Banking 2023-09-15: Unchanged at WEAKER strength rating (7th strongest of 9 levels), previous move was DOWN

SUMMARY

Performance

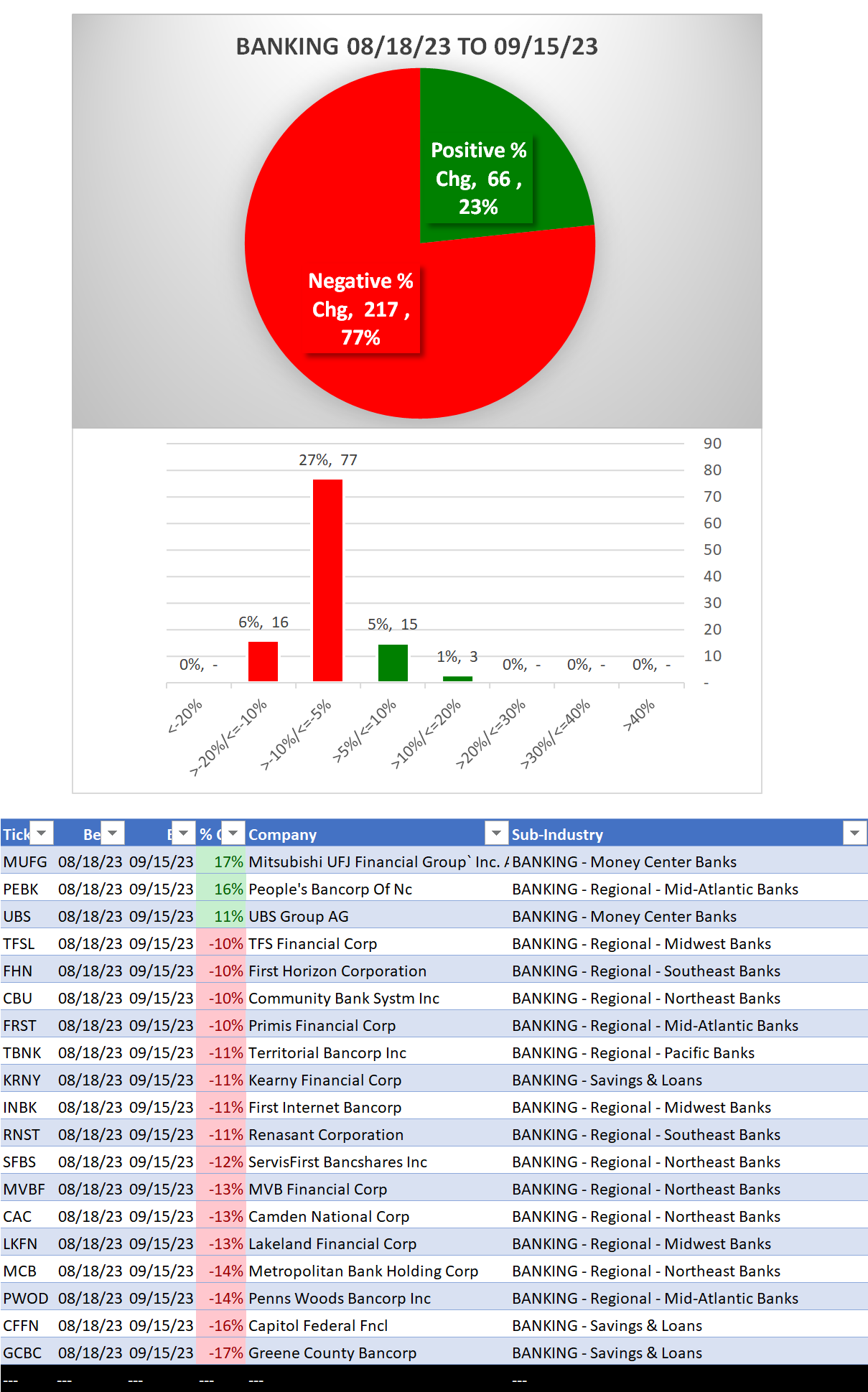

Bottom line: down over the past 5 weeks

Context: slight strengthening recently vs. YTD

- 13% positive stocks YTD

- 23% positive stocks past 4 weeks

Background

Largest of 9 sub-industries (283 stocks total):

- 96 stocks Regional - Northeast Banks

- 34 stocks Regional - Mid-Atlantic Banks

- 33 stocks Regional - Pacific Banks

10 Biggest Market Cap stocks: JPM, BAC, HSBC, WFC, RY, TD, C, MUFG, SAN, BMO

DETAIL: 1 week review, YTD/4 weeks lookbacks

1 Week Review

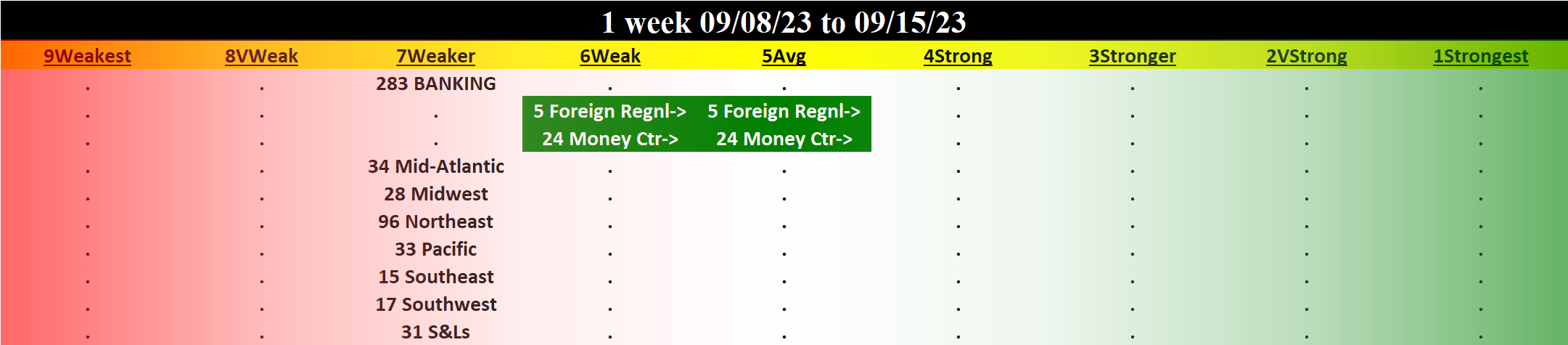

Strengthened: 2/9 sub-industries

Weakened: 0/9 sub-industries

Strongest at Average/5th strongest (of 9 levels) rating: Foreign Regional Banks, Money Center Banks

Weakest at Weaker/7th strongest rating: all others

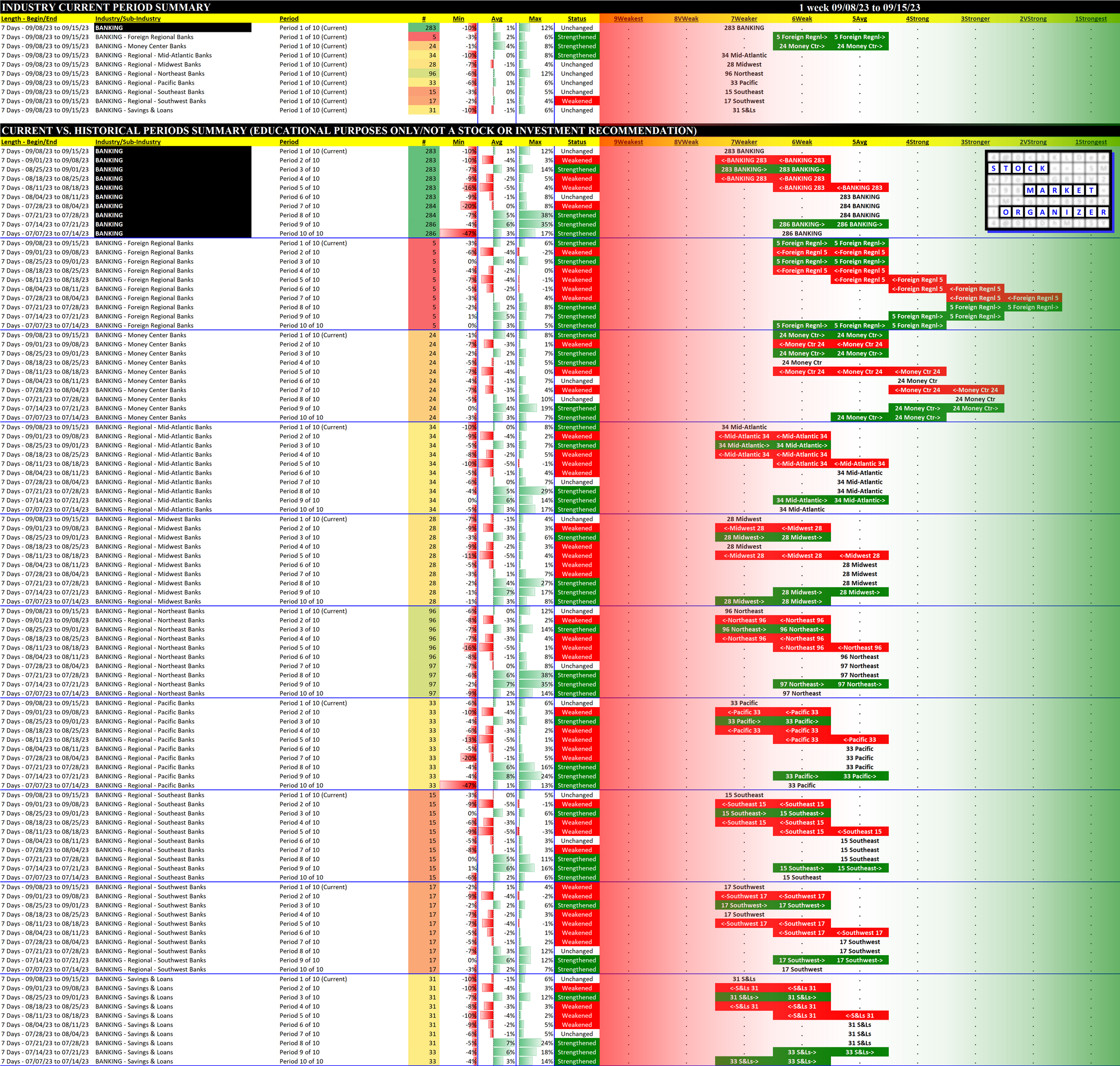

10-Week Week-by-Week Industry/Sub-industry Strength Comparison

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

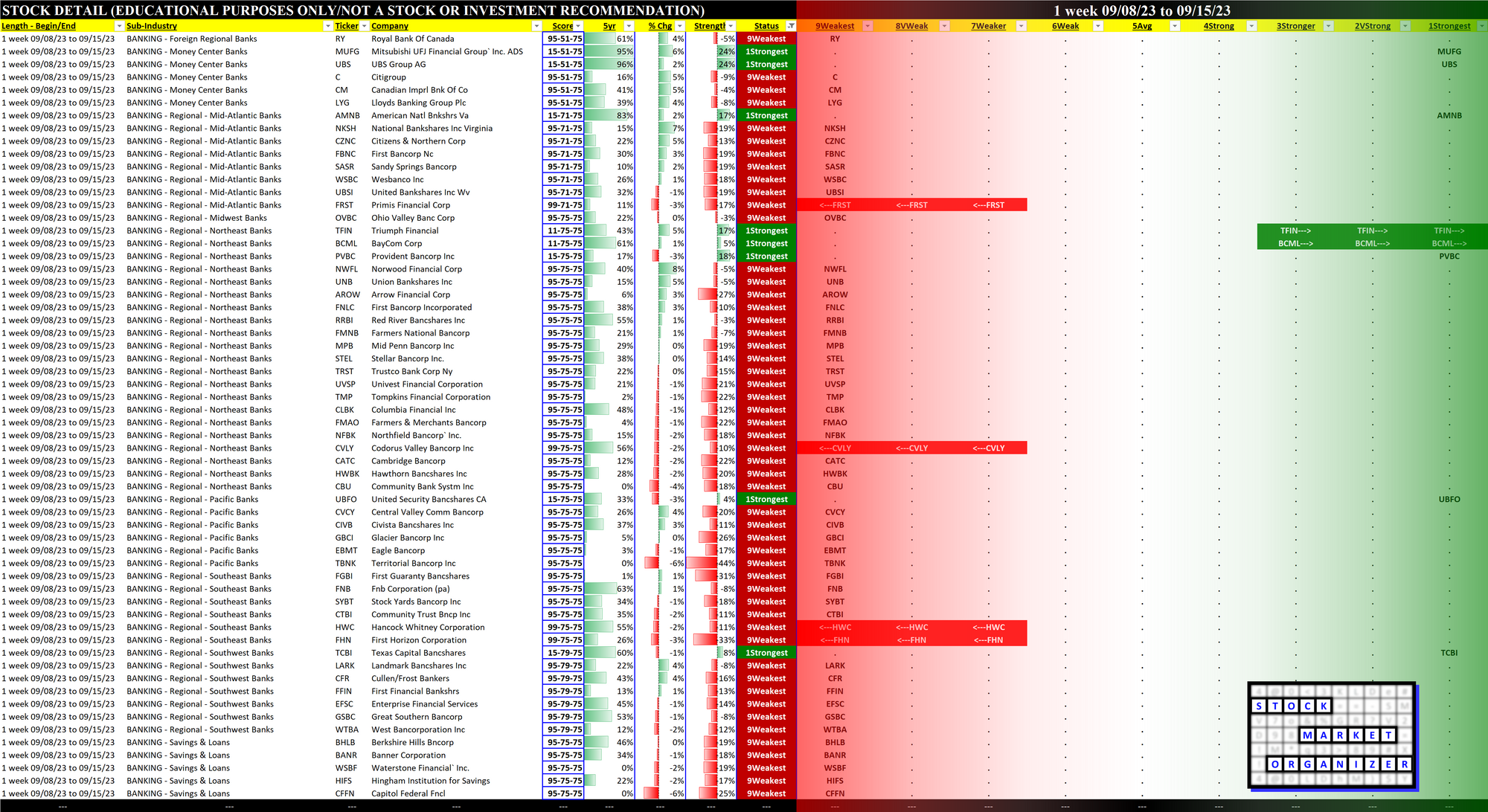

Strongest and Weakest Stocks

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest may be meme-stock mania candidates prone to breakouts, and

- the Weakest may be prone to large bottom-fishing/short-covering-driven pops... and may also be primed for bigger and faster falls. (Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

YTD Lookback

4 Weeks Lookback