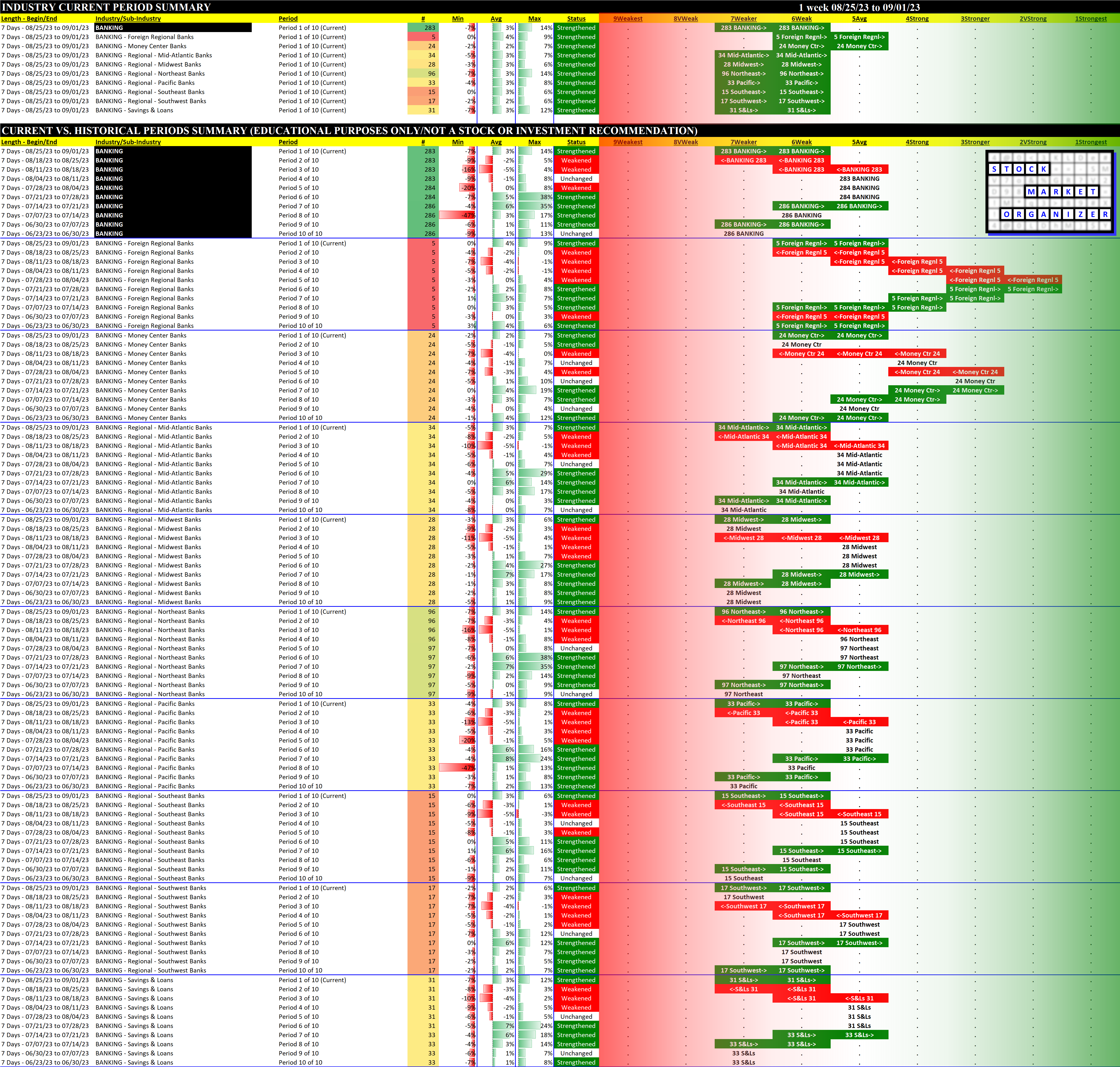

Banking 2023-09-01: +1 to "WEAK" strength rating (6th strongest of 9 levels), previous move was DOWN

All sub-industries strengthened for the trading week ending 9/1/23, a big change from what was described as "... a terrible week for Banking" for the trading week ending 8/18/23. My review of that week is available here.

Note that this was the last week of summer so volume was light. Regardless of what they say, no one has any idea if this is a good or bad thing. With this week being a holiday-shortened week, it is possible not much will happen either way.

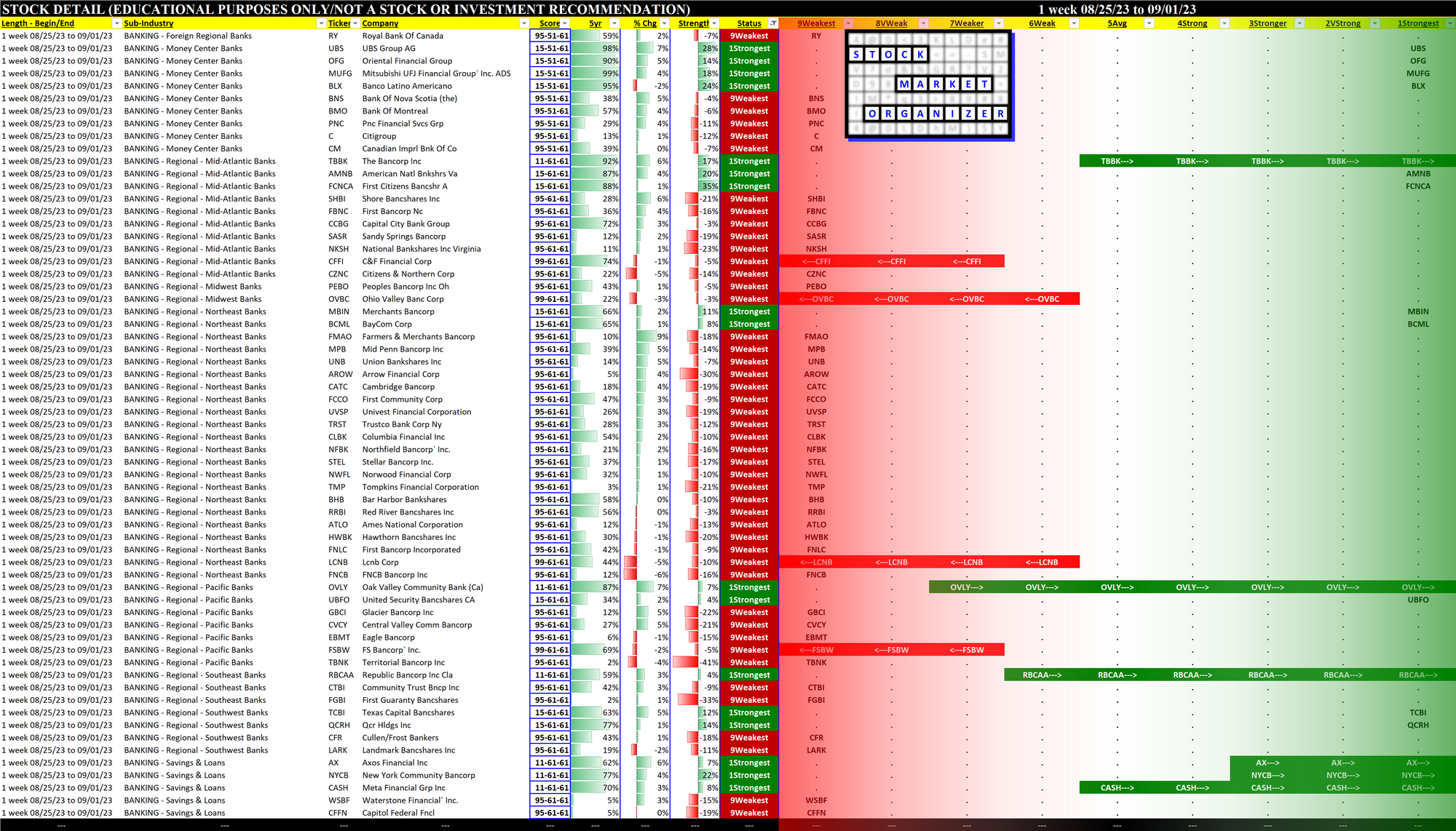

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.