Computer Hardware 2023-09-14: Unchanged at "AVERAGE" strength rating (5th strongest of 9 levels), previous move was DOWN

SUMMARY

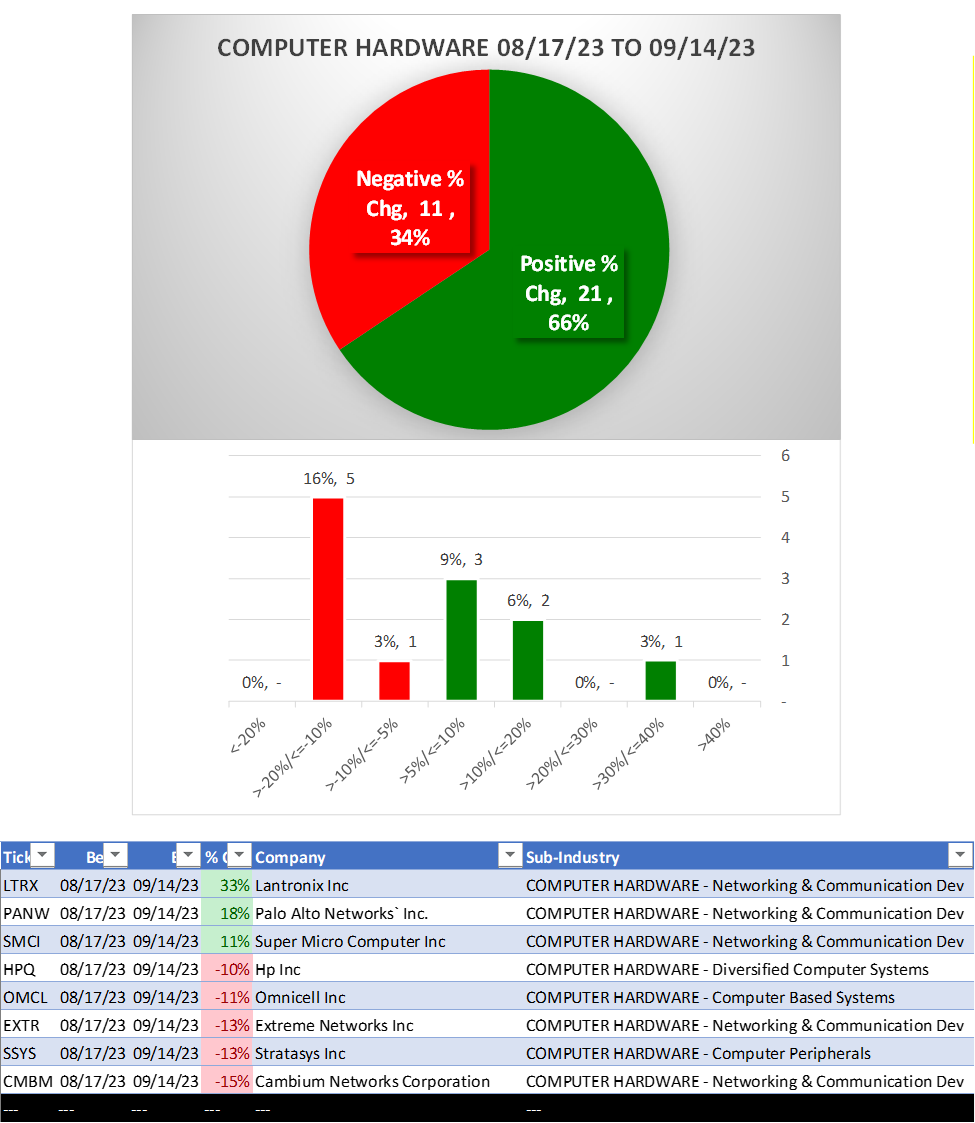

Performance

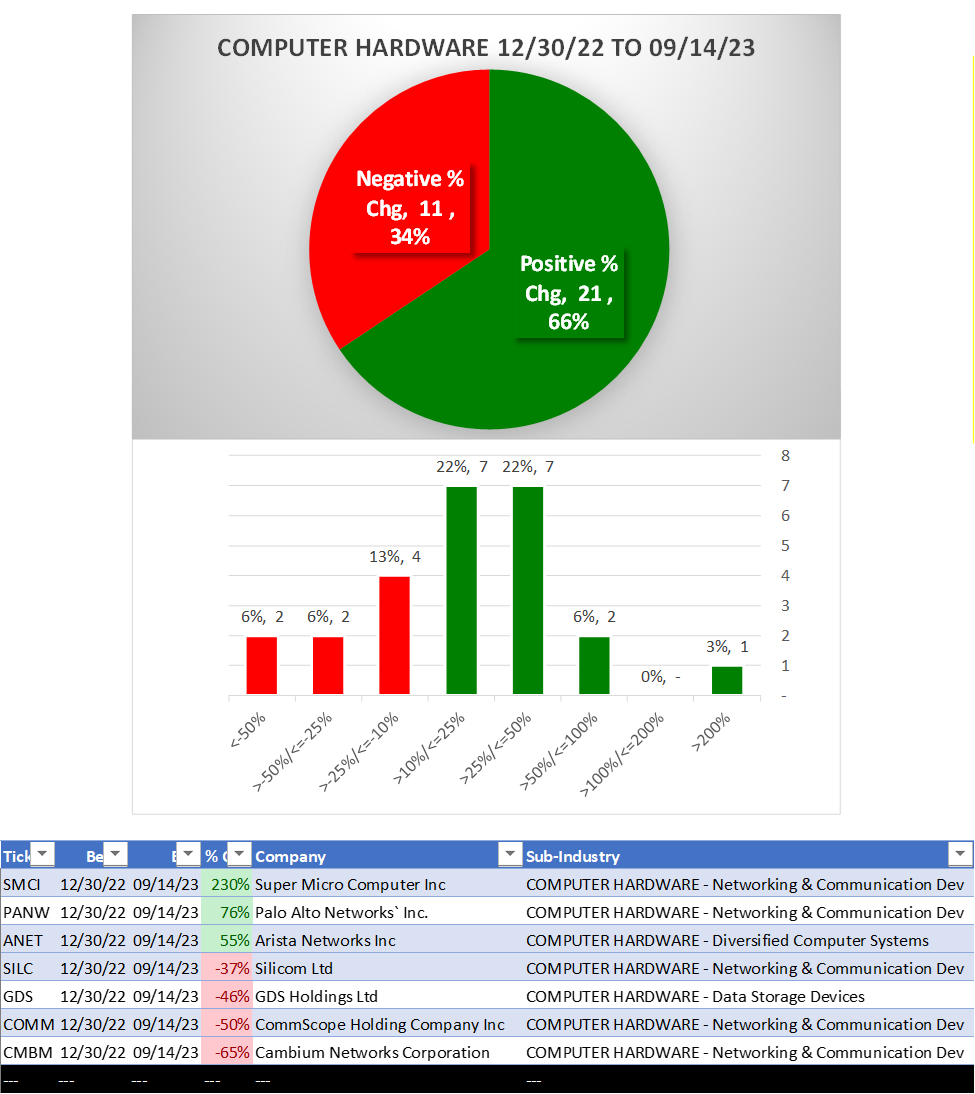

Bottom line: flat for the past 5 weeks

Context: steady performance recently vs. YTD

- 66% positive stocks YTD

- 66% positive stocks past 4 weeks

Background

Largest of 6 Sub-industries: Networking & Communication, Computer Peripherals

10 Biggest Market Cap stocks: AAPL, CSCO, PANW, ANET, CDW, HPQ, NTAP, SMCI, WDC, STX

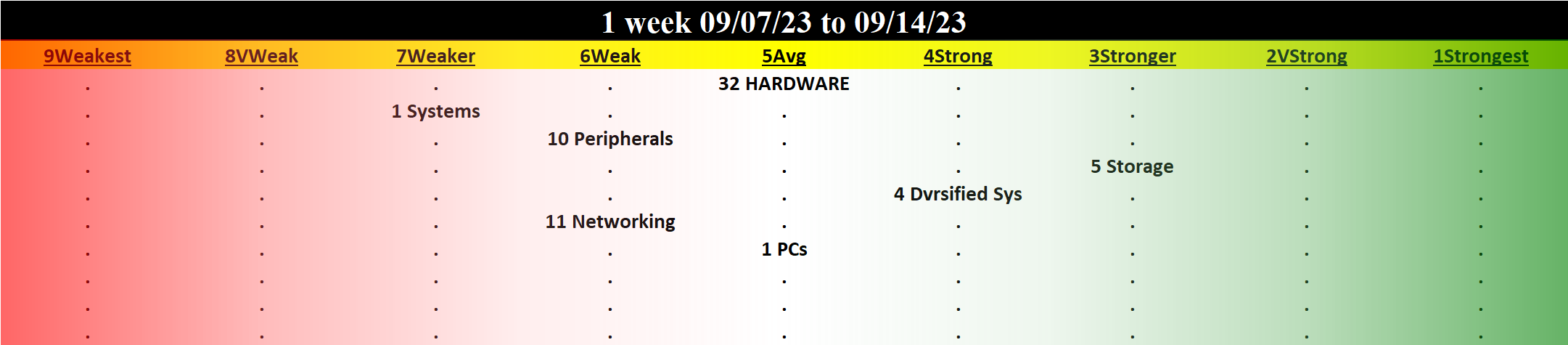

DETAIL: 1 week review, YTD/4 weeks lookbacks

1 Week Review

Strengthened: 0/6 sub-industries

Weakened: 0/6 sub-industries

Strongest at Stronger/3rd strongest (of 9 levels) rating: Data Storage Devices

Weakest at Weak/6th strongest rating: Peripherals and Networking (Computer Based Systems is 7th/Weaker but only has 1 stock)

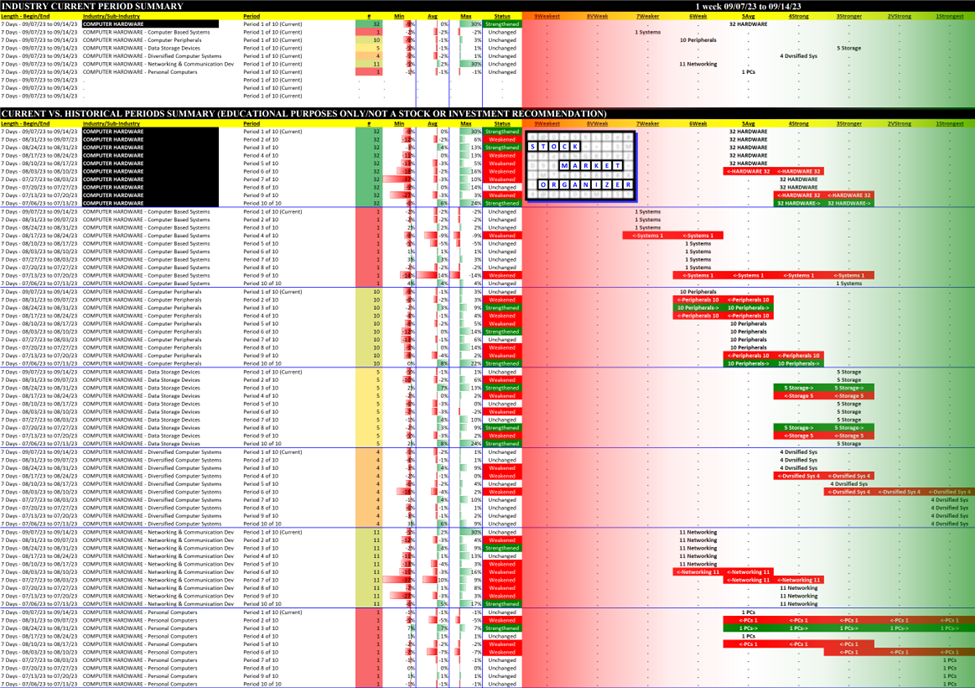

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

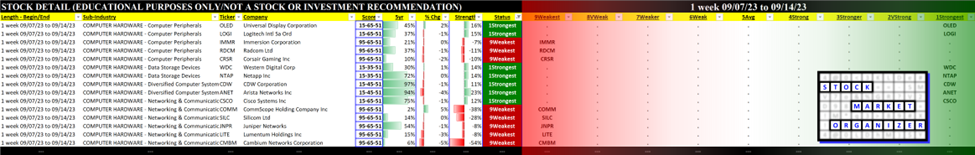

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls. (Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

YTD Lookback

4 Weeks Lookback