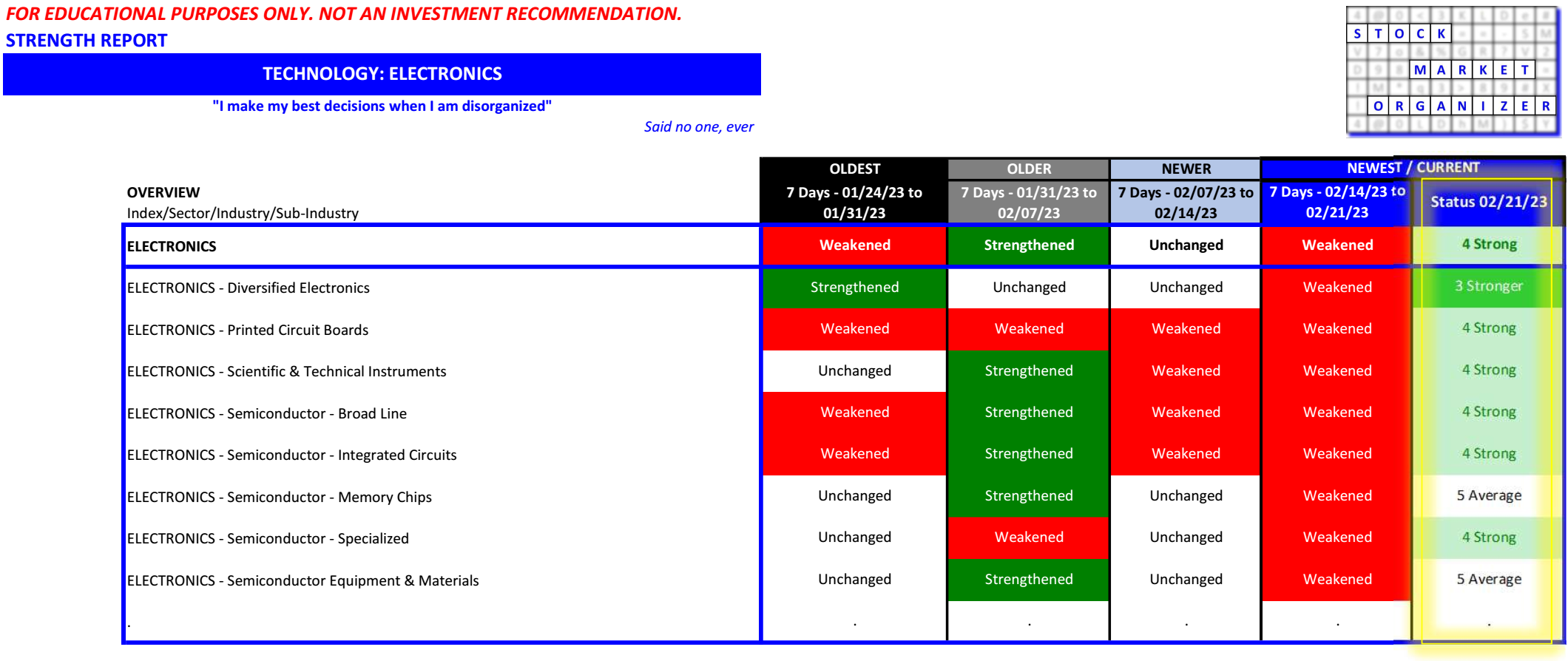

Electronics 2023-02-21 - all sub-industries weakened this past week

Today's market was down 2% or more for the major indexes and this contributed to the across-the-board weakness for all Electronics sub-industries over the past week.

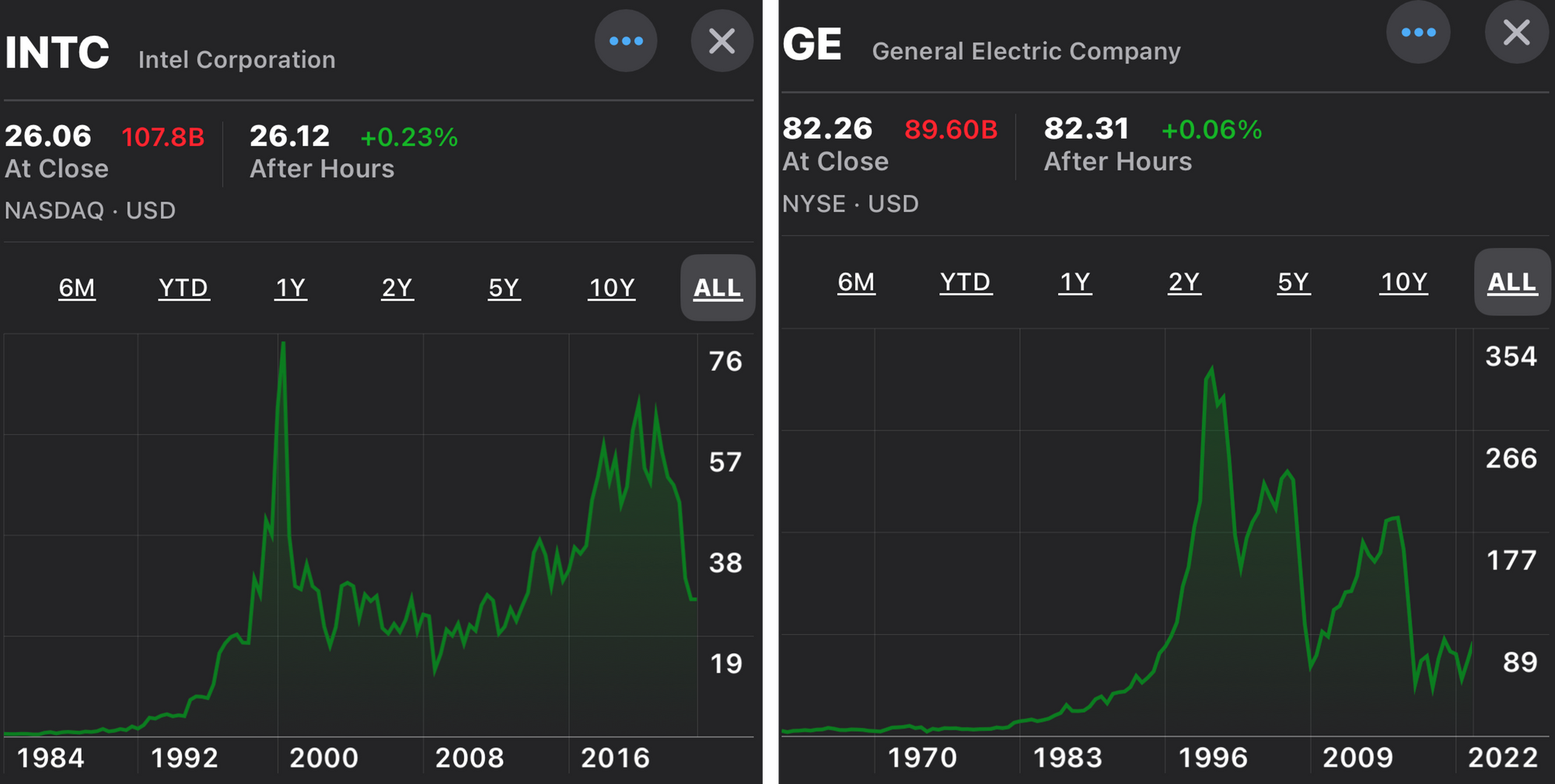

INTC: The Weakest Link

Long-time Semiconductor - Broad Line titan Intel is the caboose in its sub-industry. Just a pause before it reasserts itself, or is it like fellow long-time Big Shot Stock GE with its best days well behind it? If you own it, what do you do now?

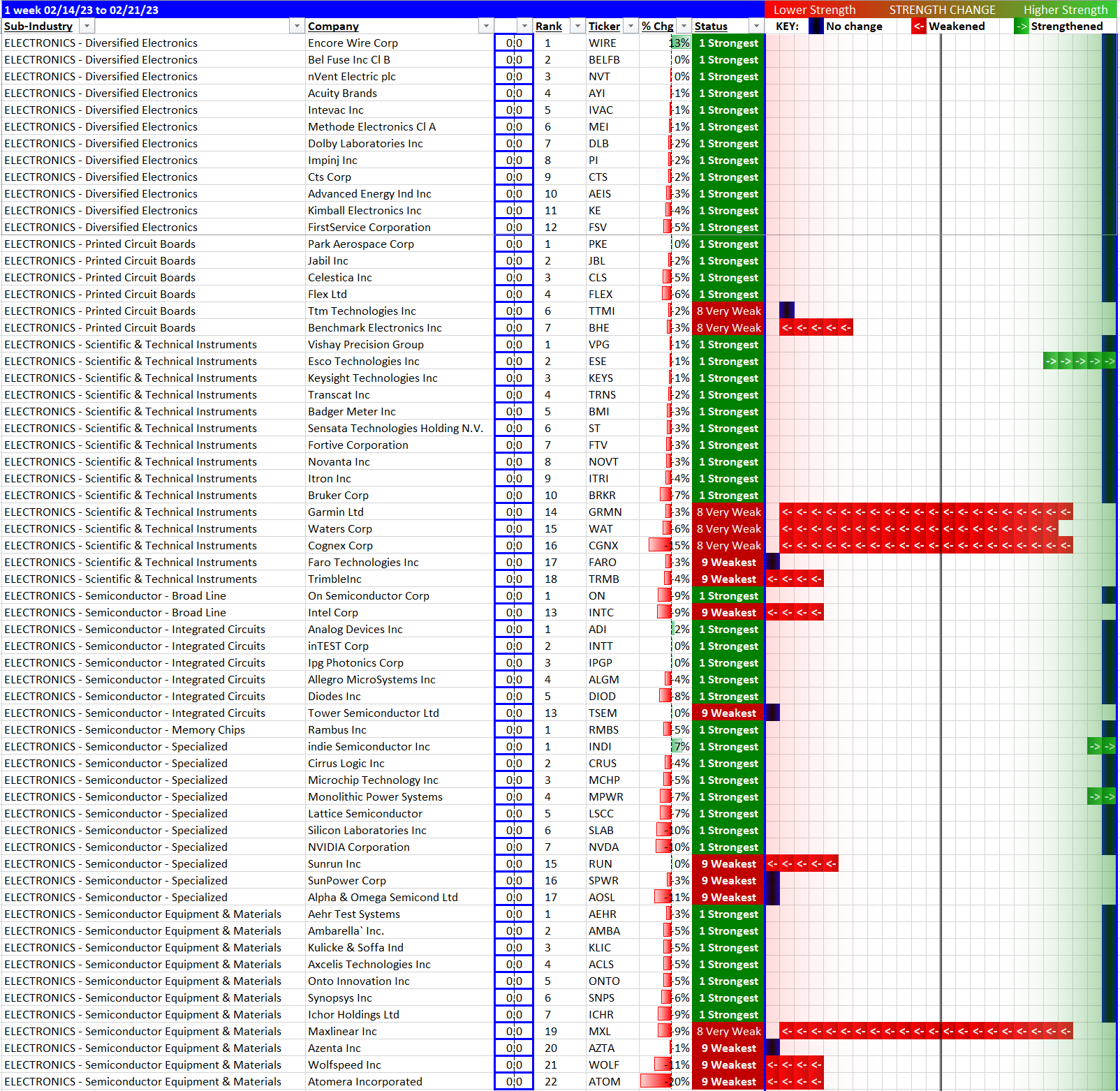

What's Meaningfully Weak and What's Strong?

Happy you asked - below is the answer, Stock Market Organizer style.

What do you do with this? Simple: if you own the weakest, decide what makes you stay in and act accordingly. Are you going to double down? Will you take a loss, or is your ownership thesis still intact? If you own the strongest, review your rules for position management and act accordingly.

If you own WIRE you are a happy camper (for those who don't own it, it has gone up 26% in the past month). Don't you wish you'd bought more when you had the chance? What will you do if it gives back this recent gain - will you buy more? When? How much more? Will you have had some sell rule in place so you didn't give back all gains? So many questions... but probably best to know these answers now when you are thinking clearly, rather than trying to make decisions while in the midst of a market and/or stock downdraft that has this holding potentially swimming in red ink.

Should INTC holders swap out some for WIRE, or vice versa? Is there something interesting developing at INDI or will it, along with everything else, get taken to the woodshed if the market can't keep up its January ways?