Energy 2022-11-07: a strong industry but if you own CLB... why?

Energy is strong overall but even in a strong industry there are leaders and laggards.

If you own CLB - at the very bottom of the list above in the Oil & Gas Equipment & Services sub-industry - what is your thesis? If there are other proven leaders out there ("leader" meaning a stock that is more liked than yours), why would you select a laggard, making the apparent assumption that you know more than everyone else in the market?

Perhaps you assume that if all the other stocks in the industry are rising, eventually so will CLB. That said, what does the market know that you don't which is keeping the stock down compared to others in the industry and sub-industry?

What happens when/if the industry and sub-industry start to fall? If CLB hasn't participated in the rally so far, it seems unlikely it would buck the trend should that happen.

One may ask the qeustion - isn't an 8% rally over the past week evidence of participating in the industry rally? Answer - yes, of course. However, there are others that have had better returns in this time without having all the baggage of having performed poorly so far in comparison to many others. Compared to these others (the industry's leaders), CLB likely has many who are looking to sell the rally rather than buy the dip due to its performance over the 18 months.

There are many stocks to choose from in this sub-industry. Why be blinded to these other possibilities? There seems to be little compelling reason to stay with CLB. At what point do you cry "uncle?" (Prudent risk management dictates you MUST have an answer to that question. Do you have that answer?)

Corollary - do not marry a stock you should just date.

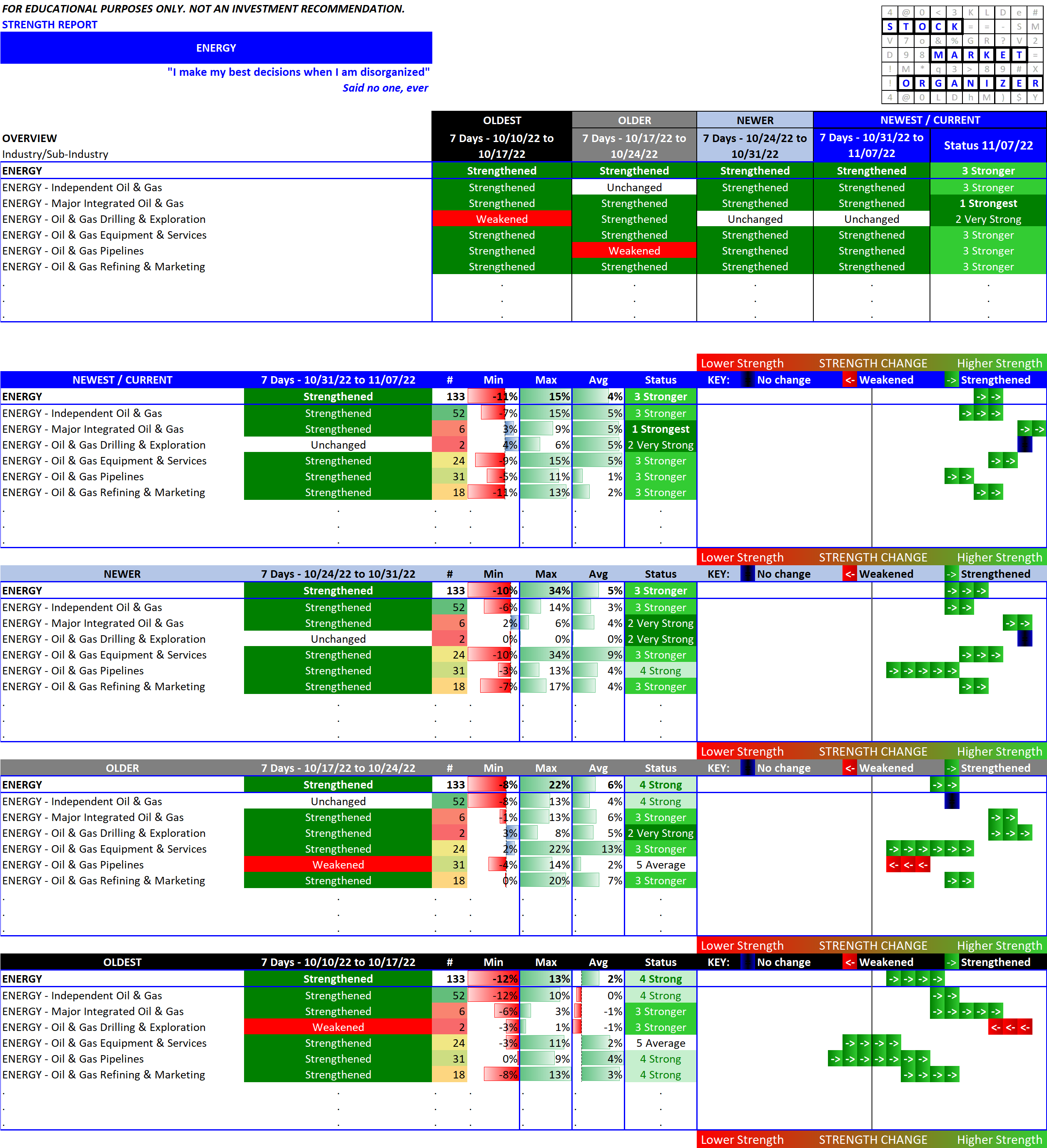

Industry overview:

Downloadable industry report below.