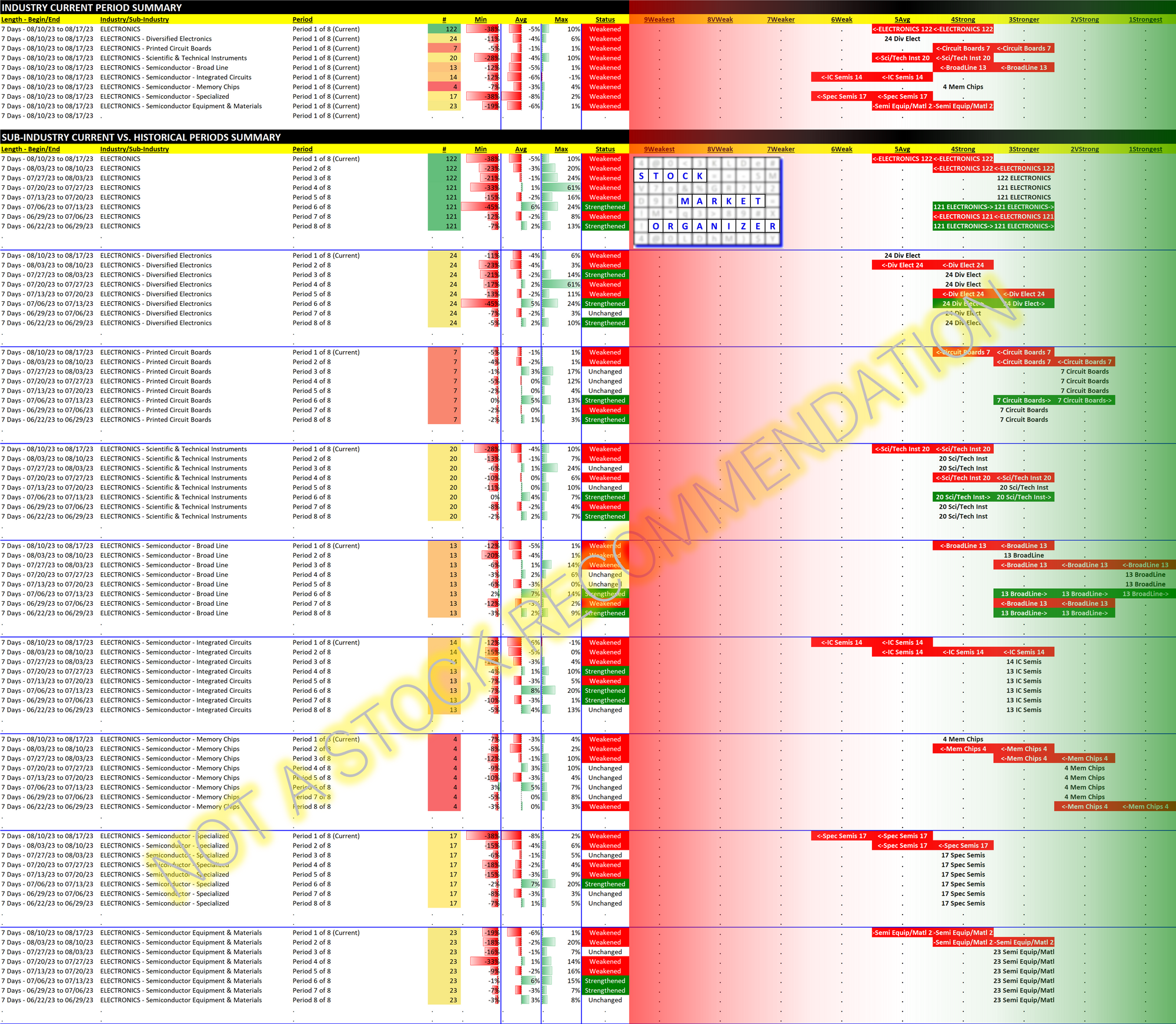

Electronics 2023-08-17: -1 to "AVERAGE" strength rating (4th strongest of 9 levels), previous move was also DOWN

Previous review of Electronics is available here.

It was a rough week for Electronics, continuing the weakness that started last week.

Everybody's favorite AI darling and Magnificent 7 member NVDA/Nvidia has flattened out over the past month, -9% since its 7/18/23 peak. This isn't that bad compared to many other Electronics industry stocks as 3 of 8 lost more than 15% during this period. The worst performer was MAXN/Maxeon Solar Technologies (-49%) while the best performer was AAOI/Applied Optoelectronics (+69%, congratulations to its lucky shareholders).

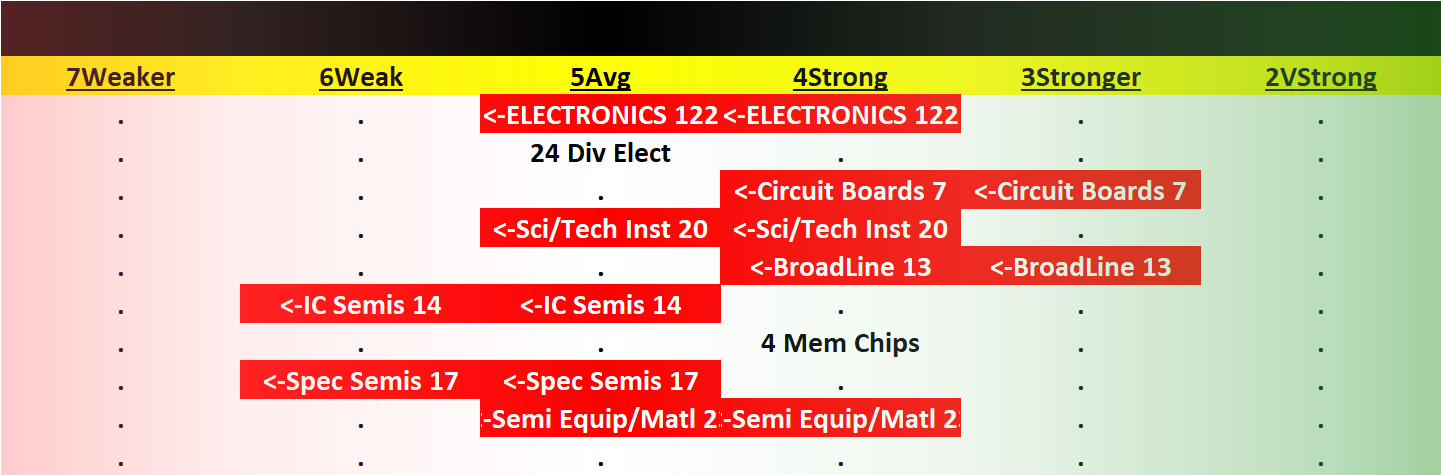

While the Memory Chips strength rating did not fall (it remained at Strong, 4th strongest of 9 levels), it has fallen over the past 8 weeks from the Strongest rating.

Similarly, Broad Line Semiconductors has fallen from the Strongest rating - which it held as recently as 3 weeks ago - down to a Strong rating.

The two weakest sub-industries, Integrated Circuits and Specialized Semiconductors, have both declined for the past two weeks to a Weak rating (6th strongest of 9 levels).

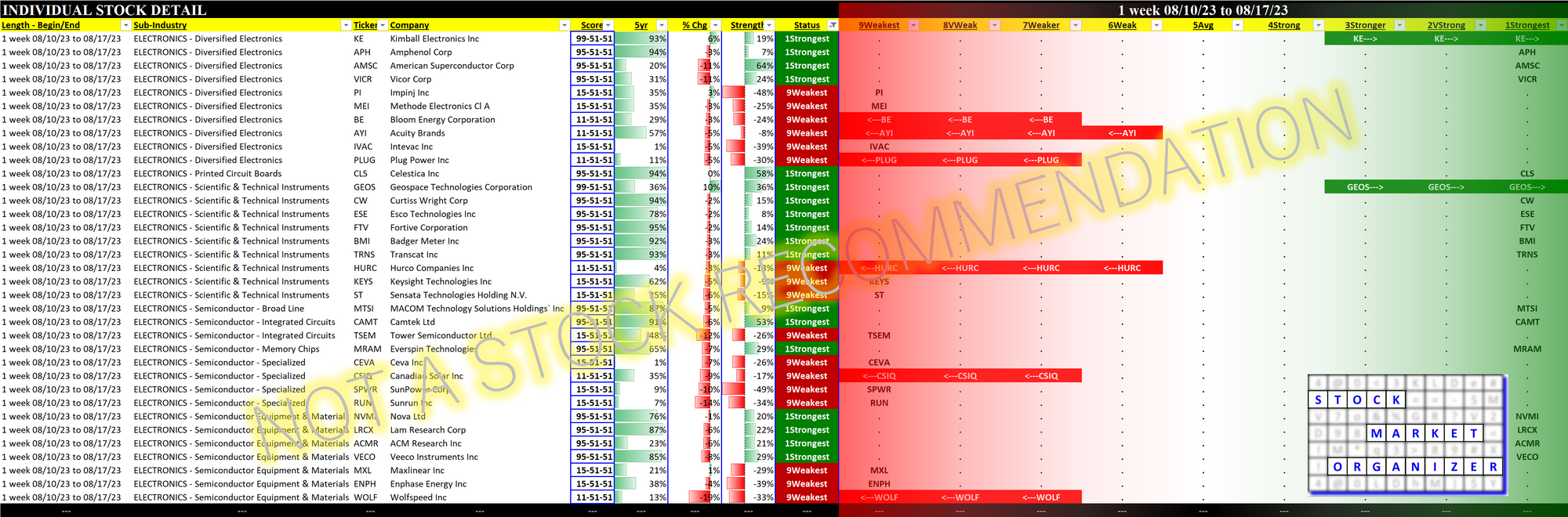

The past 3 weeks have seen a dramatic deterioration in the ratio of Strongest to Weakest stocks, from a 71:8 ratio for the week ending 7/27/23 to a much different 18:17 ratio as of today. Why? Is there a fundamental reason for such a quick deterioration? Of course I have no idea. This could be an outstanding buying opportunity. But I would not open a new long position in the face of this clear weakness.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.