Energy strength status as of 2023-05-12?

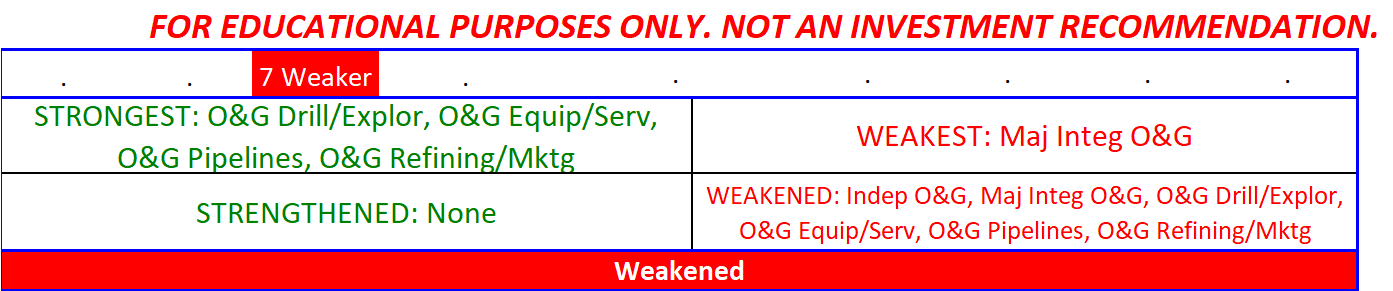

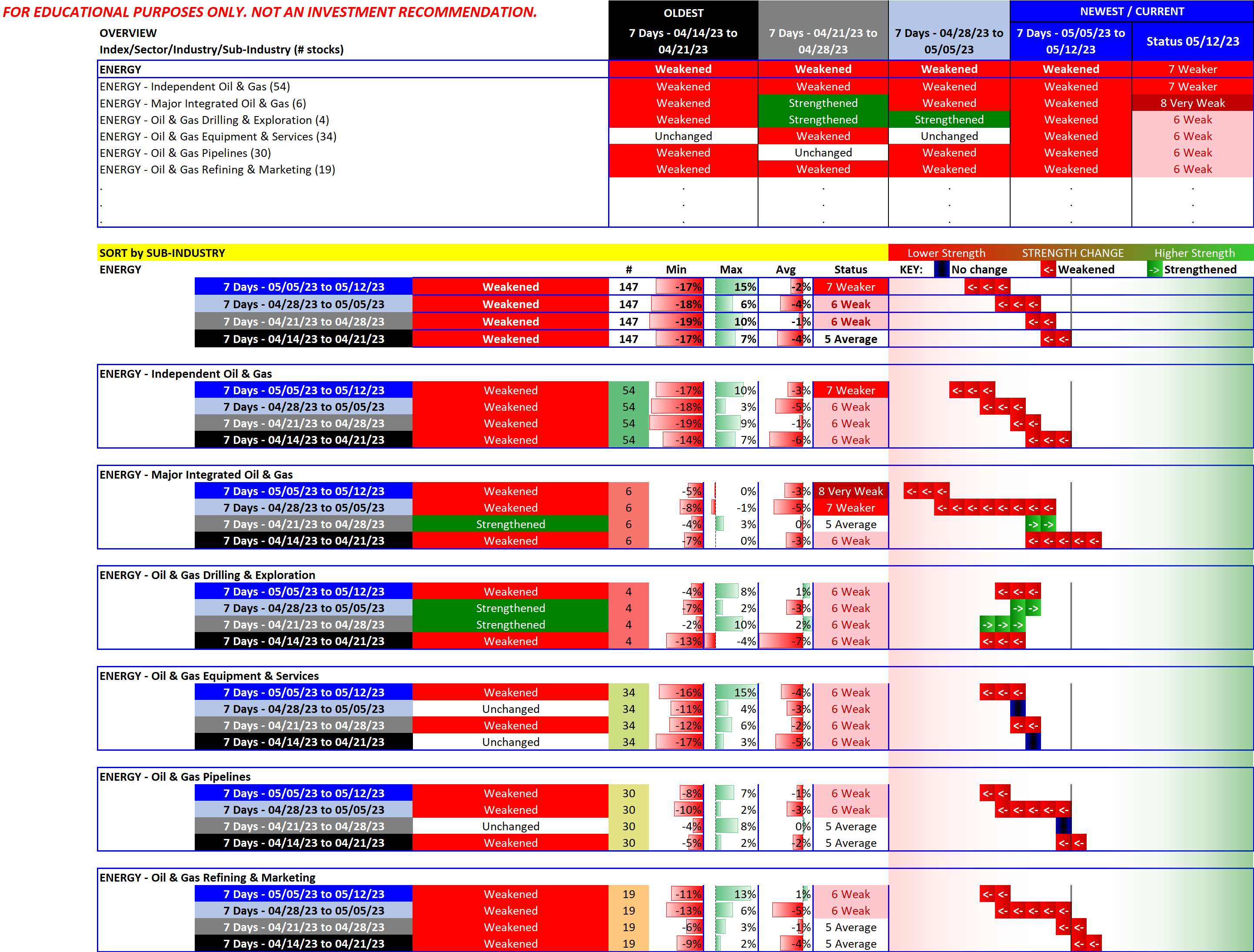

ENERGY industry status: WEAKENED over the past week, rating = "WEAKER." (Compare this to the last time I reviewed Energy.)

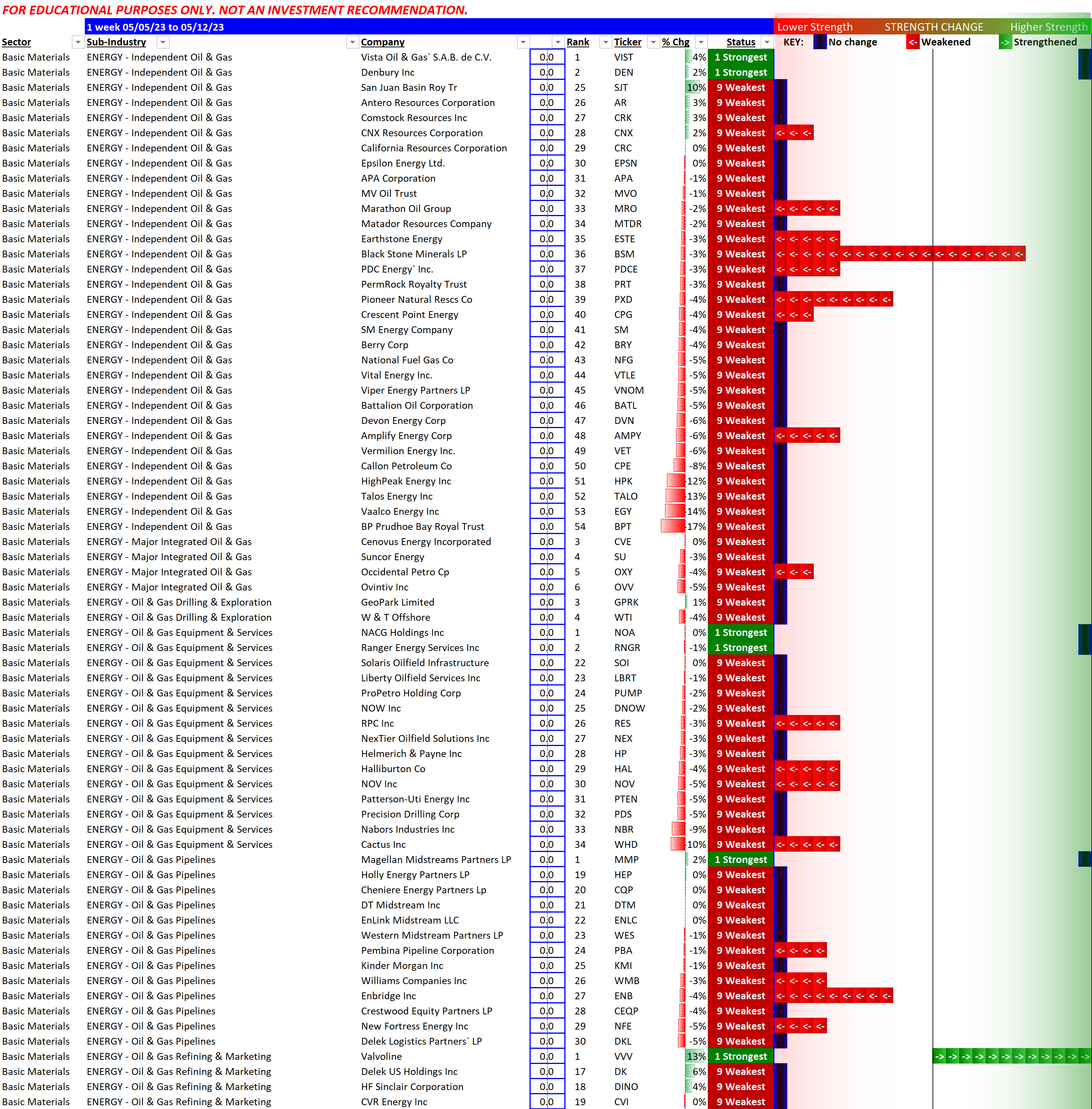

Only 6 stocks rated "Strongest" (<10% of the “Weakest”): VIST, DEN, NOA, RNGR, MMP, VVV. Major Integrated Oil & Gas = Very Weak overall (XOM, CVX, CVE, SU, OXY, OVV).

Look elsewhere if you want strong/strengthening stocks. If/when Energy stocks start to go back up a meaningful rally will last so you won't miss the bus if you wait for a strengthening week. This past week was not it.

NOTE: Like Energy, Real Estate is also "WEAKER" - but it STRENGTHENED over the past week.

Overview - All Sub-industries Weakened

The benefit of this methodology is its "Spectrum" analysis. It answers simply and clearly "how low is low." While all sub-industries weakened last week as noted below, you can simply and clearly see there is more room in the spectrum for these sub-industries (and their component stocks) to fall. As always, this is not a prediction. It is merely an observation - but it is an actionable observation.

Big Imbalance in Strongest vs. Weakest Stocks

Current Strongest:Weakest stocks ratio is 6:64, as compared to previous week ratios of 10:50, 9:29, and 17:29. The strongest and weakest are listed below by sub-industry:

Downloadable File

For the curious: