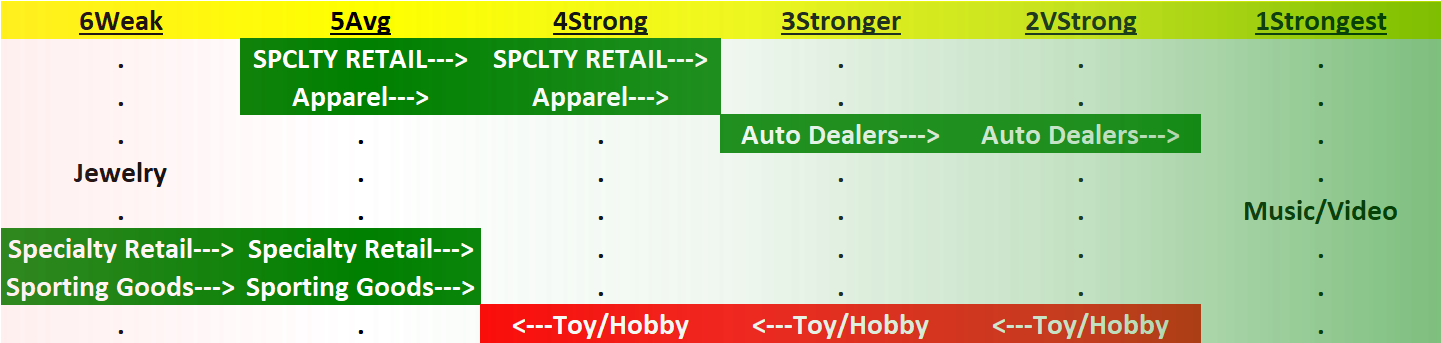

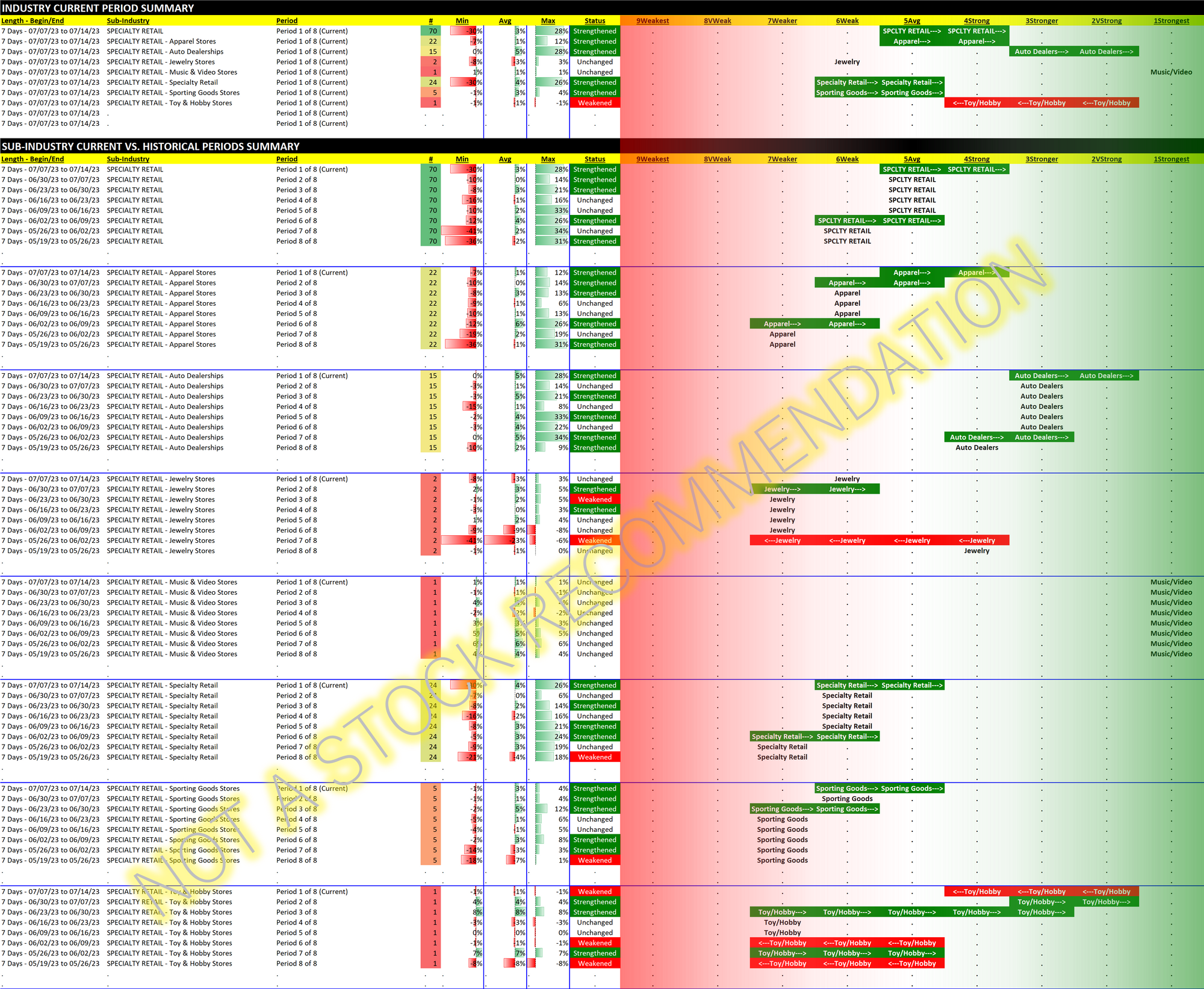

Specialty Retail 2023-07-14: +1 to "Strong" strength rating (4th strongest of 9 levels), previous move was also up

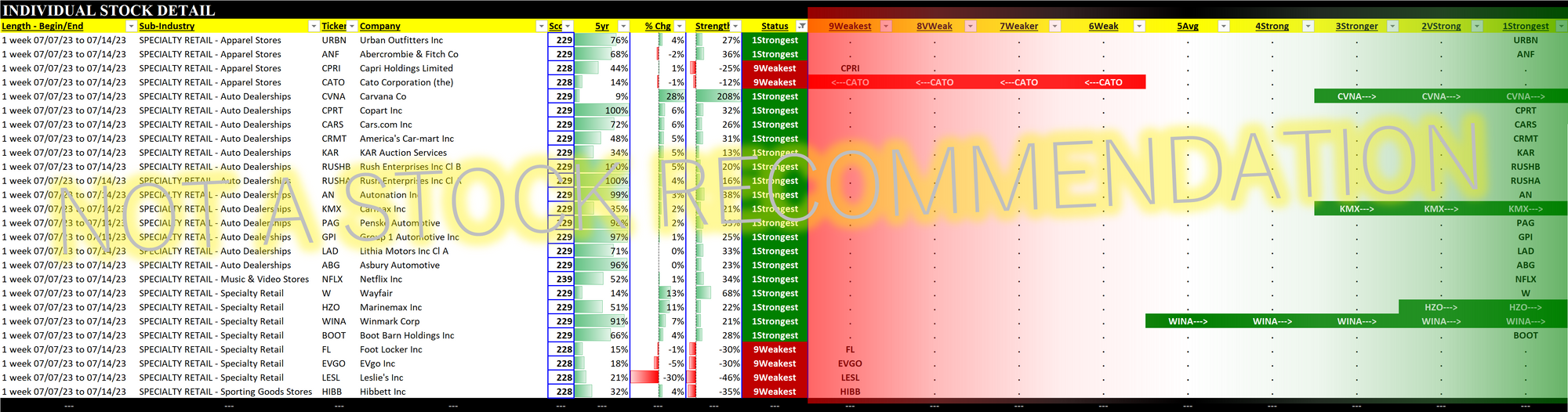

The three largest and most meaningful sub-industries within Specialty Retail all have strengthened over the past eight weeks, leading to the improvement in the industry. Apparel Stores includes JWN/Nordstrom, GPS/Gap, ROST/Ross, URBN/Urban Outfitters, and ANF/Abercrombie & Fitch. Auto Dealerships are highlighted below in "A Closer Look." Specialty Retail includes FL/Footlocker, ETSY/Etsy, W/Wayfair, TSCO/Tractor Supply, and PDD/Pinduoduo.

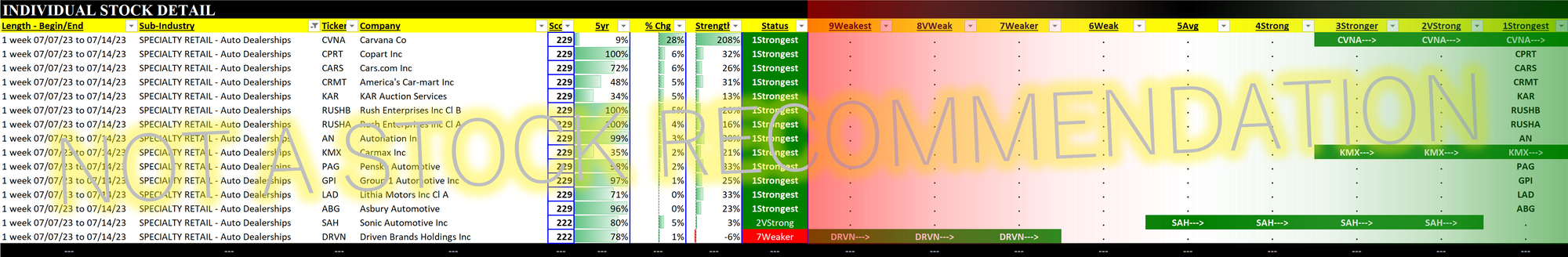

Auto Dealerships - a closer look

Remember at the beginning of 2023 when there were bankruptcy rumors surrounding CVNA/Carvana which fell from ~$360 to <$4 August 2021 to December 2022? From its $3.83 closing low December 7, 2022 Carvana has risen 884% as of July 14, 2023. It is an excellent, admittedly cherry-picked example of why I follow and highlight the Leaders and Laggards (see below). The Laggards are Prone to Price Pops exactly like the one Carvana has experienced. (Note that the 14 other Auto Dealers I follow maxed out at 48% returns during this same eight month period, so Carvana is clearly an outlier and I make no claim it is a stock I would have bought. Though it could have been bought at any time so long as one considers the Six Questions as noted in this post. Also, this could reverse at any time, and I am not now advocating purchasing Carvana.)

A well-known stock advisory service has a current article asking/stating "Up 700% this year, but why? There seem to be a few reasons why Carvana is up so far this year, some related to the macroeconomic environment in the United States and others more specific to the stock."

The horse is out of the barn. As I wrote last week, "WHAT Matters, not WHY." Intellectualization after the fact does nothing for your P&L going forward. Your P&L cares about the WHAT and that WHAT ideally is that your stocks are strengthening.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.