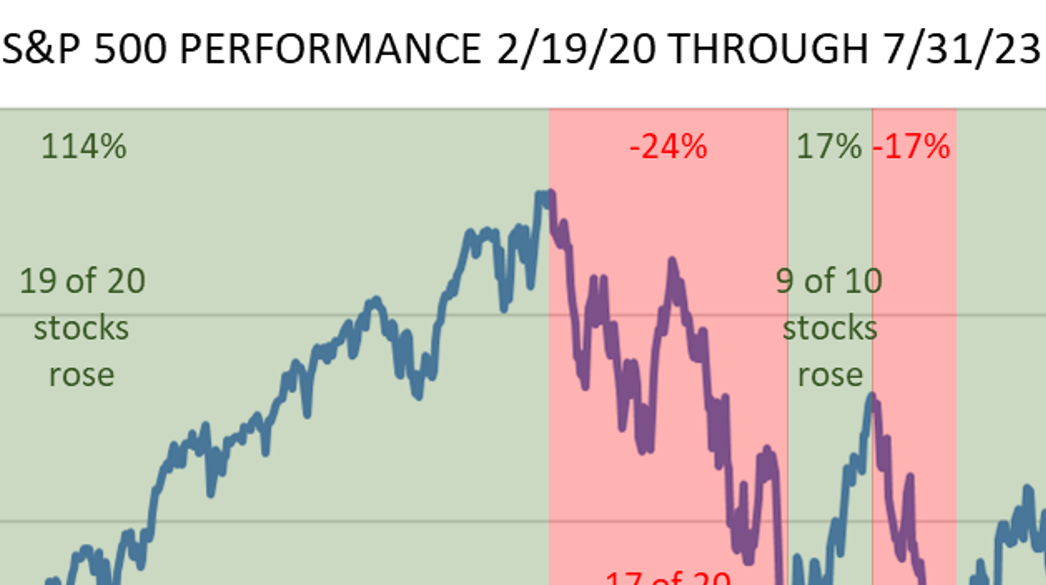

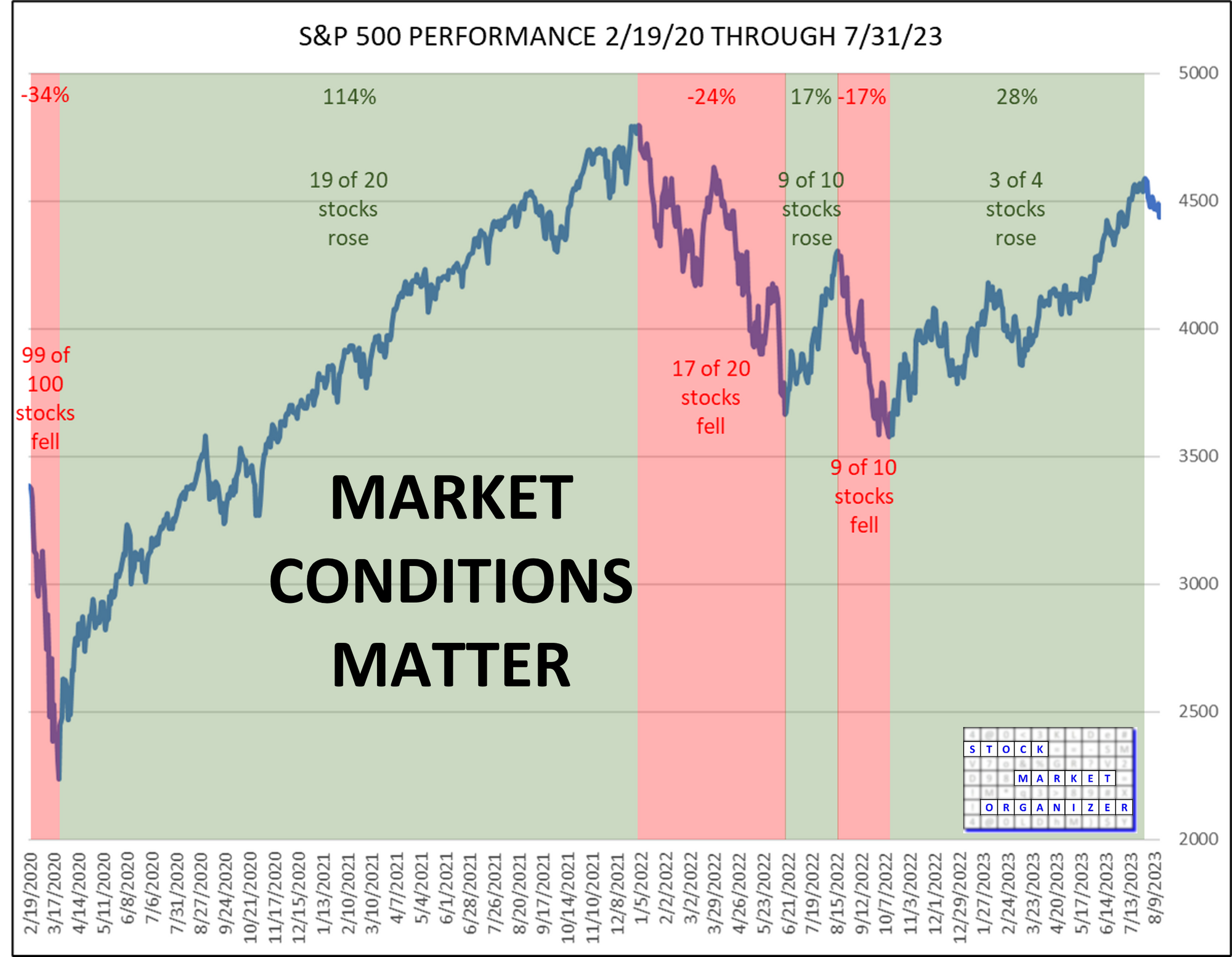

Market Conditions Matter

Did you know? 99 of 100 stocks fell during the COVID 19-caused 2020 implosion. How helpful were those style boxes during this period?

19 of 20 stocks rose as the S&P500 then more than doubled to its 1/3/22 peak. Did charting and technical analysis wizardry truly cause that green P&L?

The stronger one’s stocks, the greener one’s P&L.

(Not coincidentally, the stronger the market, the stronger the underlying stocks. After all, most stocks do what the market does - but the market can only do what its underlying stocks do. How to address this conundrum? Here's one way - by adapting the concept that, as a healthy body turns sick and a sick body turns healthy one cell at a time, a strong market turns weak and a weak market turns strong one stock at a time.)

The most direct path to a greener P&L is to ensure a portfolio is full of strengthening stocks. Do not diversify - hold only strengthening stocks for as long as they are strengthening - aka #strongtermbuyandmanage. Replace those no longer strengthening with one of the thousands of other potential candidates that then may be strengthening.

And if one cannot find any replacement strengthening stocks, this will inform about overall market strength.

_______

How difficult was it to NOT have a green P&L for the period 3/23/20 through 1/3/22?

Very.

Of the ~2,600 stocks reviewed:

* 4 of 5 gained >50%

* 3 of 5 gained >100%

* 1 in 16 gained >500%

* 40+ gained >1000%

_______

Per the famous “bull markets and geniuses” quote, market strengthening covers many mistakes.

Adapting Abraham Lincoln's famous tweet “If I had eight hours to chop down a tree, I’d spend the first six of them sharpening my axe,” it is wise to sharpen market conditions knowledge before diving in to what stocks to buy.

The more the match between one’s moves and market conditions, the better will look one’s stock analysis - technical or fundamental.