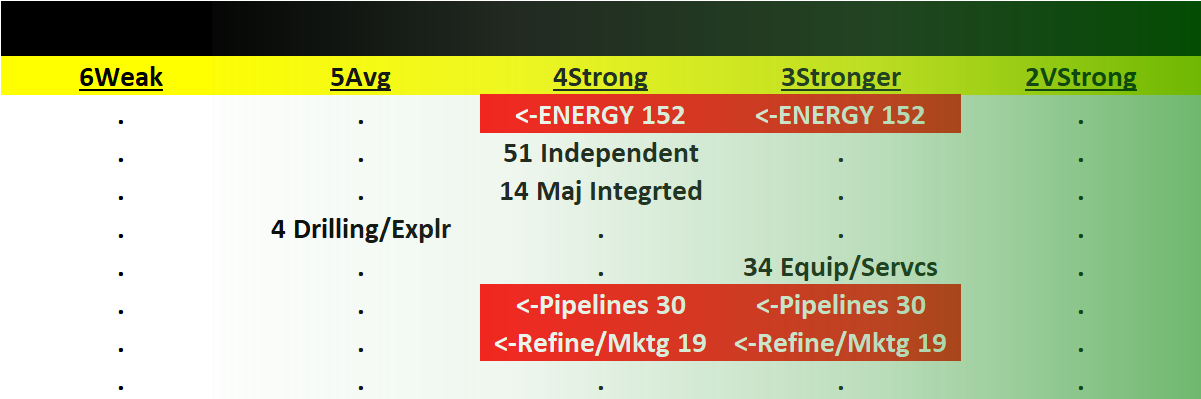

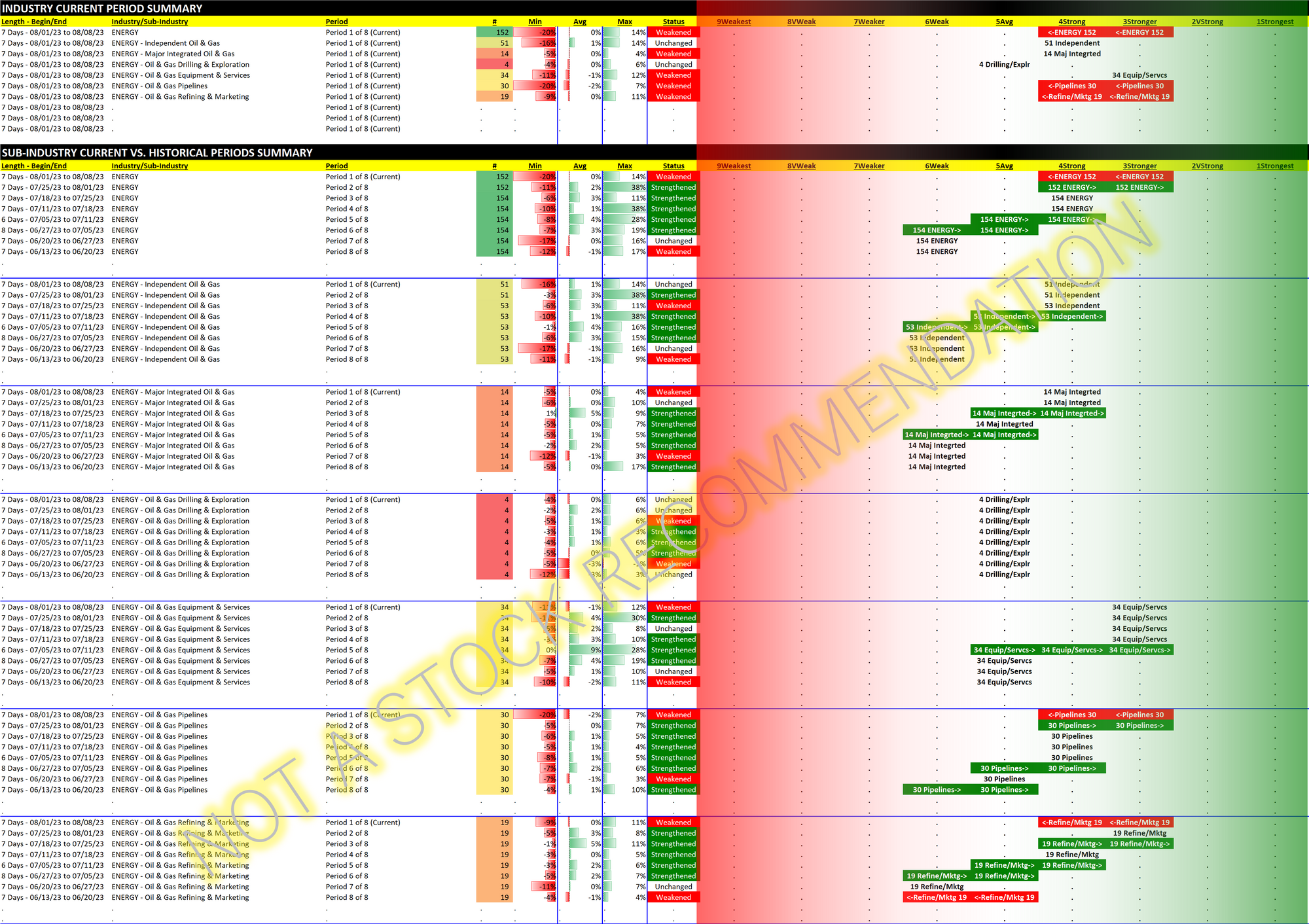

Energy 2023-08-08: -1 to "Strong" strength rating (4th strongest of 9 levels), previous move was up

Previous review of Energy is available here.

The bottom line is that Energy has been generally strengthening over the past 8 weeks until this last one.

As always I make no predictions. I will point out the obvious that a multi-week decline begins with one down week. I personally would not open a long position at the end of a down week.

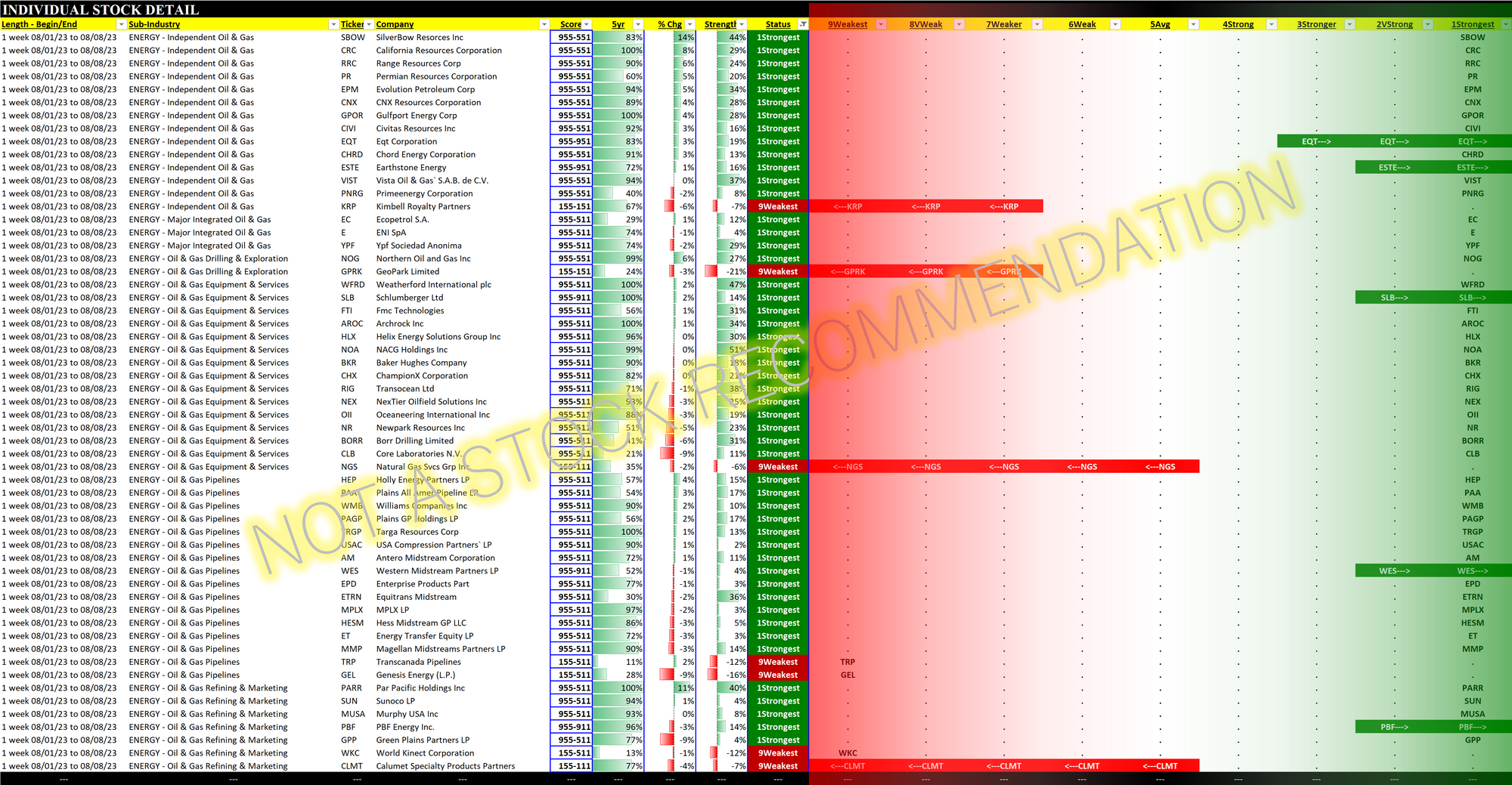

The current strongest sub-industry is Oil & Gas Equipment & Services, rated Stronger (3rd strongest of 9 levels). The sole stock here rated Weakest (lowest strength rating) is NGS/Natural Gas Services Group. The 14 stocks with the Strongest rating include (in order of larger to smaller market cap) SLB/Schlumberger Ltd., BKR/Baker Hughes Company, FTI/FMC Technologies, CHX/ChampionX Corporation, and RIG/Transocean Ltd.

Within the Major Integrated Oil & Gas sub-industry, where heavy hitters XOM/ExxonMobil and CVX/Chevron reside, there are 3 Strongest-rated stocks and no Weakest-rated stocks. The Strongest: EC/Ecopetrol S.A., E/ENI SpA, and YPF/YPF Sociedad Anonima. (If interested, ExxonMobil stayed Stronger while Chevron weakened to Weak, the 3rd- and 6th-strongest of 9 levels, respectively.)

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.