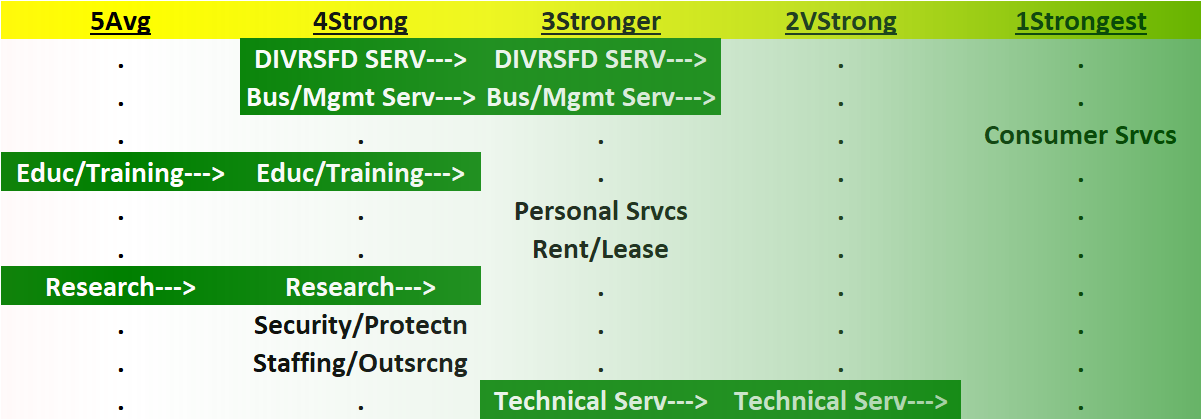

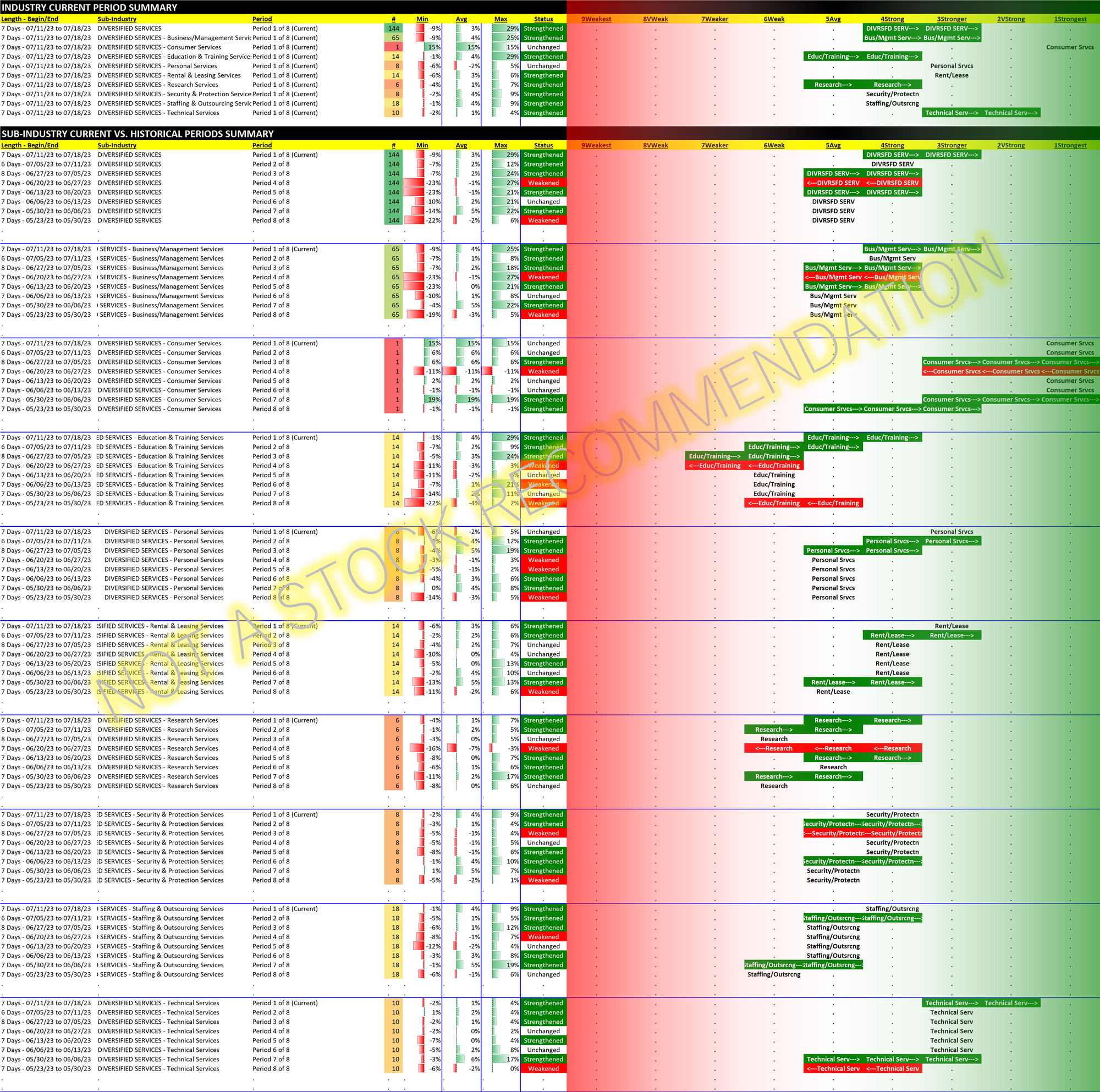

Diversified Services 2023-07-18: +1 to "Stronger" strength rating (3rd strongest of 9 levels), previous move was also up

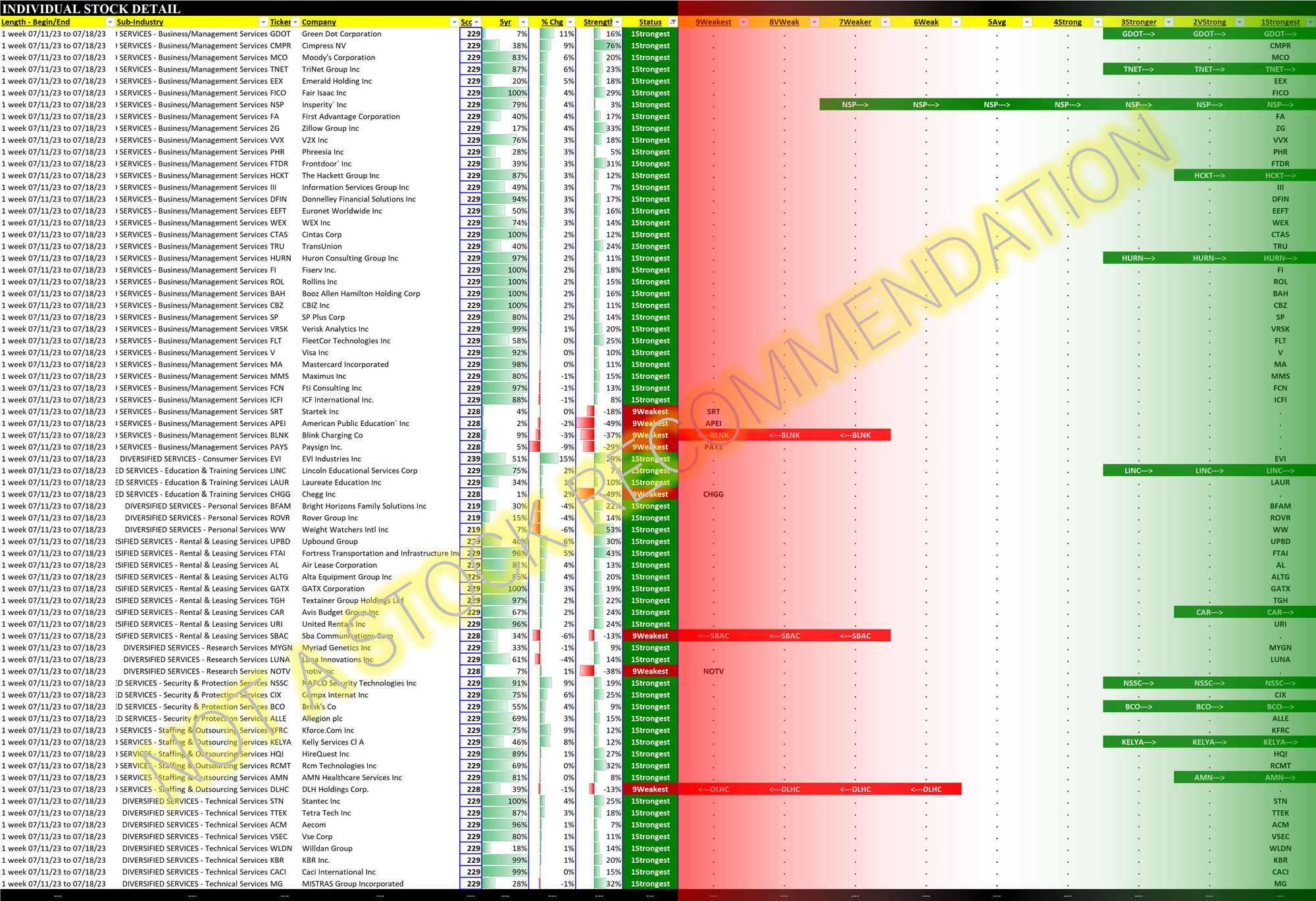

Many component stocks in this industry with five of eight sub-industries containing 10 or more stocks. Business/Management Services is the largest with 65 stocks including MCO/Moody's, TRU/Transunion, V/Visa, MC/Mastercard, and FICO/Fair Isaac. This sub-industry is also Stronger, matching the industry strength rating.

As seen in Leaders and Laggards below, BLNK/Blink Charging Co. has fallen to Weakest. Based on the numbers, its seems like it should be a hot seller - a Yahoo! article states "In Q1, total revenues soared by 121% YoY to $21.67 million. Service revenues more than tripled, and network fees surged by 911%."

Wow! Sure sounds great. But the market knows this. What is wrong?

I prefer to pay attention to the What. That is, BLNK is not in favor right now. Will it become in favor eventually? Seems like it could be a potential short term "pop" candidate. (As always, this is not a recommendation.)

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.