Computer Hardware 2023-09-21: DOWN -1 to WEAK strength rating (6th strongest of 9 levels), previous move was also DOWN

TABLE OF CONTENTS

- INDUSTRY OVERVIEW

1A. Performance

1B. Background - SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

2B. Sub-Industries 10-Week Strengthening Analysis

2C. Stocks 1 Week Strongest and Weakest - STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

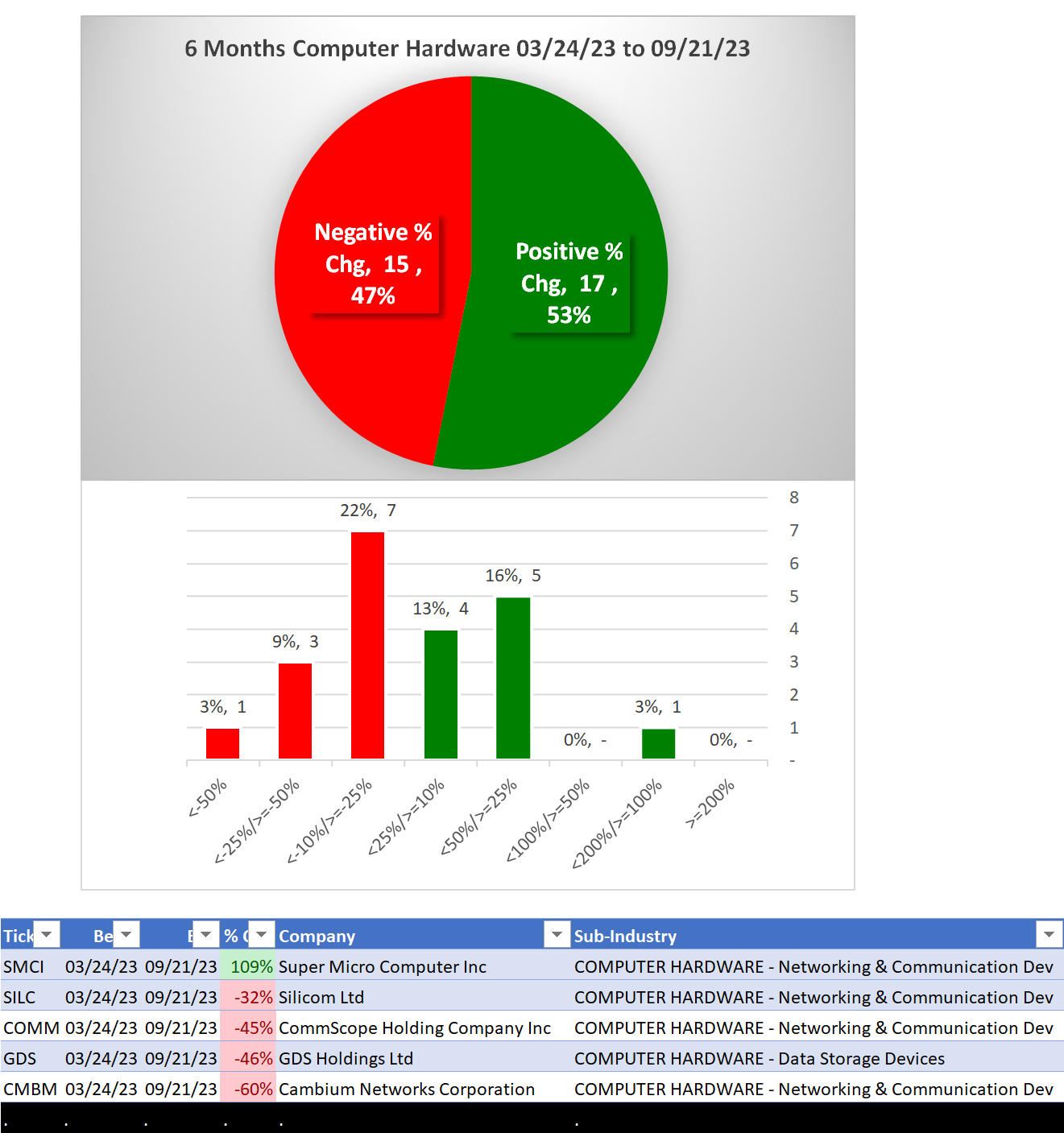

3A. Lookback 6 Months

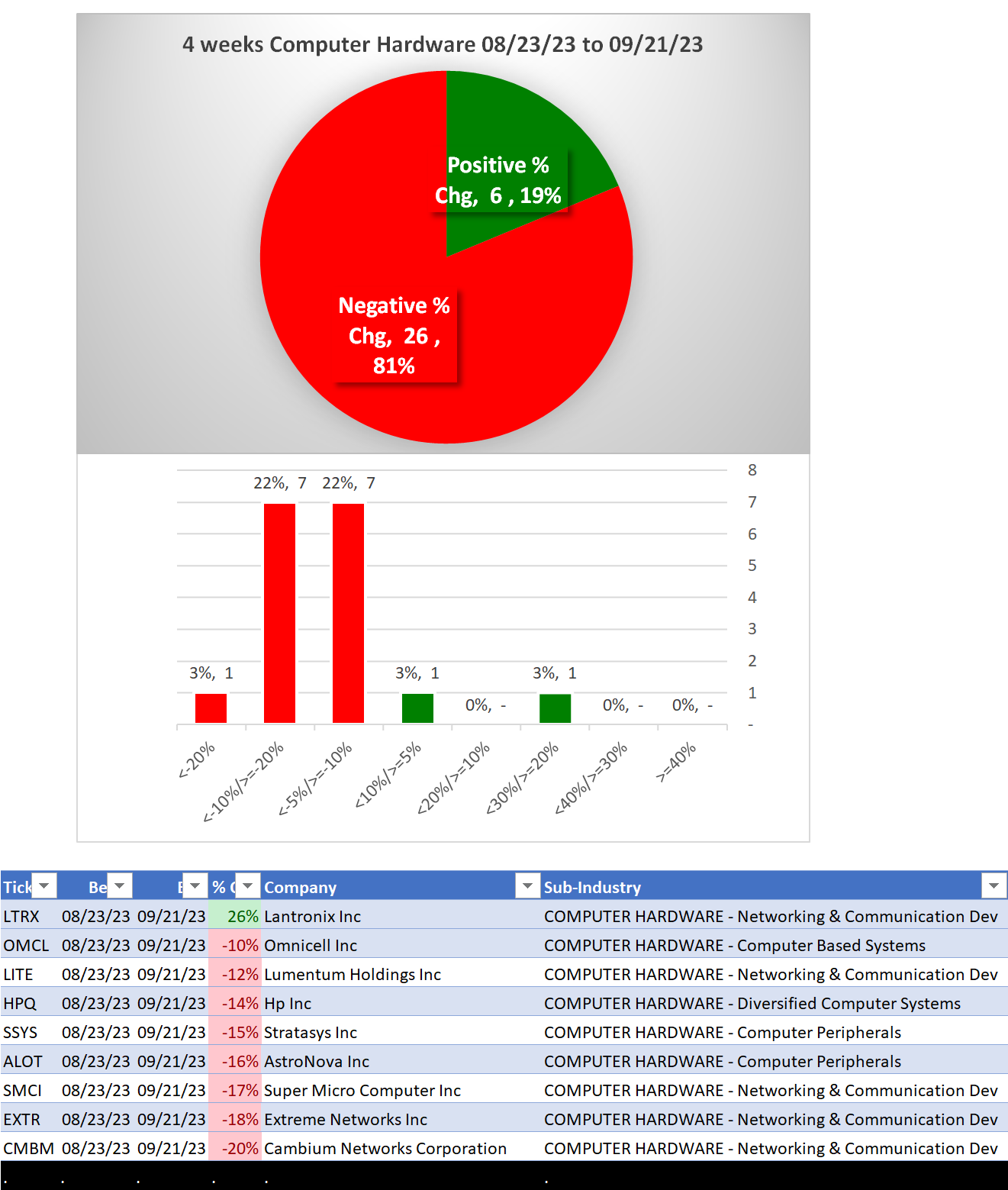

3B. Lookback 4 weeks

3C. Lookback 1 Week

1. INDUSTRY OVERVIEW

1A. Performance

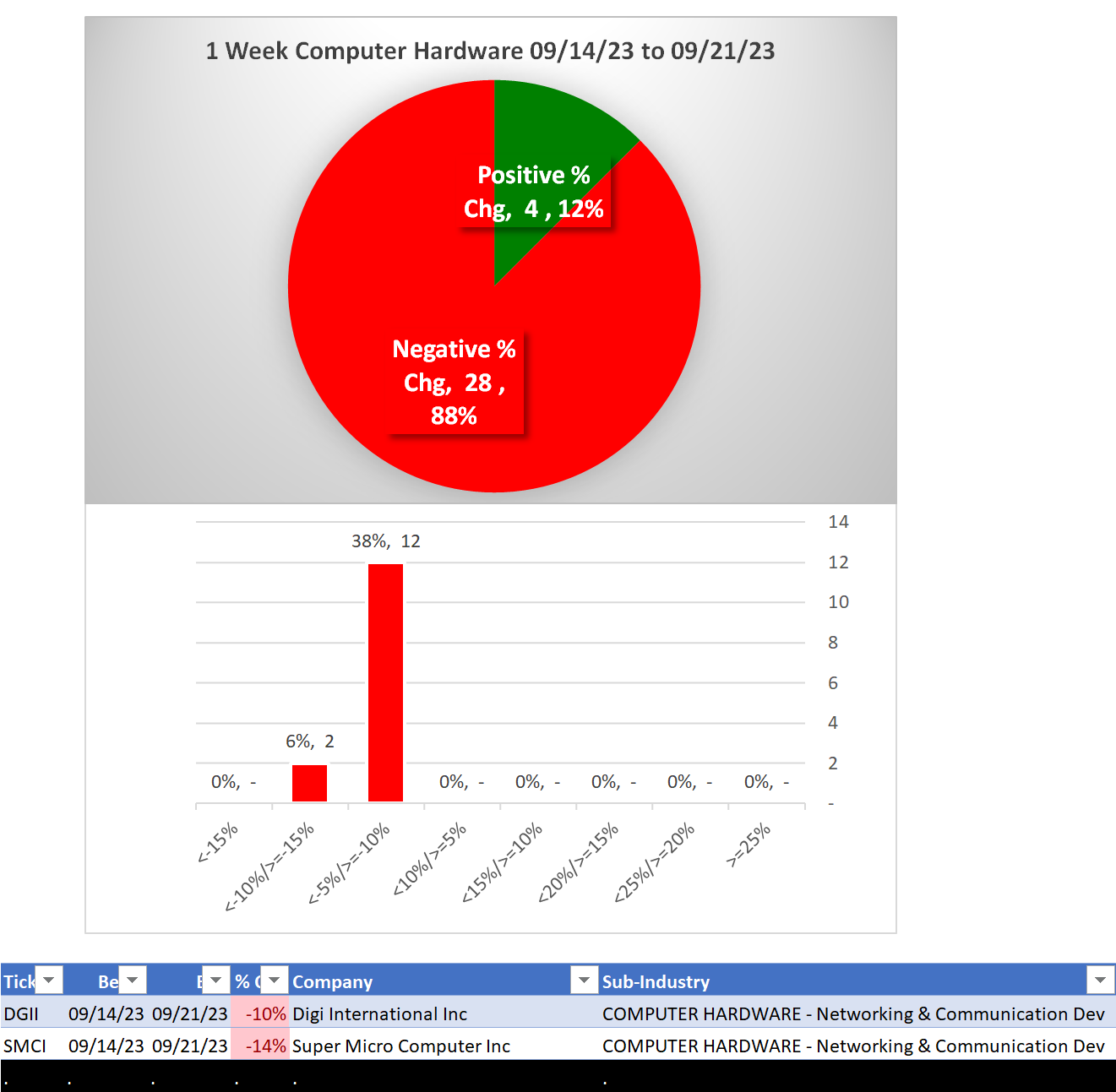

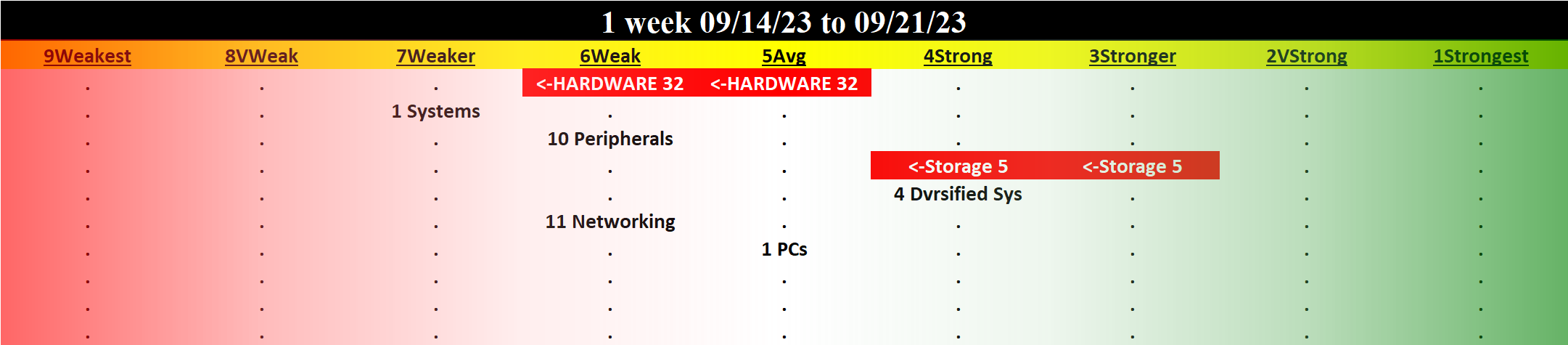

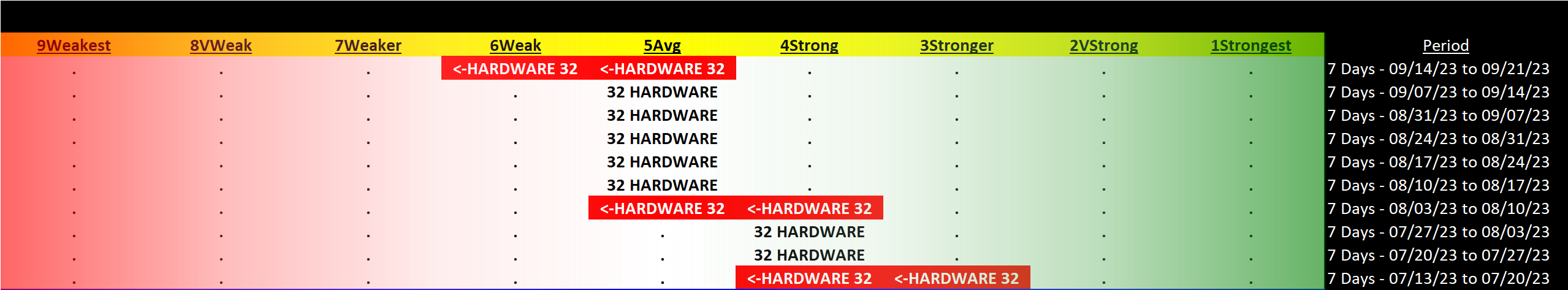

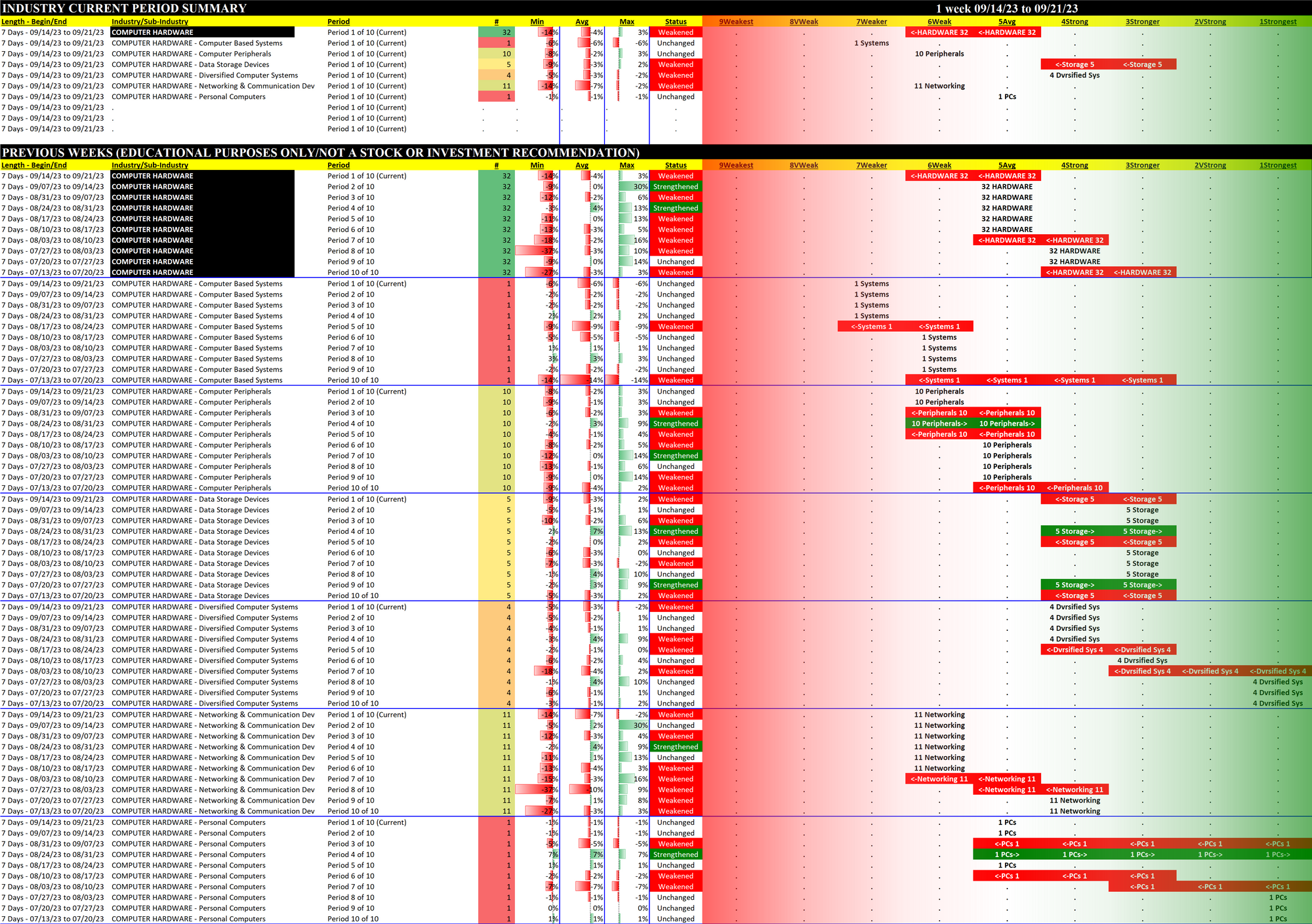

Past 10 Weeks Strengthening/Weakening week-by-week, per the following chart:

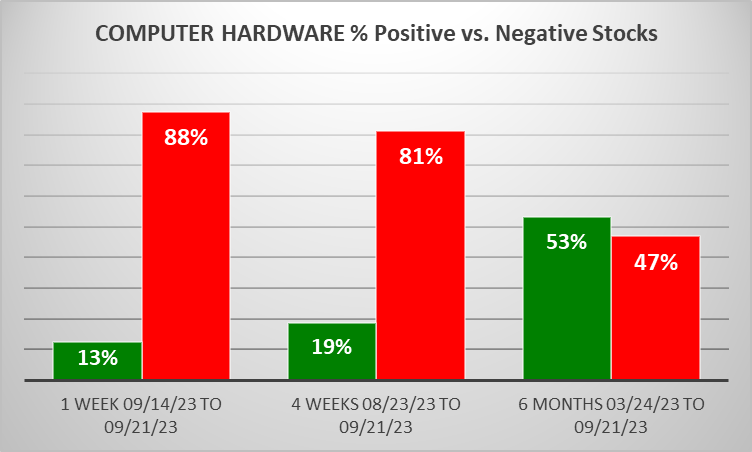

WEAKENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is LOWER than both 4 weeks and 6 Months, per the following chart:

1B. Background

Largest of 6 sub-industries (32 stocks, average 5):

- Networking & Communication Dev (11 stocks)

- Computer Peripherals (10 stocks)

Top 10 by Market Capitalization:

AAPL/Apple Inc, CSCO/Cisco Systems Inc, PANW/Palo Alto Networks Inc., ANET/Arista Networks Inc, CDW/CDW Corporation, HPQ/Hp Inc, NTAP/Netapp Inc, SMCI/Super Micro Computer Inc, WDC/Western Digital Corp, STX/Seagate Technology Holdings PLC

2. SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

Strengthened: 0/6 sub-industries

Weakened: 1/6 sub-industries

STRONGEST at Strong rating/4th strongest of 9 levels:

- Data Storage Devices (5 stocks)

- Diversified Computer Systems (4 stocks)

WEAKEST at Weaker rating/7th strongest of 9 levels:

- Computer Based Systems (1 stock)

- Computer Peripherals (10 stocks) (ranked 6th, more than 1 stock)

- Data Storage Devices (5 stocks) (ranked 6th, more than 1 stock)

2B. Sub-Industries 10-Week Strengthening Analysis

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

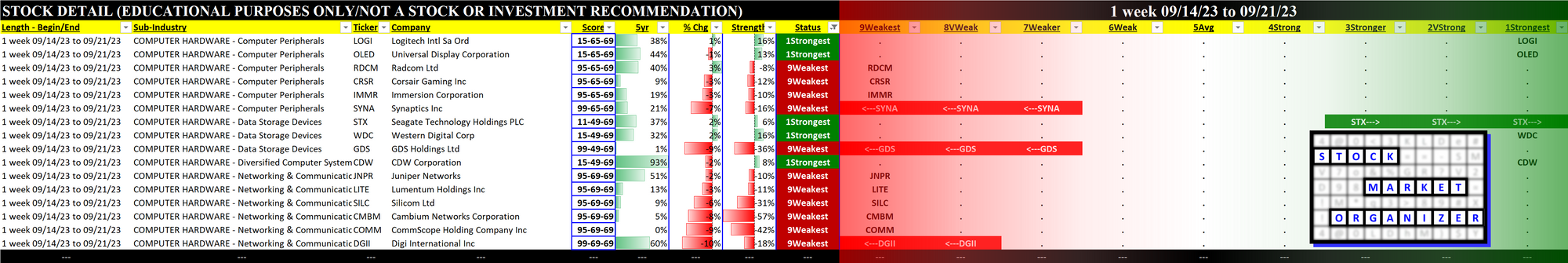

2C. Stocks 1 Week Strongest and Weakest

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest have the least amount of overhead supply to dampen breakouts while

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

3. STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week