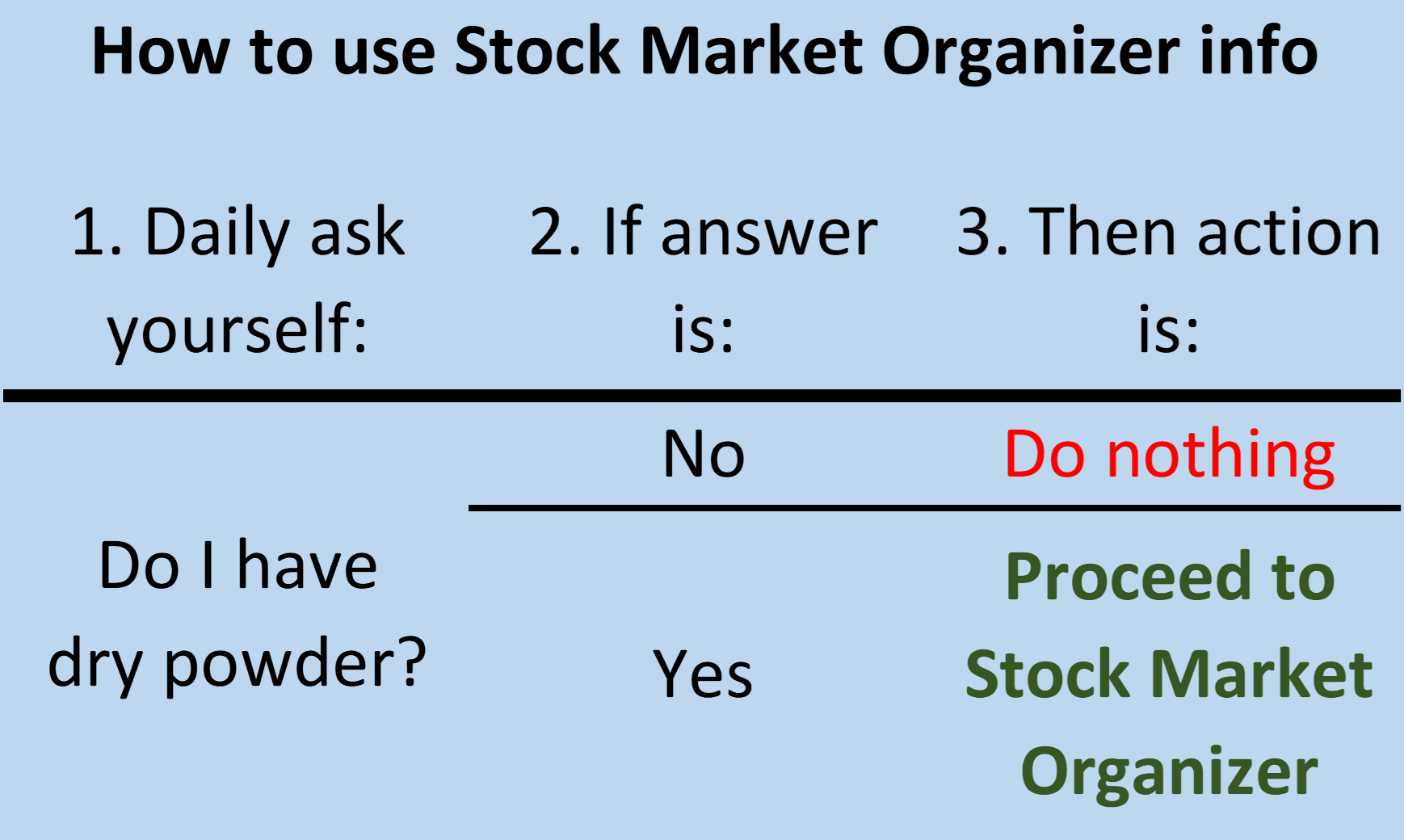

It doesn't have to be so complicated: How to use Stock Market Organizer information

Dry powder? No = ignore. Yes = proceed.

Entry/Sizing/Exit Process

1. Determine max % of portfolio you want to risk on one position - say 2%. For every $100,000 in your portfolio, this would be 2% x $100,000 = $2,000.

2. Find a candidate from Stock Market Organizer in a sub-industry/industry of interest.

- Primary: strengthening/strong stock with strengthening/strong sub-industry and industry

- For the adventurous: weakest stock with strengthening/strong sub-industry and industry

3. Find your candidate's 21 day Average True Range. Let's say it is a $20/share stock with a $3 21 day Average True Range.

4. Multiply this by 2.4 to get the amount risked per share. $3 x 2.4 = $7.20 risked per share.

5. Divide $2,000 (your total amount risked per position per 1. above) by the amount risked per share ($7.20 risked per share per 4. above) = $2,000 / $7.20 = 277.8.

6. 277.8 is the number of shares you can buy of this stock. Round down to 275 shares or something logical (for example 270, 250).

7. Buy this number of shares the next trading day. If the stock hasn't dramatically change from its $20/share price (per 3. above) you'll be buying 275 shares at $20/share = $5,500 total position size.

8. Set your initial mental sell stop at your purchase price less your amount risked per share ($7.20 per 4. above). Assume a $20/share entry, you will sell if the stock closes below $20 - $7.20 = $12.80. This is the lowest your stop will be. Your stop will be raised as the stock climbs higher, per 9. below. It will never be lowered.

9. Every day the stock sets a new high, trail your mental stop at the higher of the previous mental stop or the new high less the amount risked per share. Belaboring the obvious, if the stock reaches $25.00, your stop will be $25 - $7.20 = $17.80. Optional: recalculate the then-21 day ATR x 2.4 amount risked per share and subtract that from the new high to determine your mental trailing stop BUT without ever lowering your mental trailing stop regardless of any new recalculations of the amount risked per share. Again - never lower your stop. Note you can use new closing highs (instead of intraday highs) to determine your stop. The point here - and in fact through this entire process - is to have a pre-determined objective process for sizing and managing (entering/exiting) your positions.

10. Monitor daily until you get stopped out.

11. Redeploy dry powder again at that time using the above steps.

Your benefits

- You stay in a position as long as its price action stays positive.

- YOU aren’t making the exit decision. The stock’s action is making the decision for you. Zero emotion. If market forces take the stock well past fundamentally attractive levels, you are still in.

- You are accounting for your own personal risk tolerance (% and $ risked per position) in the content of what is signal and noise for any specific stock. A volatile stock needs more room to move without shaking the holder out. Note that higher volatility will automatically lower your position size.

- You are always long. No shorting. Why? The most you can gain from shorting is 100%. But you can get many multiples of this going long.

- You will always be rotating into strong/strengthening stocks at the time their sub-industries and industries are strong/strengthening. One never knows if such strength will continue but if they do you’ll be on the right side of these larger forces.

- Should you choose a weak stock, you might enjoy a fast pop but don't expect a long-term ride to the heavens because there are plenty of holders holding losing positions, waiting for higher prices to unload at smaller losses.