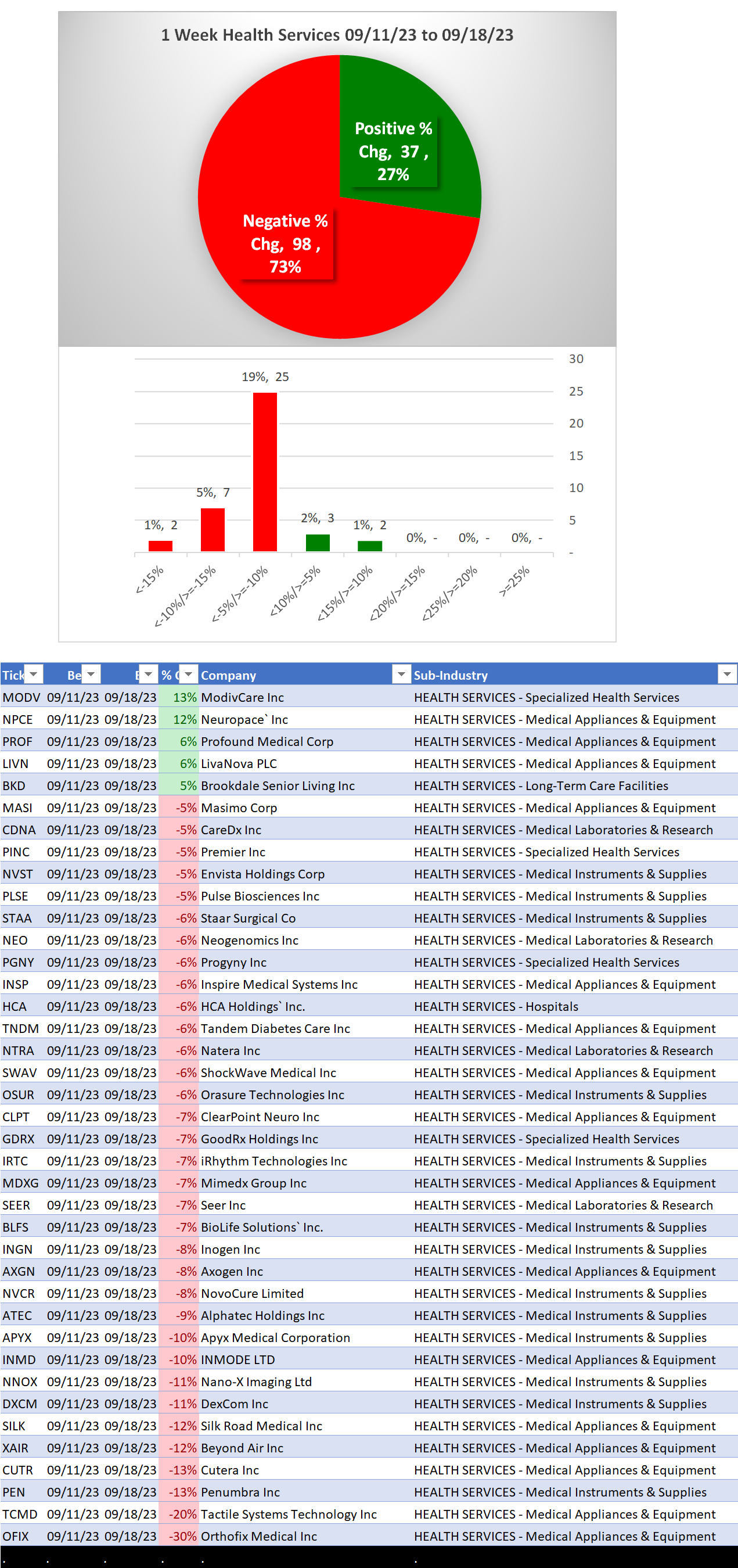

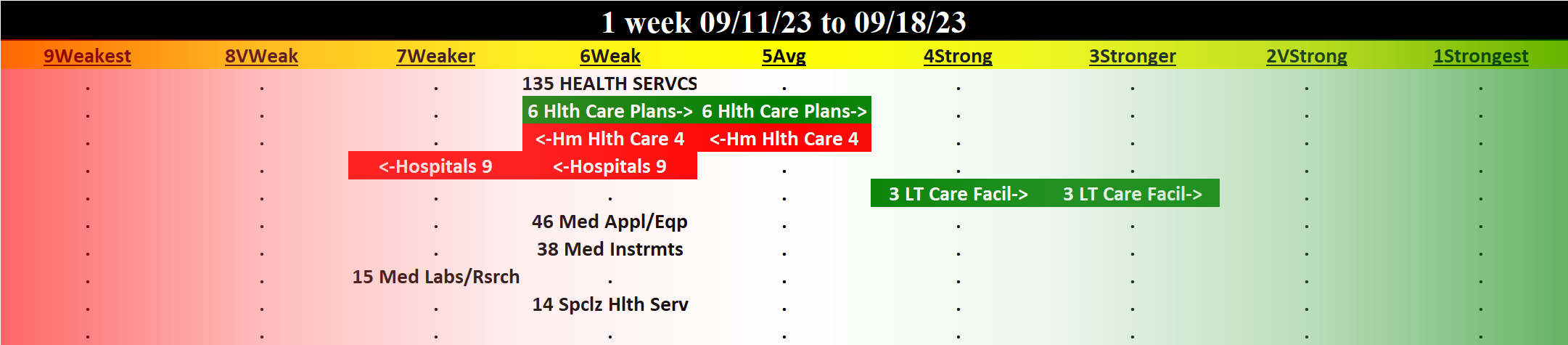

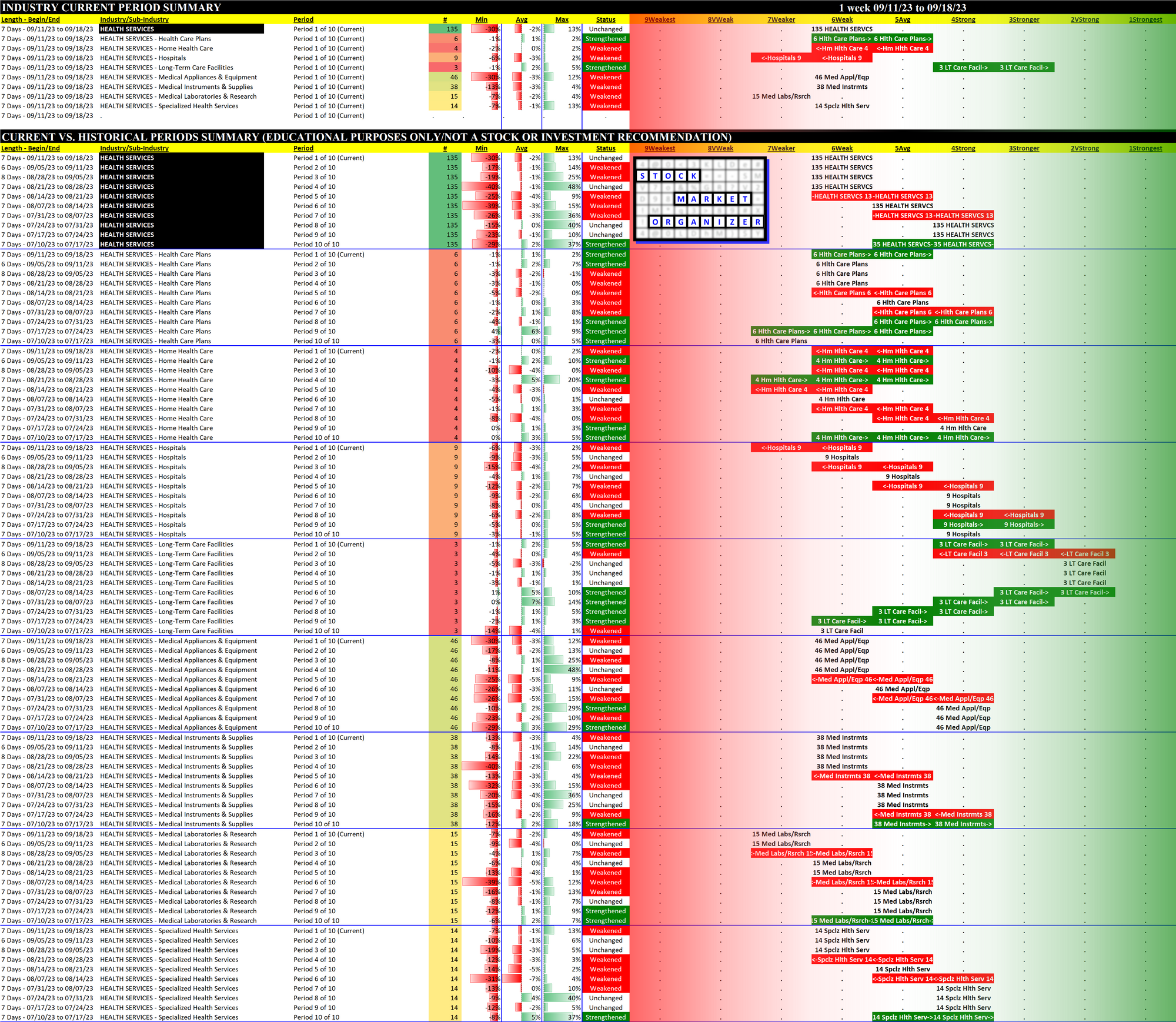

Health Services 2023-09-18: Unchanged at WEAK strength rating (6th strongest of 9 levels), previous move was DOWN

SUMMARY

Performance

Bottom Line: weakened 2 strength levels over the past 7 weeks

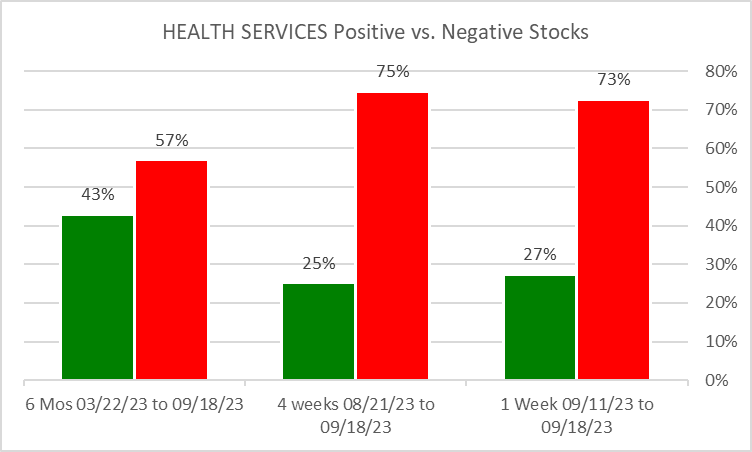

Context: 1 week positive/negative stocks ratio is WEAKER than 6 Months and STRONGER than 4 weeks. Very high proportion of negative stocks.

Other Notes:

Past 6 months

31 stocks -25% or more (23% of total)

MDXG/Mimedx Group (Medical Appliances & Equipment) 120%

NPCE/Neuropace (Medical Appliances & Equipment) 115%

SILK/Silk Road Medical Inc (Medical Appliances & Equipment) -60%

NVCR/NovoCure Limited (Medical Instruments & Supplies) -67%

CUTR/Cutera Inc (Medical Appliances & Equipment) -67%

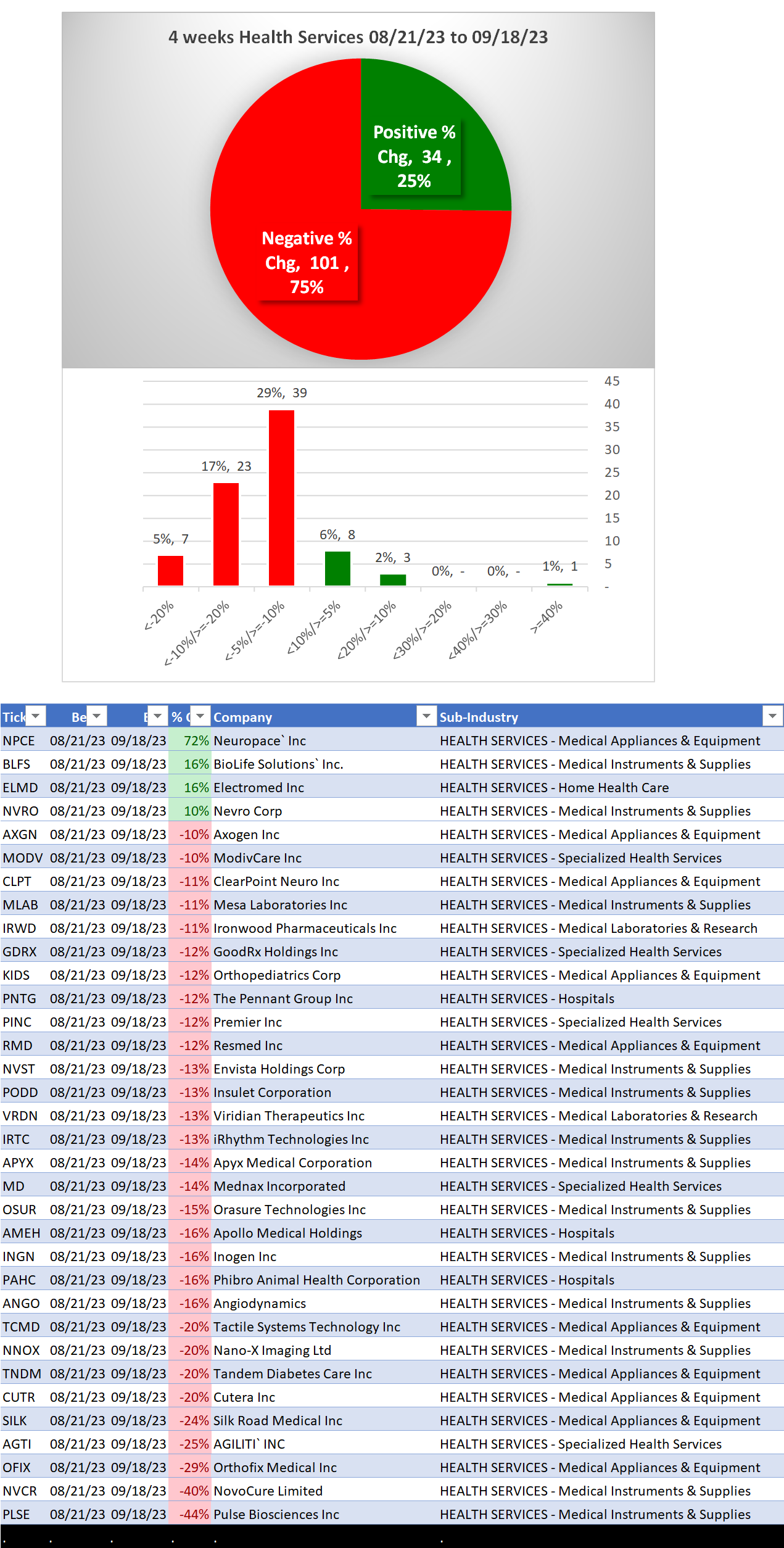

Past 4 weeks

30 stocks -10% or more (22% of total)

NPCE/Neuropace (Medical Appliances & Equipment) 72%

NVCR/NovoCure Limited (Medical Instruments & Supplies) -40%

PLSE/Pulse Biosciences Inc (Medical Instruments & Supplies) -44%

Past 1 week

34 stocks -5% or more (25% of total)

59 stocks rated Weakest (44% of total)

OFIX/Orthofix Medical Inc (Medical Appliances & Equipment) -30%

Background

Material of 8 sub-industries (135 stocks total, average 17 stocks/sub-industry):

46 stocks Medical Appliances & Equipment

38 stocks Medical Instruments & Supplies

15 stocks Medical Laboratories & Research

14 stocks Specialized Health Services

10 Biggest Market Cap stocks:

UNH, TMO, ABT, SYK, MDT, ELV, ISRG, CI, BSX, BDX

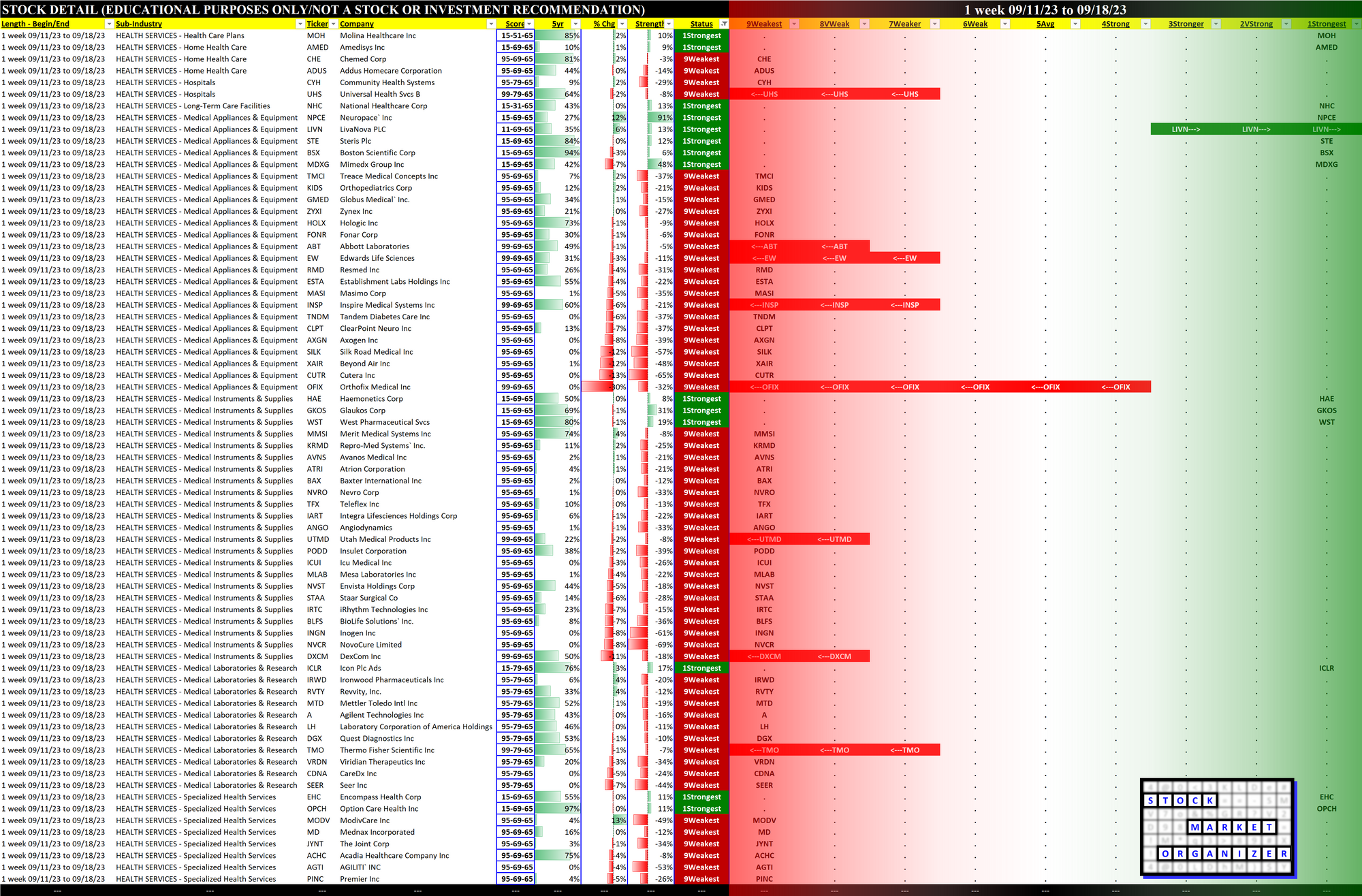

DETAIL: 1 Week Performance Review

Status

Strengthened: 2/8 sub-industries

Weakened: 2/8 sub-industries

Strongest at Stronger rating/3rd strongest of 9 levels:

3 stocks Long-Term Care Facilities

Weakest at Weaker rating/7th strongest of 9 levels:

9 stocks Hospitals

15 stocks Medical Laboratories & Research

Detail Charts: Sub-Industry and Stock

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

DETAIL: Lookbacks 6 Mos vs. 4 weeks vs. 1 Week

6 Mos Lookback

4 weeks Lookback

1 Week Lookback