Banks 2023-03-10 next shoe to drop part 2?

To say the above action is highly unusual would be accurate.

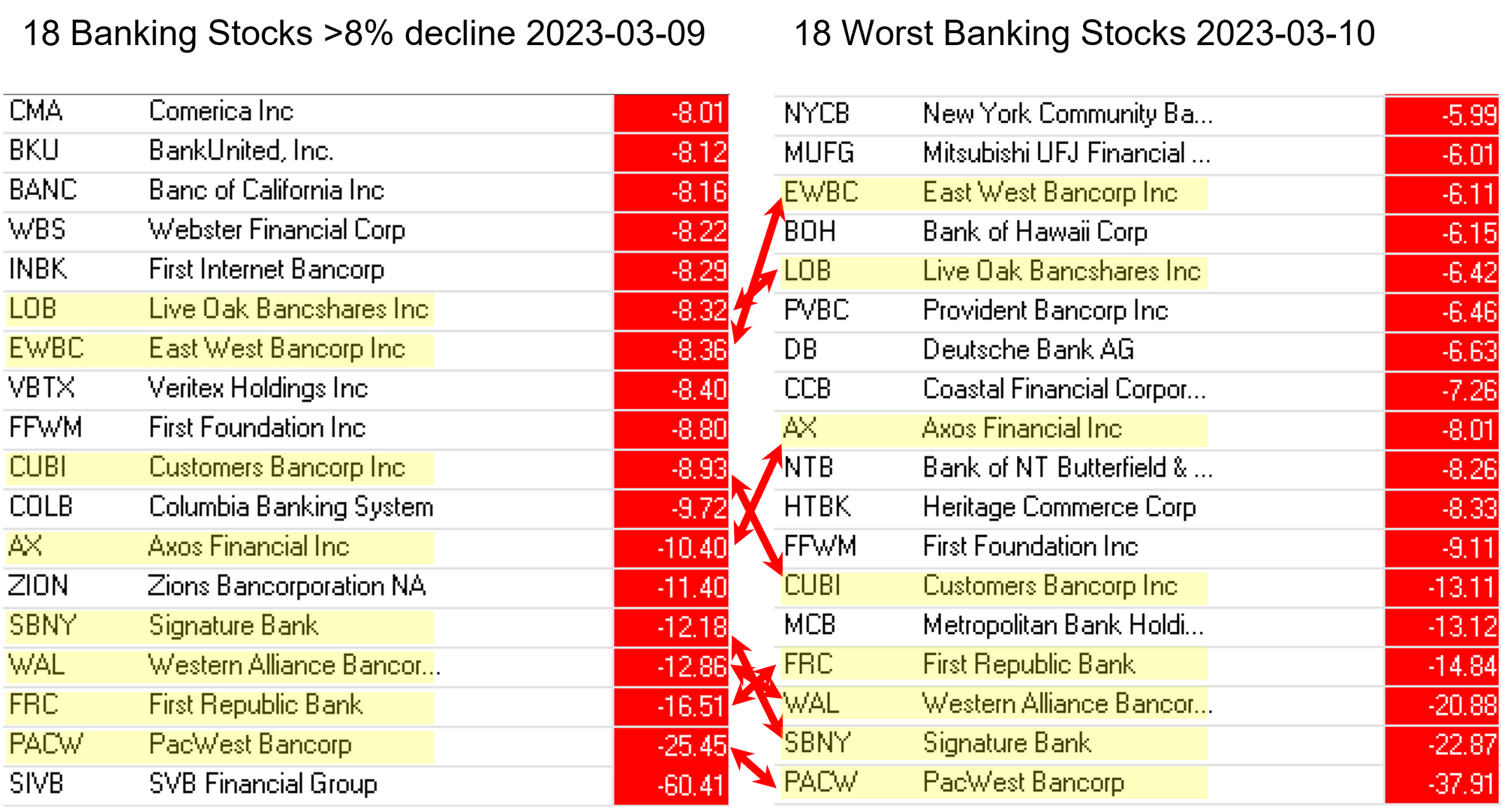

Here are the worst performing 18 banking stocks yesterday and today (excludes the smallest caps):

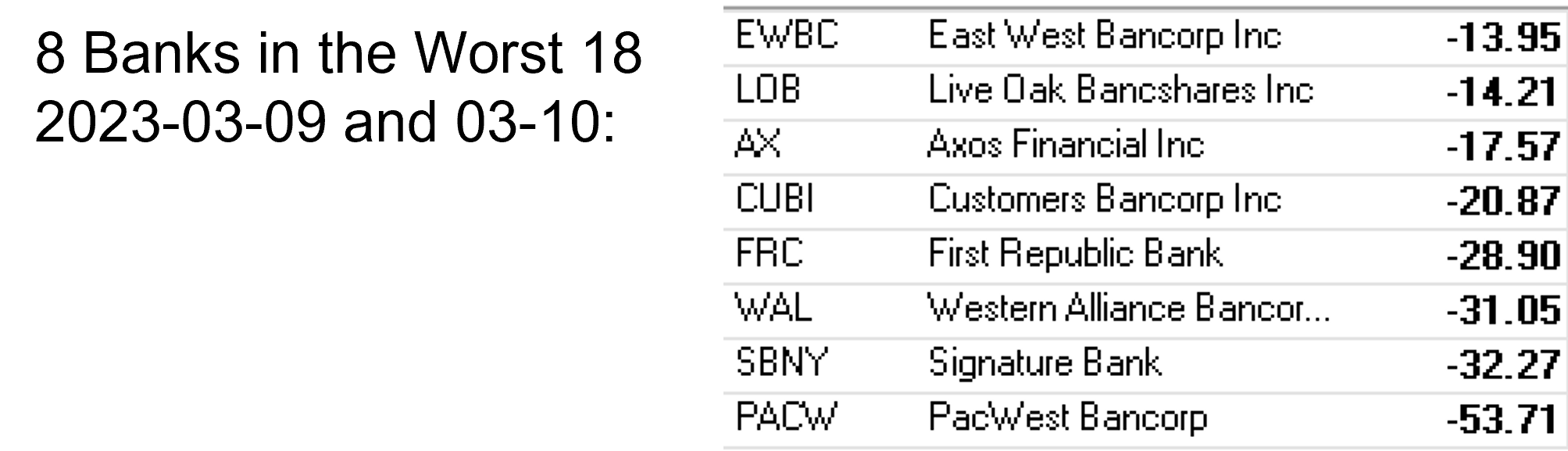

Let's look through the Stock Market Organizer lens at these 8 over the past week ended 3/10/23.

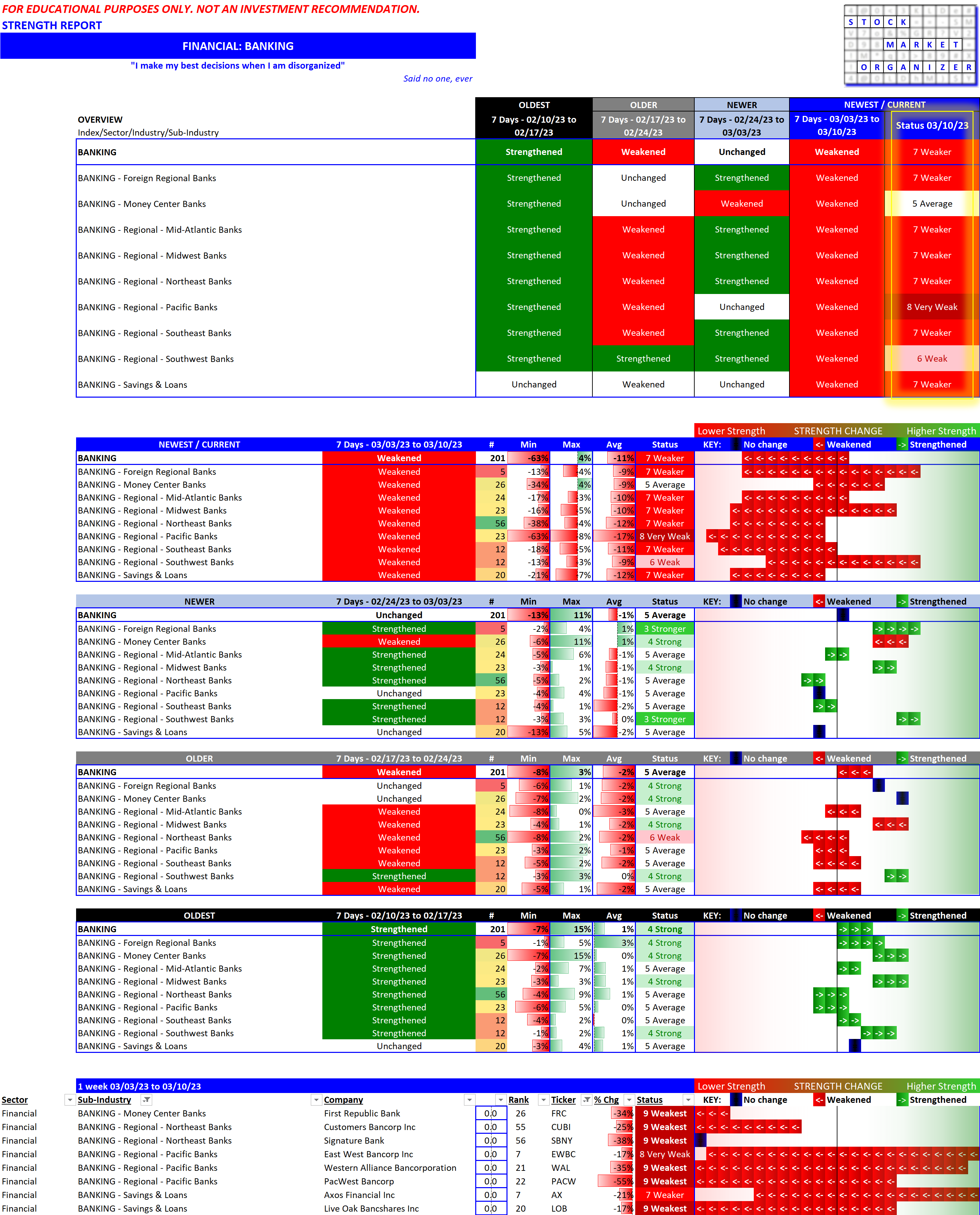

- Significant weakening for all sub-industries.

- Money Center banks are the (comparatively) strongest, Pacific Banks are the weakest.

- Of the 8, six now have the weakest ranking (First Republic Bank/FRC, a money center bank; Customer Bancorp/CUBI and Signature Bank/SBNY, both Northeast banks; Pacwest Bancorp/PACW, and Western Alliance Bancorporation/WAL, both Pacific banks; and Live Oak Bancshares/LOB, an S&L).

What next?

As always I have no idea and make no predictions. I simply measure current strengthening/weakening and put this into context for stocks, sub-industries, and industries. From my market experience, the harder the fall the worse the damage to a stock. The market is NOT dumb and while emotional overreactions do happen and provide opportunities for short-term holders (do NOT marry a stock you should just date), directionally the market usually has it right.

The above word salad means I believe the stocks that were rated weakest or have fallen to the weakest rating have done so for reasons that may or may not be evident to you or me.

By the time I find out, if ever, there will be other influences taking precedence.

A more practical basis for next steps is to think of someone falling down stairs. Fall two steps, no big deal. Fall two flights, there will be major damage and the recovery will be longer. Perhaps much longer.

In this case, stocks that have fallen to the weakest rating now have not only prospectively fundamental issues that caused them to be weak in the first place, they also have many owners who will be happy to get out at break-even. So even if/when the now very-weak stock recovers, there will be owners looking for opportunities to exit, forgetting about dreams of four-baggers and happy simply to not book a loss.

So the answer to "what next" is...?

Ideally, if you were an owner of any of the now very weak stocks, you had sell stops in place and had the discipline to follow them if triggered. If not, then your ownership thesis remains intact and you'll continue to hold until your pre-determined "uncle!" price is triggered. Or better yet, the stock recovers and you ultimately end up with your dreamed-of four-bagger.

If you don't own these stocks and you have dry powder, it's better to look elsewhere in the market, where there are strong stocks enjoying the uplift from strengthening sub-industries and industries.

If you have no dry powder, just keep appropriately monitoring your current holdings, managing them per your pre-set position management rules.