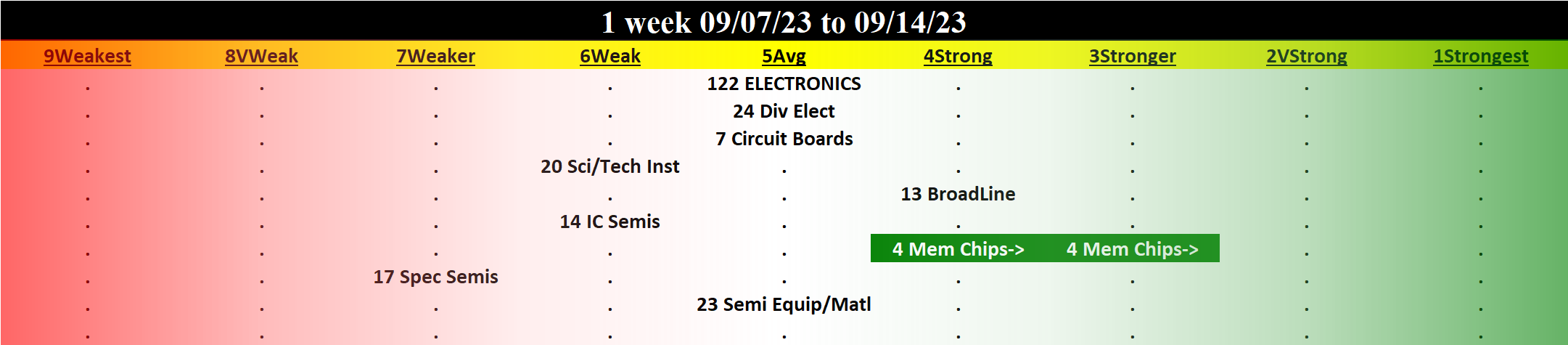

Electronics 2023-09-14: Unchanged at "AVERAGE" strength rating (5th strongest of 9 levels), previous move was DOWN

SUMMARY

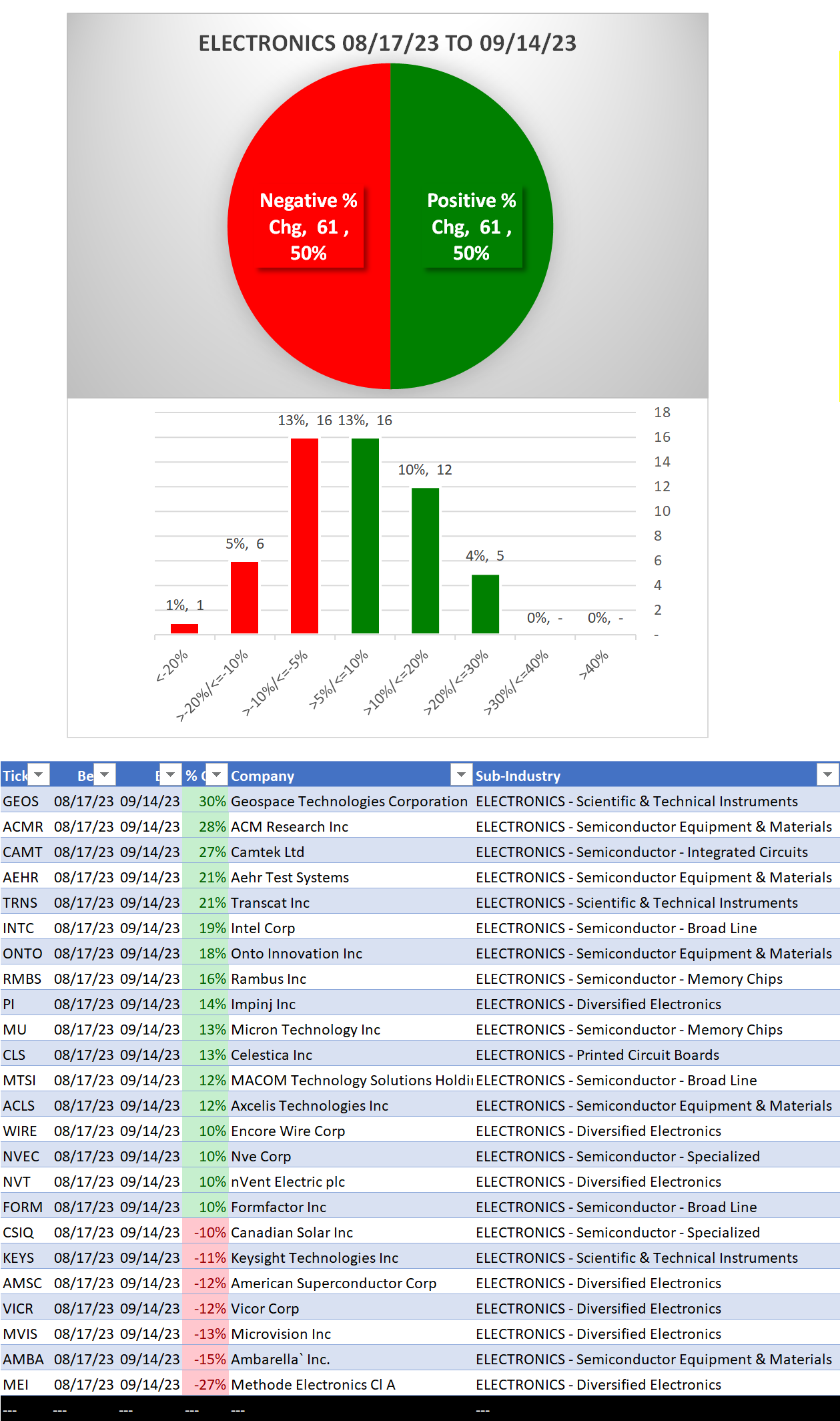

Performance

Bottom line: 4 weeks flat after weakening 2 levels in 2 weeks

Context: slightly weaker recently vs. YTD

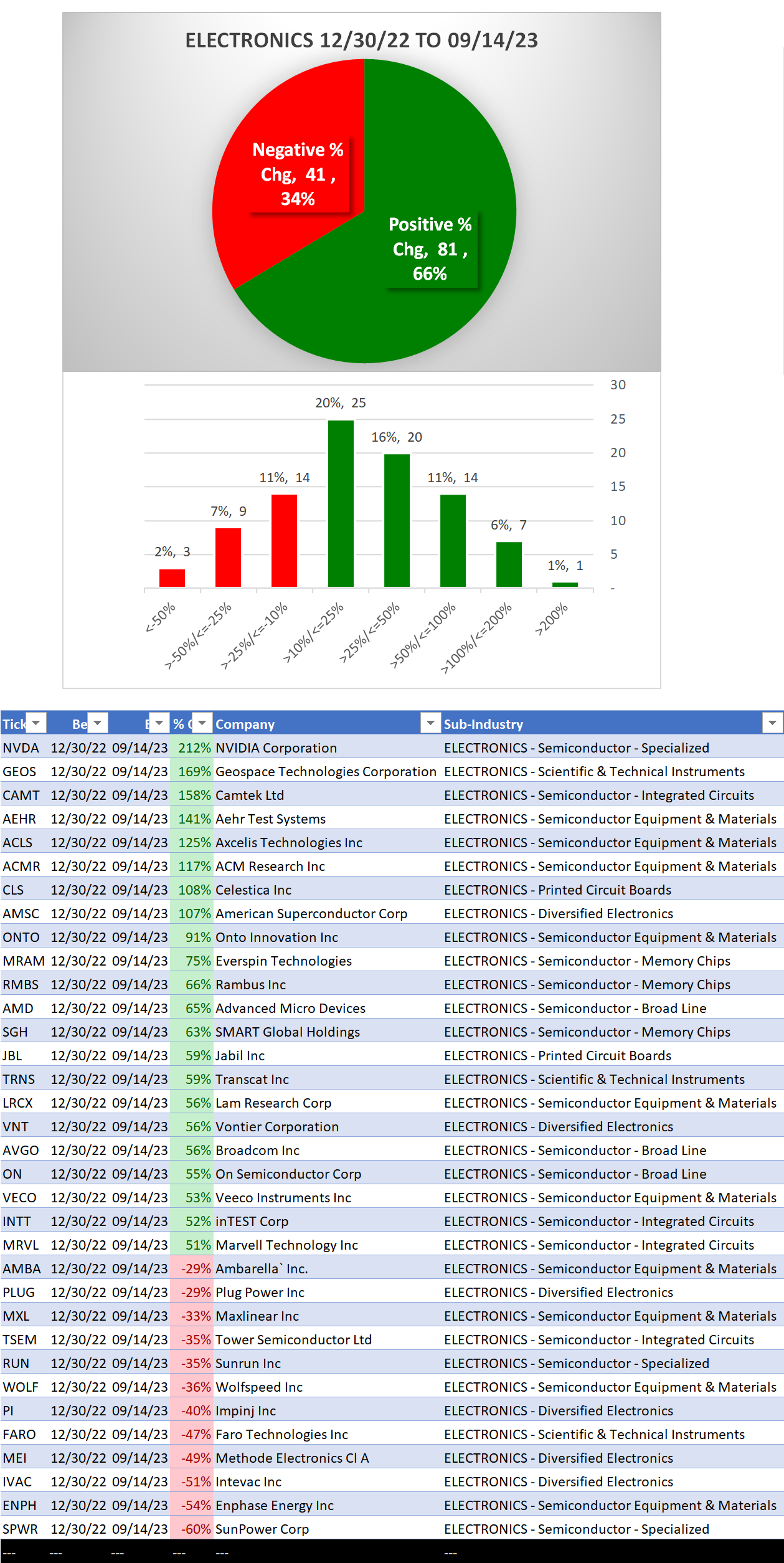

- 66% positive stocks YTD

- 50% positive stocks past 4 weeks

Background

Largest of 8 Sub-industries (122 stocks total):

- 24 stocks Diversified Electronics

- 23 stocks Semiconductor Equipment & Materials

- 20 stocks Scientific & Technical Instruments

10 Biggest Market Cap stocks: NVDA, TSM, AVGO, AMD, INTC, TXN, AMAT, LRCX, ADI, MU

DETAIL: 1 week review, YTD/4 weeks lookbacks

1 Week Review

Strengthened: 1/8 sub-industries

Weakened: 0/8 sub-industries

Strongest at Strong/4th strongest (of 9 levels) rating: Semiconductor - Memory Chips

Weakest at Weaker/7th strongest rating: Semiconductor - Specialized

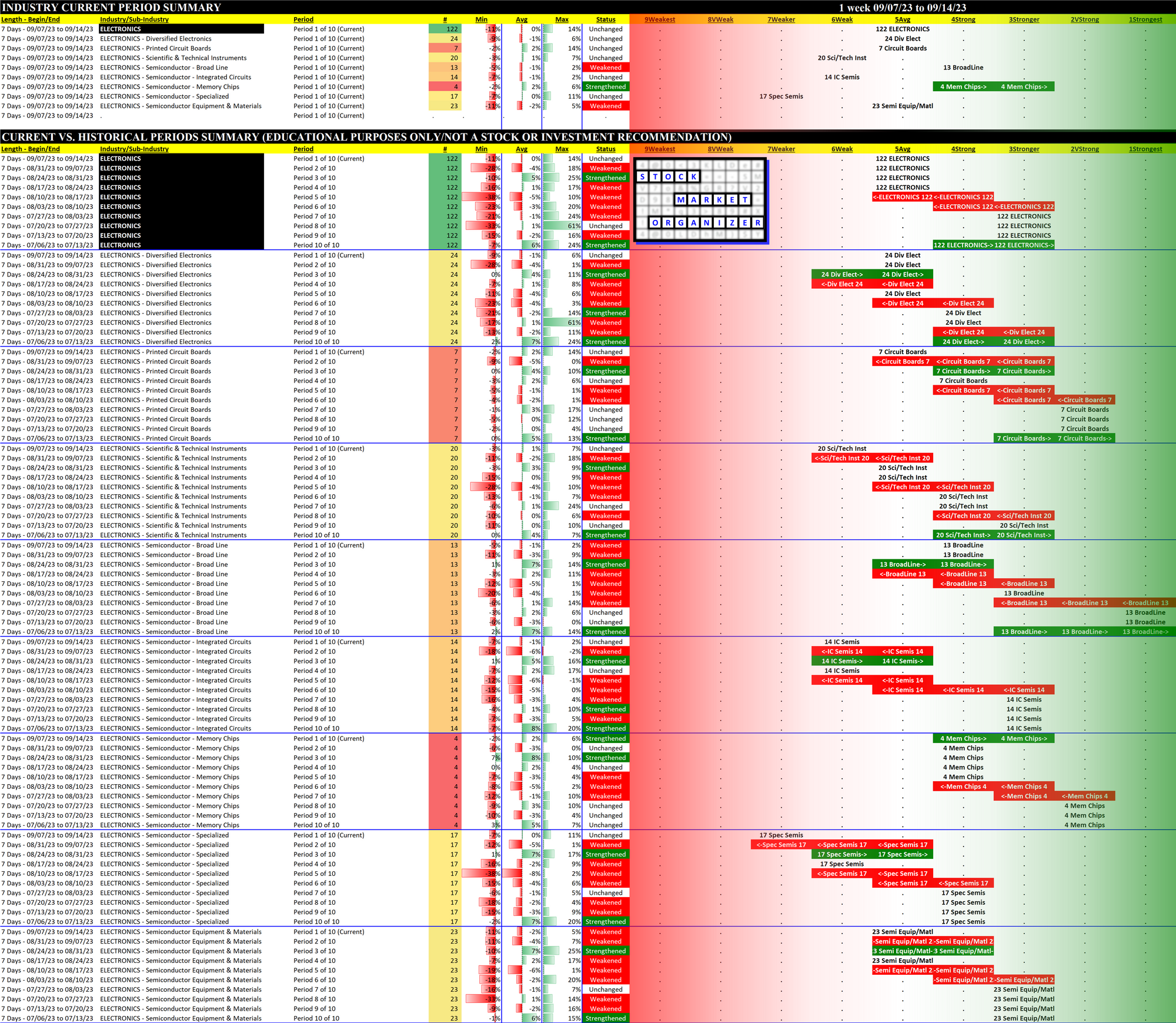

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

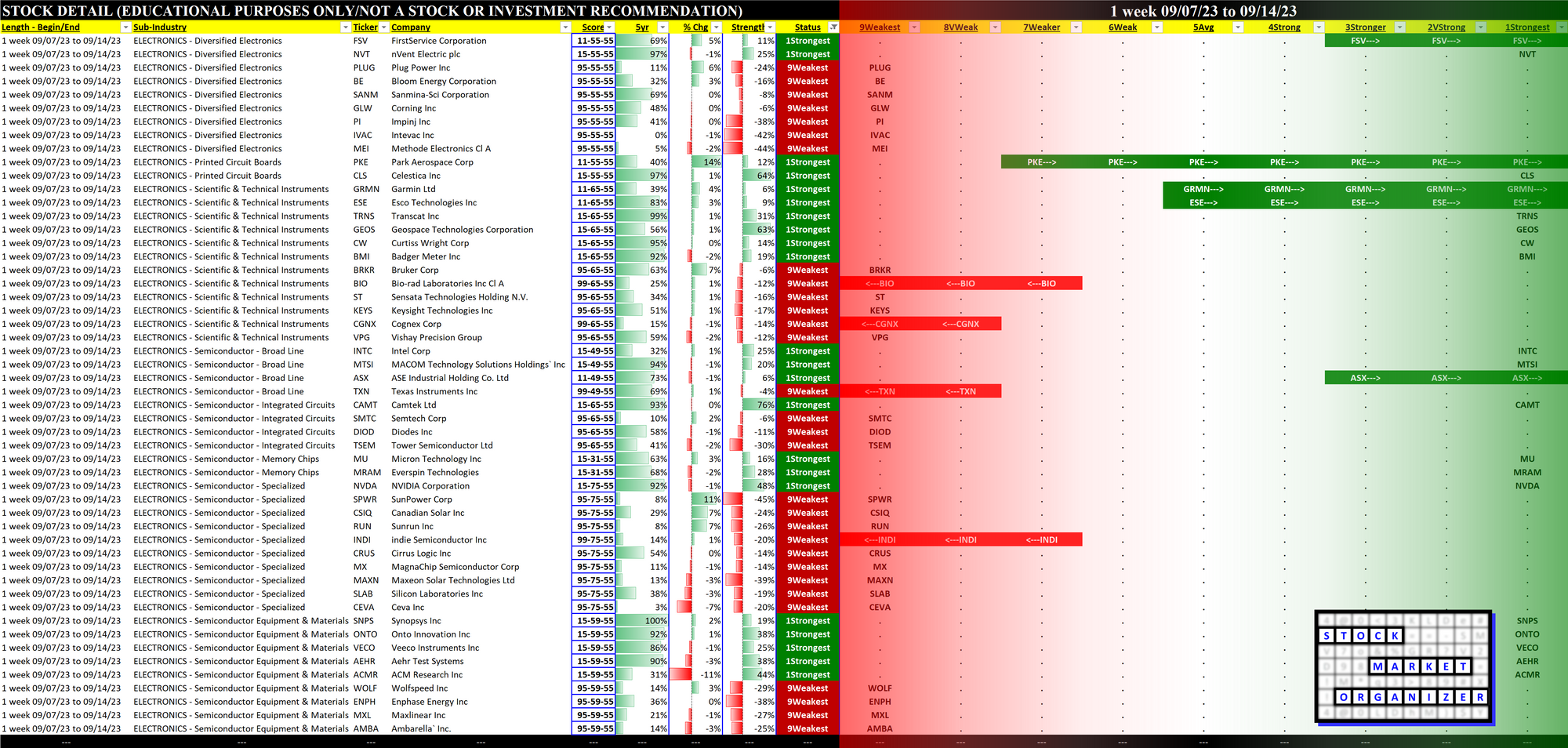

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls. (Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

YTD Lookback

4 Weeks Lookback