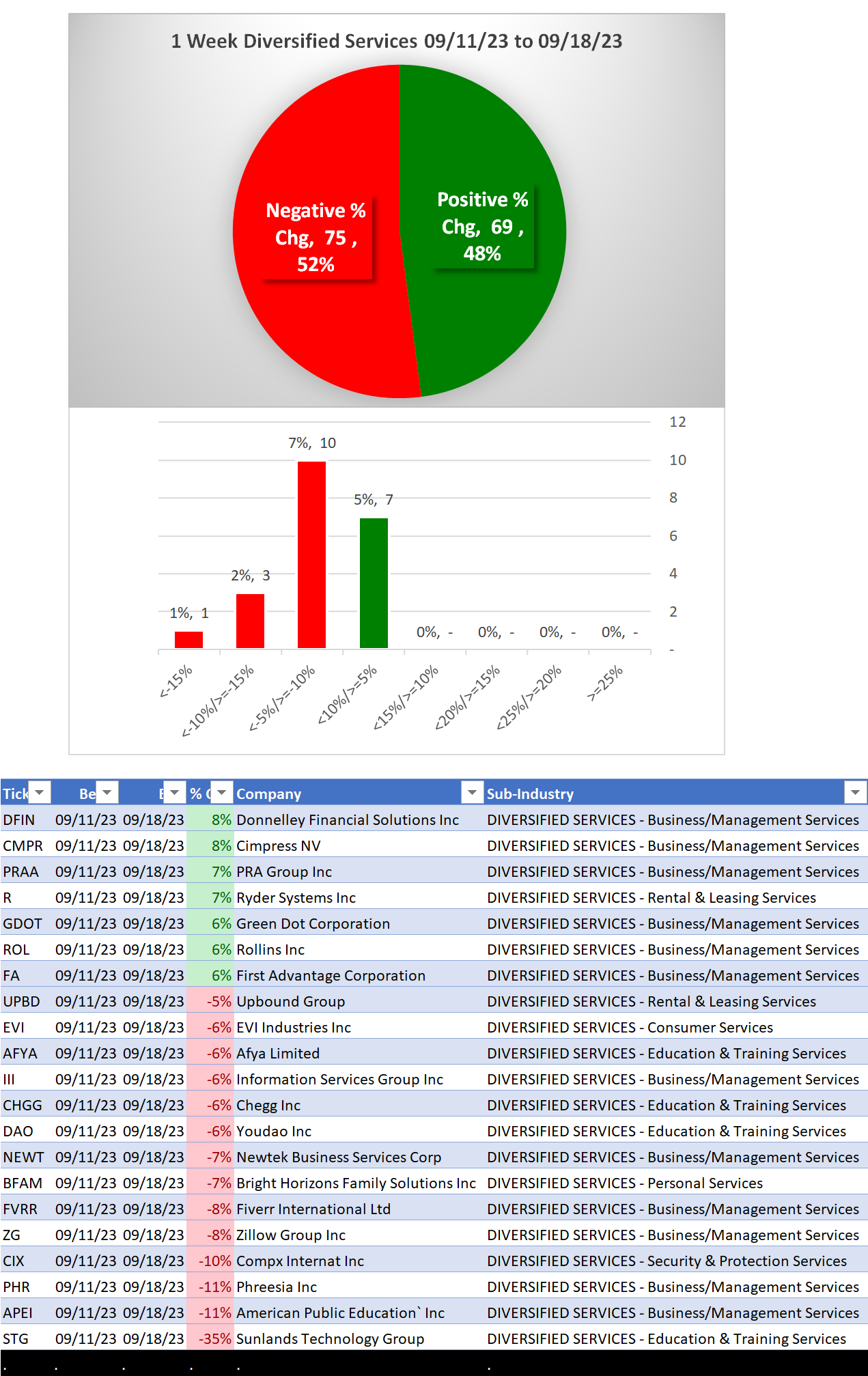

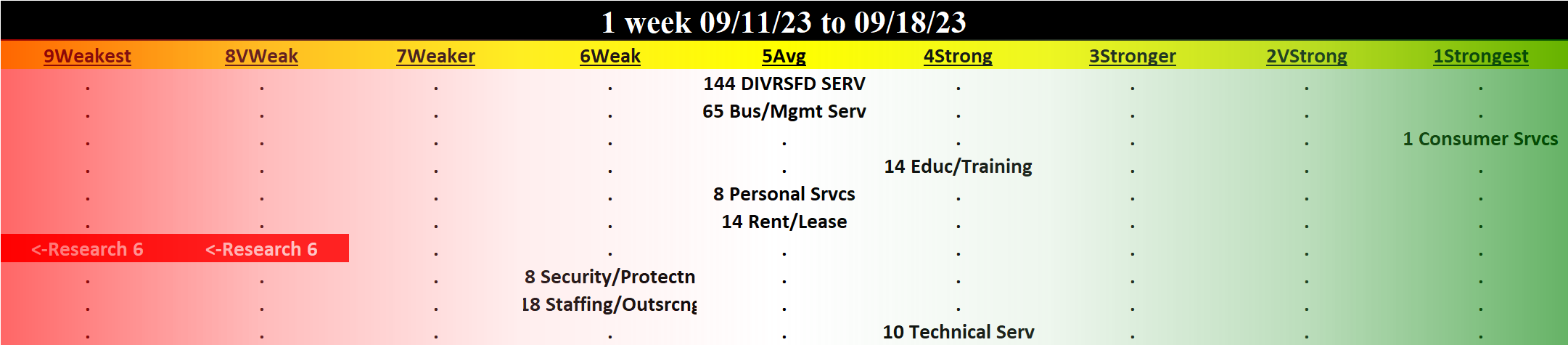

Diversified Services 2023-09-18: Unchanged at AVERAGE strength rating (5th strongest of 9 levels), previous move was DOWN

SUMMARY

Performance

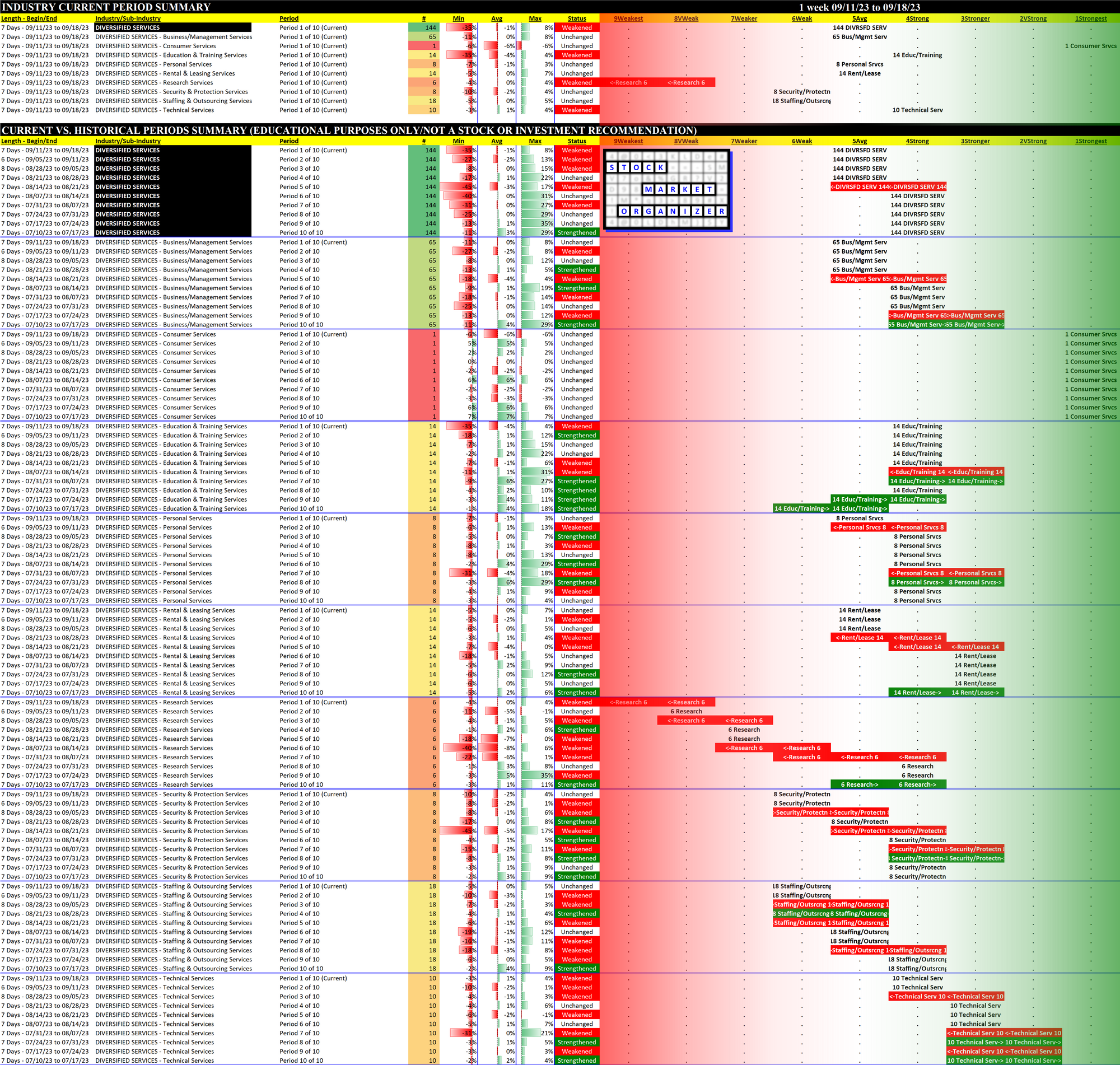

Bottom Line: weakened 1 level over the past 10 weeks

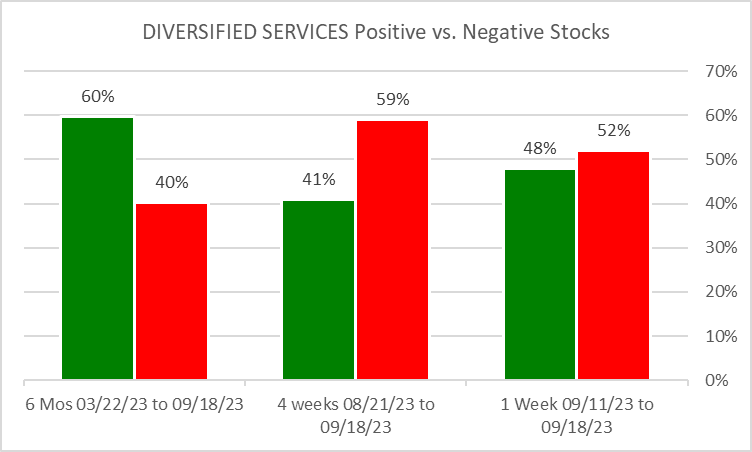

Context: 1 week positive/negative stocks ratio is WEAKER than 6 Mos and STRONGER than 4 weeks.

Other Notes:

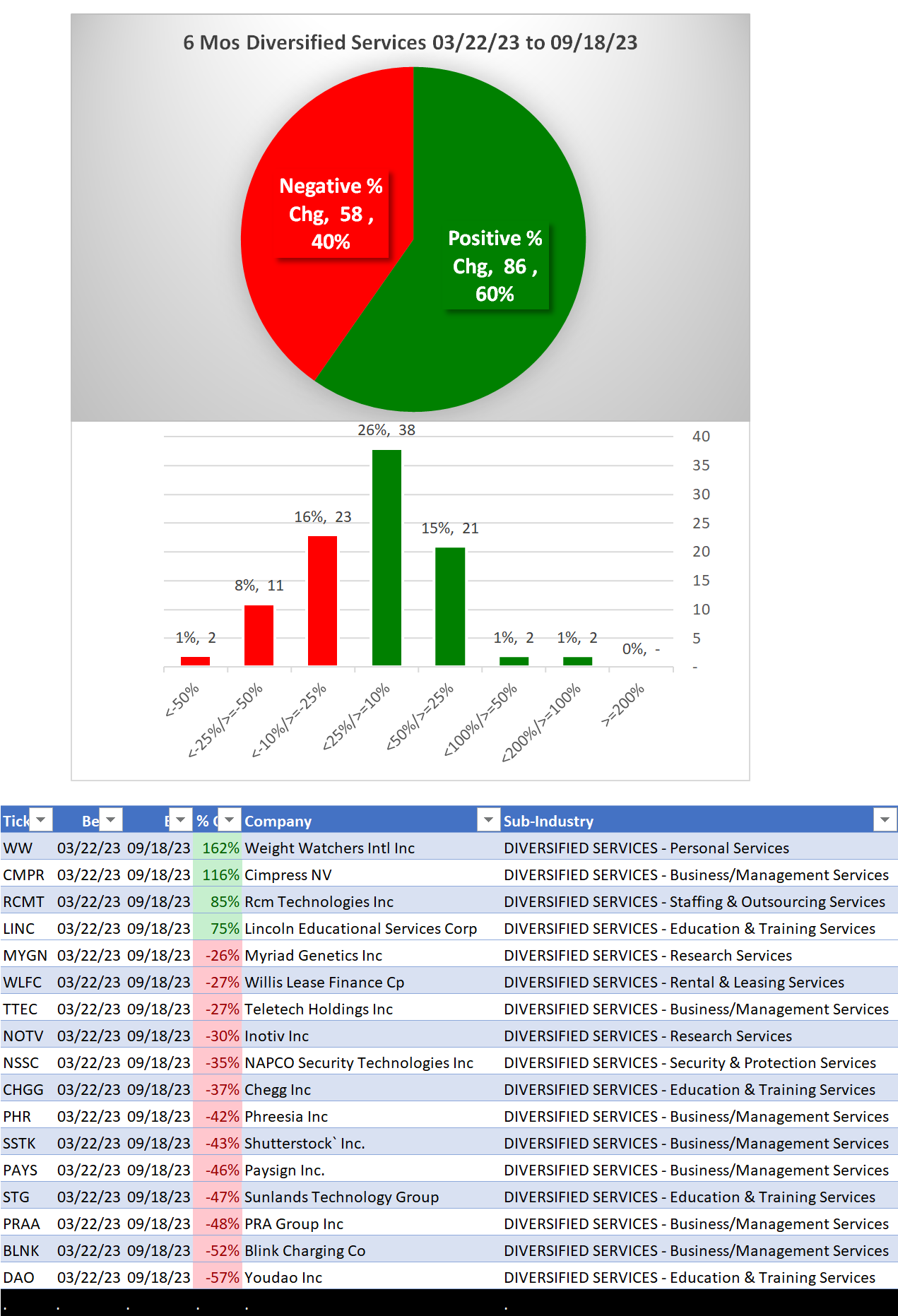

Past 6 months

- WW/Weightwatchers +162% getting some attention due to the obesity drugs?

- CMPR/Cimpress NV Business/Management Services sub-industry +116%, as BLNK/Blink Charging in the same industry is -52%

- DAO/Youdao Education & Training sub-industry -57%

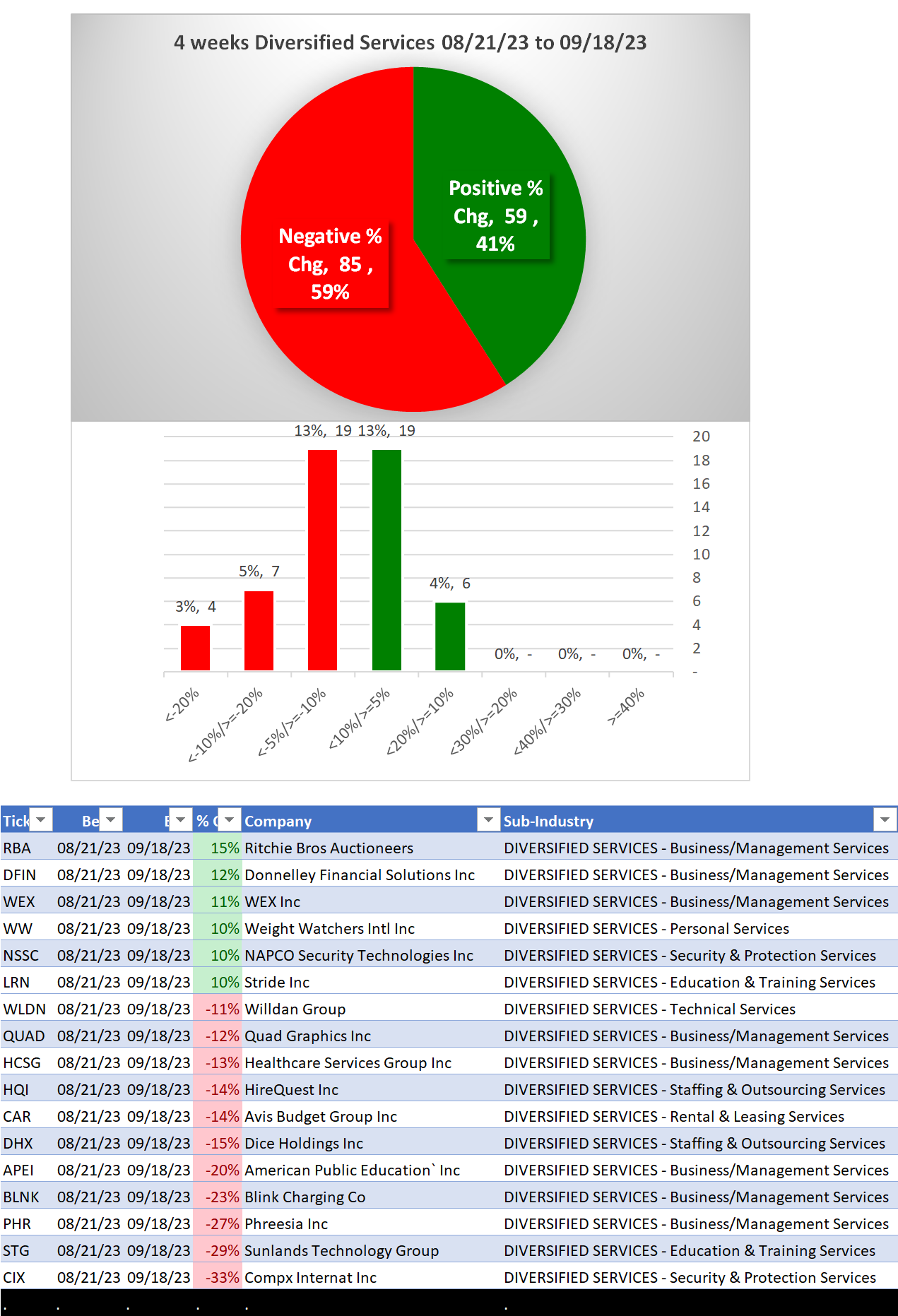

4 Weeks

CIX/Compx International, Security & Protection Services - 33%

1 Week

- STG/Sunlands Technology Group -35%

Background

Material of 9 sub-industries (144 stocks total, average 16 stocks/sub-industry):

65 stocks Business/Management Services

18 stocks Staffing & Outsourcing Services

14 stocks Education & Training Services

14 stocks Rental & Leasing Services

10 stocks Technical Services

10 Biggest Market Cap stocks:

V, MA, FI, MCO, CTAS, PAYX, VRSK, GPN, URI, SBAC

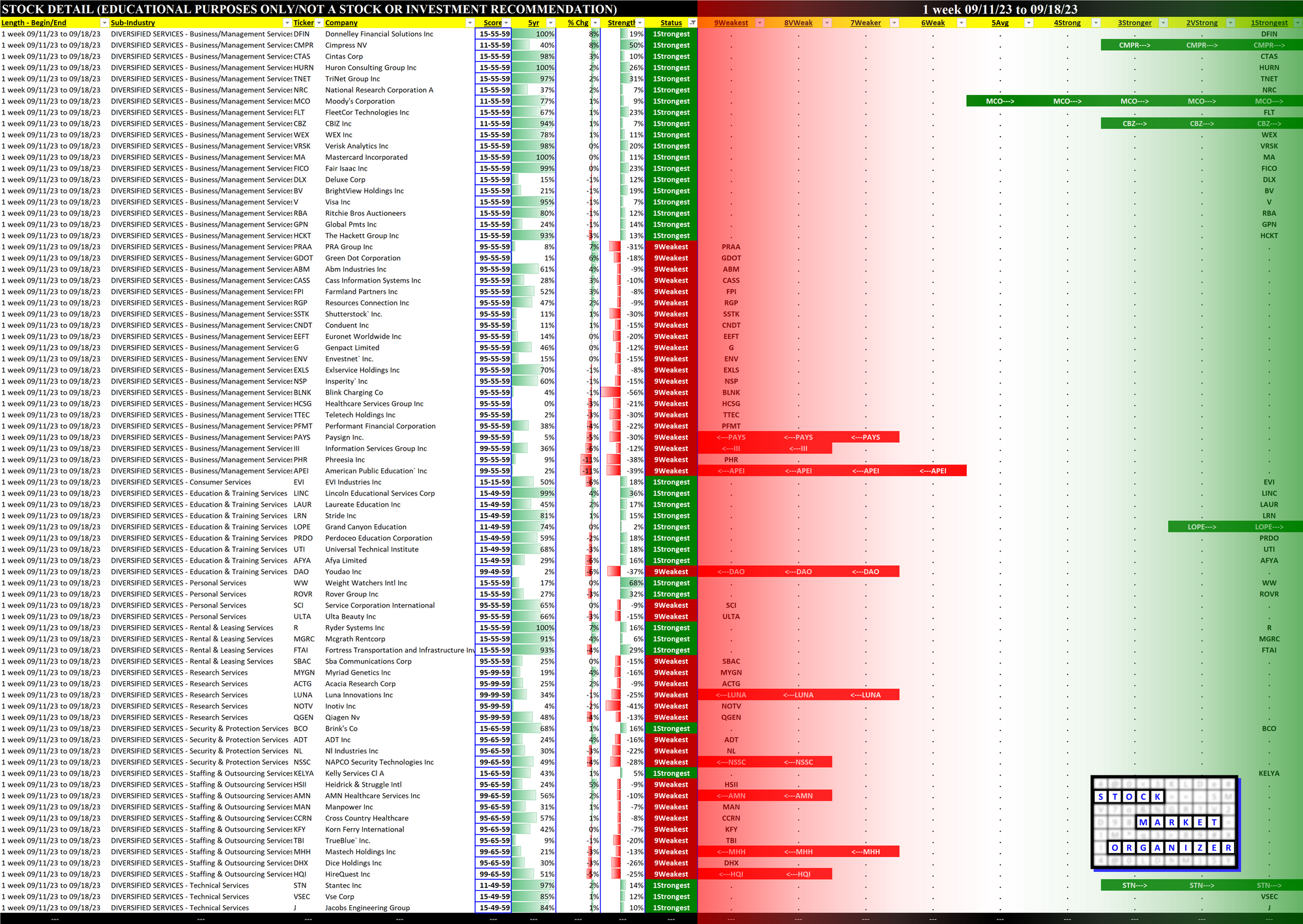

DETAIL: 1 Week Performance Review

Status

Strengthened: 0/9 sub-industries

Weakened: 1/9 sub-industries

Strongest at Strongest rating/1st strongest of 9 levels:

1 stock Consumer Services

Tie at Strong/4th Strongest:

- 14 stocks Education & Training Services

- 10 stocks Technical Services

Weakest at Weakest rating/9th strongest of 9 levels:

6 stocks Research Services

Detail Charts: Sub-Industry and Stock

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

DETAIL: Lookbacks 6 Mos vs. 4 weeks vs. 1 Week

6 Mos Lookback

4 weeks Lookback

1 Week Lookback