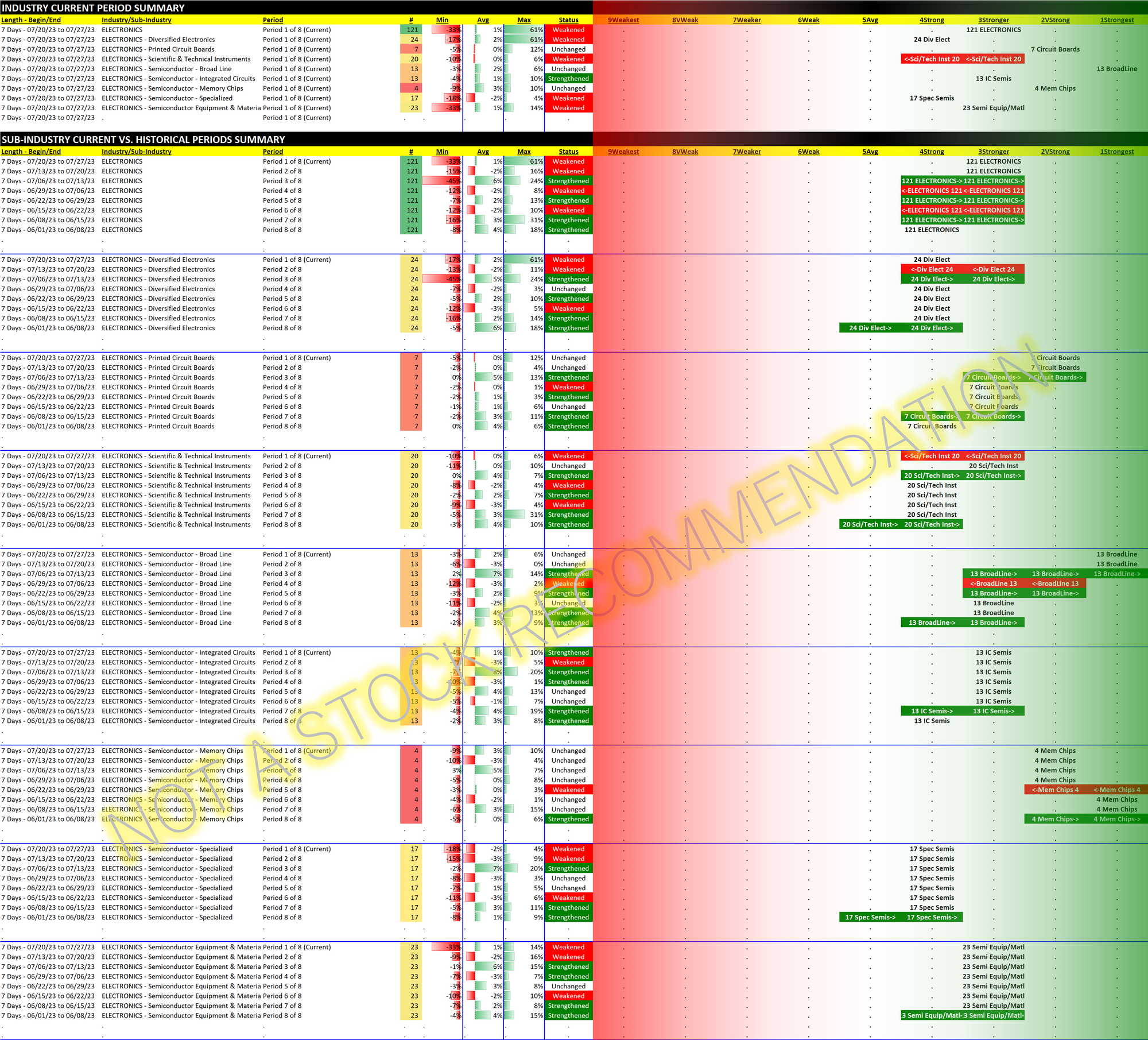

Electronics 2023-07-27: Unchanged at "Stronger" strength rating (3rd strongest of 9 levels), previous move was up

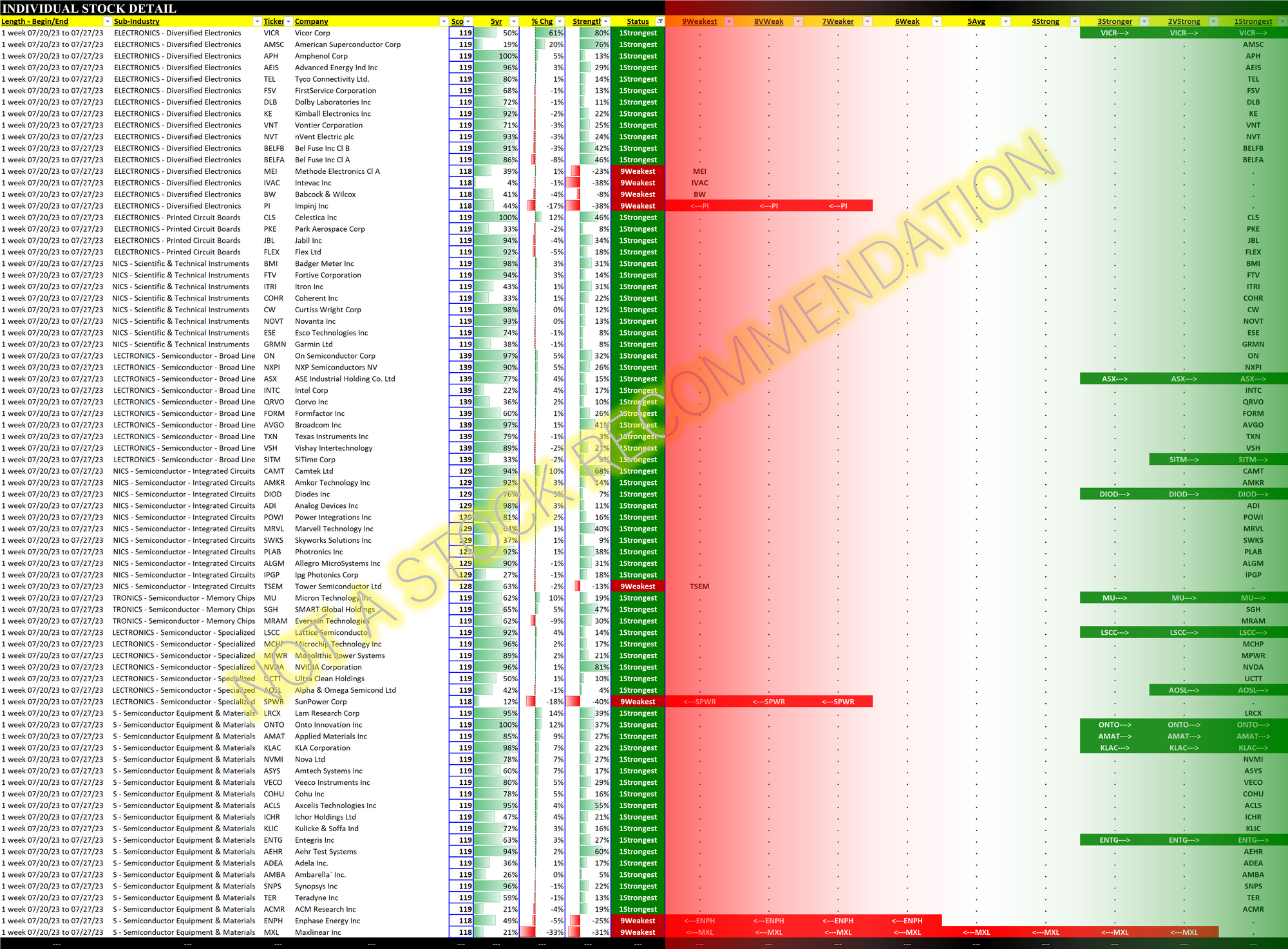

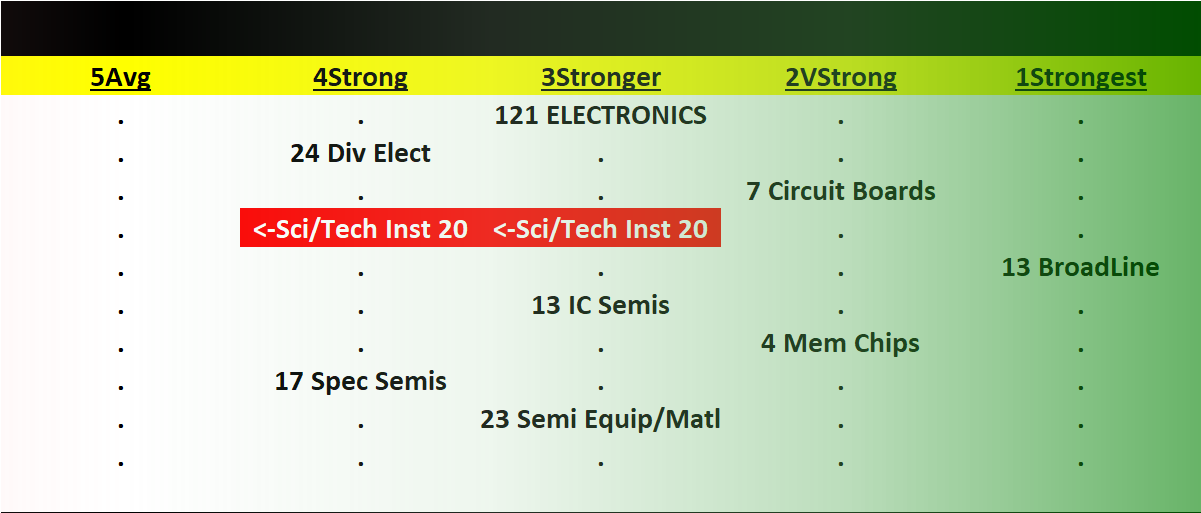

The Electronics industry with 121 stocks has remained Stronger over the past two weeks and was choppy for the preceding five. Broad Line Semiconductors (13 stocks) is the strongest sub-industry. This is the home of long-time stalwarts INTC/Intel and TXN/Texas Instruments along with AVGO/Broadcom, all of which have the Strongest rating.

VICR/Vicor Corp. turned in a 61% week to lead the Diversified Electronics sub-industry, while AMSC/American SuperConductor enjoyed a 20% return.

Will either or both these go the way of CVNA/Carvana, which has been on a tear recently and which popped 40% in one day after it had already increased 884% in recent months? (To be fair it fell 16% the next day.)

A similar example which may be possible comes from looking at NVDA/Nvidia which has had a stellar 2023. Through May 24, 2023 it increased 109% for the year. It then jumped 24% in one day, and has soldiered on to another 20% gain in the subsequent two months.

My point is just because a stock has had a strong week does not mean it is fated to immediately turn around. Sometimes - painful as it can be to those not on board - stocks can "pop" and keep going. Then as the stock gets the attention of the general public and they start to jump on board the seeming next "hot thing," the stock really takes off.

This happens regularly. And it just as regularly gets dismissed by most. Agreed it doesn't make sense, from a fundamental analysis perspective. But, due to emotional responses of market participants, it does happen. If you aren't looking for these types of opportunities, you certainly won't find them.

And how do you find these opportunities? By continually focusing on individual stock strengthening and weakening. Through this one can find and benefit from emotionally-driven market events.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.