Is C/Citigroup a good short candidate (2023-08-21)?

Following up this post about a short sale that ran into issues quickly, I'll flag something that I would consider a more attractive short sale possibility which is NOT a stock recommendation. #notastockrecommendation

Banking Analysis on LinkedIn

Earlier today I posted a Banking analysis on LinkedIn, which I originally posted here on this site.

For my LinkedIn post I created a new document which you can download from the following link:

Shorting Comment on LinkedIn

In browsing LinkedIn later I saw a comment that someone shorted C/Citigroup today. Rationale: "Triple top. $42 support broken."

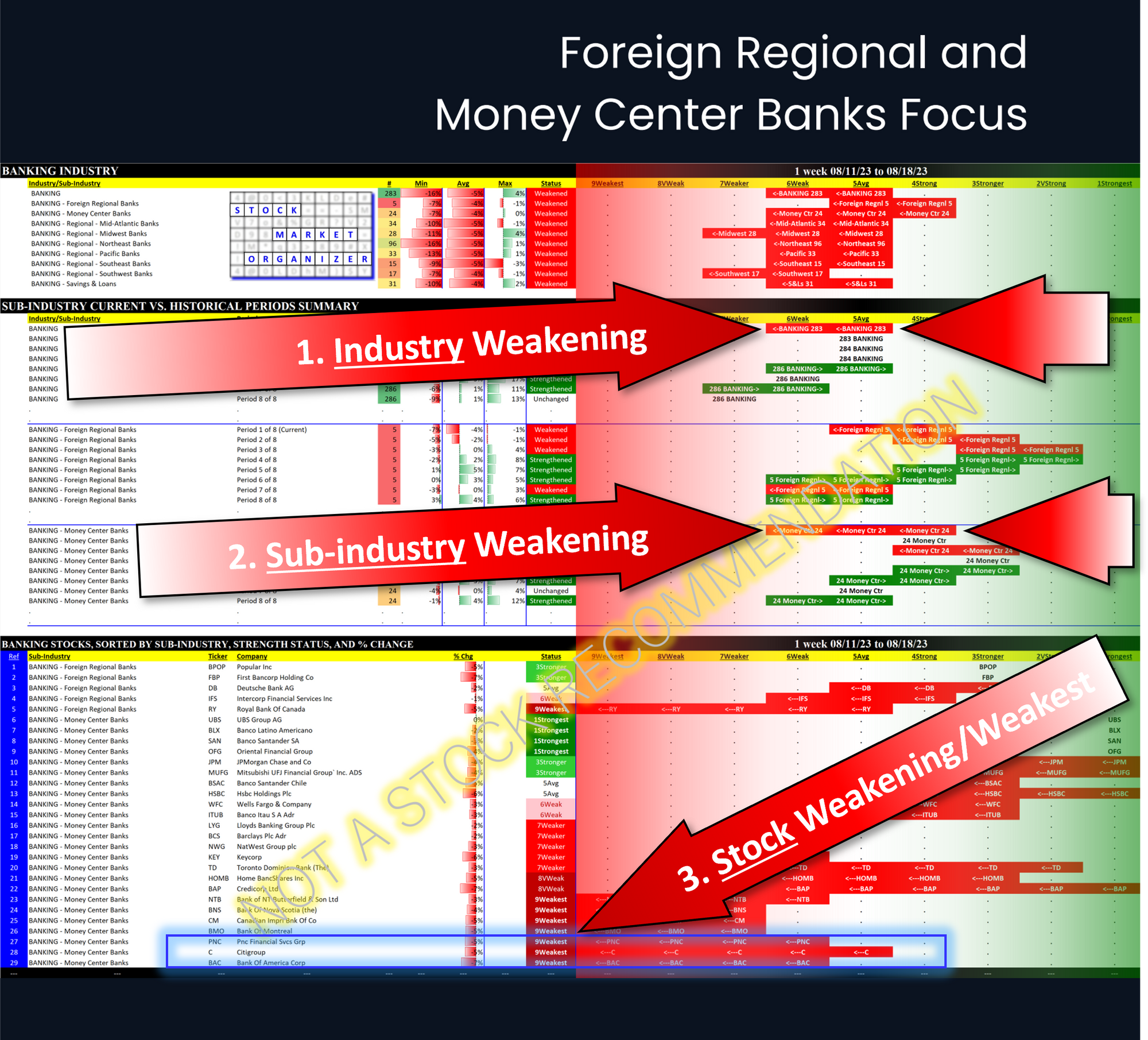

In response I posted the following screen shot, originally sourced in the above downloadable document to which I added the annotations...

...with this commentary on LinkedIn:

Screen shot shows that for the trading week ending 8/18/23:

1. Banking industry weakened for the first time in two months: ☑

2. Money Center Banks sub-industry weakened two levels, continuing recent weakness: ☑

3. C/Citigroup weakened to Weakest (lowest) strength rating: ☑

Many like to short high flyers. All's good with that. No judgment.

That said, attractive shorting candidates can be found among the weakening/already-weak, especially when their sub-industry and industry are weakening.

We've all seen stocks fall 75%, enticing the bargain bin crowd, only to fall another 50+%. Stocks aren't just randomly weak. If/when psychology takes over, look out.

Bottom Line

While I don't short, in my opinion C/Citigroup is a better candidate than current high-flyer FRHC/Freedom Holding Corp. There's always the possibility that a stock defying the laws of gravity can come quickly crashing back down. (Check out RIOT/Riot Platforms +72% 6/30/23 through 7/13/23, then -45% 7/13/23 through today 8/21/23. Excellent short if you had the guts at the right time.) But, in my opinion, the combination of a weakening industry, weakening sub-industry, and weakening/weak stock offers more consistently attractive shorting opportunities than going against the flow of high flyers.