Proof of flight to big caps? 2023-04-13

This methodology provides the flexibility and ability to meaningfully compare stocks by capitalization.

In downturns, there aren't meaningful differences - see the February 19, 2020 through March 23, 2020 period when everything was taken out to the woodshed.

In all parts of the market cycle, use a strengthening/weakening look to compare, as shown below.

Further, key changes in strength are caught immediately by closely watching these measurements. The changes may not be lasting, but they will be caught. And this ability is valuable for when the changes ARE lasting.

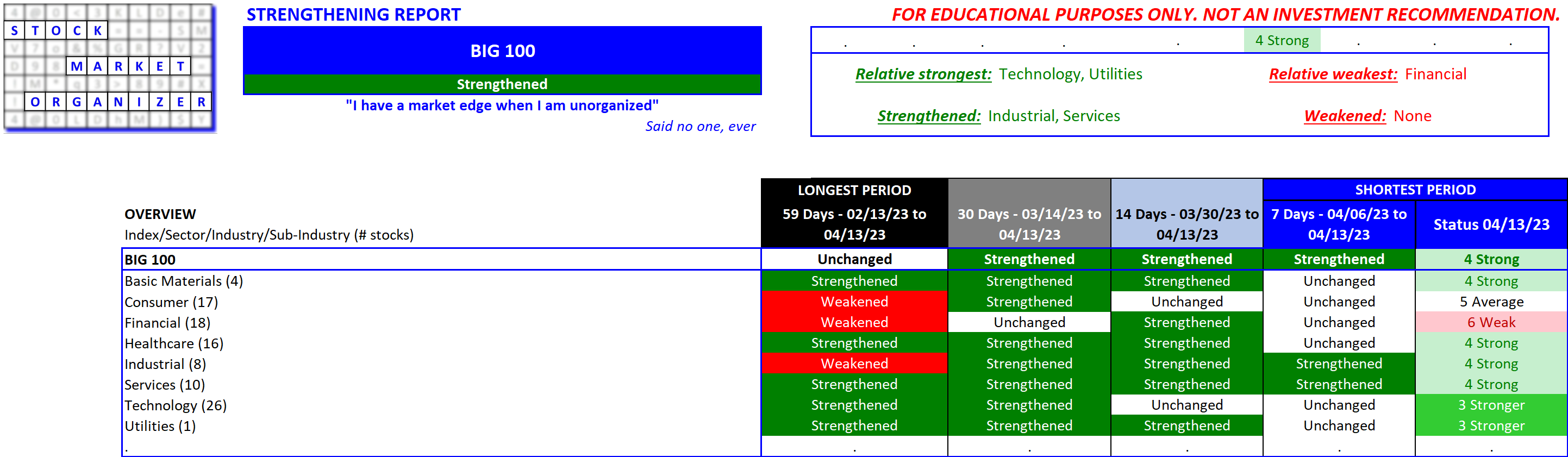

Summary Comparisons

Big Caps (top 100):

These are Strong and strengthened over the past week on the backs of two sectors strengthening. The remaining sectors did not change strength. As with the S&P 500, Nasdaq 100, and Dow 30 as seen in yesterday's post, Financials are the weak link.

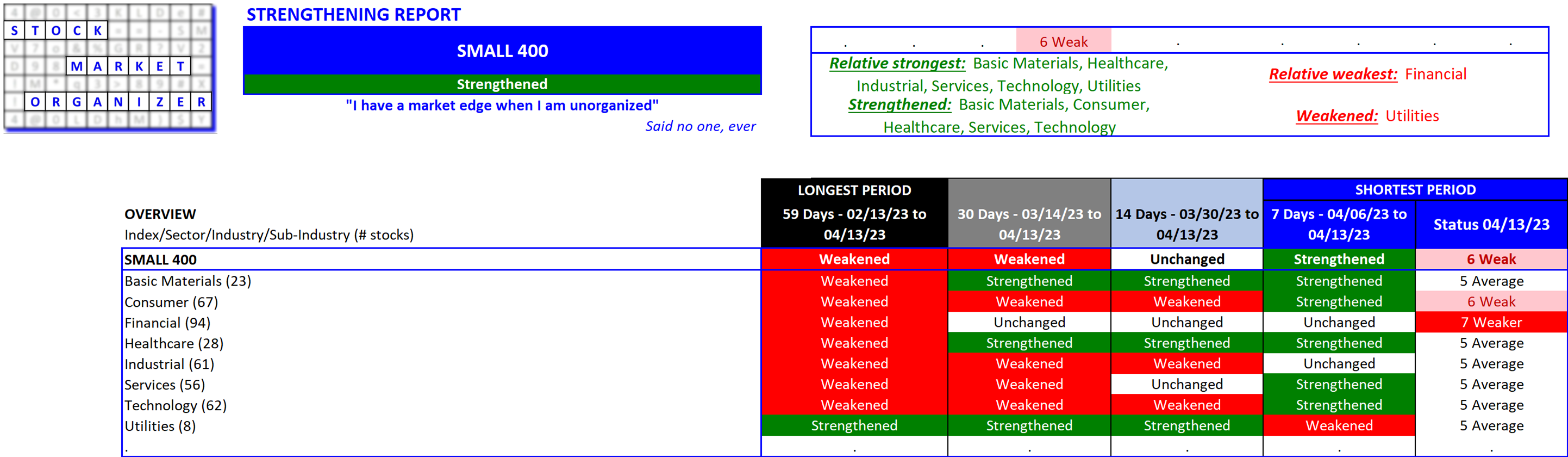

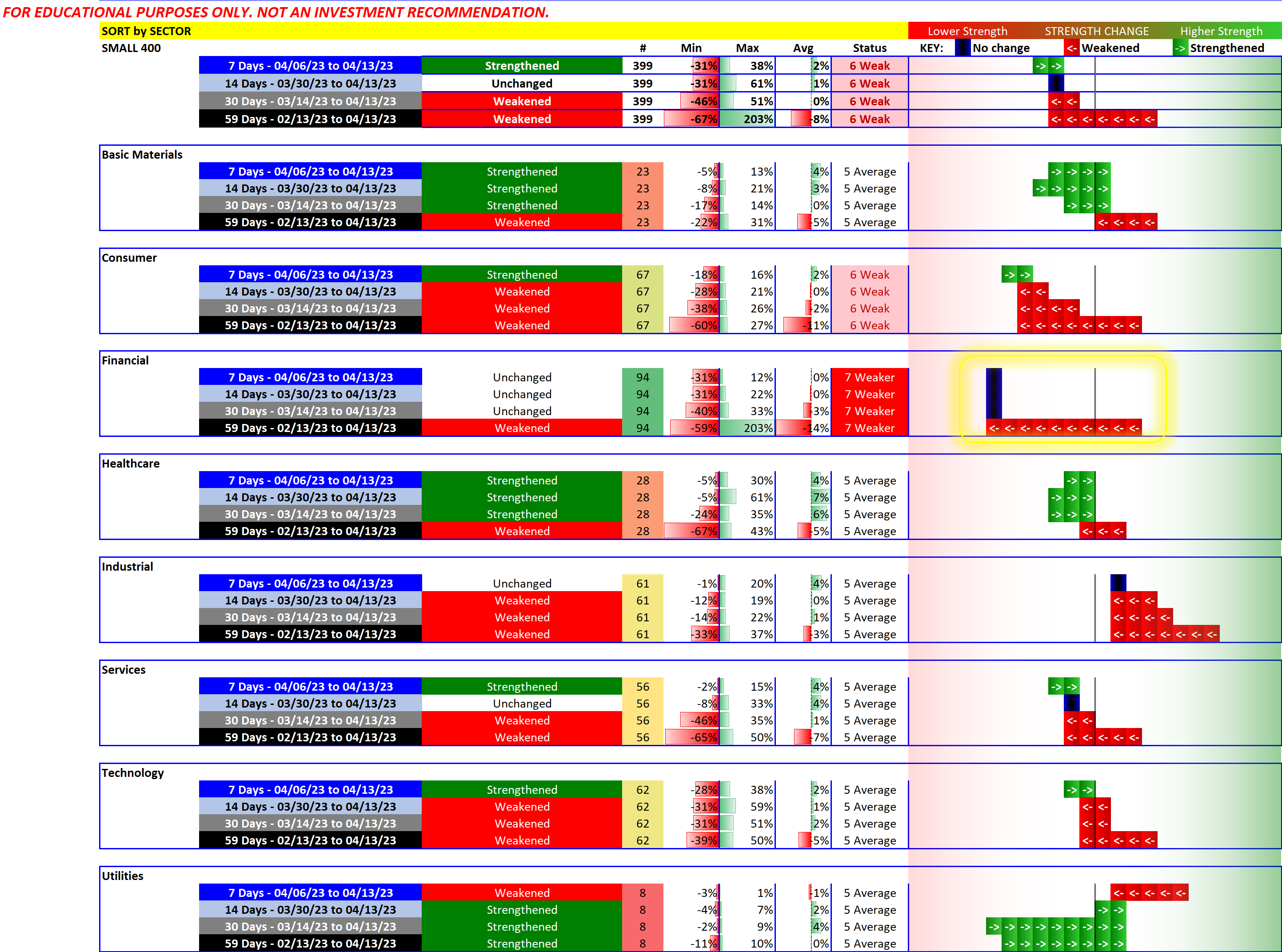

Small Caps (small 400):

These are Weak but strengthened over the past week. Financials are the weakest of the sectors, as with the Big 3 indexes and the Big Caps. Five of the eight sectors strengthened - perhaps this is the start of a comeback by the Small Caps? How will you know? (One way: by continually measuring strengthening and weakening.)

You will not find what you are not looking for.

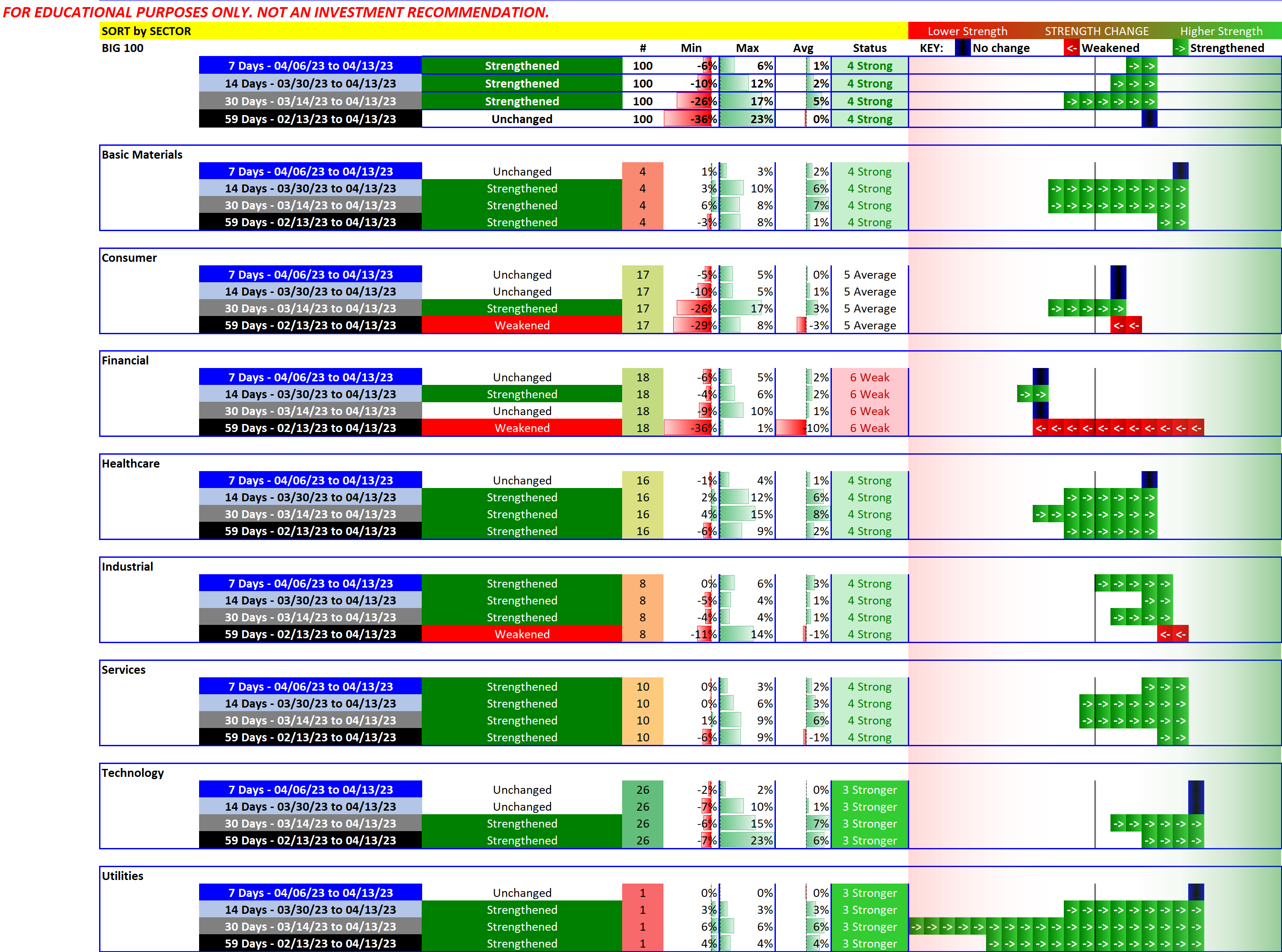

Comparison by Sector

Big Caps:

There is mostly green over the past two months, with the notable exception of Financials.

Small Caps:

Compared to the Big Caps, there is significantly more red displayed here. This perspective clearly captures the improvement over the last week.

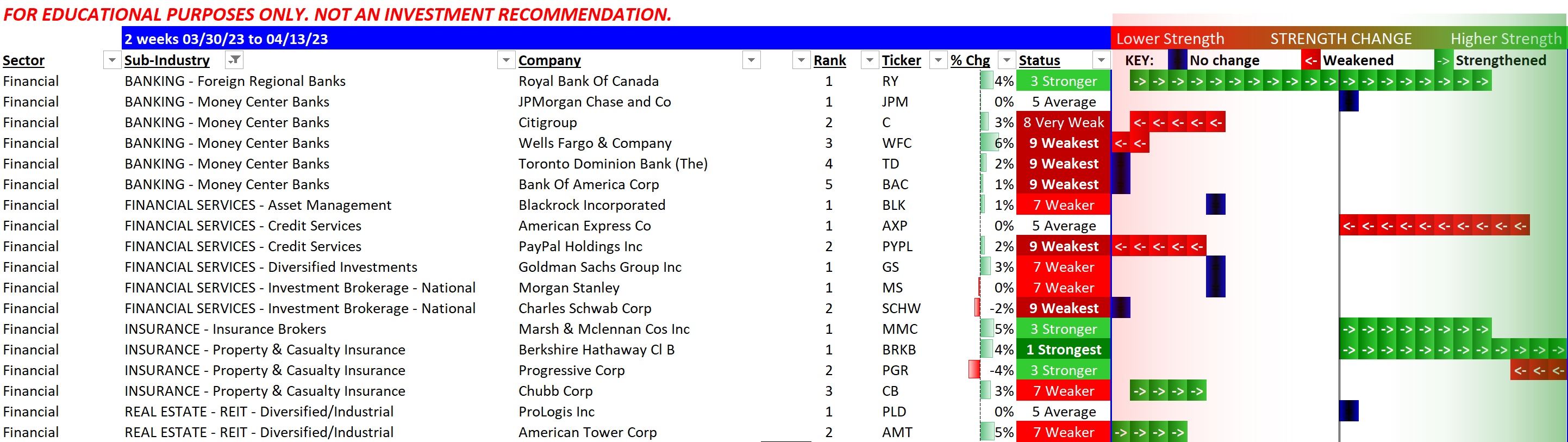

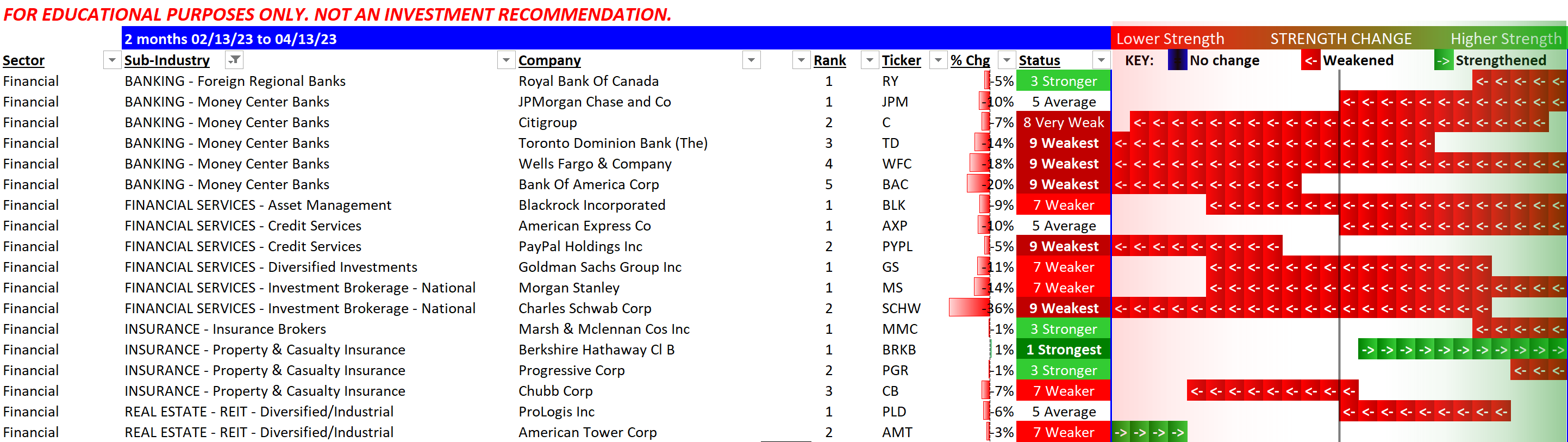

Bonus Analysis: Big Caps Financials Focus

The unique insights available with this method are shown in the following graphics of Financials only. Much red throughout due to the early March banking industry pratfall with related fallout, while three of the four strongest-rated stocks are Insurance stocks.

Two months perspective - much red throughout, this period reflects the significant weakening in the Big Caps Financial sector:

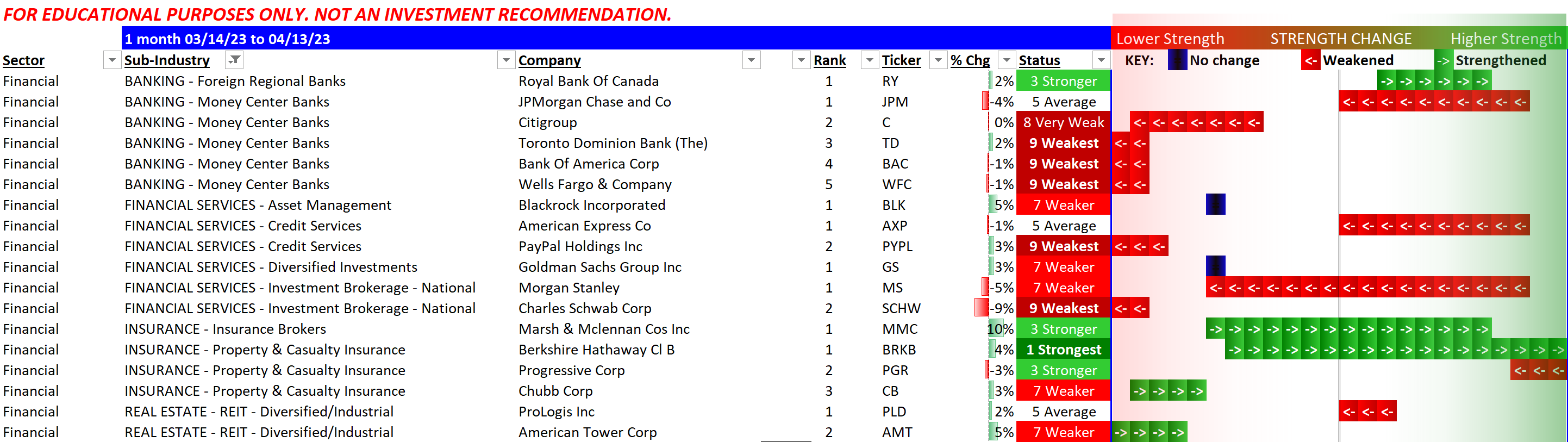

One month perspective - Several stocks showed material weakening and strengthening but on the whole there was much less change during this shorter period:

Two weeks perspective - a natural settling since most stocks typically don't move much in two weeks, with eight of 18 stocks not changing. Meanwhile Royal Bank of Canada/RY comparatively made a move that stands out: