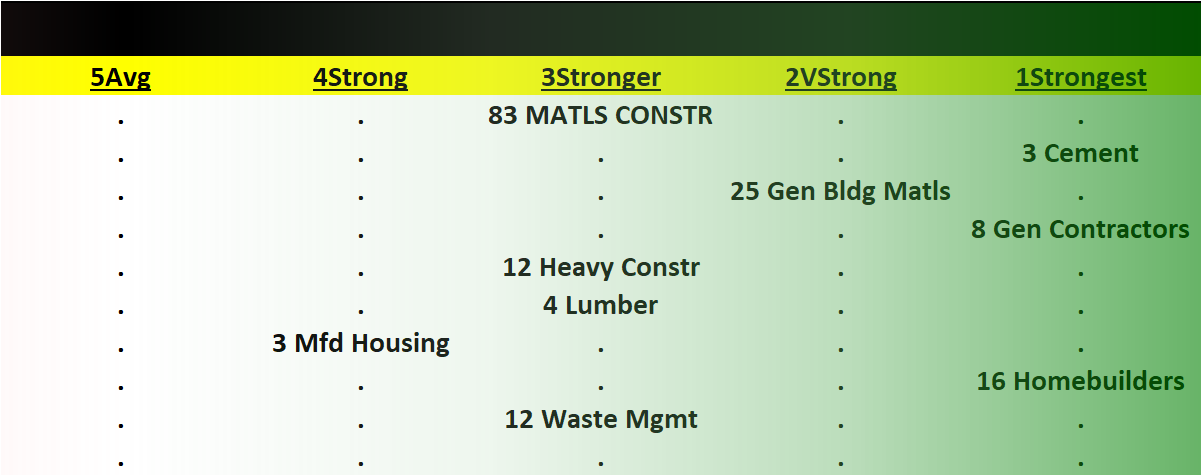

Materials/Construction incl. Homebuilders 2023-07-25: Unchanged at "Stronger" strength rating (3rd strongest of 9 levels), previous move was up

Here's my most recent previous review of homebuilders.

In this subsequent two week period it has been more of the same.

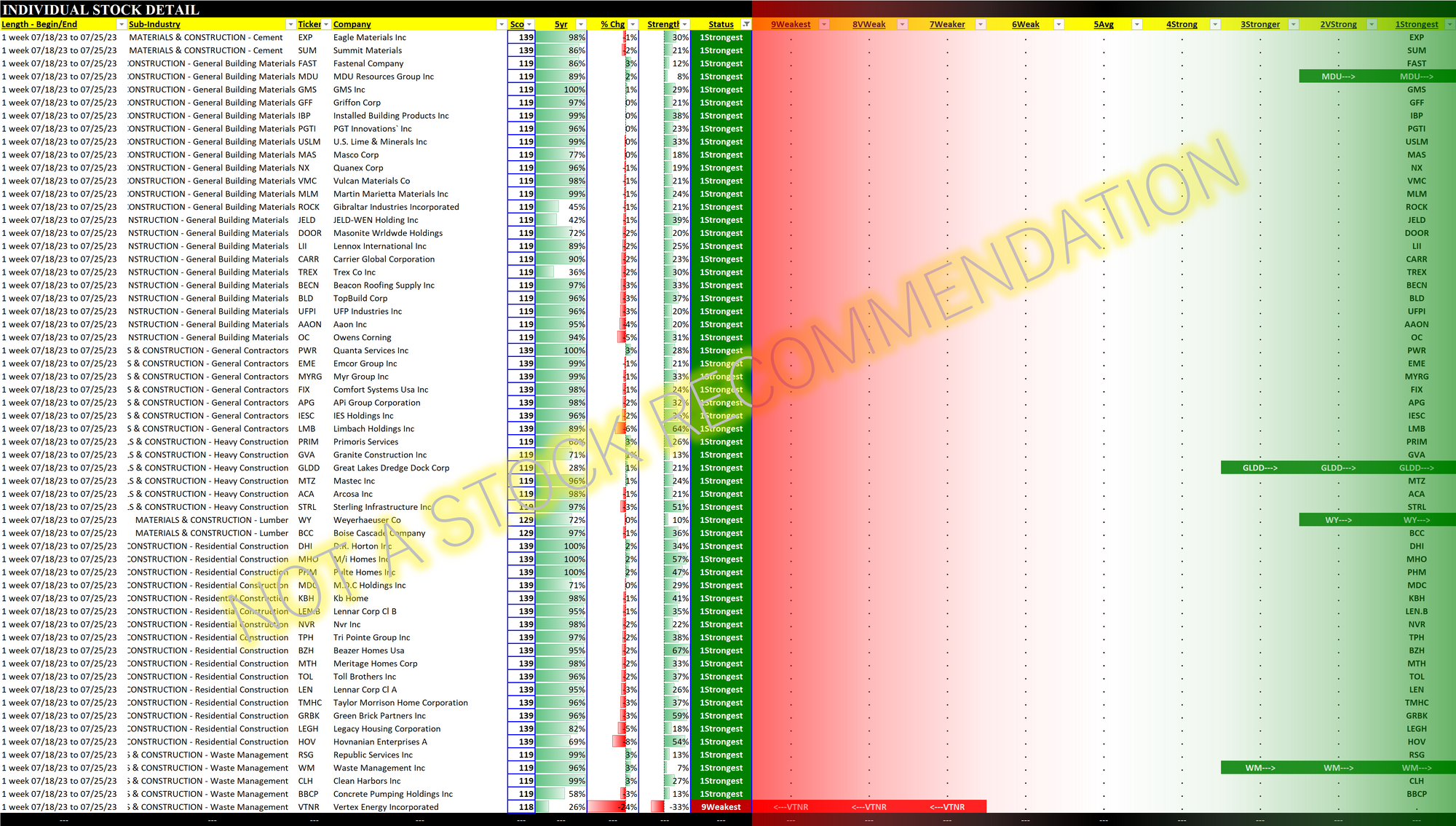

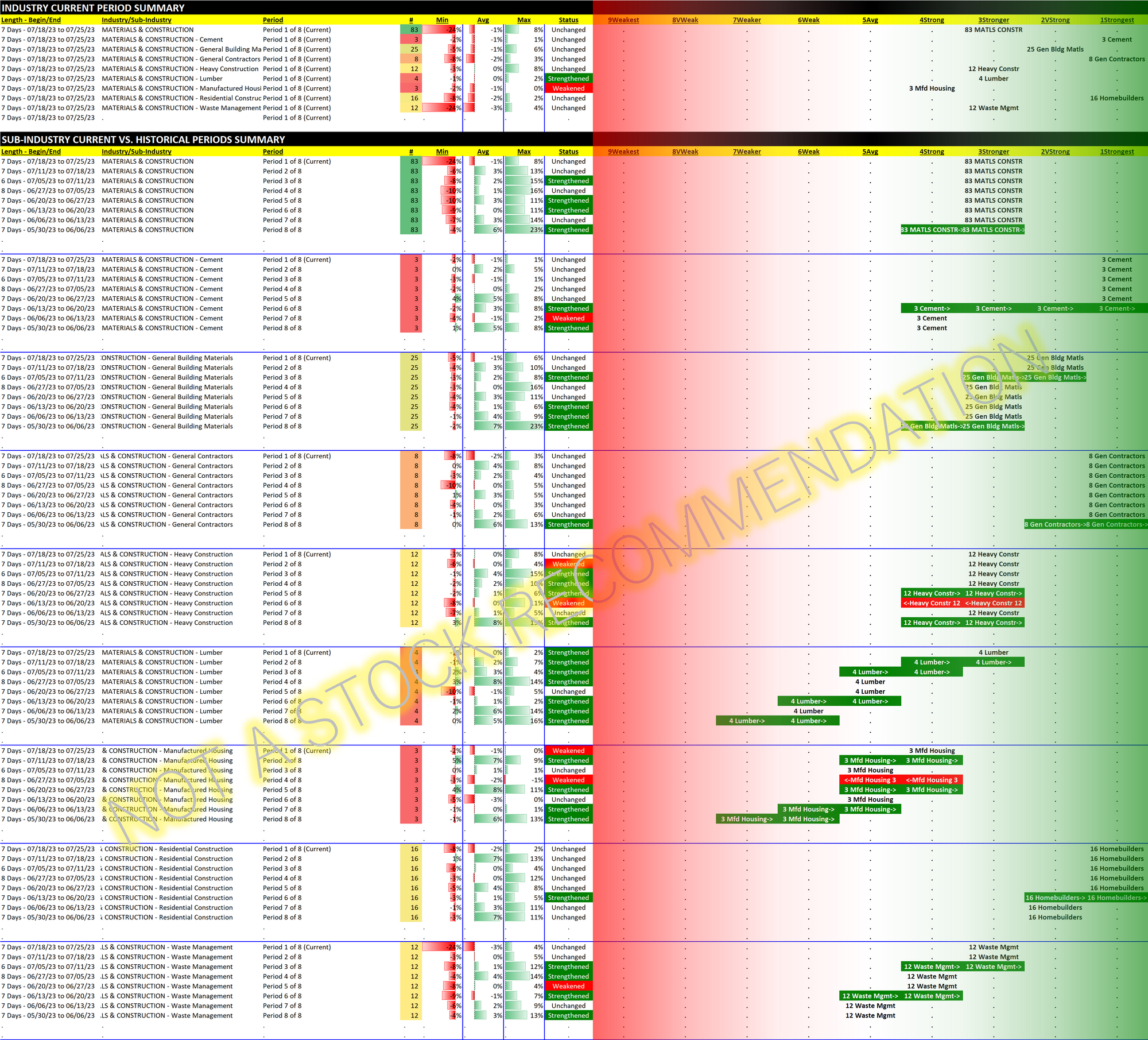

Materials/Construction has been strong for a while. The three sub-industries ranked Strongest (Cement, General Contractors, and Residential Construction/Homebuilders) have been so for at least six weeks. Proving - so obvious it may be ludicrous to point it out - that multi-week rallies begin with one up week. #movesofconsequencelast

How long will the strength in the industry last? As always I have no idea, and neither does anyone else. But through this analysis I'll know when Materials/Construction begins to weaken.

Until then, the industry is guilty (of being Stronger) until proven innocent.

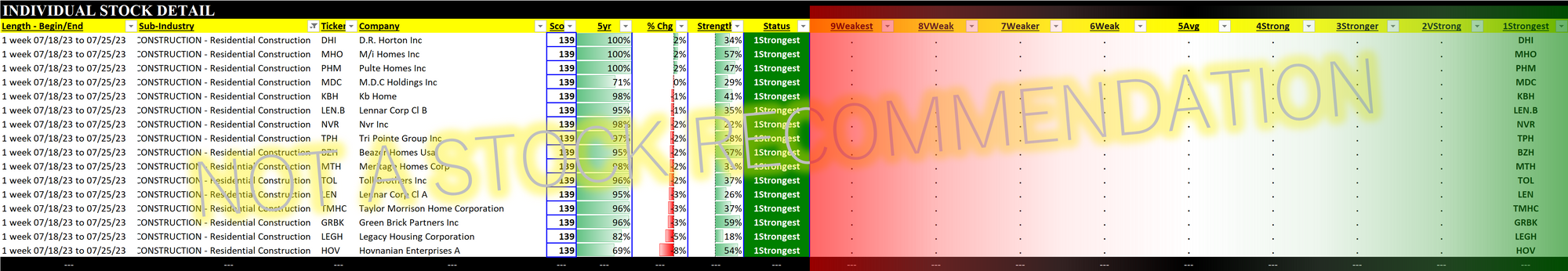

Homebuilders - a closer look

Also known as Residential Construction. All are currently rated Strongest.

I saw a recent article headlined "Finally Time To Short The Homebuilders Because It Doesn't Get Any Better."

I disagree.

Specifically, I disagree about it being time to short. Of course I could be wrong and the author could be right. I don't care about being right or wrong. I care about respecting a clear market message. If the market is telling me it likes homebuilders - which it clearly does - why would I argue with that? #everybodyknowsmorethananybody

(As a broader point... anecdotally - meaning I have not completed, nor will I be completing, an academic study that proves this - if you are going to short something it is much better to short a stock that has been proven weak than to short a stock that has been skyrocketing. There's at least one practical reason why the latter is true - with a skyrocketing stock, there are many holders regretful they did not buy more when they had the chance. Declines give them this opportunity, and if enough jump on this chance they will stop the decline and perhaps ignite the next leg up. Also, I'm not a fan of shorting because 1/ your gains are capped at 100% and 2/ as Long Term Buy and Holders like to cite the market tends to rise over time. If you are shorting during market strength you are asking for trouble unless you really know what you are doing.)

The rally has been orderly. There does not appear to be some emotional impetus for homebuilders to be showing strength. (Remember AMC and GME a couple of years ago?) And it has happened despite an inverted yield curve which every commentary I read tells me means there is a recession in our future. Why the strengthening? I don't know. And I don't have to know. Because by the time I know anything everybody else knows it also so it is by definition already baked into the stock price. #whatmattersnotwhy

I have no homebuilder positions. I have no homebuilder recommendations. What I do have is a philosophy that just because one has an opinion on one stock does not mean they must actually take a position on that stock.

Just because you can does not mean you should.

There may be dozens of better opportunities to make money in the market besides something on which you happen to be focusing. With at least 3,500 stocks you could buy in which institutional investors may also be interested, what are the chances that what you are looking at randomly provides the best opportunity at that very moment? But if you are fixated just on what you know, if you aren't looking for these other opportunities, you will never know about them. #youwontfindwhatyouarentlookingfor

In which case your overall portfolio performance will suffer compared to what it could be.

Leaders and Laggards

Current strongest stocks are shown below. Two weeks ago, there were no "Weakest" (Laggard) stocks in the Materials/Construction industry. Now there is one, and it only became so this week.