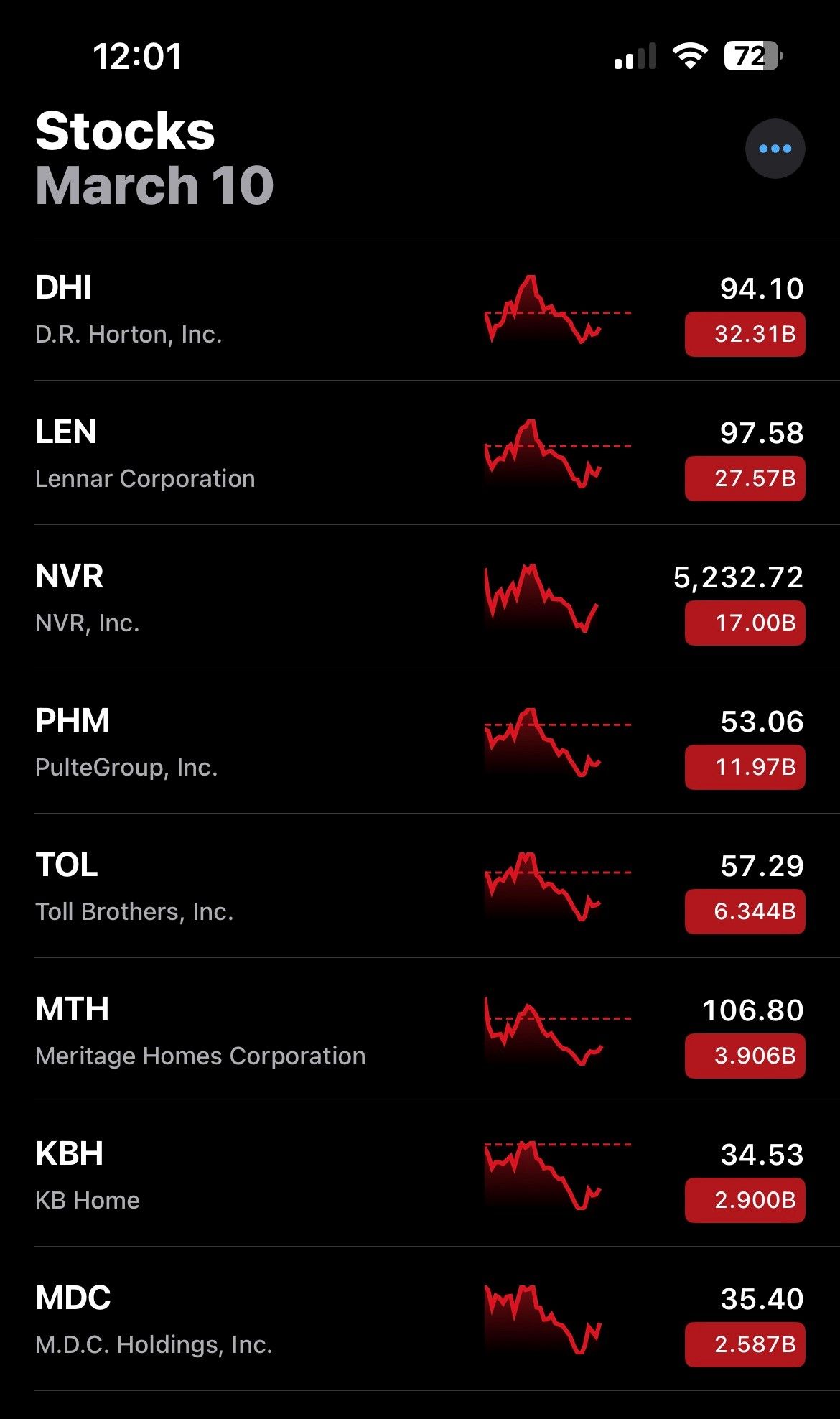

Homebuilders mid-day 2023-03-10: birds of a feather flock together edition

In this mid-day view of today's homebuilders trading action, spot the firms with the most attractive combinations of financial strength, management, pipeline, and competitive position, among other factors:

This is cherry-picked of course and there are certainly differences in each. Knowledgeable industry insiders have insights the rest of us cannot hope to gain. Intra-day, this action isn't unexpected, as the knowledge of these insiders takes time to be incorporated into the price. This knowledge will not be reflected in any given trading day's action. One can count on these insiders to generally buy when the price dips too far below fundamental value such that over time they'll profit from their industry insider knowledge. And this educated buying, unrelated to the price action of any given day, is what forms bottoms.

What can the rest of us without specialized expertise and experience do?

We can objectively measure the comparative strengthening and weakening of these stocks (not just within/among the homebuilding space, but also compared to commercial real estate, financials, and other sectors) to gain actionable and profitable insights based on this strengthening and weakening.

Don't pick the best horse in a glue factory

With this knowledge, we can become free of "FOMO Syndrome." While nothing will guarantee favorable outcomes, one can open a position objectively knowing it is supported by sub-industry and industry strength. Generally, it is better to select strong stocks in sub-industries and industries that are strengthening rather than try to (figuratively of course) pick the best horse in a glue factory.

And when the stock you pick declines, that leads to FOMO Syndrome. And the subsequent emotional damage that comes from making the wrong decision, as you will always do.

For those seeking to go long banks in today's SIVB-influenced environment, heeding notions of industry and sub-industry strength would be a good thing.