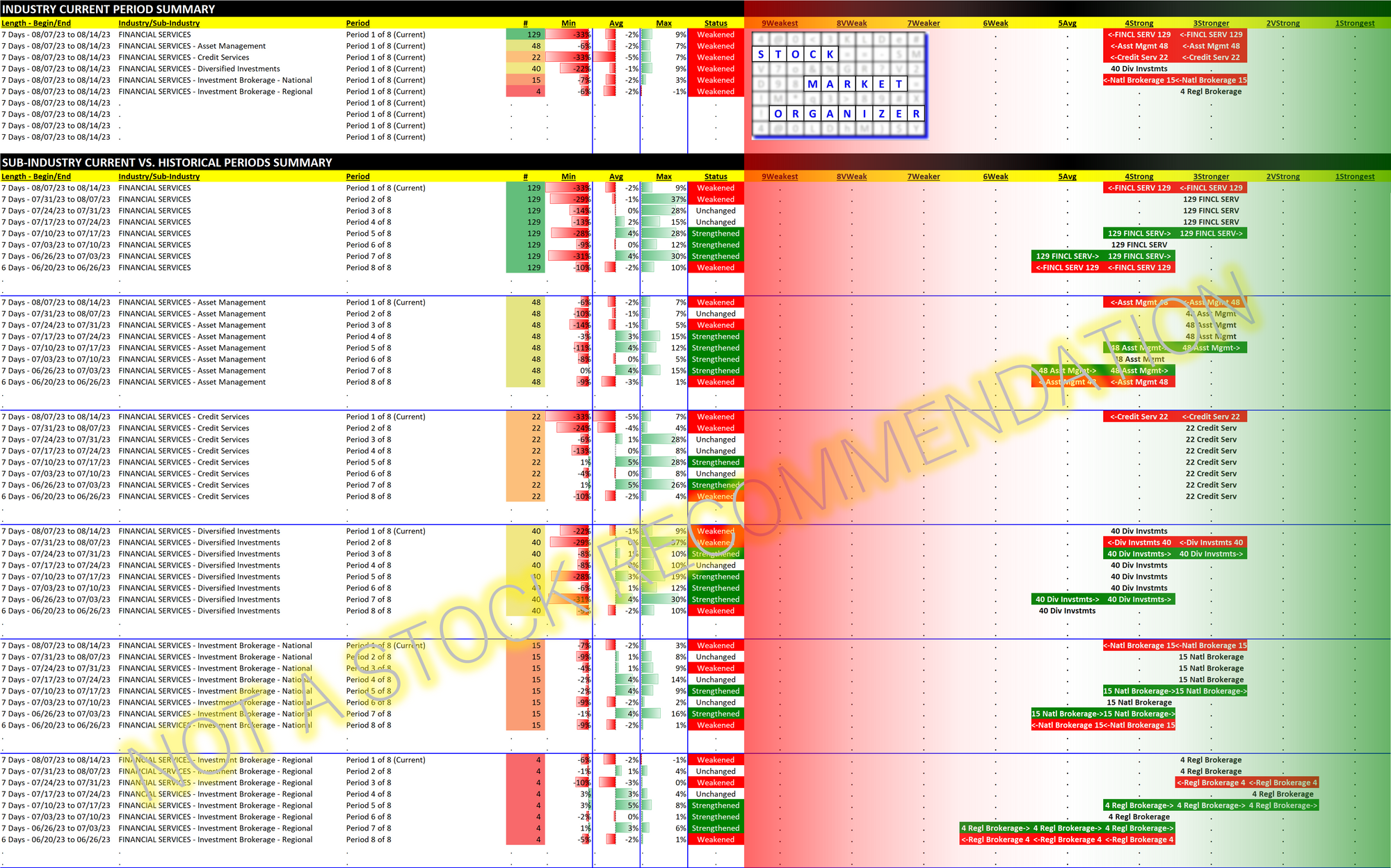

Financial Services 2023-08-14: -1 to "Strong" strength rating (4th strongest of 9 levels), previous move was up

Previous Financial Services review from 2 weeks ago is here.

Recession or no? Hard or soft landing? Some are arguing "this time is different" (when looking at inverted yield curves and other data which historically have signaled oncoming recession). This industry should reflect the bite of higher interest rates.

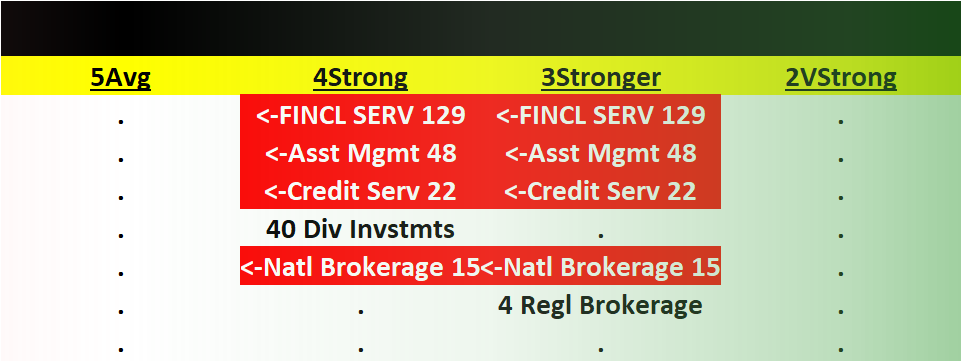

This trading week ending 8/14/23 shows a weakening for the first time in seven weeks.

I don't know if it will continue but a consistent theme here is that a multi-week or longer decline begins with one down week.

Two weeks ago I wrote "SOFI/SoFi Technologies jumped almost 20% today by (per Yahoo!) 'reporting a surge in members in the second quarter and raising its full-year outlook.'" Since then: -24%.

Also highlighted then: UPST/Upstart, which had increased 28% for the trading week ending 7/31/23. Since then: -49%.

Both SOFI and UPST are in the Credit Services sub-industry which weakened from Stronger to Strong (4th strongest of 9 levels). This sub-industry previously had been flat for two months beginning the week of 6/12/23, rising from Strong to Stronger during the week of 6/5/23.

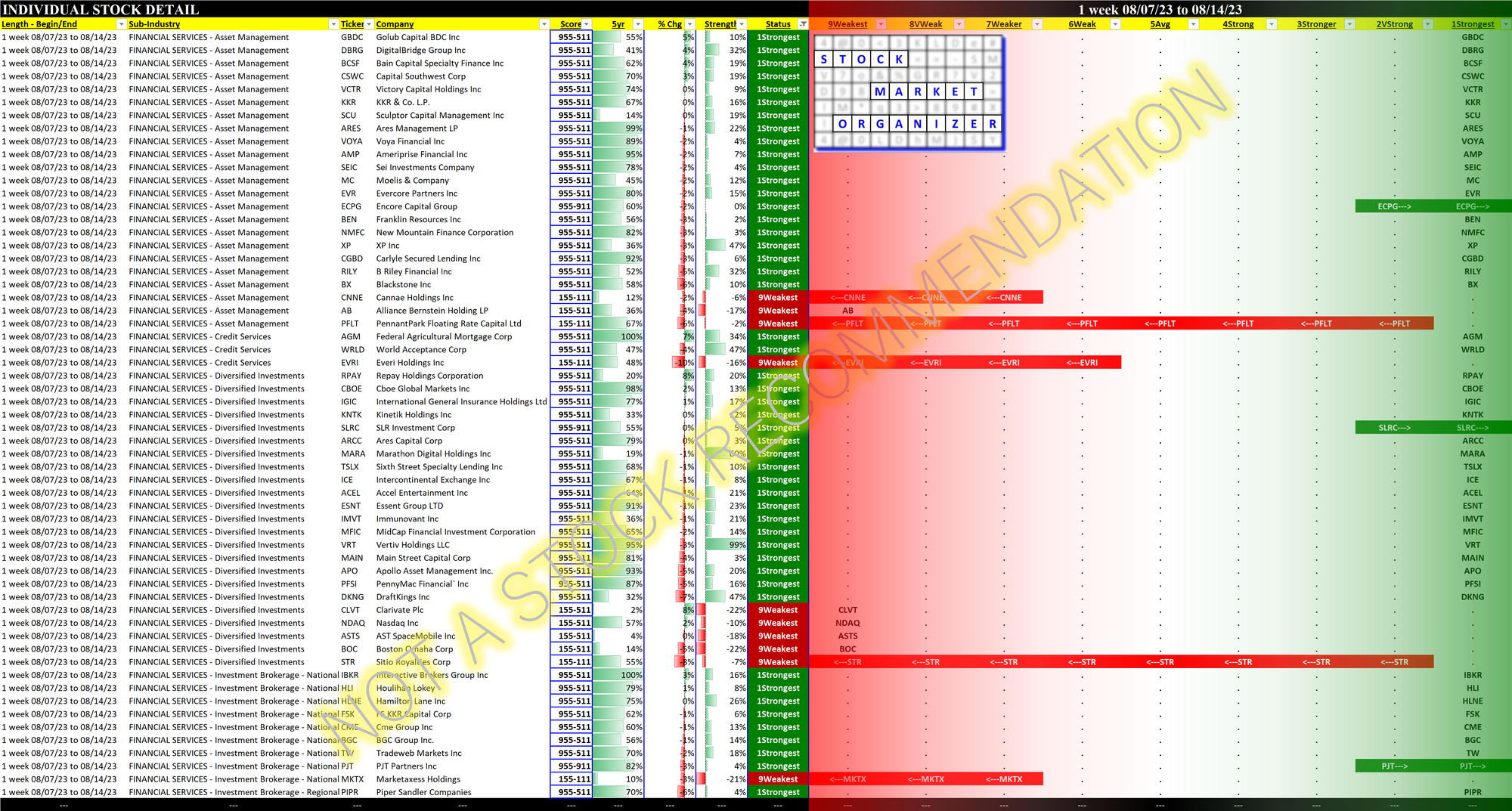

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.