Banks 2023-03-13 next shoe to drop part 3?

This is a continuation of this post.

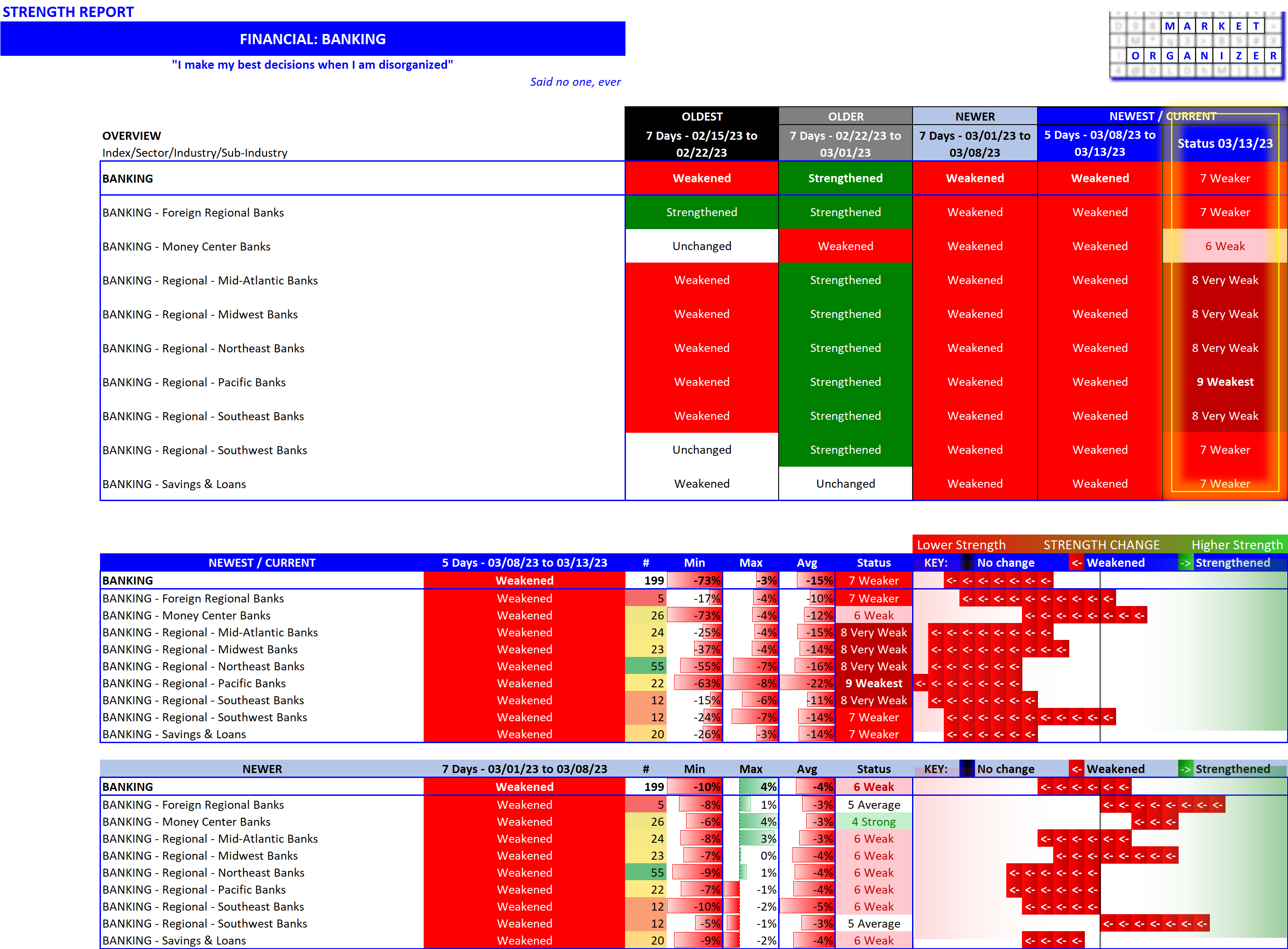

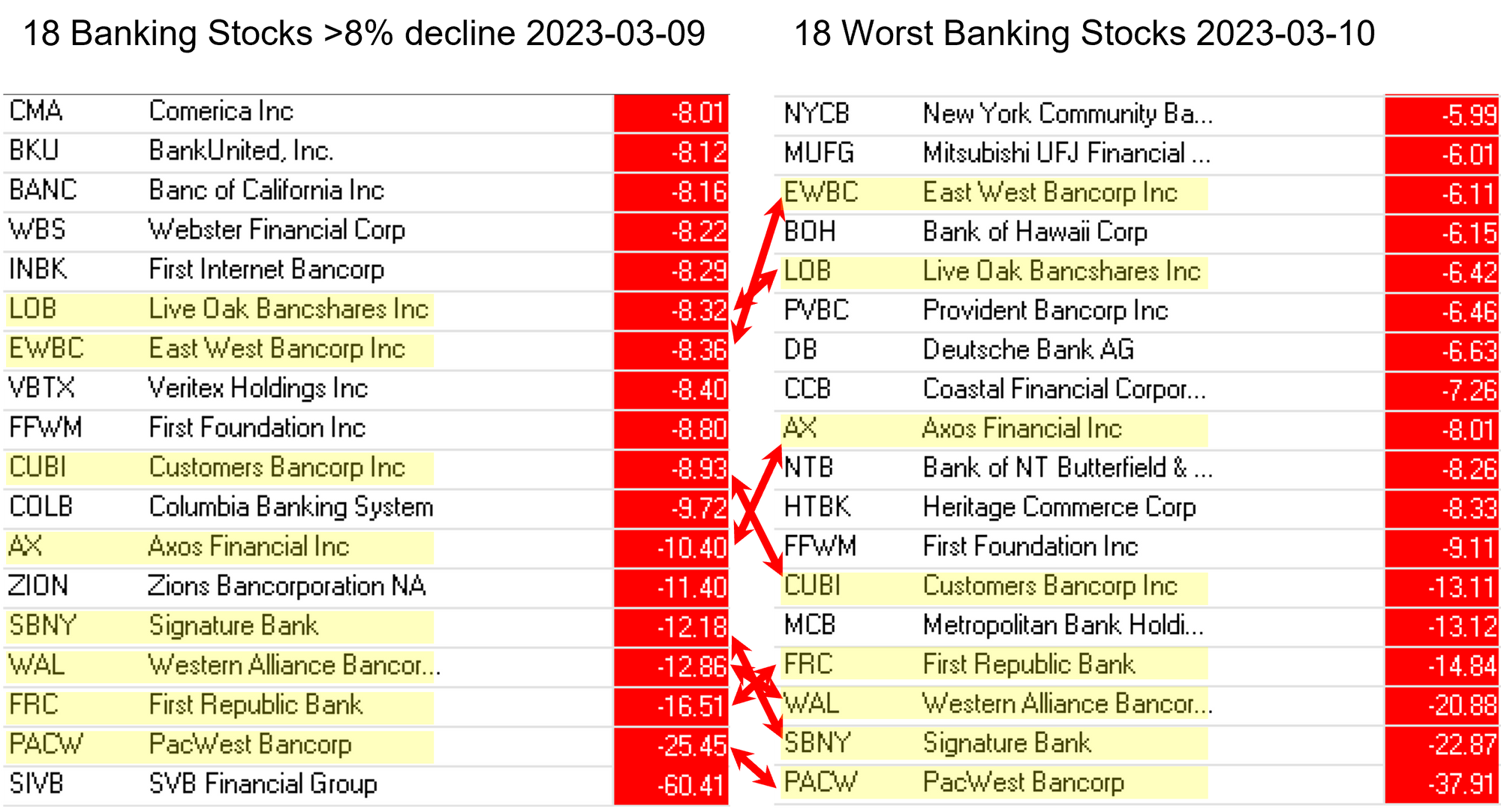

I put the following picture in that post, which showed that the bottom 18 bank stocks on 2023-03-09 fell 8% or more, and there was more distress but not as bad the next day 2023-03-10:

The government stepped in Sunday 2023-03-12. What happened today? There were 65 bank stocks - nearly 1 in 3 followed (based on a minimum size/volume level) that fell more than 8%.

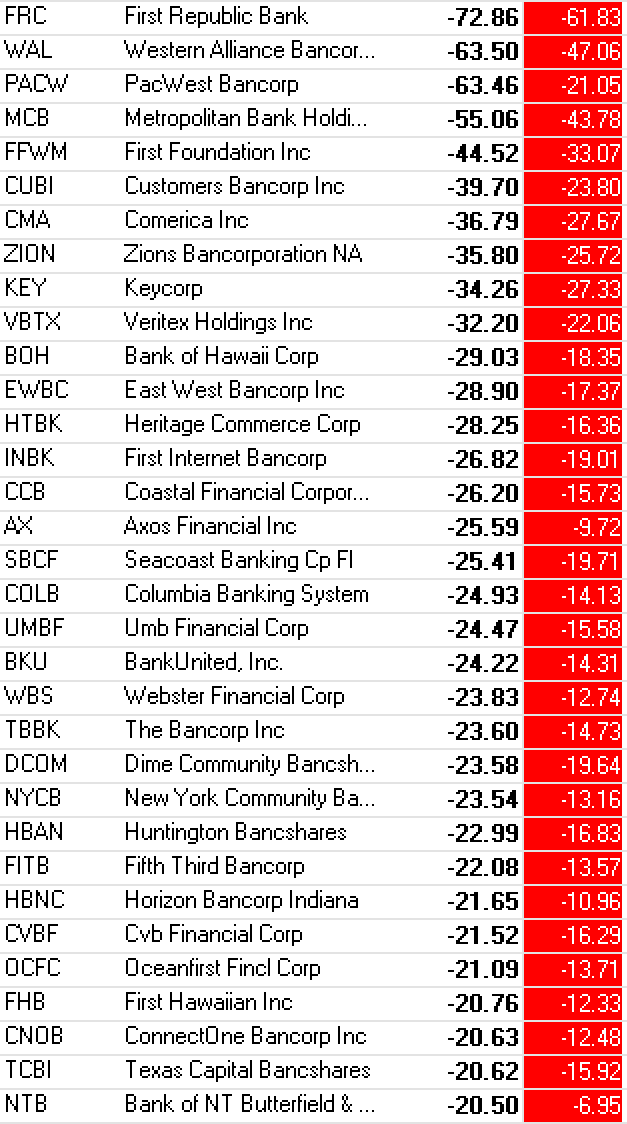

Furthermore, there were 33 bank stocks (excluding Silicon Valley and Signature) that fell at least 20% since Wednesday 2023-03-08:

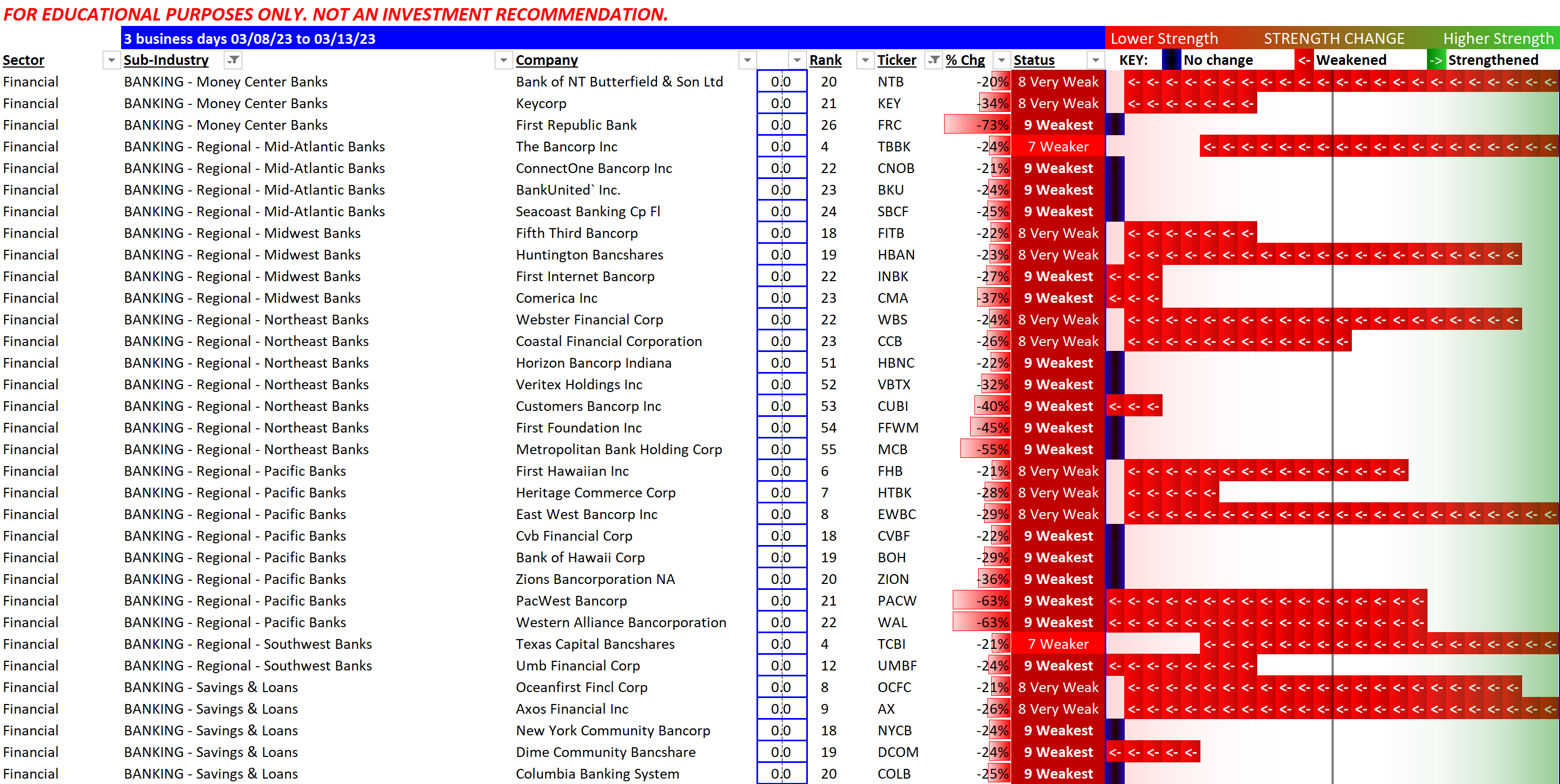

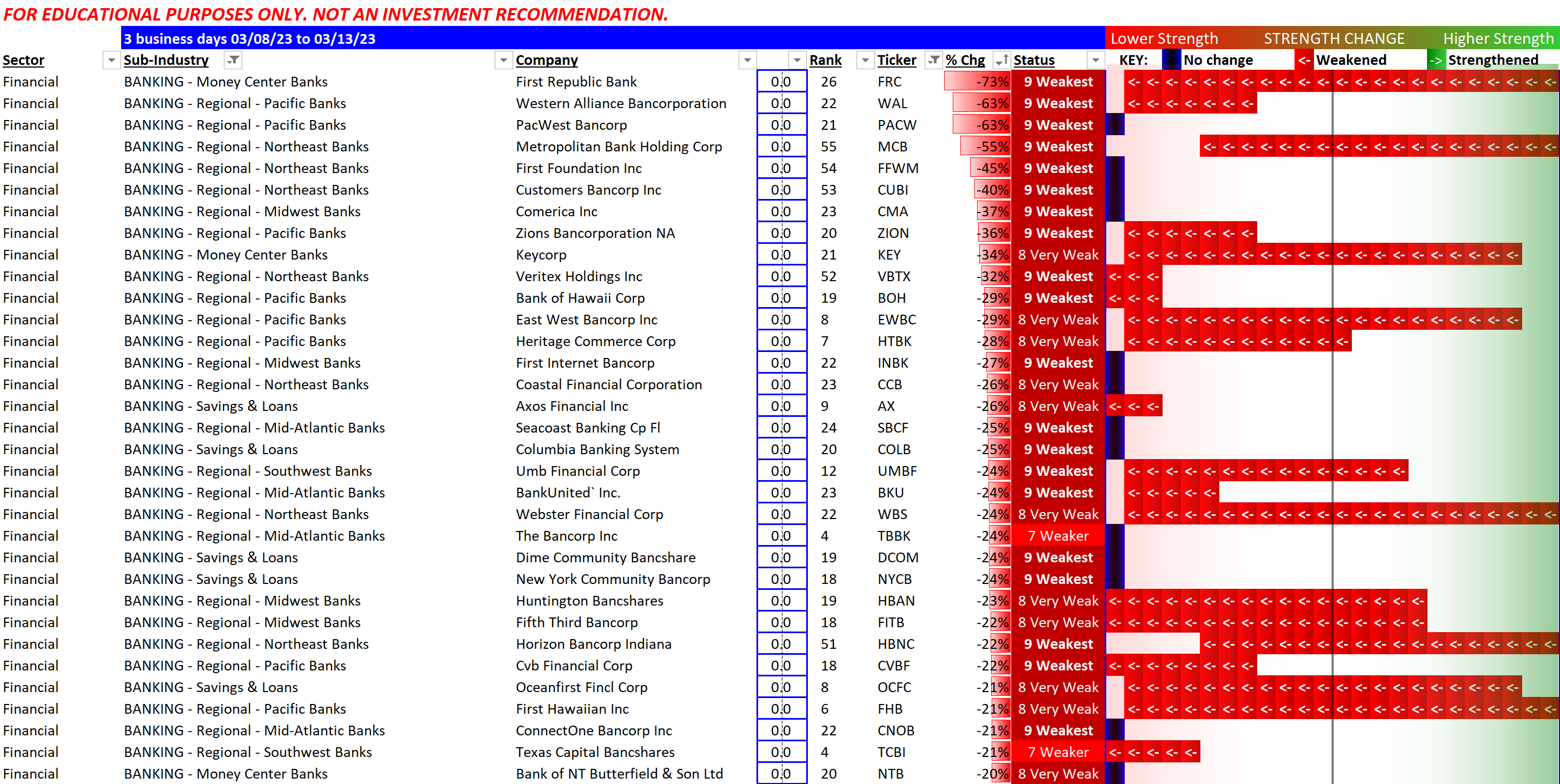

Next, here is a look at these 33 stocks showing their change for the three business/trading days from Thursday 2023-03-09 through Monday 2023-03-13 (from after the close of business Wednesday 2023-03-08):

Next is the same table sorted in order of return (worst return first).

This method is not a magic bullet for avoiding losses once in a position. First Republic had the strongest rating before last Thursday. However, per the graphic at the top, both its sub-industry and industry were weak before last Thursday (in fact also for the week prior to that) so there would not have been any entry trigger for it or any of the strong/strengthening stocks in Banking.

The magic bullet for avoiding catastrophic loss is having the discipline to know prior to entry what is your "uncle!"/exit point. LTB&Hing or making it up as you go is not a profitable long-term strategy.

So what is the next shoe to drop?

I have no idea. I never make predictions, but I can tell you within and throughout the market where there is strengthening and weakening - objectively and in a repeatable manner. With this knowledge, you can know when to stay out of a position, as well as what stocks are in position to benefit from positive sub-industry and industry movement.

My analysis concluded that for the moment there are no buy possibilities in the banking industry.

Downloadable file

The underlying analysis to the graph at the top of this post can be downloaded at the following link.