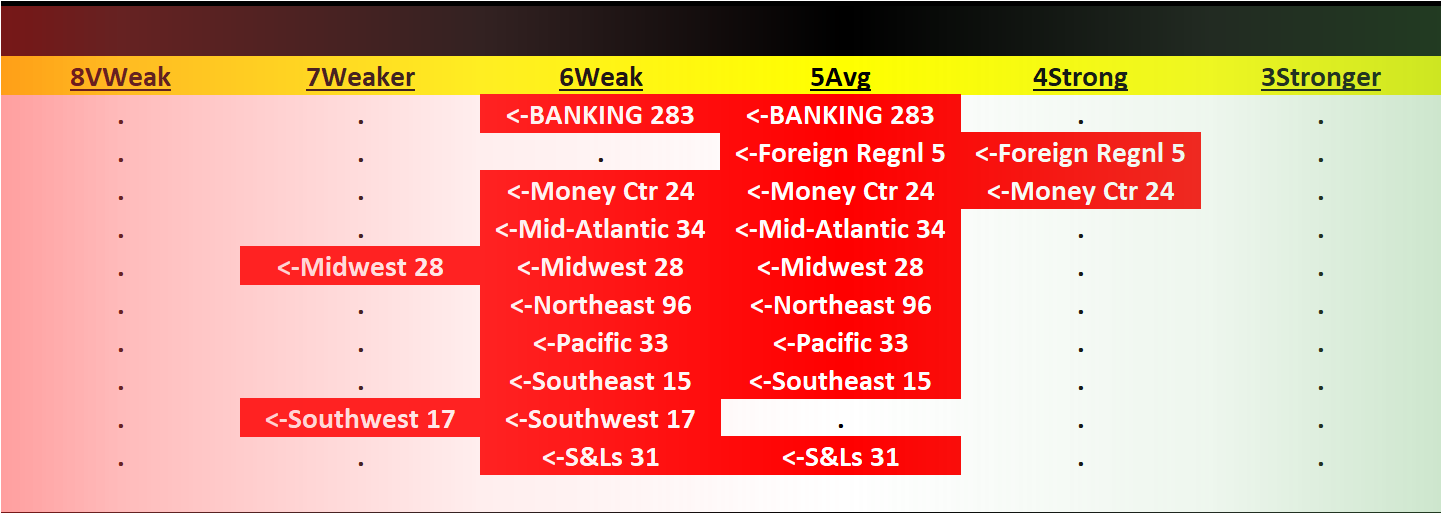

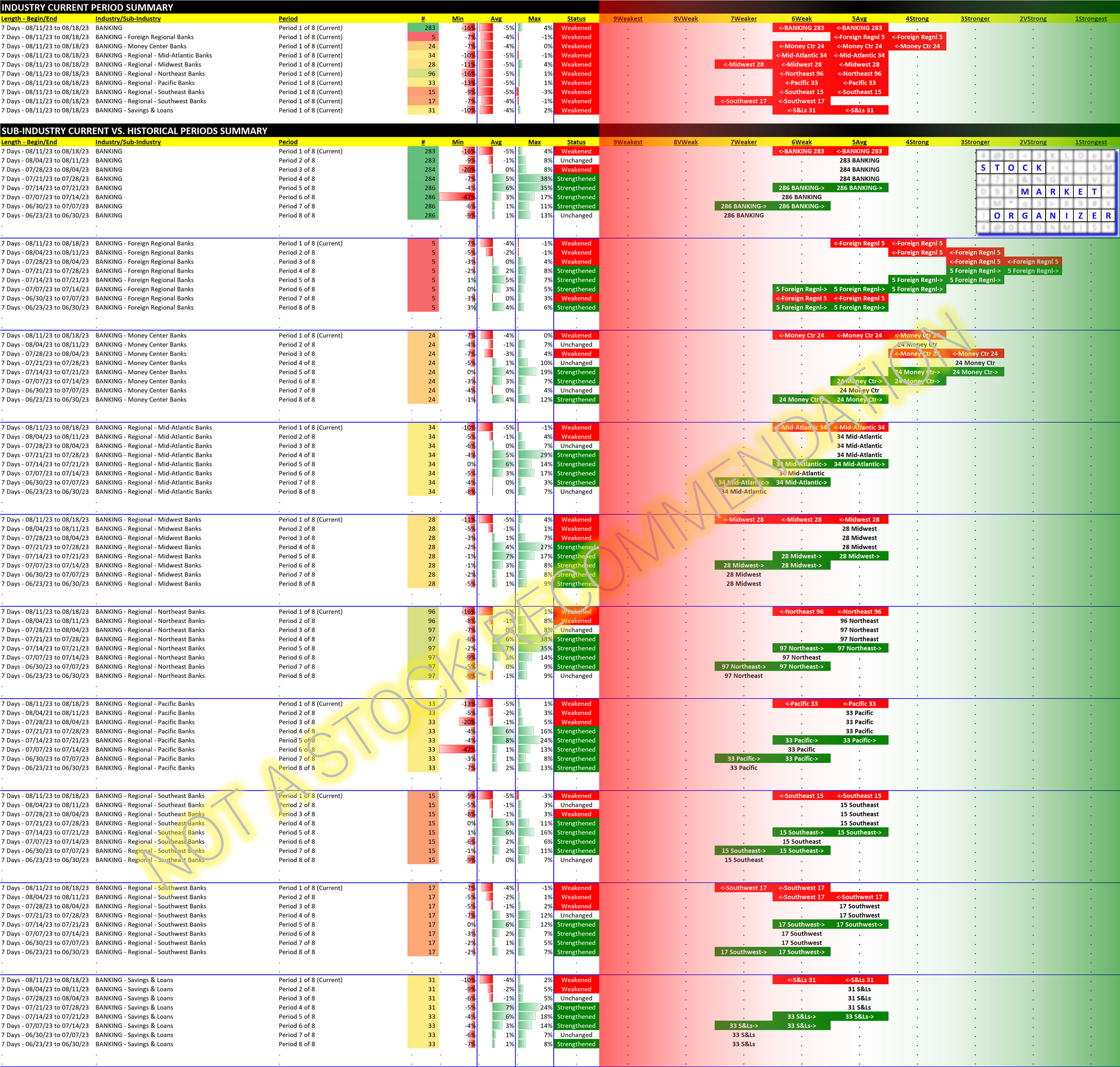

Banking 2023-08-18: -1 to "WEAK" strength rating (6th strongest of 9 levels), previous move was UP

What a terrible week for Banking. Here's my August 4, 2023 review. Things have changed since then.

How bad was it?

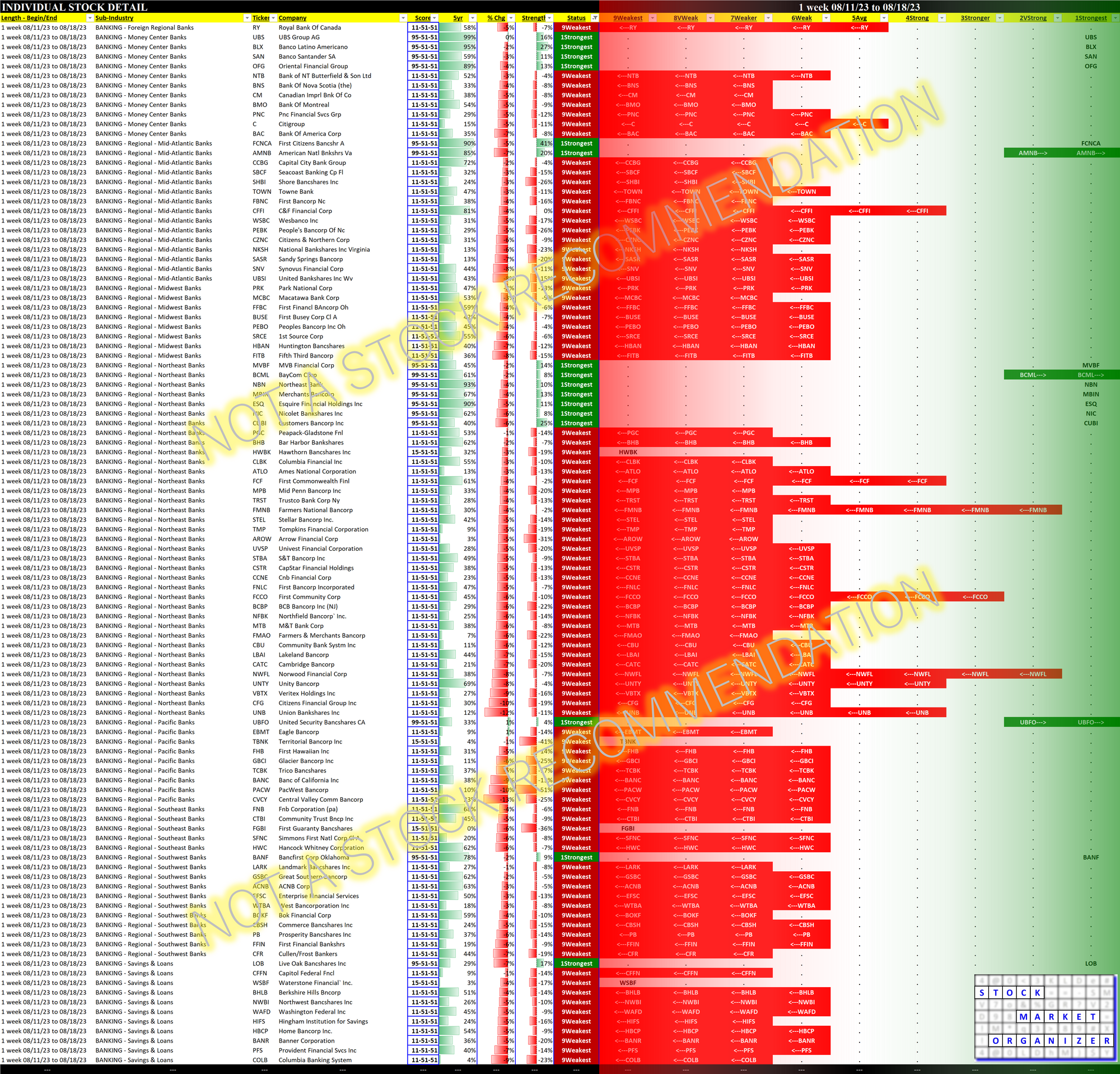

- All sub-industries weakened, with Money Center and Midwest Banks each weakening two levels.

- 19 of 20 Banking stocks fell for the week (270 of 283).

- 129 (close to half) fell more than 5%, including 5 that had double-digit percentage losses (worst: FVCB/FVCBancorp Inc., -16%).

- 92 Banking stocks are rated Weakest (lowest strength rating), up from 8 and 3 (just 2 and 4 weeks ago, respectively), 88 of these new this week.

- Best performer: OVBC/Ohio Valley Banc Corp +4%

Will this continue? Of course I have no idea. This smackdown was broad. Maybe this was a one hit wonder and maybe it is the first step in a multi-week decline. The regional banks had generally been treading water for the past month after strengthening several weeks before that. That all ended this week. (Except for Southwest Banks, which had also weakened last week.)

As stated in previous posts, while these may be setting up for an attractive entry, I would not open any new positions in a weakening sub-industry.

Banking is currently a no-fly zone for new positions.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.