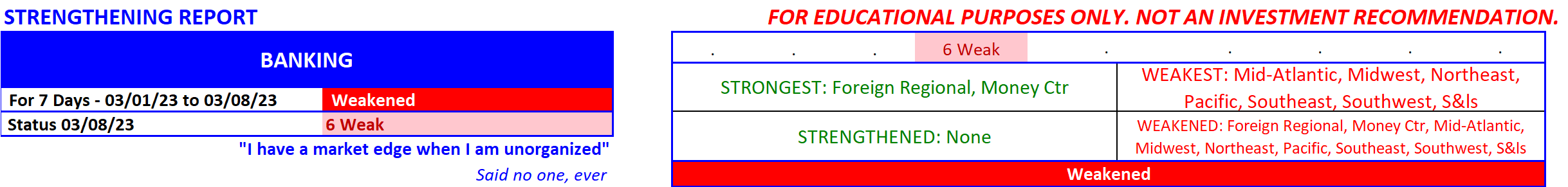

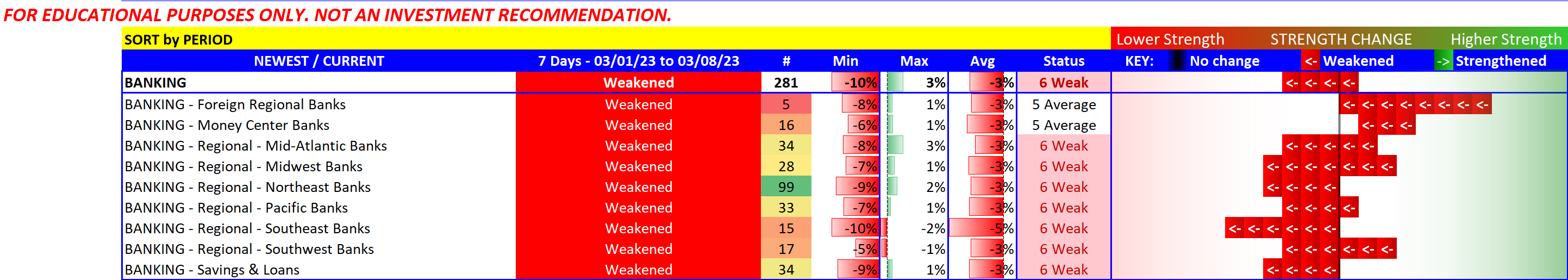

Banking strength status as of 2023-03-08? (Pre-carnage, for context)

Did you know ALL Banking sub-industries weakened the week ending 3/8/23 - the cusp of the subsequent carnage? And, today's ratio of 2:253 strongest vs. weakest Banking stocks (see this post for more detail) is well below the 37:82 ratio on 3/8/23. Could we be at a low with today's unbalanced ratio?

I'd prefer to see strengthening first. Rallies of significance last more than one week. And you don't get to a two-month rally without going first through a one-week rally. This is worth repeating:

After all, the one weakening week ending 3/8/23 led to two weakening weeks, then three… Conversely, one strengthening week may lead to two strengthening weeks, then three…

And you won’t be aware of this unless you are looking for it.

(Generally, if you are looking for the value stock with the greatest margin of safety, you won't be looking for market strength. Yet, it is certainly a huge and direct influence on stock prices - to wit, the massive market decline which took down 95%+ of all stocks, regardless of value or growth, from February 19 through March 23, 2020.)

Downloadable File - showing strong and weak stocks

Per above, as of 3/8/23 the ratio of strong to weak stocks was 37:82, a far cry from today's (5/10/23) ratio of 2:253. Details are in the linked document below.