Leisure 2023-03-21 with pandemic era 4- and 8-week context

This post ventures into new territory to show how it can be used for longer term periods than 4-week perspectives.

Typically I'll show a reverse week-by-week look culminating in the most recently-completed week. For those who prefer longer term looks, this method can provide those. In this post I will show the context from the pandemic era bottom on March 23, 2020, in both 4-week and 8-week looks back.

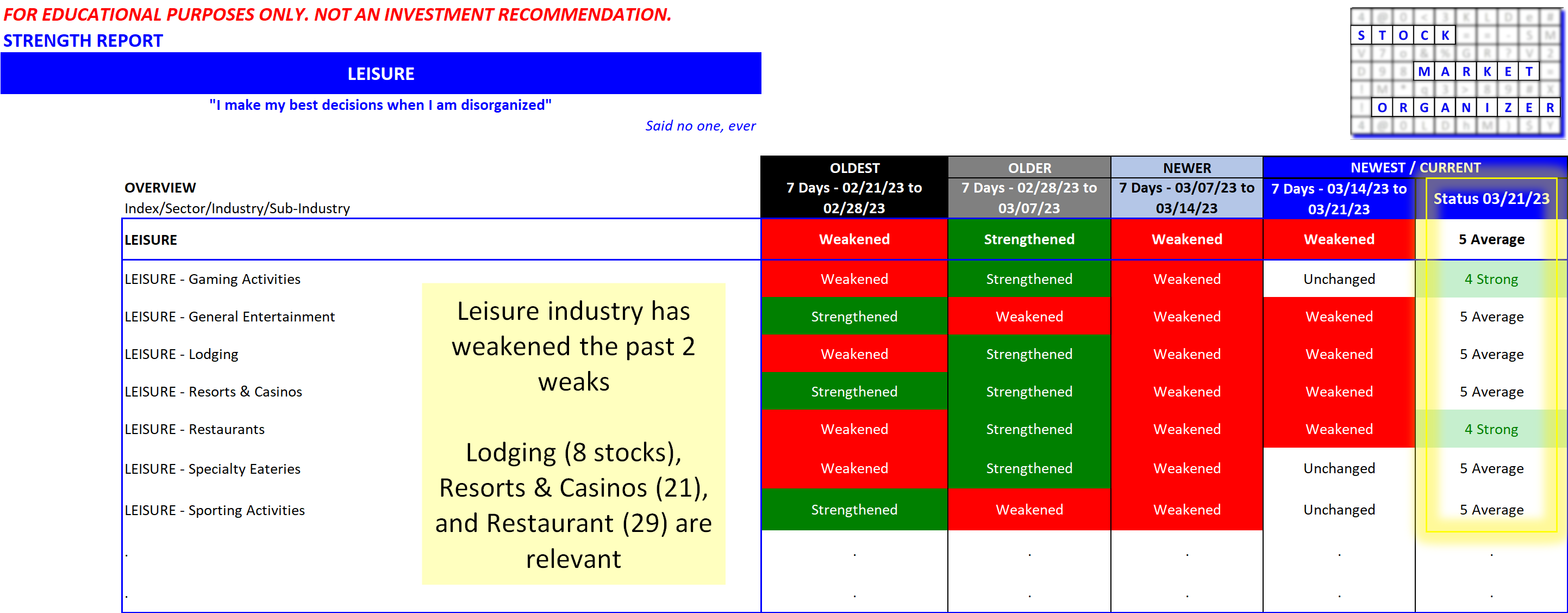

Look back period comments (4 weeks is standard)

I use a 4-week look back as my standard because the week-to-week changes are sensitive enough to capture the start of a move without being too sensitive to day-by-day changes. Similarly, while 8-week looks back can show a larger trend, this does not seem sensitive enough to underlying industry and sub-industry changes.

One never knows when the first week rally (or decline) will turn into something longer.

Leisure industry comments

I advocate looking in relatively homogenous industries and sub-industries for the highest strengthening relevance. If the entire industry and its sub-industries are strengthening, there are larger trends afoot above the company/stock-specific level that are positively impacting them all. Thus, even individual stocks with problems might also rise. And holding rising stocks is certainly the goal of going long. In short:

With this lead-in, I would be interested only in potential possibilities within these three Leisure sub-industries:

1. Lodging (with 8 stocks)

2. Resorts & Casinos (21 stocks), and

3. Restaurants 29 stocks).

The other Leisure sub-industries all have less than five stocks, making suspect their sub-industry strength measurements in terms of the "rising tide" concept.

Current view 4-week look back (typical)

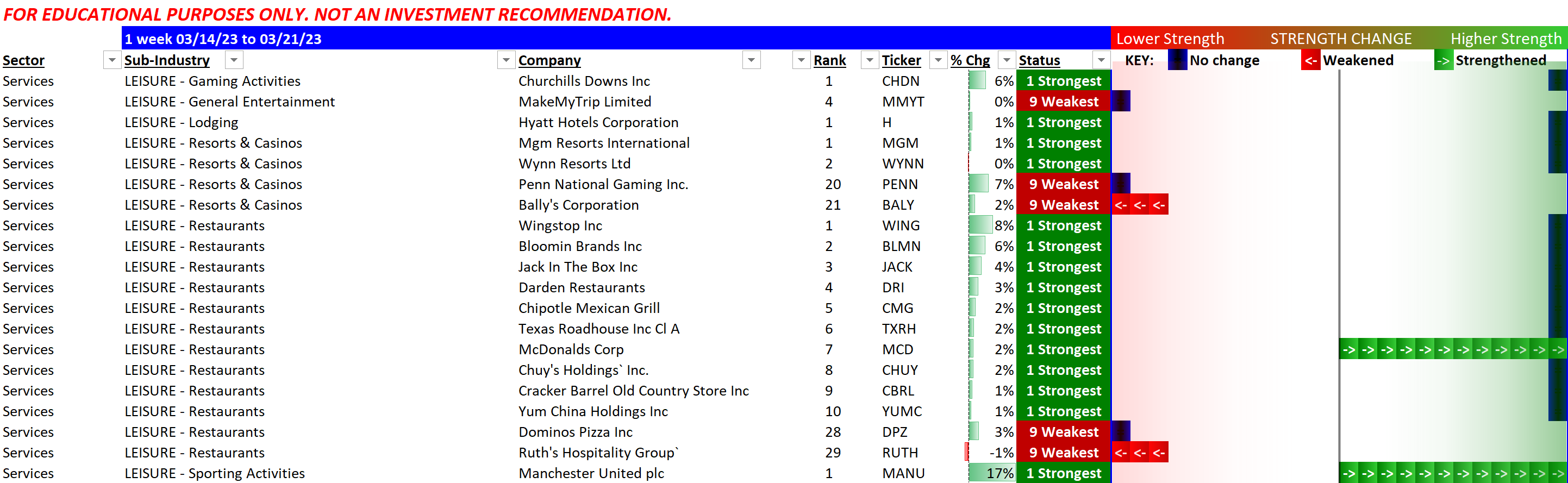

Are you aware that currently in Resorts & Casinos MGM Resorts International/MGM and Wynn Resorts Ltd./WYNN are strongest while Penn National Gaming/PENN and Bally's Corporation/BALY are weakest? Does the market have these right? If you have PENN and BALY are you confident enough in your holdings to keep them, or might you be better off switching some/all of these allocations to MGM or WYNN? Or, perhaps these funds are better off in Semis? #notastockrecommendation

Here's a summary of the currently strongest and weakest in Leisure:

Downloadable report with stock-by-stock detail is available here:

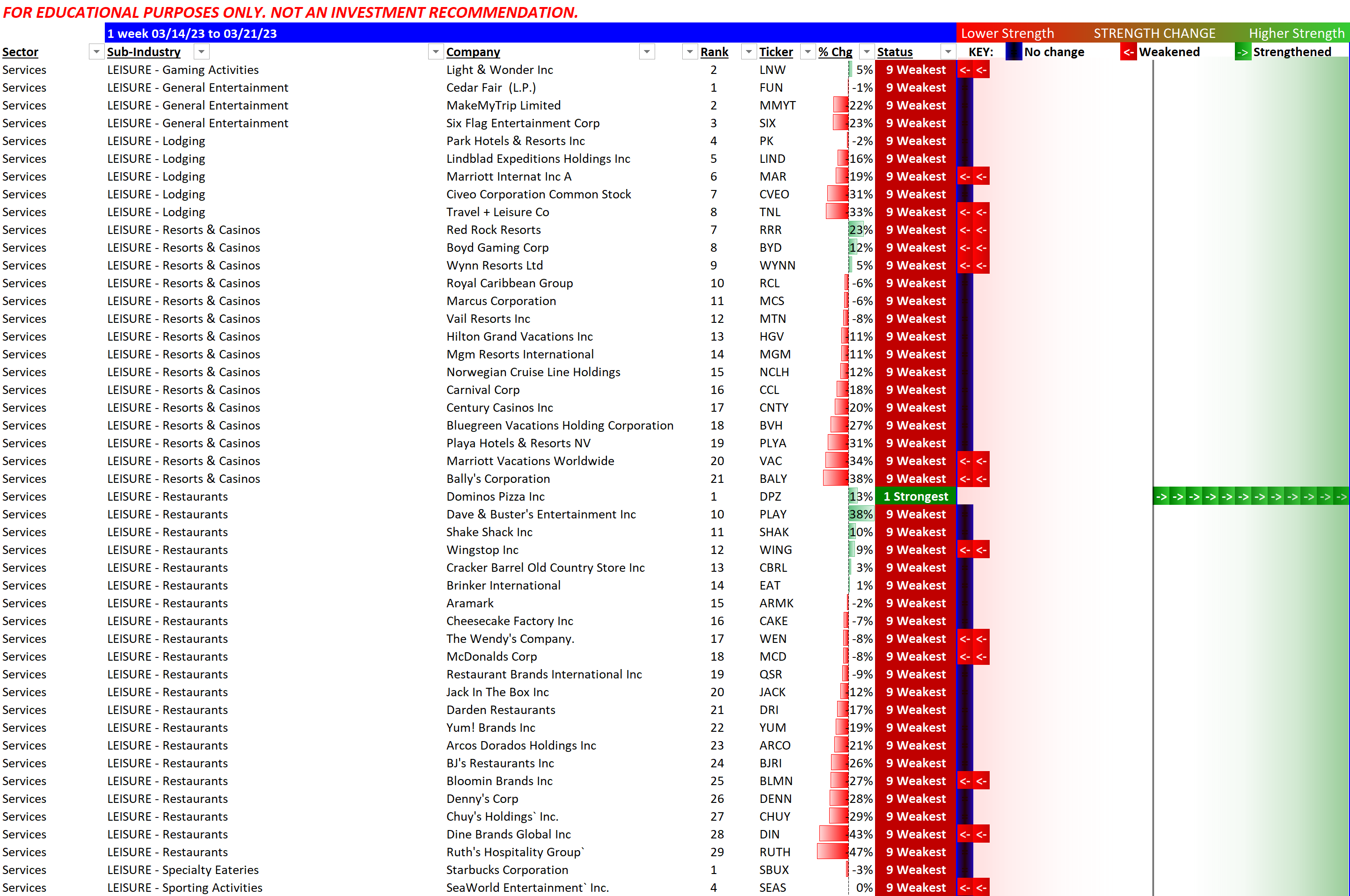

Context - March 23, 2020 4-week look back (pandemic decline)

Of 68 tracked stocks at that time, one had the highest strength: Dominos Pizza/DPZ. Peloton/PTON was the only other stock remotely close in strength.

Below is a summary of the strongest and weakest stocks during the week ending March 23, 2020. One could have rightfully asked at the time based on this view "how much lower can these go?"

Downloadable detailed stock-by-stock report is available here:

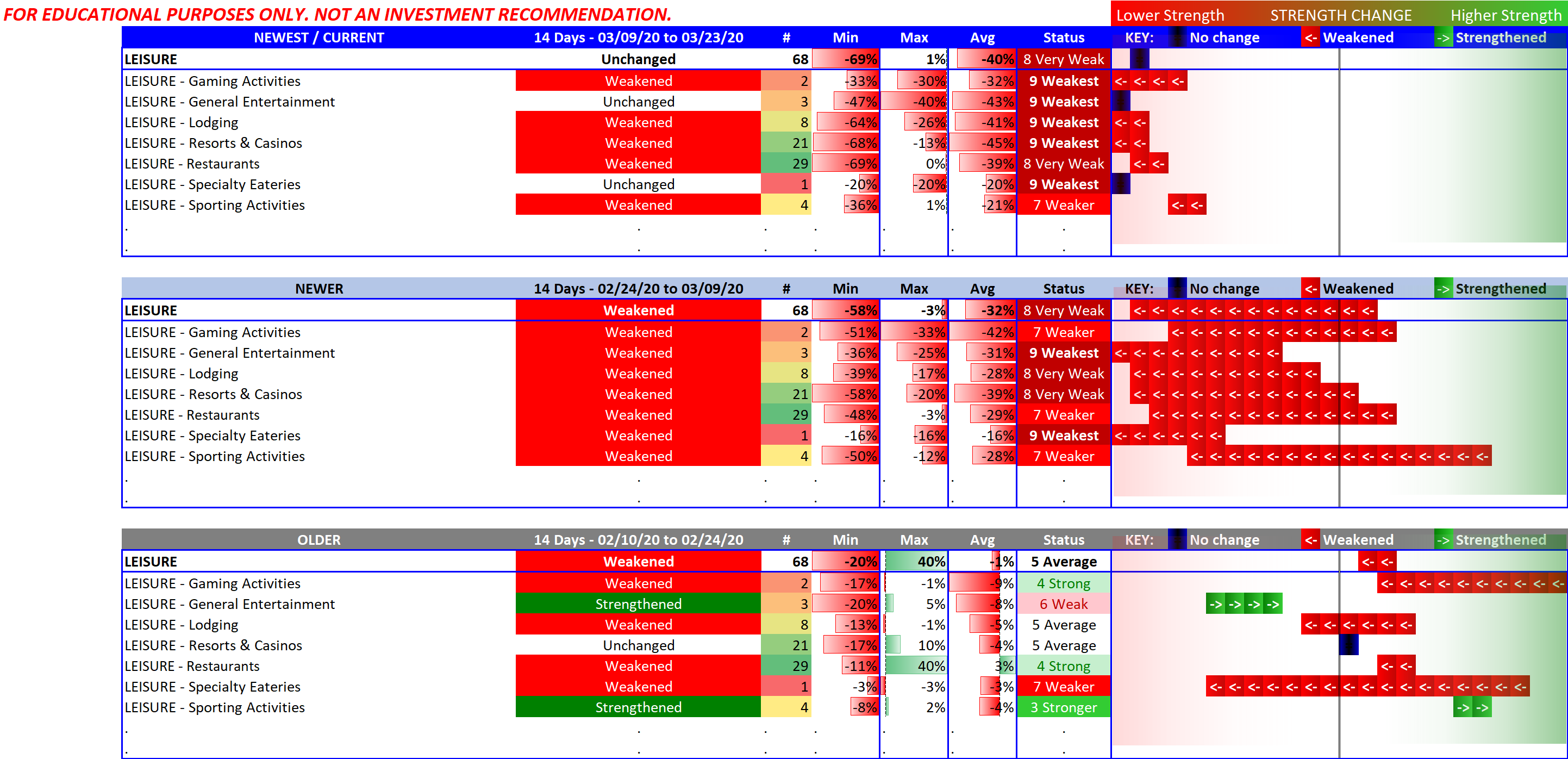

Context - March 23, 2020 8-week look back (pandemic decline)

As the decline started February 19, 2020 for the S&P 500, this perspective shows the full pandemic decline, as shown in the following:

Downloadable detailed stock-by-stock report is available here: