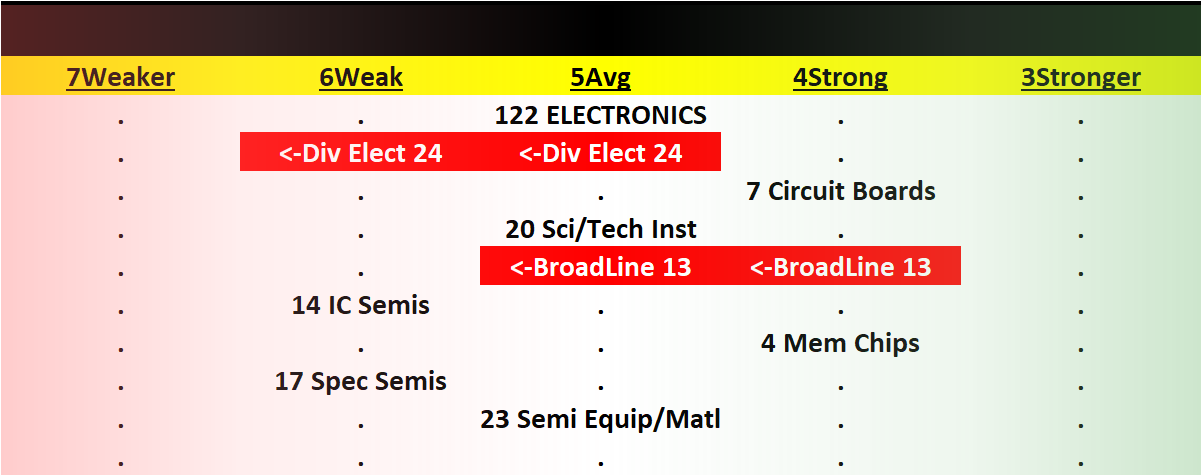

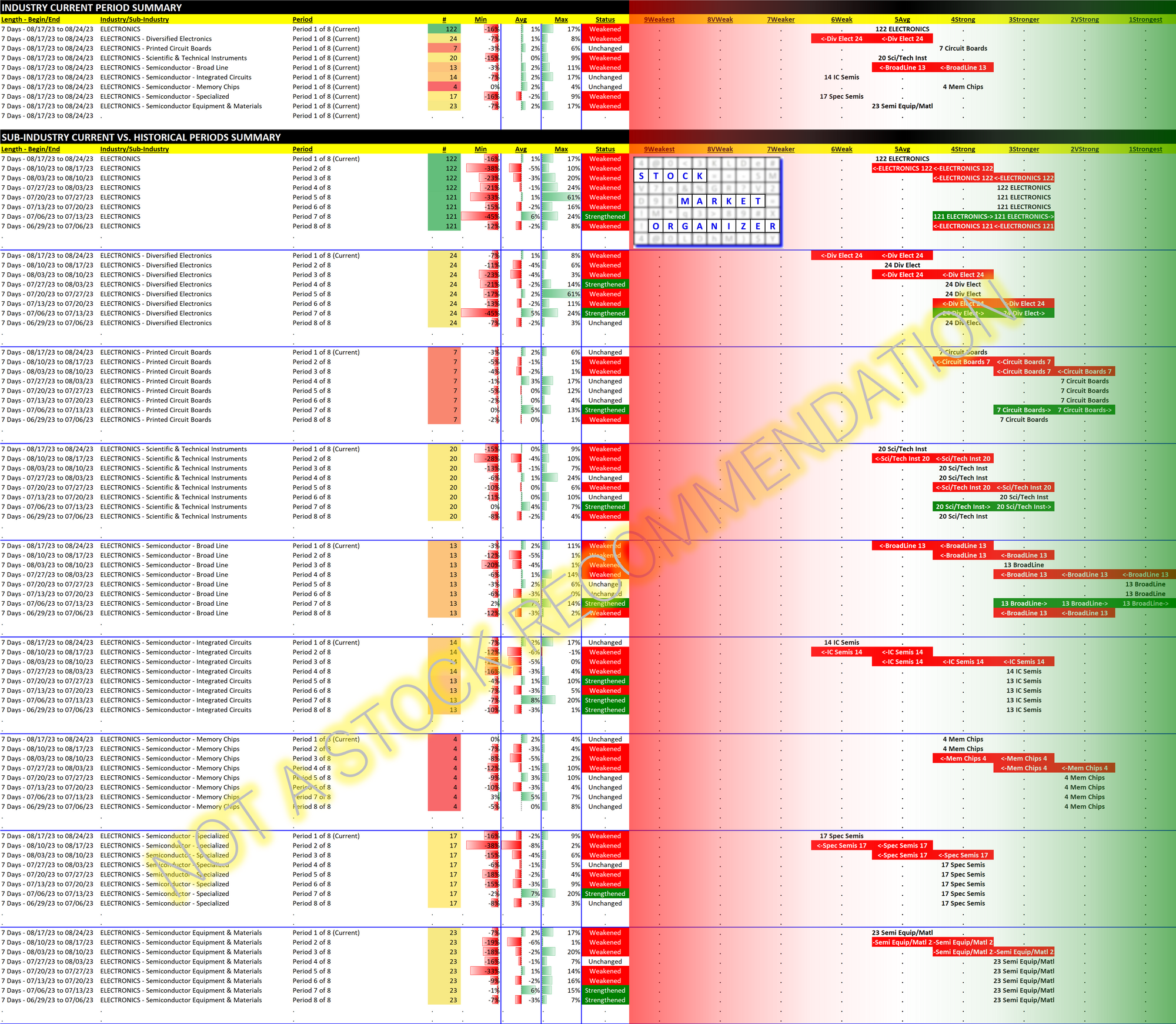

Electronics 2023-08-24: Unchanged at "AVERAGE" strength rating (5th strongest of 9 levels), previous move was DOWN

Previous review of Electronics on August 17, 2023 is available here.

NVDA/Nvidia crushed its earnings report yesterday after hours. And the market sold off today on the news. Exhibit A of why it is fruitless to anticipate anything in the market. The numbers were far better than expected. And the market shrugged (if not worse). Next up, Jackson Hole.

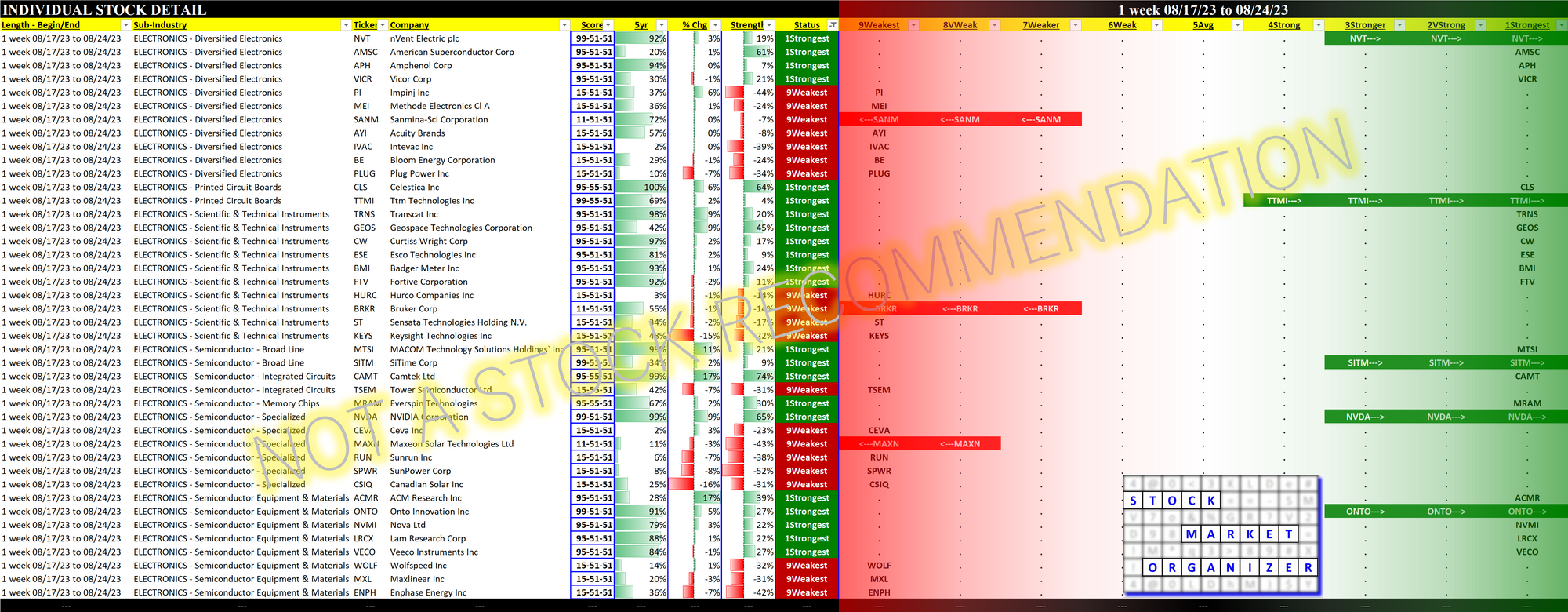

Today, of the technology stocks universe I monitor, less than 1 in 8 stocks was positive. Within the Electronics industry, only 1 in 17 stocks was positive. Including NVDA, which was a whopping +0.1%.

Meanwhile AMD/Advanced Micro Devices was one of the industry's worst performers today at -7%. MRVL/Marvell Technology reported solid earnings and was -7% during the regular session today and -5% after hours.

So much for the glow of AI glory.

NVDA has gained 223% year to date, the only one in Electronics with a >200% return during this period. CAMT/Camtek, AMSC/American Superconductor Corp., GEOS/Geospace Technologies Corporation, ACLS/Axcelis Technologies, and AEHR/Aehr Test Systems all are over 100% during this period.

In total, about 1 in 3 Electronics stocks has returned >+25% in 2023, which would seem like a strong figure. That said, it would seem troubling that the market could not leverage off the strong NVDA report. This may turn out to be a meaningful (aka impactful) day in the market.

I would not yet open a new position in any of the Electronics sub-industries.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.