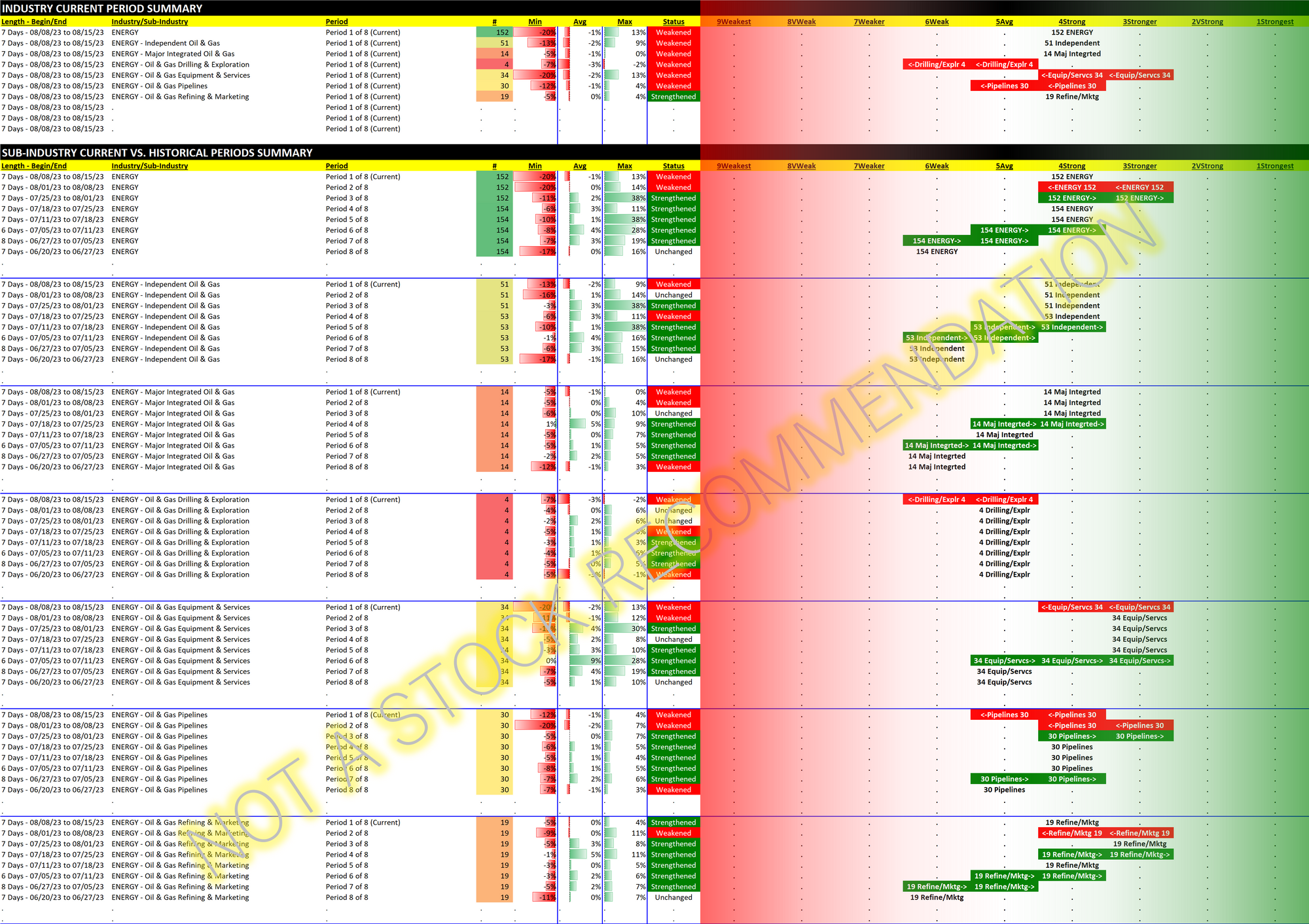

Energy 2023-08-15: Unchanged at "STRONG" strength rating (4th strongest of 9 levels), previous move was DOWN

Previous review of Energy is available here.

In that review I stated the following:

The bottom line is that Energy has been generally strengthening over the past 8 weeks until this last one.

As always I make no predictions. I will point out the obvious that a multi-week decline begins with one down week. I personally would not open a long position at the end of a down week.

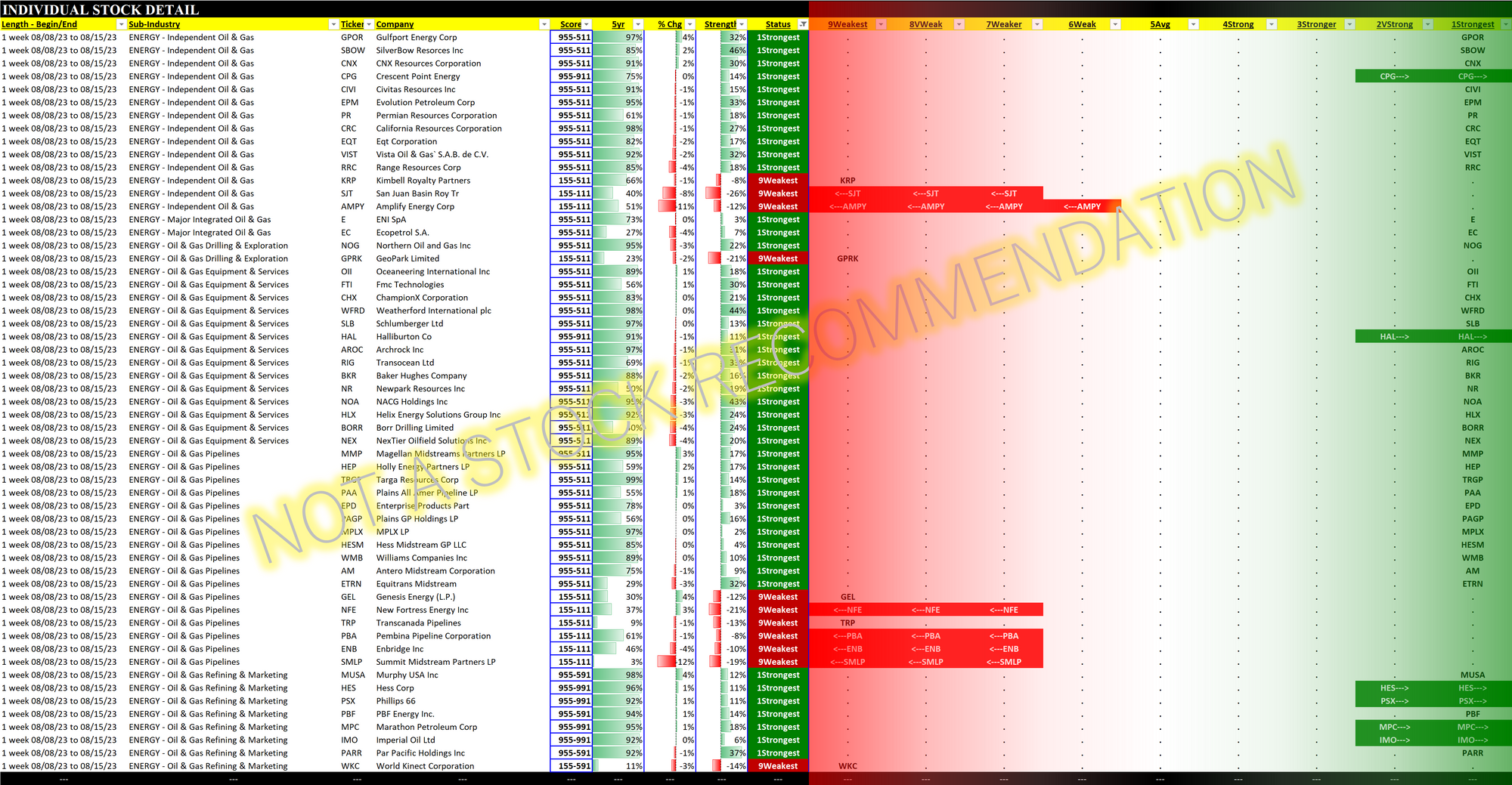

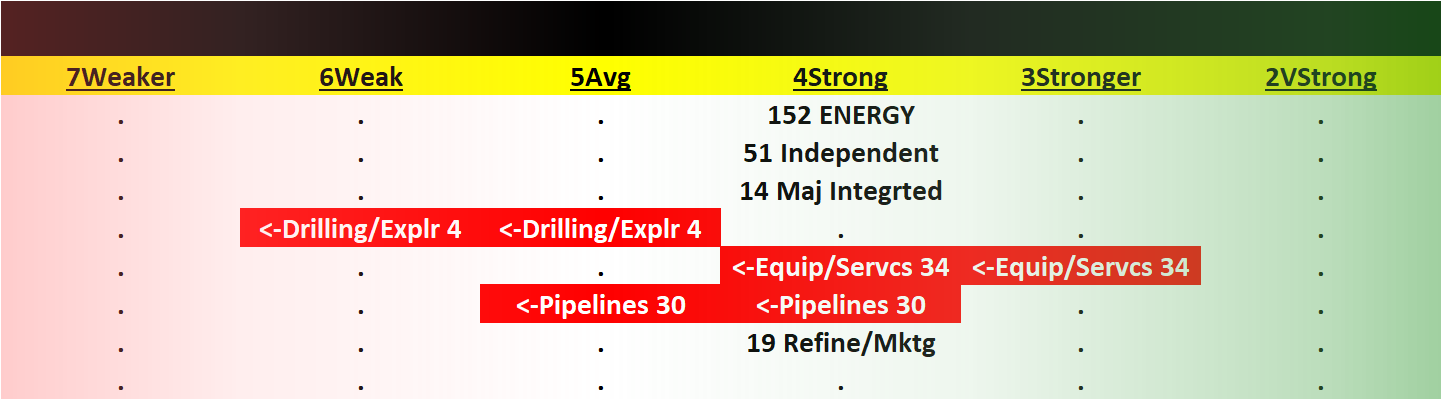

One week of weakness has dribbled into two. Over the trading week ending 8/15/23, 48 of these 152 Energy stocks rose while 104 fell. For the previous trading week ending 8/8/23, 81 rose and 71 fell. The weakness became more pronounced during this past week.

Whether this weakness continues or reverses, you can be sure I'll be monitoring the situation closely, stock by stock.

Why? Because as noted in this post, Market Conditions Matter. Regardless of what you read in the press - which I see as 99%+ content purely provided to obtain eyeballs rather than to helpfully and meaningfully inform, and which (relatedly) tells you to ignore day-to-day movements - I can gain an advantage by knowing as early as possible meaningful changes that are happening beneath the market surface.

Call me crazy. But that craziness is what has led to what you see on these pages. And this generates useful intel that can in turn give YOU an edge. Without you having to monitor the market day by day, stock by stock.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.