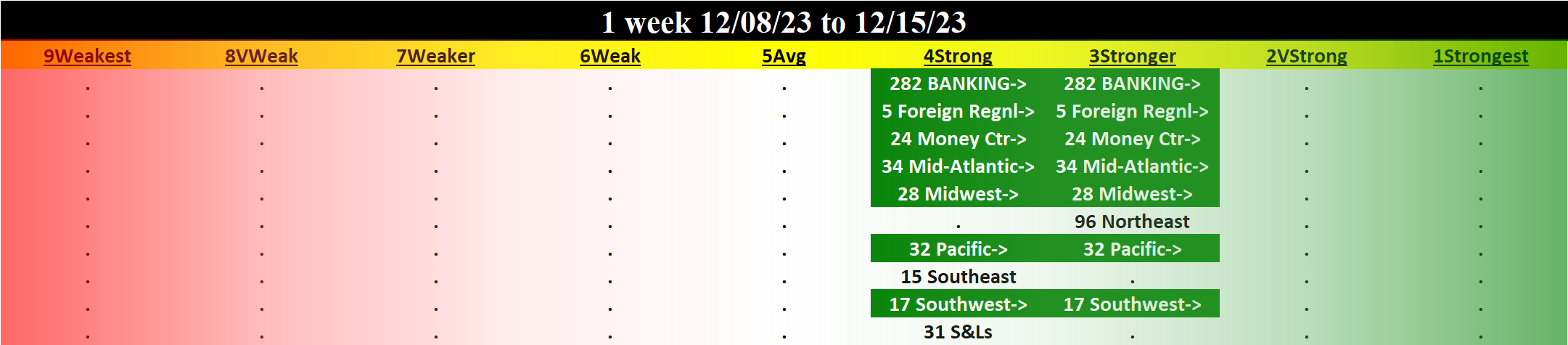

Banking 2023-12-15: UP +1 to STRONGER strength rating (3rd strongest of 9 levels), previous move was also UP

Banking is the Shohei Ohtani of the market - crushing it. 1 month 72% stocks >10%/1 week 96% positive stocks, 30:1 Strongest:Weakest stocks.

Full details at downloadable file linked below.

What are you seeing here and why do you care? Partial listing:

🔹 An objective measurement of industry strengthening and weakening so you can objectively compare strength and weakness across/within industries and sub-industries.

🔹 A listing of stocks rated Strongest and Weakest (highest/lowest strength of 9 levels) by sub-industry, saving you significant time finding stocks that may be prone to making bigger moves faster. Stronger stocks have less overhead resistance, Weaker stocks are prone to “pops” from bargain hunting and short-covering yet due to preceding weakness are also prone to falling far and fast.

Details

🔹 30% Strongest Stocks, 1% Weakest Stocks.

🔹 Mixed/WEAKENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is LOWER than 4 weeks but HIGHER than 3 Months (96%/98%/95% positive)

🔹 Sub-industry Overview:

STRONGEST at Stronger rating/3rd strongest of 9 levels:

- Foreign Regional Banks (5 stocks)

- Money Center Banks (24 stocks)

- Regional - Mid-Atlantic Banks (34 stocks)

- Regional - Midwest Banks (28 stocks)

- Regional - Northeast Banks (96 stocks)

- Regional - Pacific Banks (32 stocks)

WEAKEST at Strong rating/4th strongest of 9 levels:

- Regional - Southeast Banks (15 stocks)

- Savings & Loans (31 stocks)

🔹 Lookback Periods Comparison:

3 Months: 49% stocks >+20% and 0% stocks <-20%.

___UP most:

AROW +58% (Northeast)

CUBI +55% (Northeast)

GBCI +51% (Pacific)

AMAL +47% (Northeast)

MCB +44% (Northeast)

___DOWN most:

IFS -15% (Foreign Regnl)

PWOD -9% (Mid-Atlantic)

BCS -6% (Money Ctr)

NYCB -6% (S&Ls)

NWG -5% (Money Ctr)

4 weeks: 72% stocks >+10% and 0% stocks <-10%.

___UP most:

TBNK +54% (Pacific)

FFWM +47% (Northeast)

HMST +46% (S&Ls)

MCB +40% (Northeast)

ISTR +38% (Northeast)

___DOWN most:

PWOD -2% (Mid-Atlantic)

FCNCA -2% (Mid-Atlantic)

GCBC -1% (S&Ls)

MUFG -1% (Money Ctr)

OVBC -1% (Midwest)

1 Week: 20% stocks >+10% and 0% stocks <-10%.

___UP most:

HMST +29% (S&Ls)

NKSH +26% (Mid-Atlantic)

FFWM +25% (Northeast)

CVLY +24% (Northeast)

MBCN +23% (Northeast)

___DOWN most:

LARK -4% (Southwest)

MUFG -4% (Money Ctr)

SAN -2% (Money Ctr)

BFC -1% (Northeast)

FCNCA -1% (Mid-Atlantic)