Gory Real Estate Details 2023-03-17 (office has been leading down but struggles abound industry-wide)

This is follow-up detail to the Real Estate summary provided in this post.

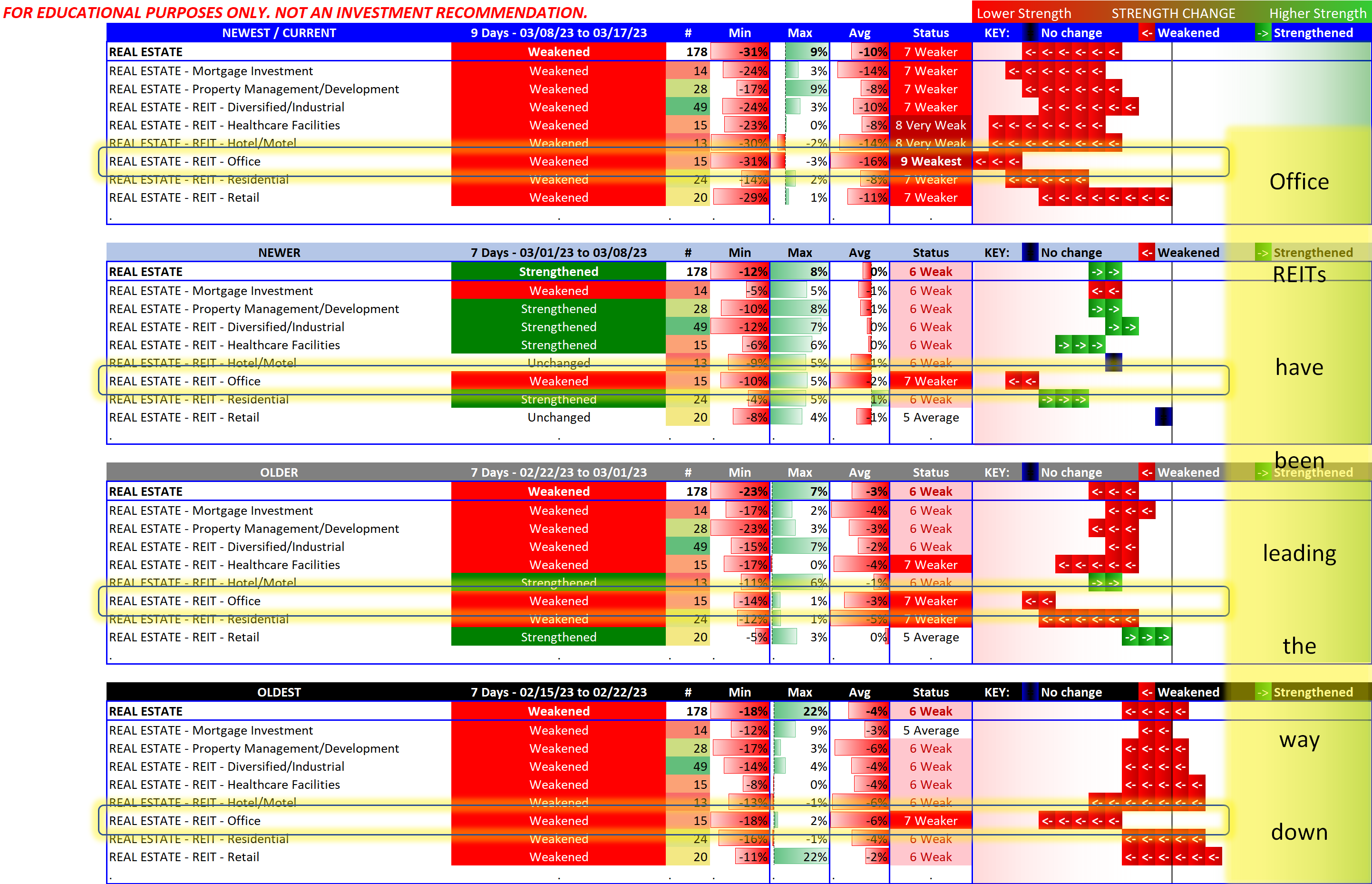

Much has recently been written in the press about the struggles for the office sector given macro trends such as WFH. The fact is, the entire Real Estate industry is currently on the ropes, as you'll see from the detailed sub-industry by sub-industry reviews below.

Here's the downloadable full industry report:

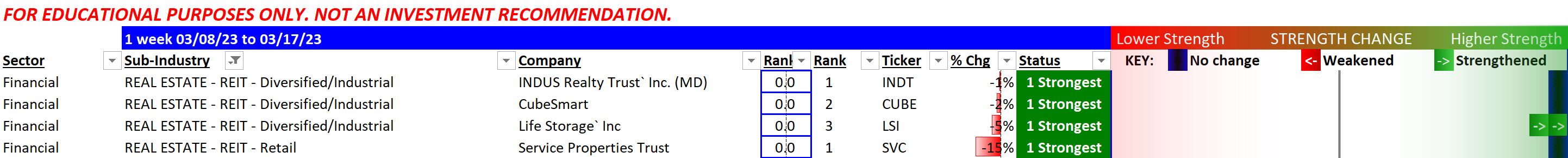

The punch line: the strongest (4 stocks) and weakest (90)

The following two charts provide a quick summary of the current best and worst in the Real Estate industry. A huge imbalance toward weak stocks. Of the eight Real Estate sub-industries, there are only two that have stocks with the highest strength score.

Sub-industry details

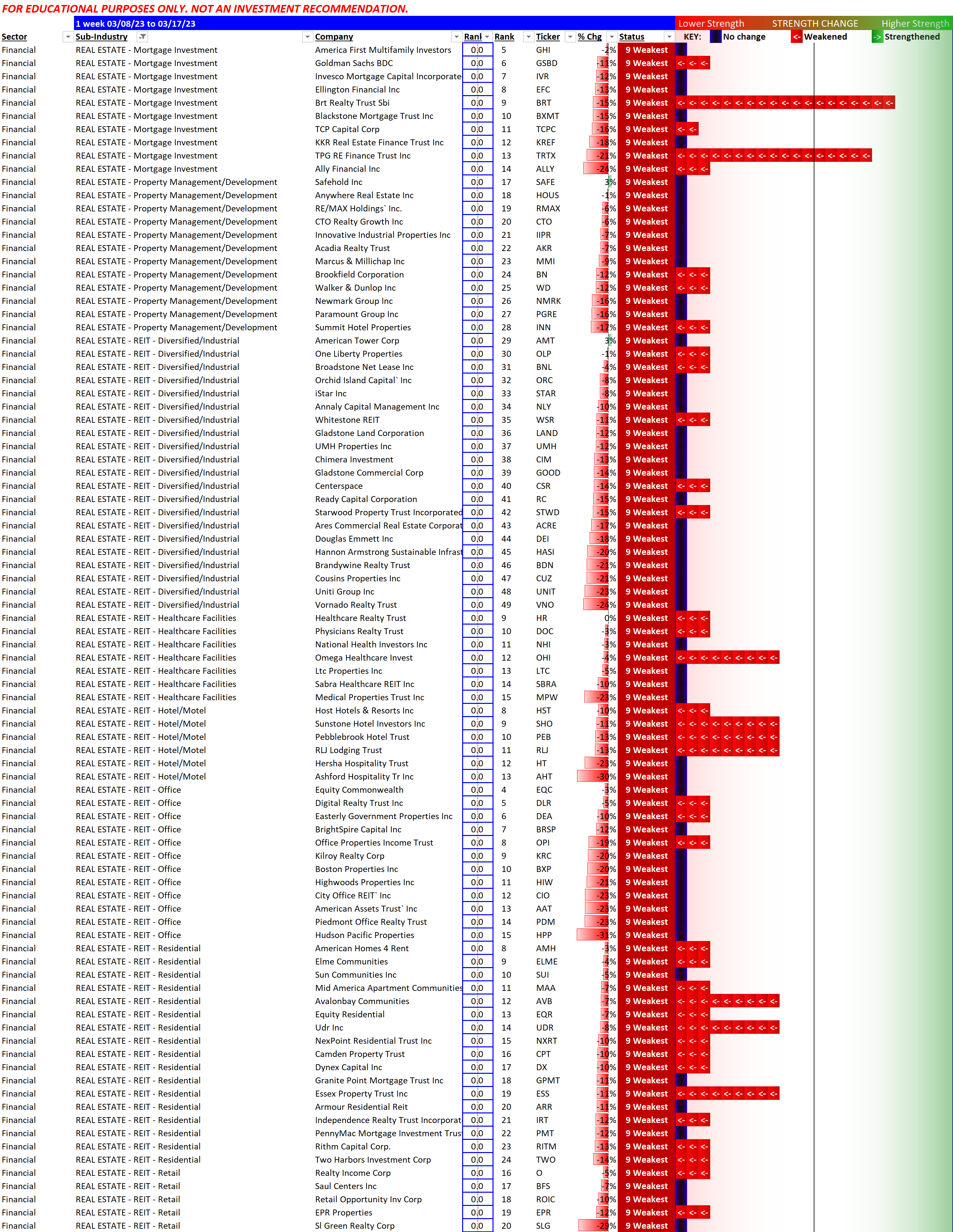

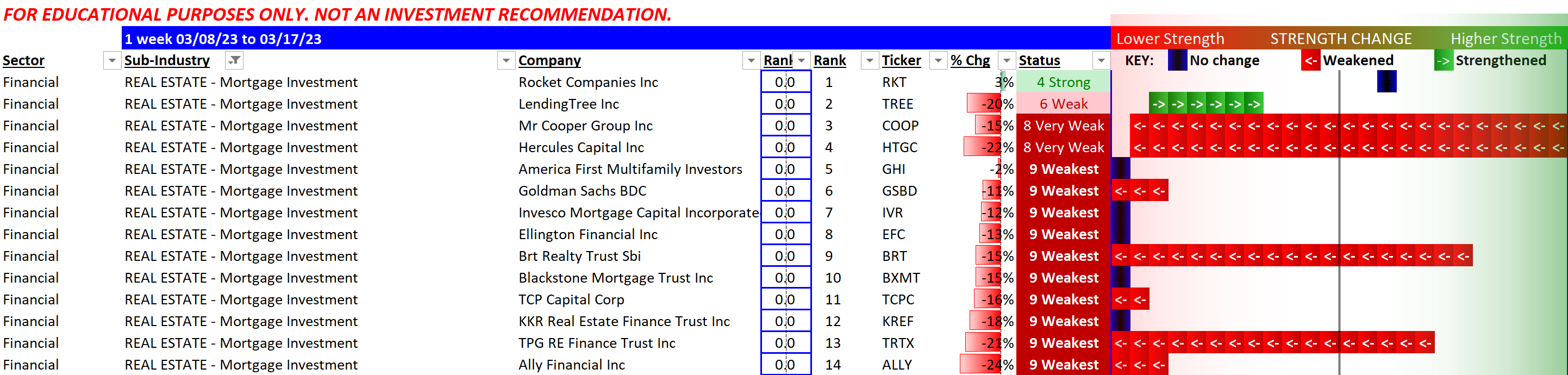

Mortgage Investment

Painful. Rising rates are not helping. Although, what happens when/if rates start trending back downward? Is now a good buying opportunity? (Answer: the stocks themselves will tell you when they are turning around. Follow them closely for their clues.)

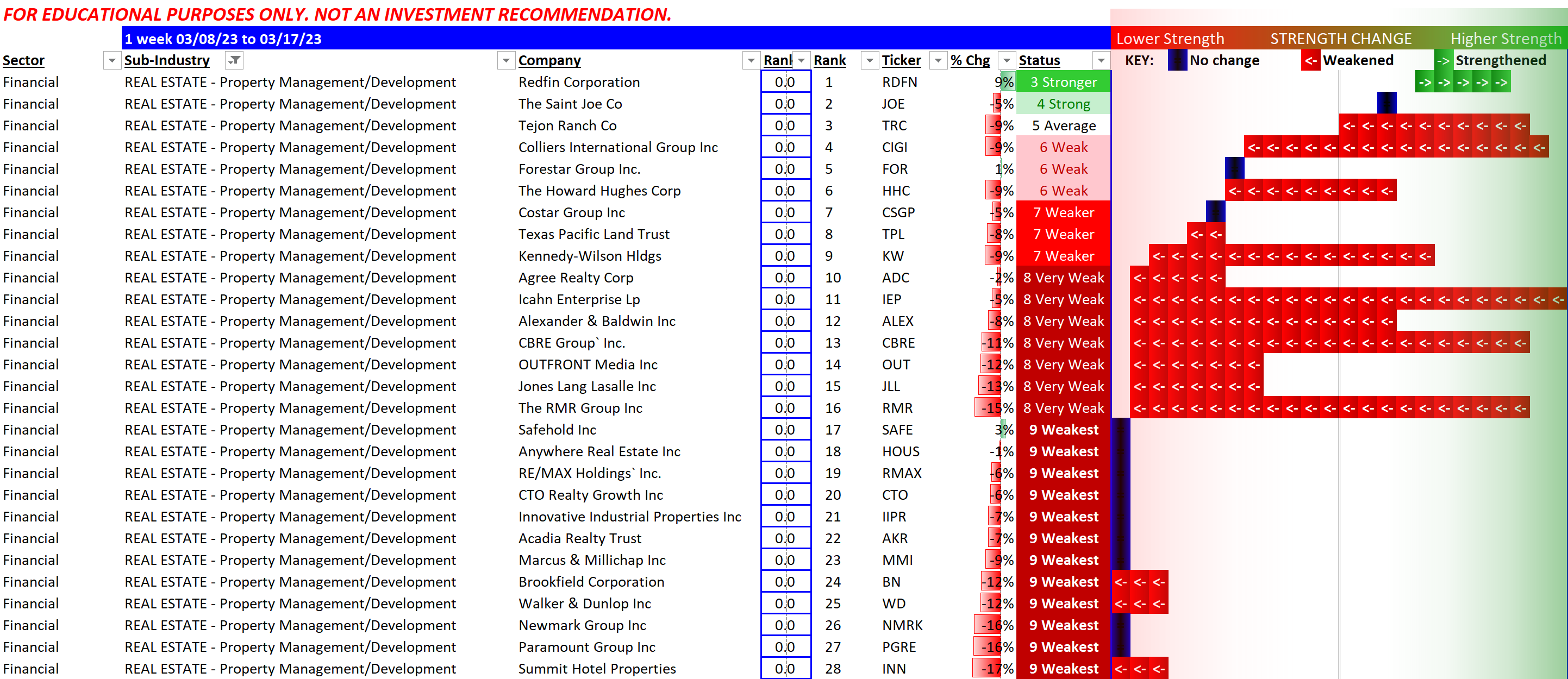

Property Management and Development

Redfin surprisingly (to me) holding up. Everyone else, not so much.

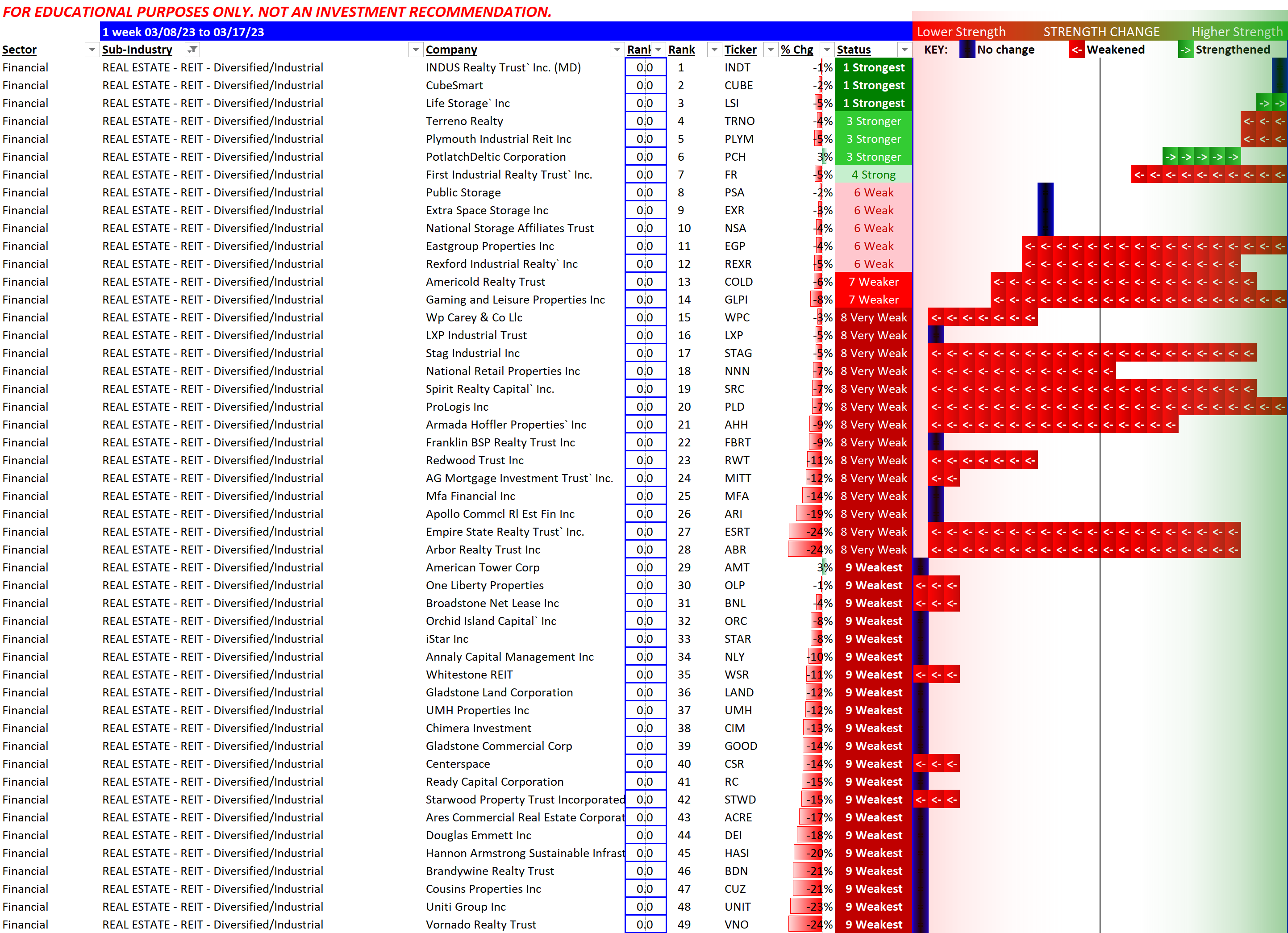

Diversified/Industrial

The top one listed here (INDT) is being acquired. Storage company stocks have migrated to the top, with CubeSmart/CUBE and LifeStorage/LSI holding the highest strength ratings. This is the home of Vornado Realty Trust/VNO which has cratered to multi-decade lows.

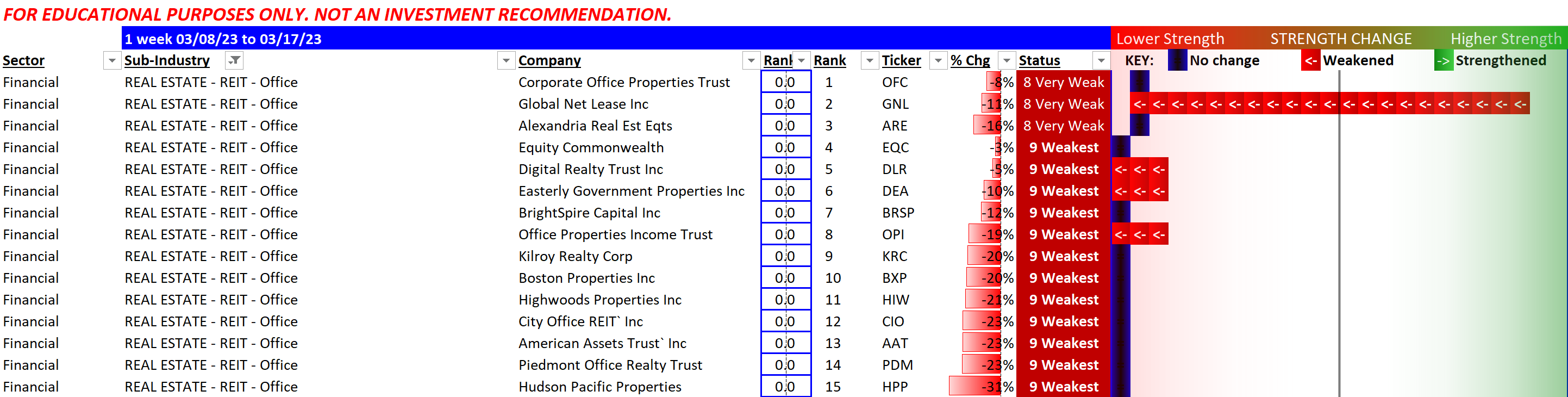

Office REITs

Putting this right behind Diversified/Industrial because some of those REITs have much office exposure. A basket case for all the reasons everyone knows. Forecasts state a high proportion of the existing inventory will not be office by the end of the decade. The pummeling which started with Covid (high lease occupancy plus low physical occupancy means easy parking and the need to supply tenants with fancy digs to induce them to stay - buy stock in bouncy houses and meditation room equipment) continues and may not abate. At least if rates stop rising then so will cap rates.

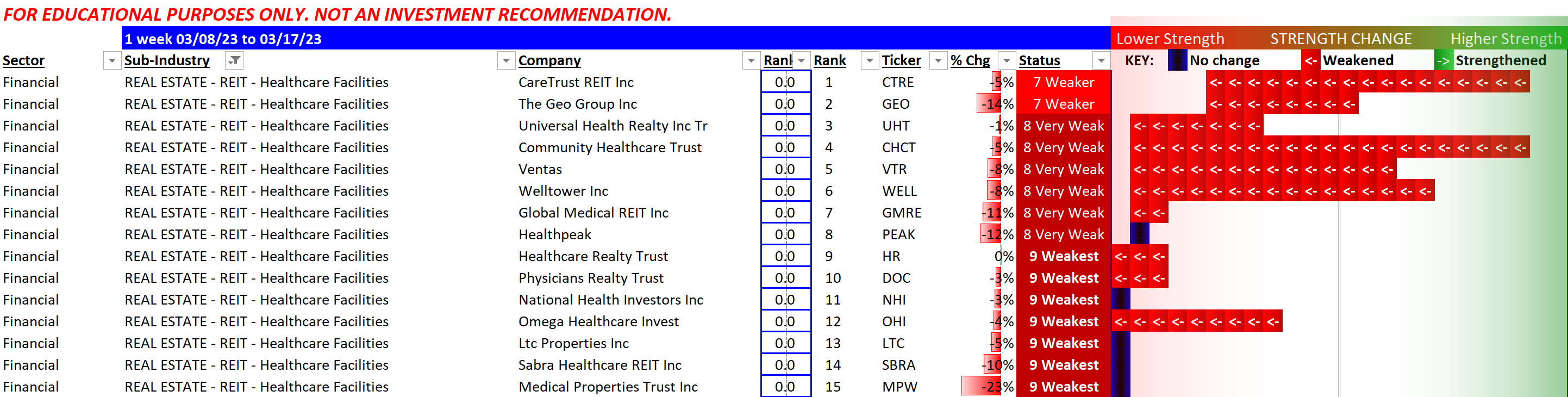

Healthcare REITs

Negative performance all around since 3/8/23, except for Healthcare Realty Trust/HR which managed to break even. Though it still has the weakest rating.

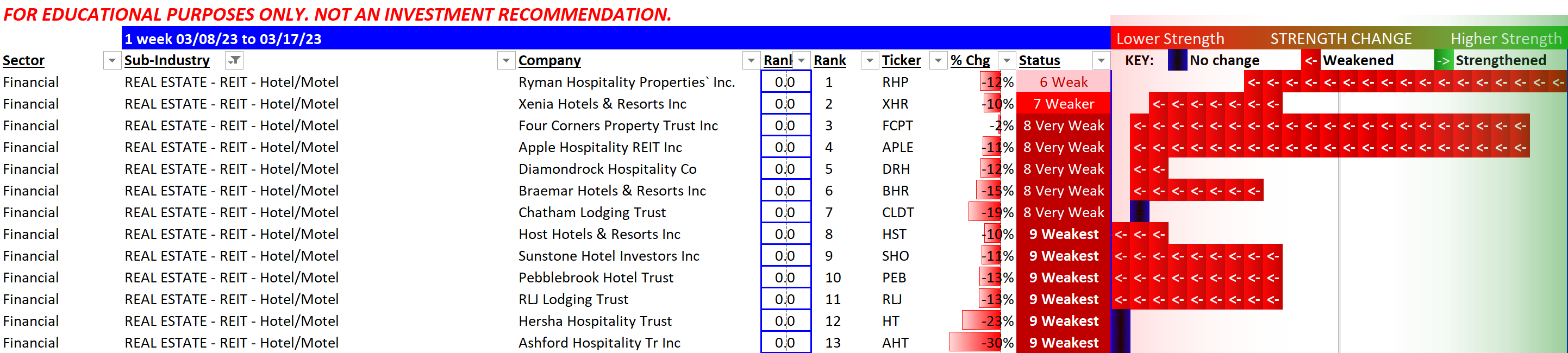

Hotel REITs

Had a hard time during Covid. Now that more normal full-year results are finally becoming available (2022), the overall market is running into issues. But, as we've seen, this is industry-wide and not limited just to Hotel REITs.

Residential REITs

Genuinely shocking that some of the longest-running big names in the sub-industry are having issues, based on their stock prices (Equity Residential/EQR, AvalonBay Communities/AVB, UDR Inc./UDR, Camden Property Trust/CPT).

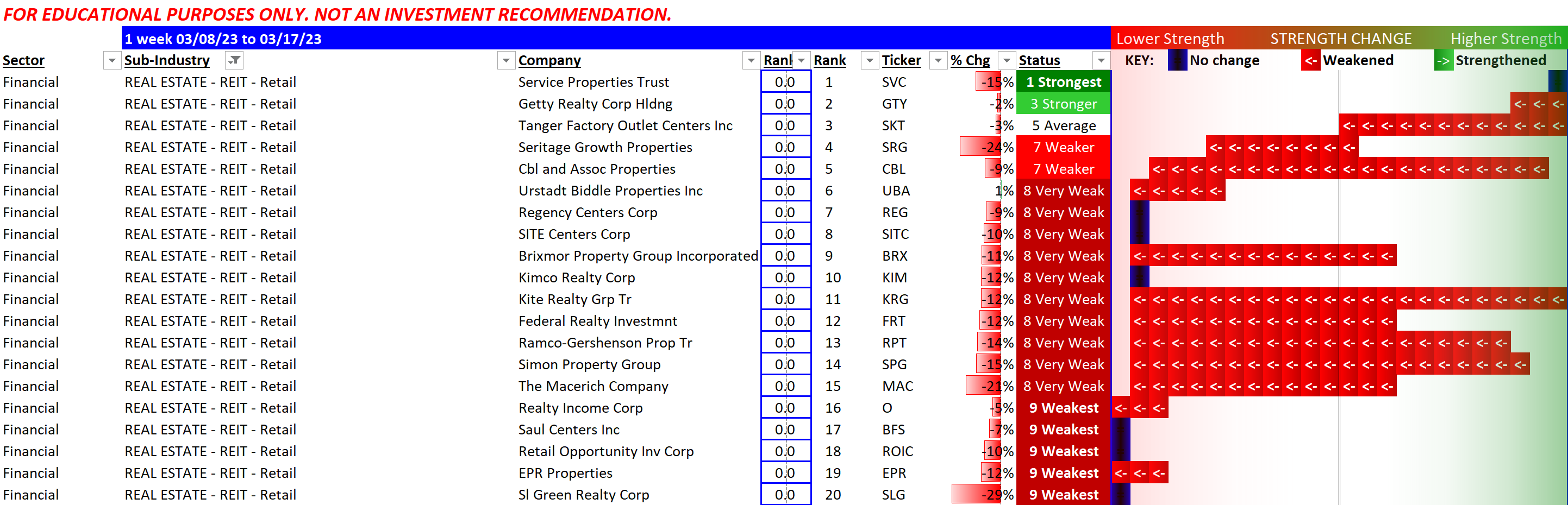

Retail REITs

One stalwart (Service Properties Trust/SVC) amidst many cratering Retail REIT stocks. Perhaps it will remain the leader when the sub-industry begins to turn around.