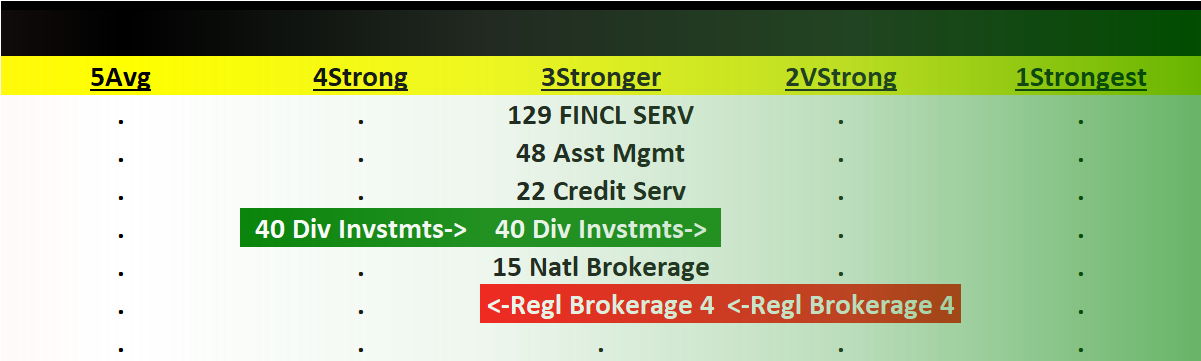

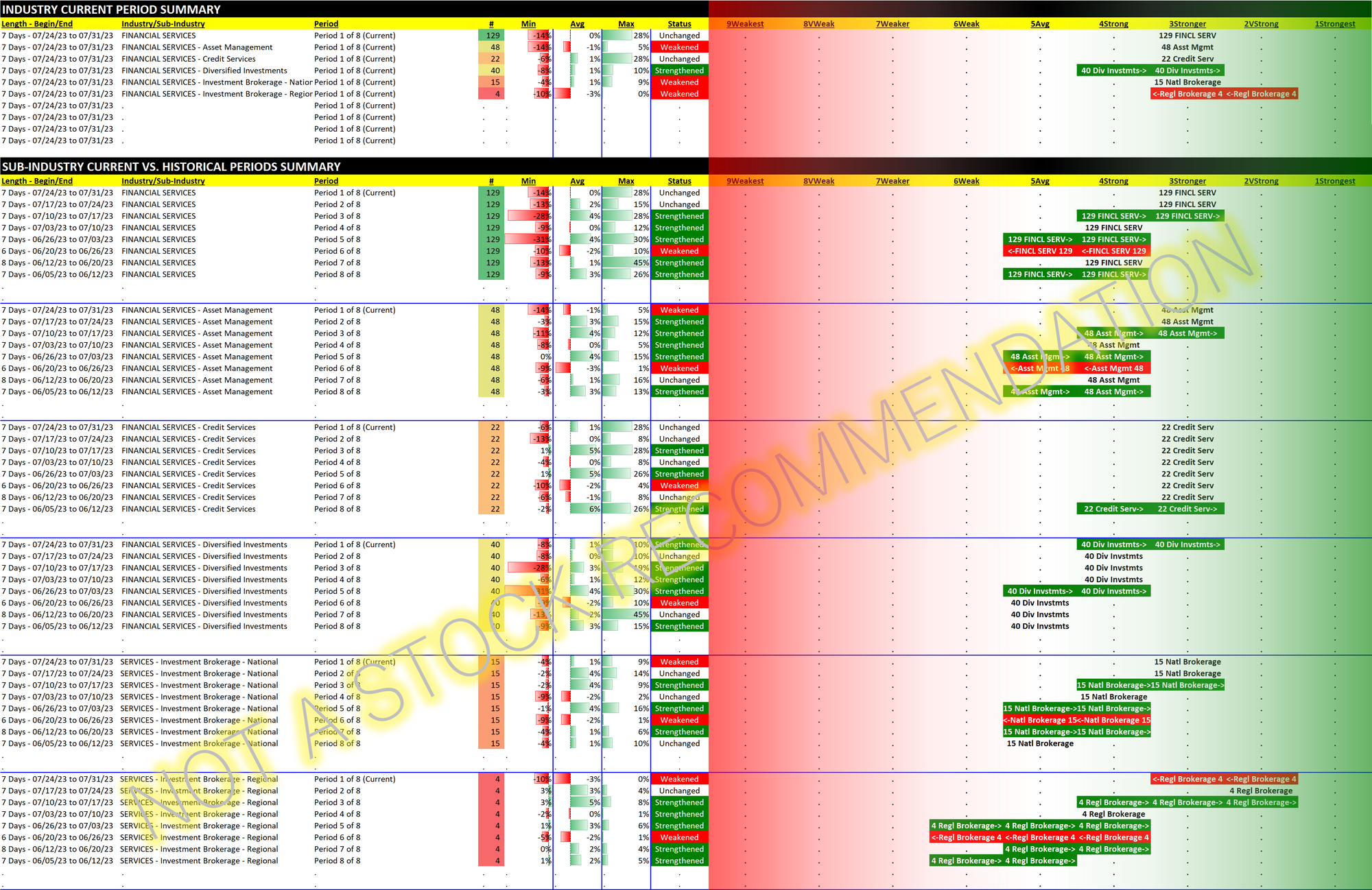

Financial Services 2023-07-31: Unchanged at "Stronger" strength rating (3rd strongest of 9 levels), previous move was up

Should it be expected that these stocks would be stronger in a rising rate environment?

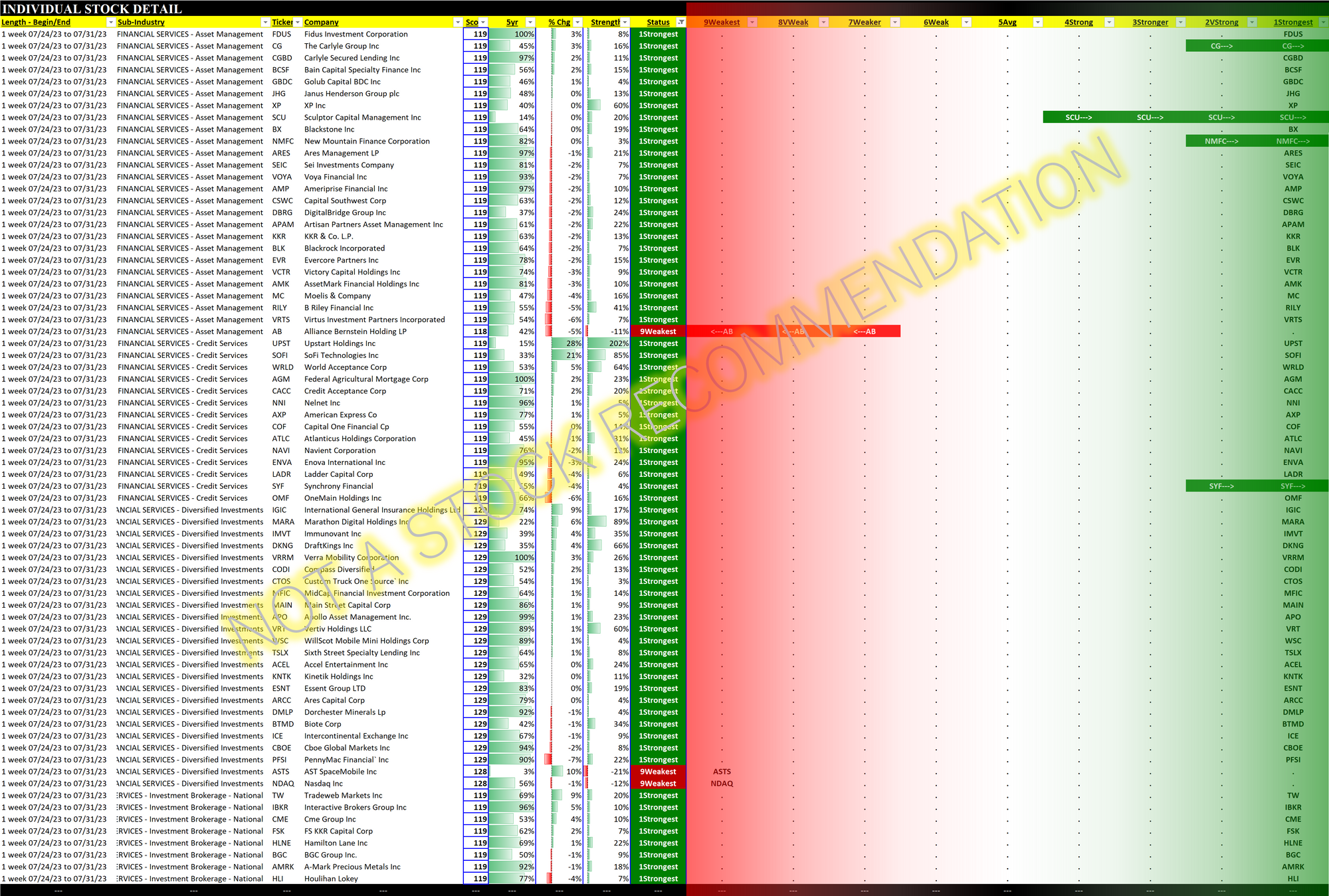

Financial Services is comprised of of Asset Management, Credit Services, Diversified Investments, and National and Regional Brokerages. This is the home of MS/Morgan Stanley, GS/Goldman Sachs, AXP/American Express, SCHW/Schwab Group, BLK/Blackrock Incorporated, and PYPL/Paypal Holdings (top 6 by market capitalization).

This industry has been strengthening over the past five weeks, though it has been flat for the past two weeks.

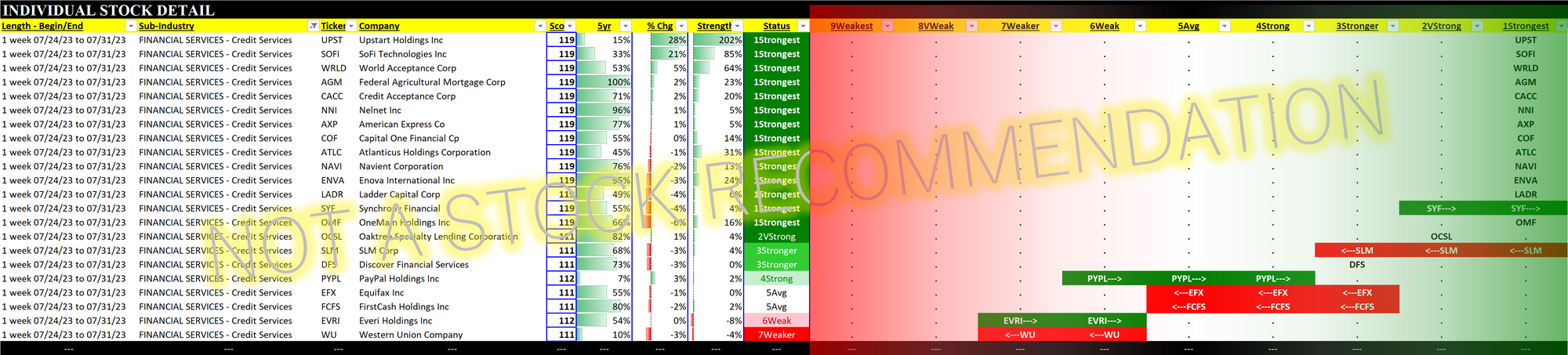

Credit Services - a closer look

SOFI/SoFi Technologies jumped almost 20% today by (per Yahoo!) "reporting a surge in members in the second quarter and raising its full-year outlook." Cherry-picking its recent low of May 16, 2023, this puts its gain through today July 31, 2023 at 141%. This is second behind only UPST/Upstart Holdings +254% during this period among all Credit Services stocks. Add both of these to the list of stocks that have enjoyed continued strong runs after enjoying strong rallies prior to that advance. Upstart increased 28% last week.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.