Energy Industry 2025-02-27: 6Weak strength rating (Weakened one rating)

This post is organized as follows:

I. Introduction

II. Market Environment

III. Industry Background

IV. Industry/Sub-industry Recent Performance

V. Stock Details

I. Introduction

This post provides detail on the Energy industry - specifically:

🔹 An objective measurement of industry strengthening and weakening so you can objectively compare recent strength and weakness across/within industries and sub-industries.

🔹 A listing of stocks from 1Strongest through 9Weakest (highest/lowest rating of 9 levels) by sub-industry. Generally, stronger stocks rated 1Strongest have less overhead supply to impede further price appreciation. Meanwhile, weaker stocks rated 9Weakest may 1) be prone to “pops” from bargain hunting and short-covering yet, due to preceding weakness, are 2) also prone to falling far and fast from holders "throwing in the towel."

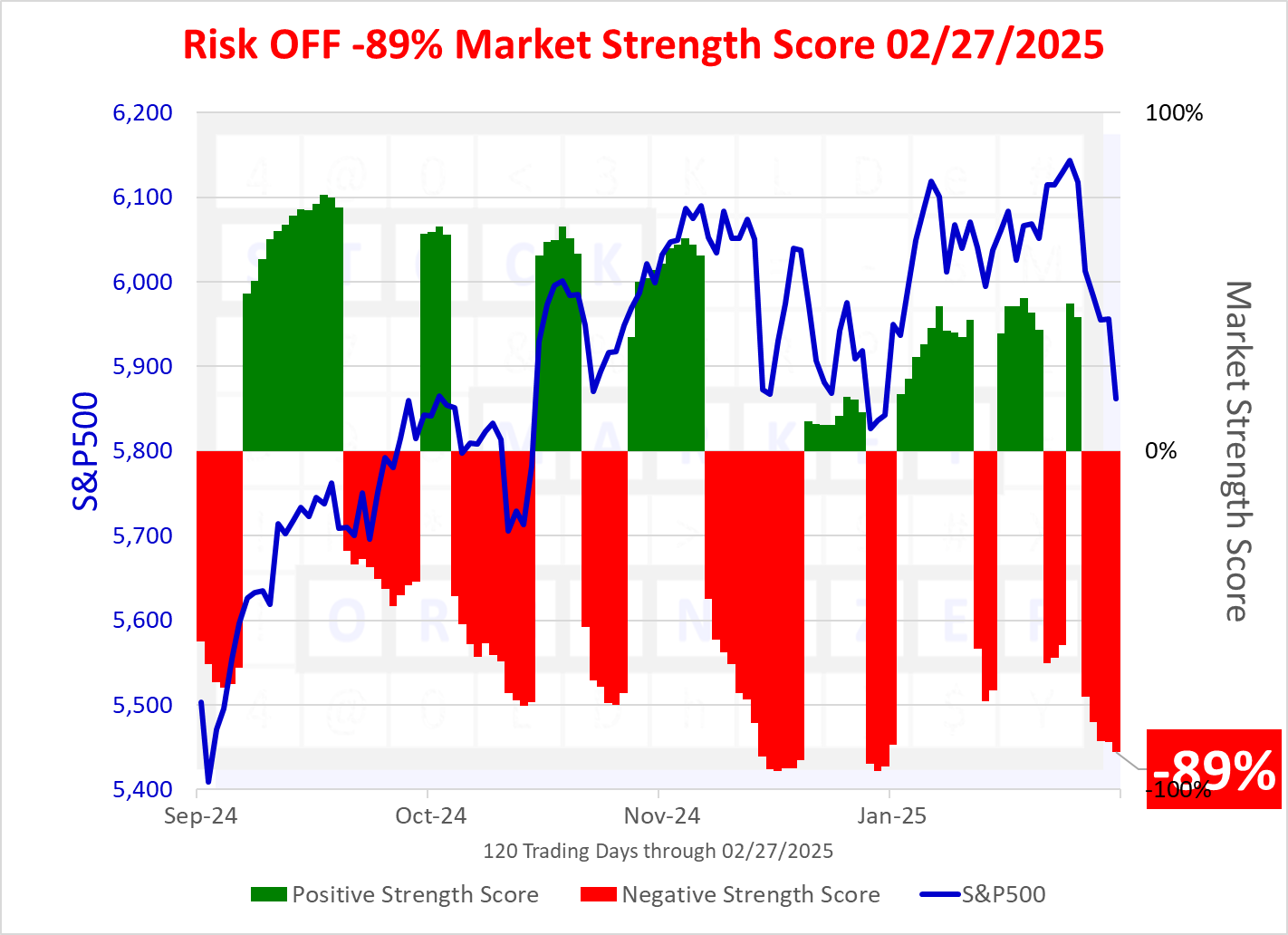

II. Market Environment

This system seeks to understand the current market environment before considering sector, industry, sub-industry, and stock-level strength. There is no guarantee this objective measurement will remain either favorable to longs (tailwinds present) or unfavorable (headwinds present). The critical factor is this acknowledges the clear influence market factors have on the levels below it and lays the groundwork for subsequent principle-based decision-making.

The current strength score is -89% as shown below. The lower bound for this score is -100% so, while of course not guaranteed that will happen, there is room to fall. There is no way to determine the amount of index points that would be associated with a fall to -100%. Please see this post for a look at two key times the strength score reached -100% (the Great Financial Crisis and the Covid Pandemic).

III. Industry Background

Largest of 6 sub-industries (124 stocks, average 21):

- Independent Oil & Gas (39 stocks)

- Oil & Gas Equipment & Services (28 stocks)

- Oil & Gas Pipelines (24 stocks)

- Oil & Gas Refining & Marketing (17 stocks)

- Major Integrated Oil & Gas (14 stocks)

Top 10 Market Caps:

XOM/Exxon Mobil Corporation, CVX/Chevron Corp, TTE/TotalEnergies SE, COP/ConocoPhillips, PBR/Petroleo Brasileiro S.A., ENB/Enbridge Inc., BP/BP P.L.C., EQNR/Equinor ASA, EOG/Eog Resources Inc, EPD/Enterprise Products Part

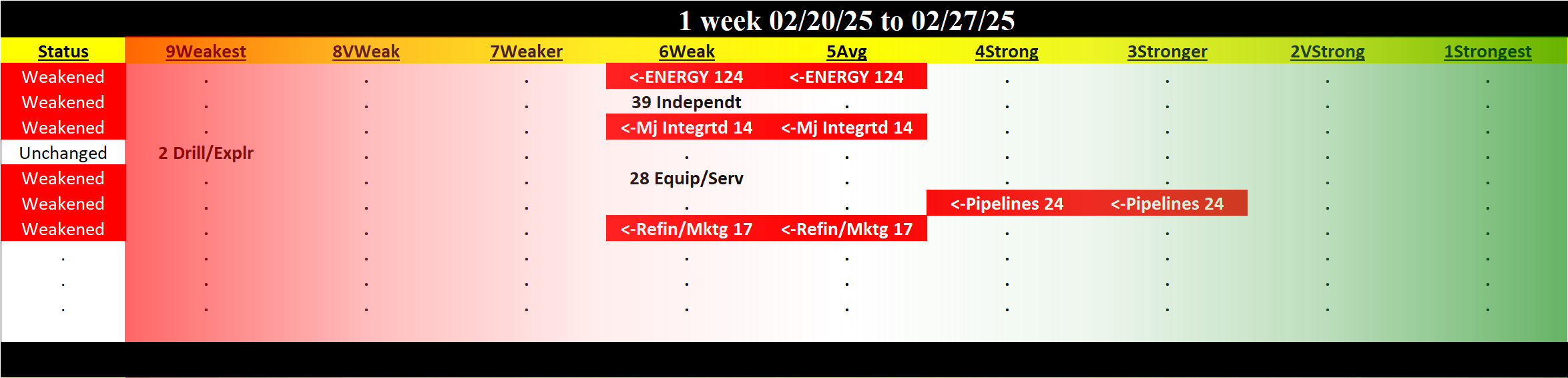

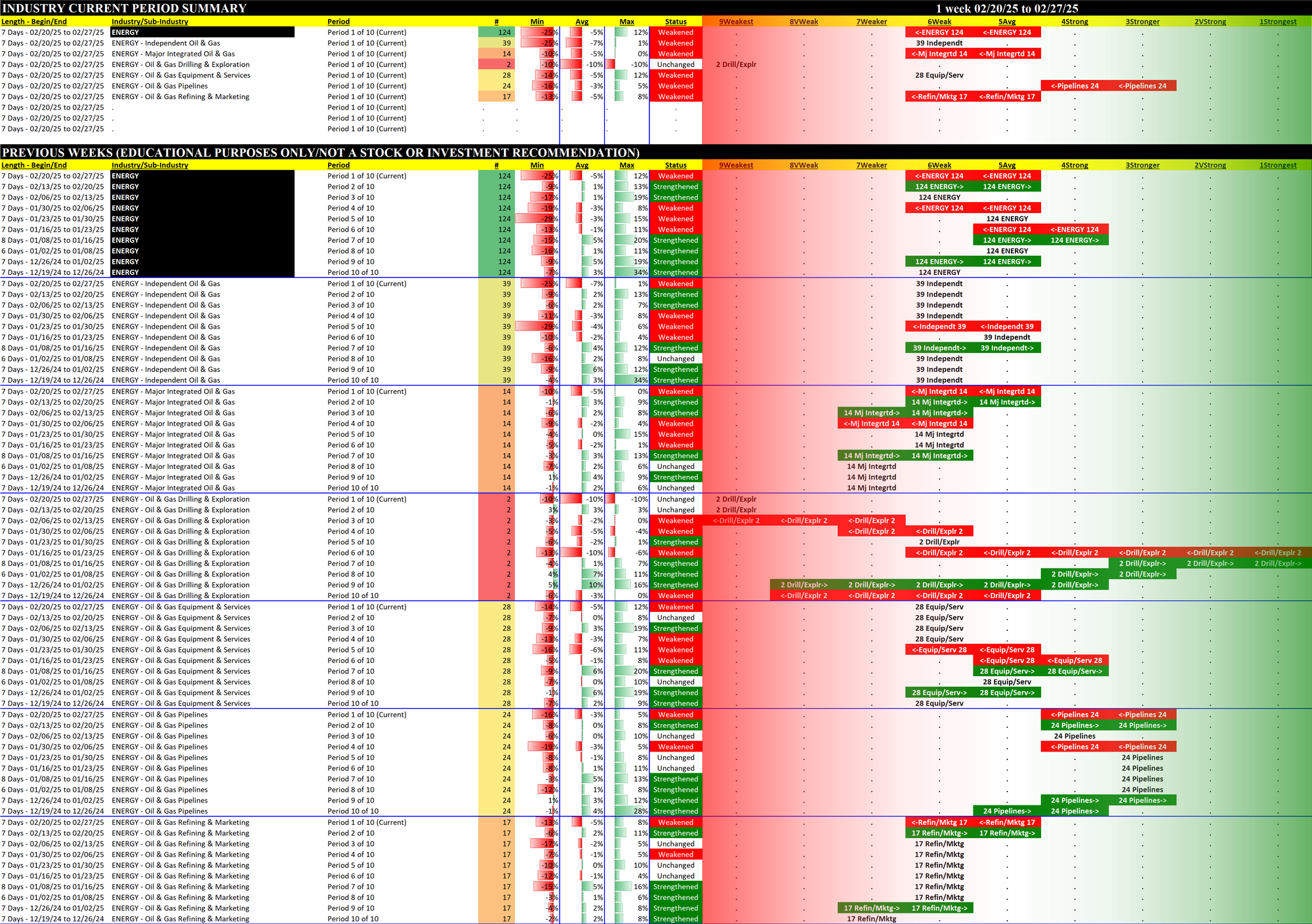

IV. Industry Recent Performance

The following summarizes the past 10 weeks ratings and changes for the Energy sub-industries.

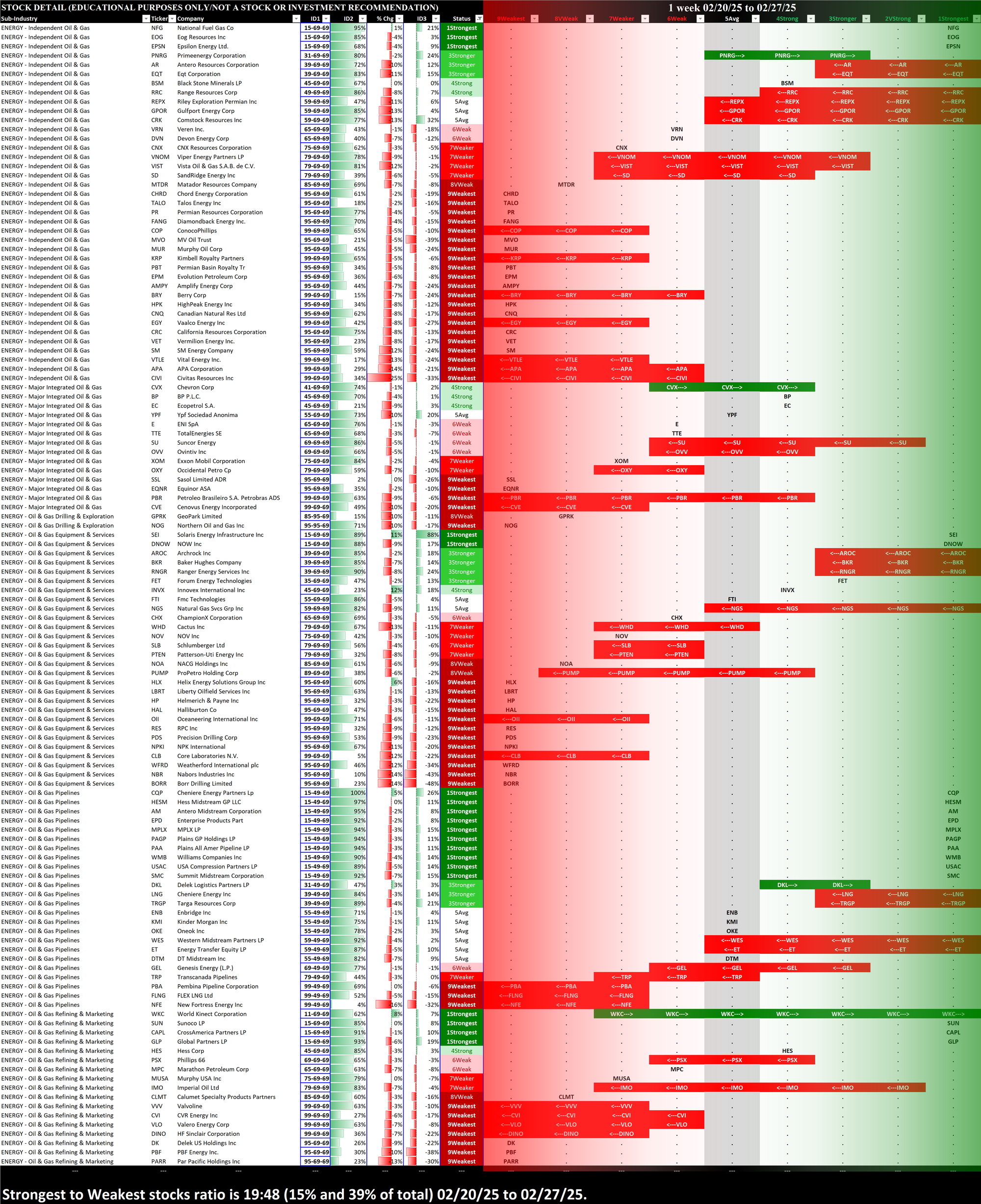

V. Stock Details

The following provides a listing of all Energy industry stocks in order of 1) sub-industry, 2) strongest-to-weakest strength rating, then 3) highest to lowest return this week.

Note the Strongest to Weakest stocks ratio is 19:48 (15% and 39% of total) from 02/20/25 to 02/27/25.