Diversified Services 2023-12-18: UNCHANGED at STRONG strength rating (4th strongest of 9 levels), previous move was UP

Diversified Services status? 1 month NOTV/APEI/ZG +53%/50%/48%, 1-week 76% positive stocks.

Full details at downloadable file linked below.

What are you seeing here and why do you care? Partial listing:

🔹 An objective measurement of industry strengthening and weakening so you can objectively compare strength and weakness across/within industries and sub-industries.

🔹 A listing of stocks rated Strongest and Weakest (highest/lowest strength of 9 levels) by sub-industry, saving you significant time finding stocks that may be prone to making bigger moves faster. Stronger stocks have less overhead resistance, Weaker stocks are prone to “pops” from bargain hunting and short-covering yet due to preceding weakness are also prone to falling far and fast.

Background

Largest of 9 sub-industries (144 stocks, average 16):

- Business/Management Services (65 stocks)

- Staffing & Outsourcing Services (18 stocks)

- Education & Training Services (14 stocks)

- Rental & Leasing Services (14 stocks)

Largest market cap stocks: V/Visa Inc, MA/Mastercard Incorporated, FI/Fiserv Inc., MCO/Moody's Corporation, CTAS/Cintas Corp, PAYX/Paychex Inc, VRSK/Verisk Analytics Inc, GPN/Global Pmts Inc, URI/United Rentals Inc, FICO/Fair Isaac Inc.

Details

🔹 38% Strongest Stocks, 6% Weakest Stocks.

🔹 Mixed/WEAKENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is LOWER than 4 weeks but HIGHER than 3 Months (76%/81%/72% positive)

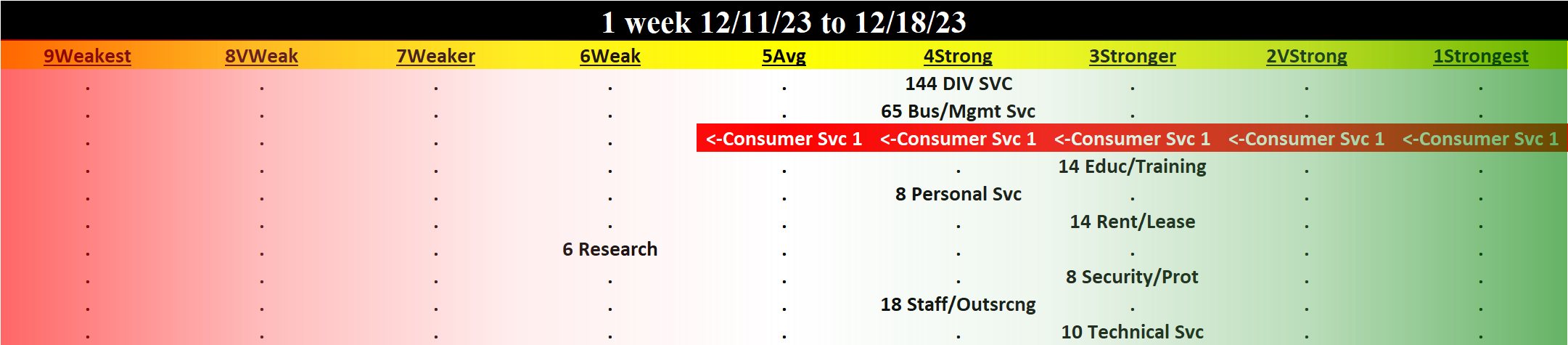

🔹 Sub-industry Overview:

STRONGEST at Stronger rating/3rd strongest of 9 levels:

- Education & Training Services (14 stocks)

- Rental & Leasing Services (14 stocks)

- Security & Protection Services (8 stocks)

- Technical Services (10 stocks)

WEAKEST at Weak rating/6th strongest of 9 levels:

- Research Services (6 stocks)

🔹 Lookback Periods Comparison:

3 Months: 21% stocks >+20% and 3% stocks <-20%.

___UP most:

APEI +78% (Bus/Mgmt Svc)

ROVR +74% (Personal Svc)

STG +63% (Educ/Training)

RCMT +46% (Staff/Outsrcng)

NSSC +46% (Security/Prot)

___DOWN most:

GDOT -34% (Bus/Mgmt Svc)

WW -27% (Personal Svc)

DHX -24% (Staff/Outsrcng)

LPSN -24% (Bus/Mgmt Svc)

AMN -21% (Staff/Outsrcng)

4 weeks: 28% stocks >+10% and 1% stocks <-10%.

___UP most:

NOTV +53% (Research)

APEI +50% (Bus/Mgmt Svc)

ZG +48% (Bus/Mgmt Svc)

PHR +44% (Bus/Mgmt Svc)

PRAA +31% (Bus/Mgmt Svc)

___DOWN most:

BLNK -17% (Bus/Mgmt Svc)

LSAK -11% (Bus/Mgmt Svc)

FCN -8% (Bus/Mgmt Svc)

J -8% (Technical Svc)

HURN -7% (Bus/Mgmt Svc)

1 Week: 8% stocks >+10% and 1% stocks <-10%.

___UP most:

ZG +26% (Bus/Mgmt Svc)

PHR +23% (Bus/Mgmt Svc)

PRAA +15% (Bus/Mgmt Svc)

ENV +15% (Bus/Mgmt Svc)

NOTV +15% (Research)

___DOWN most:

ANIX -11% (Bus/Mgmt Svc)

EVI -10% (Consumer Svc)

UTI -8% (Educ/Training)

FCN -8% (Bus/Mgmt Svc)

CIX -8% (Security/Prot)