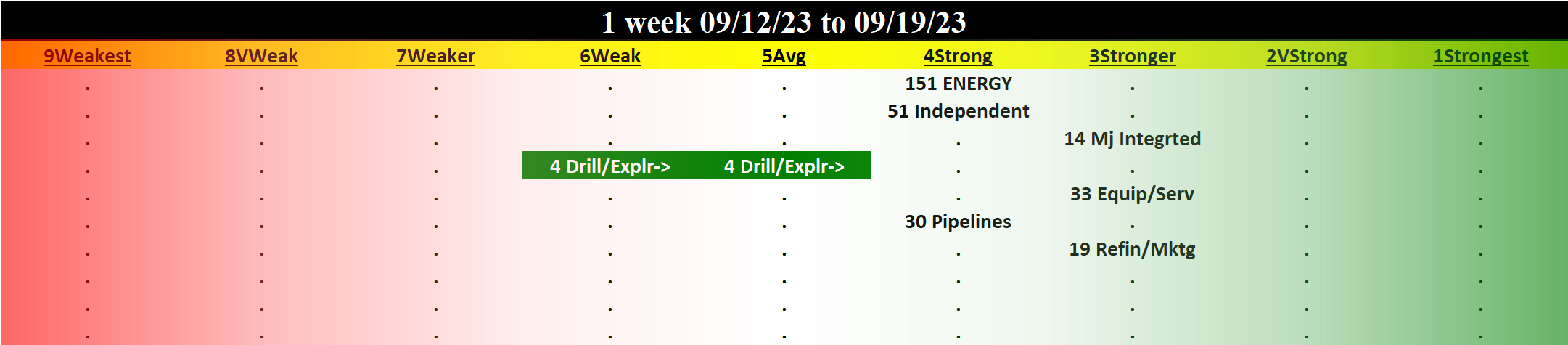

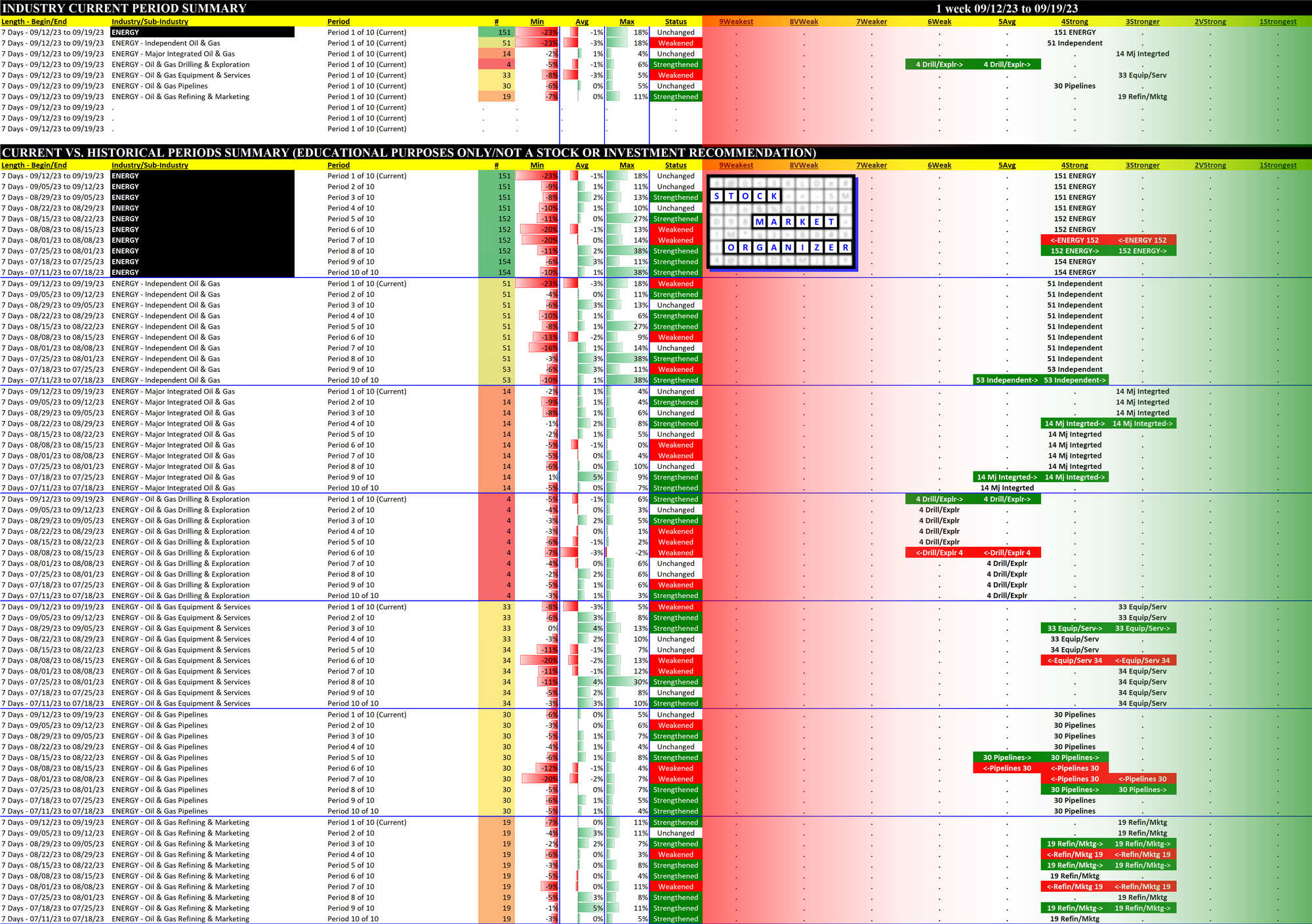

Energy 2023-09-19: Unchanged at STRONG strength rating (4th strongest of 9 levels), previous move was DOWN

SUMMARY

Performance

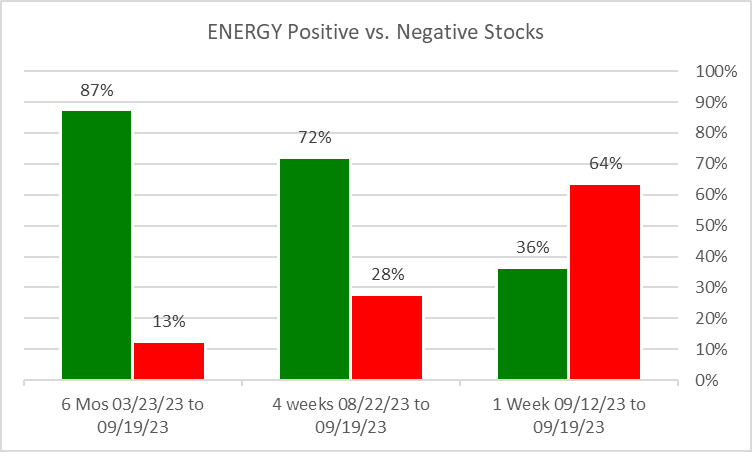

Bottom Line: has remained Strong or better for 10 weeks

Context: weakening short term vs. mid-term and longer-term. Positive stocks 1 week are half what they have been for the past 4 weeks.

Other Notes:

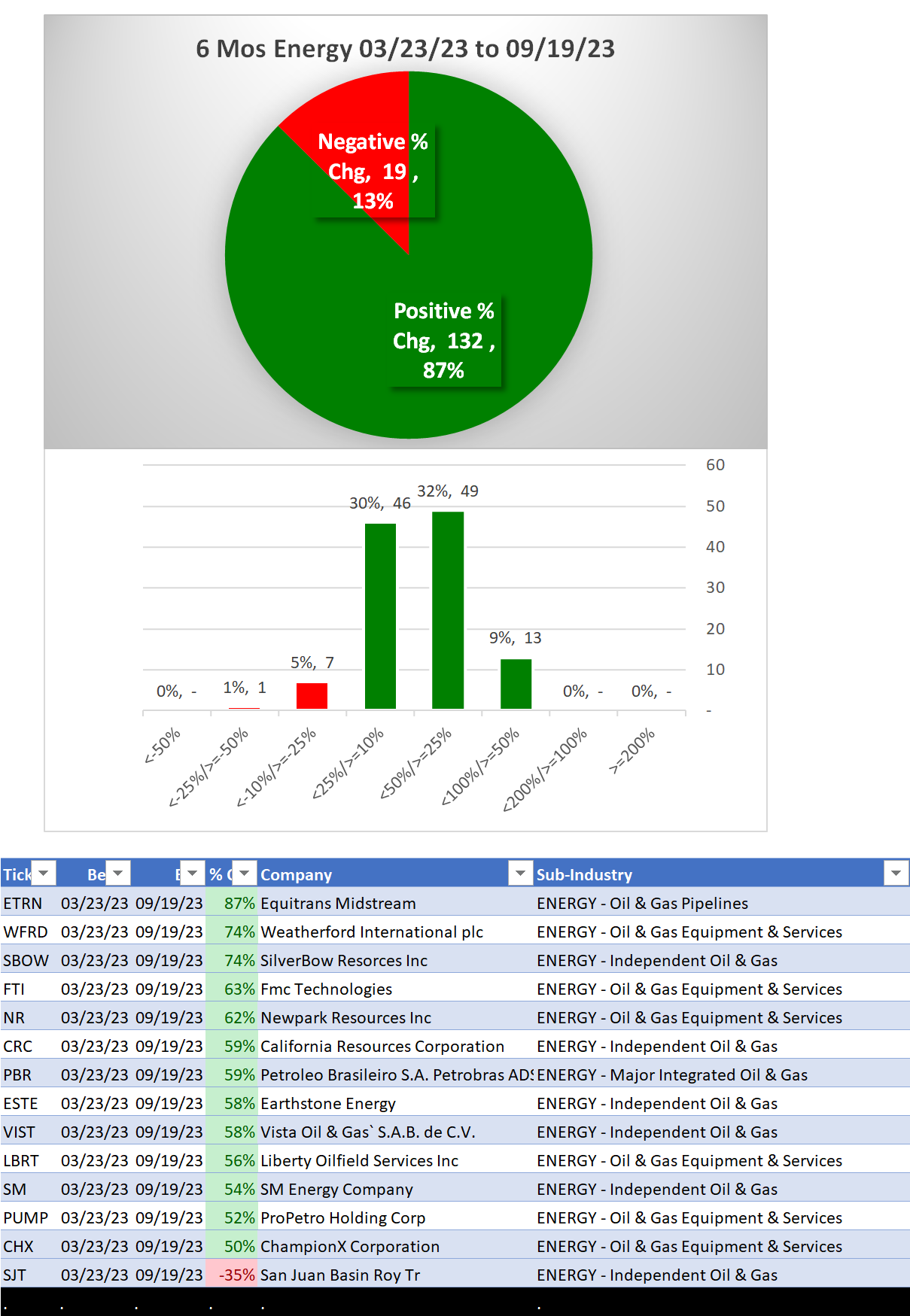

6 months

ETRN/Equitrans Midstream (Oil & Gas Pipelines) +87%

WFRD/Weatherford International plc (Oil & Gas Equipment & Services) +74%

SBOW/SilverBow Resorces Inc (Independent Oil & Gas) +74%

SJT/San Juan Basin Roy Tr (Independent Oil & Gas) -35%

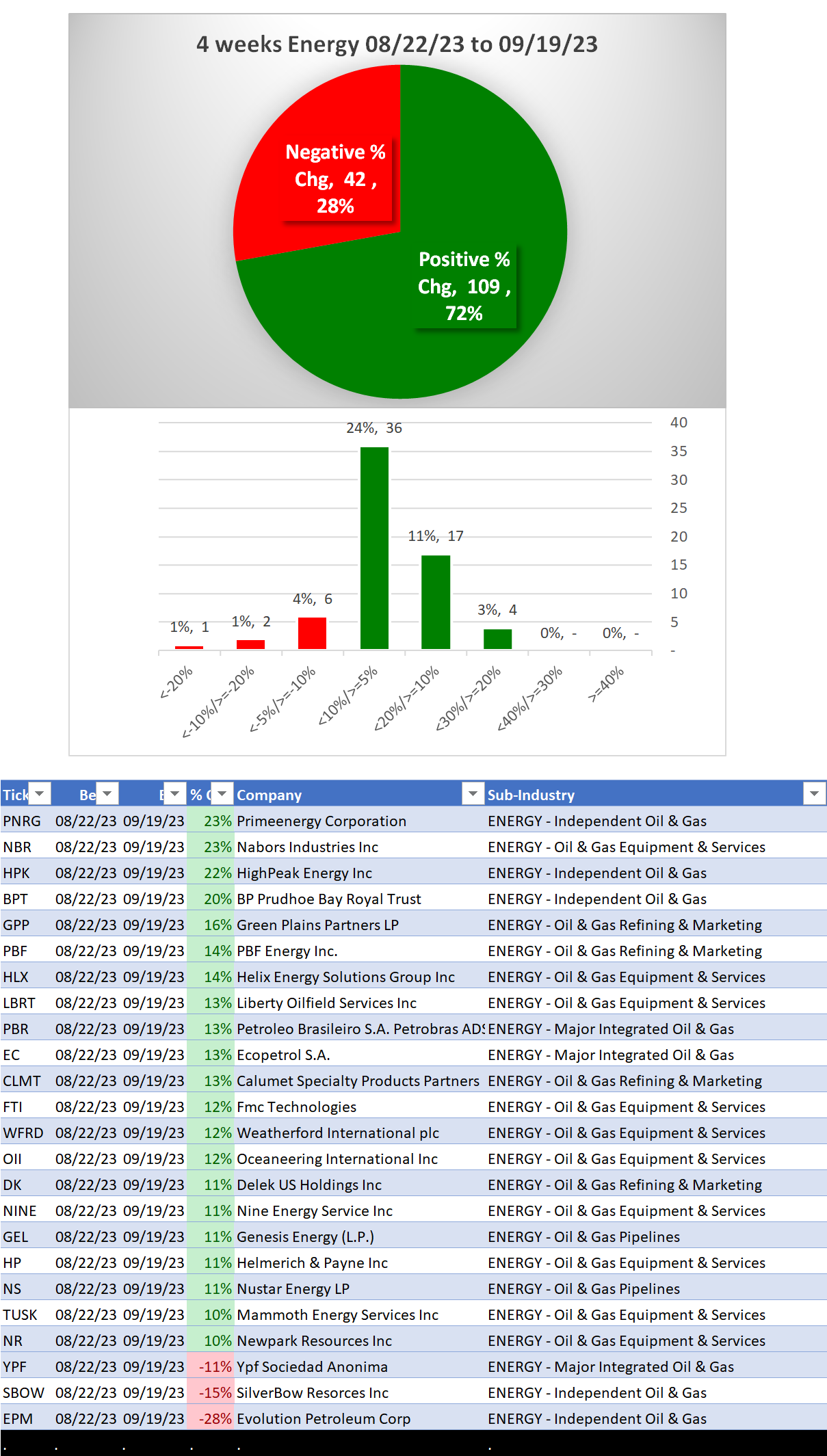

4 Weeks

PNRG/Primeenergy Corporation (Independent Oil & Gas) +23%

NBR/Nabors Industries Inc (Oil & Gas Equipment & Services) +23%

HPK/HighPeak Energy Inc (Independent Oil & Gas) +22%

BPT/BP Prudhoe Bay Royal Trust (Independent Oil & Gas) +20%

SBOW/SilverBow Resorces Inc (Independent Oil & Gas) -15%

EPM/Evolution Petroleum Corp (Independent Oil & Gas) -28%

1 Week

59 Strongest stocks (39% of total)

PNRG/Primeenergy Corporation (Independent Oil & Gas) +18%

HPK/HighPeak Energy Inc (Independent Oil & Gas) +13%

GPP/Green Plains Partners LP (Oil & Gas Refining & Marketing) +11%

SBOW/SilverBow Resorces Inc (Independent Oil & Gas) -16%

EPM/Evolution Petroleum Corp (Independent Oil & Gas) -23%

Background

Material of 6 sub-industries (151 stocks total, average 25 stocks/sub-industry):

51 stocks Independent Oil & Gas

33 stocks Oil & Gas Equipment & Services

30 stocks Oil & Gas Pipelines

19 stocks Oil & Gas Refining & Marketing

14 stocks Major Integrated Oil & Gas

10 Biggest Market Cap stocks: XOM, CVX, TTE, COP, BP, PBR, SLB, EQNR, EOG, CNQ

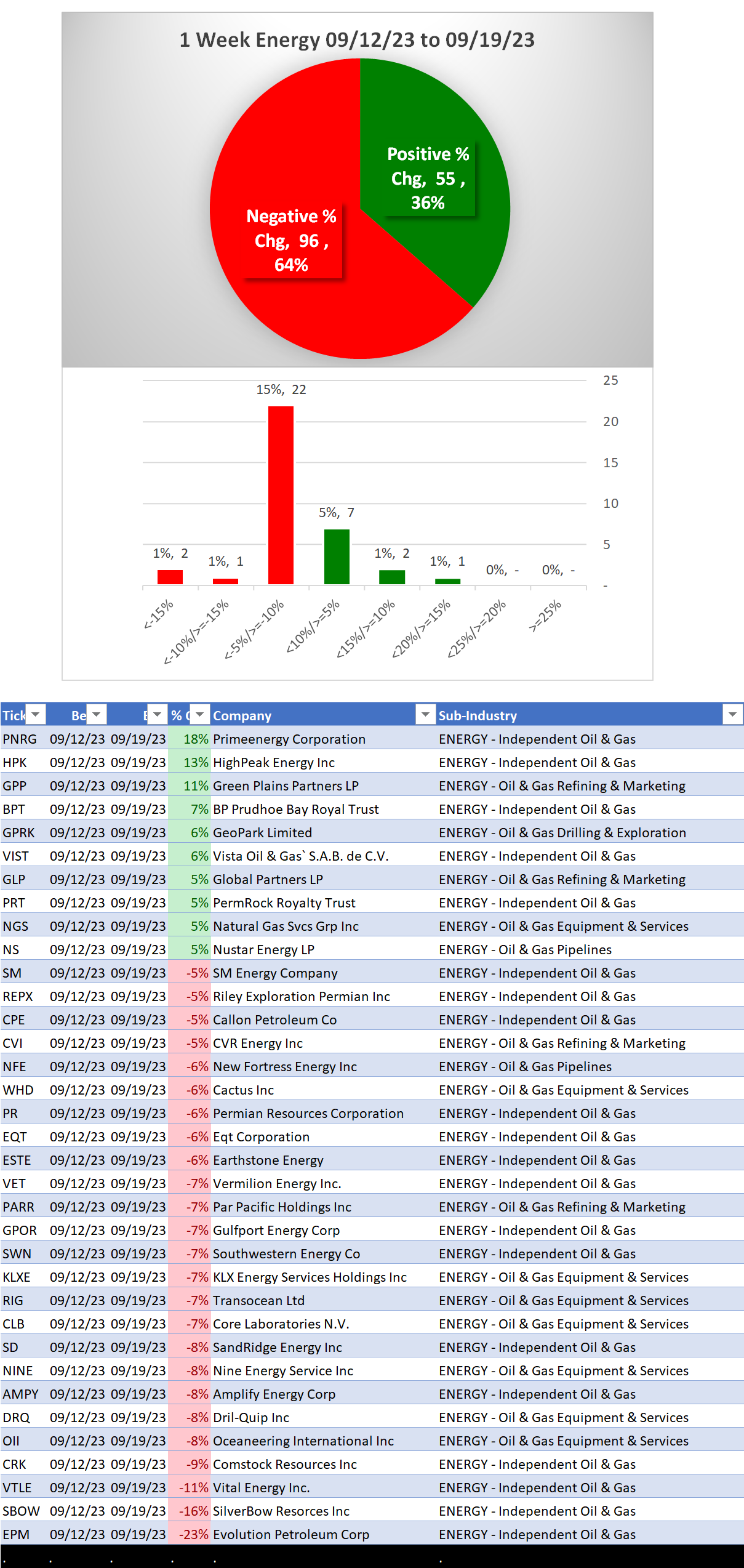

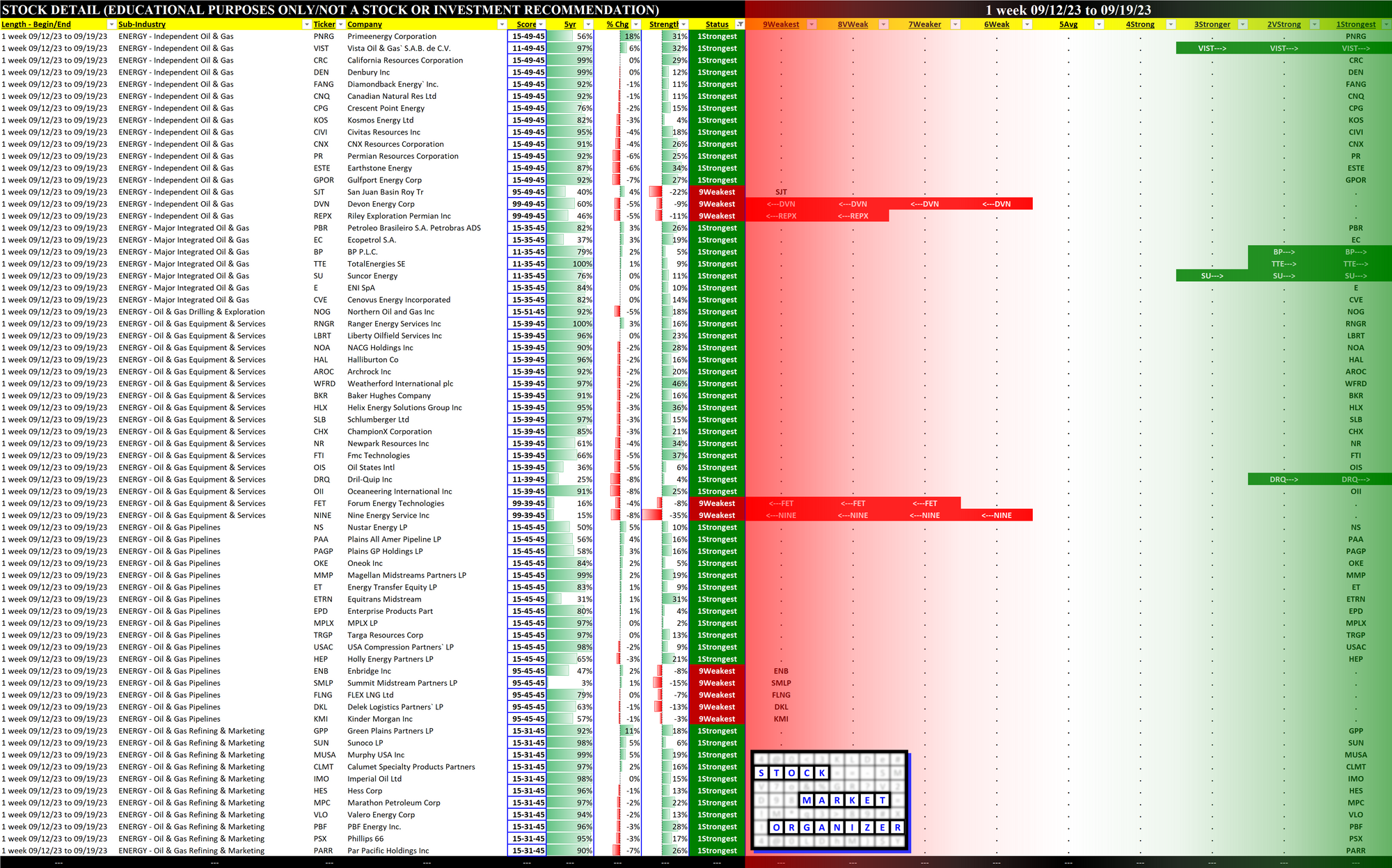

DETAIL: 1 Week Performance Review

Status

Strengthened: 1/6 sub-industries

Weakened: 0/6 sub-industries

Strongest at Stronger rating/3rd strongest of 9 levels:

Major Integrated Oil & Gas

Oil & Gas Equipment & Services

Oil & Gas Refining & Marketing

Weakest at Average rating/5th strongest of 9 levels:

Oil & Gas Drilling & Exploration

Detail Charts: Sub-Industry and Stock

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: : objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

DETAIL: Lookbacks 6 Mos vs. 4 weeks vs. 1 Week

6 Mos Lookback

4 weeks Lookback

1 Week Lookback