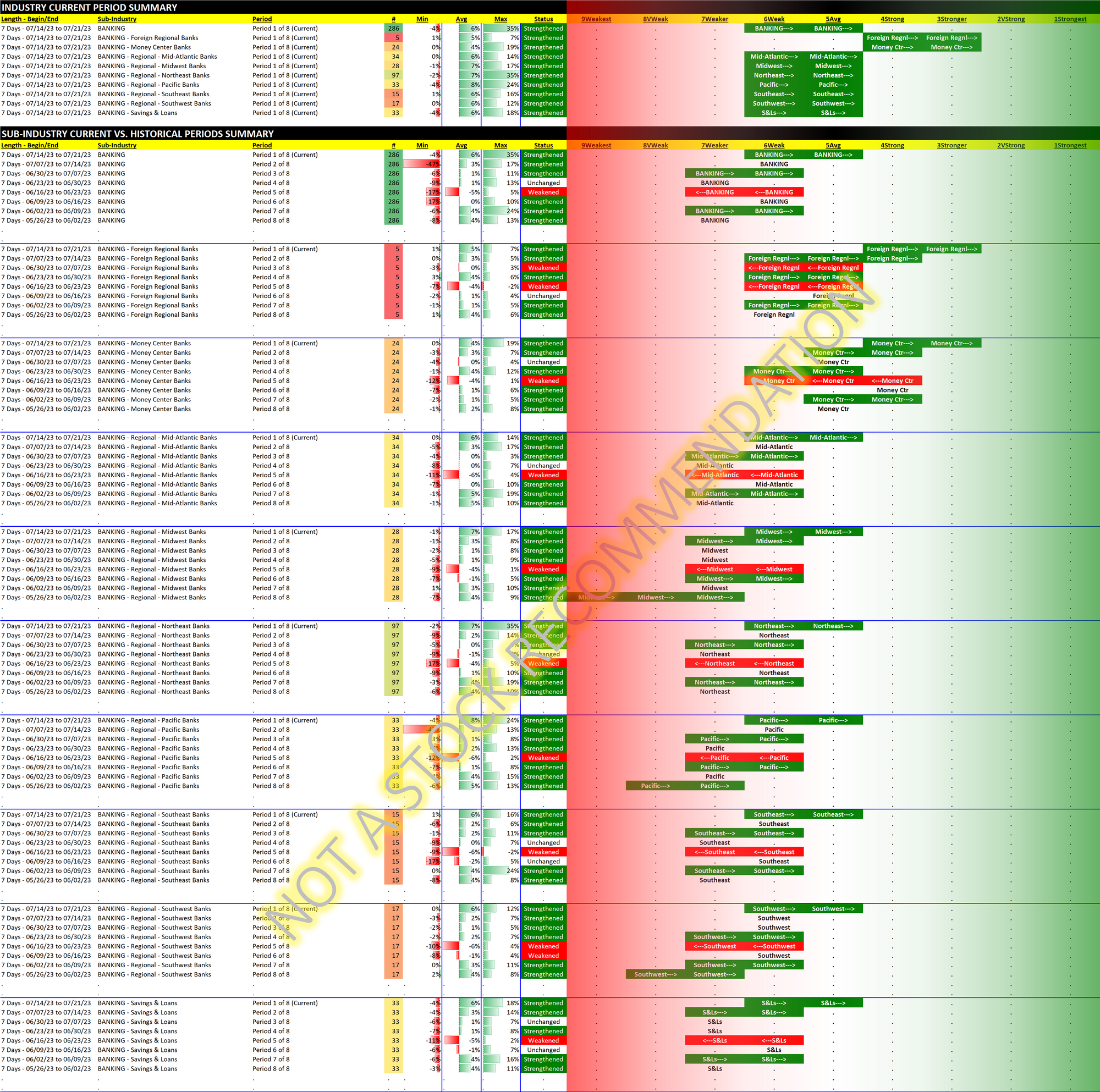

Banking 2023-07-21: +1 to "Average" strength rating (5th strongest of 9 levels), previous move was up

Strengthening throughout Banking for the just-completed trading week. Foreign Regional and Money Center banks leading the charge with Stronger ratings, 3rd strongest of nine levels.

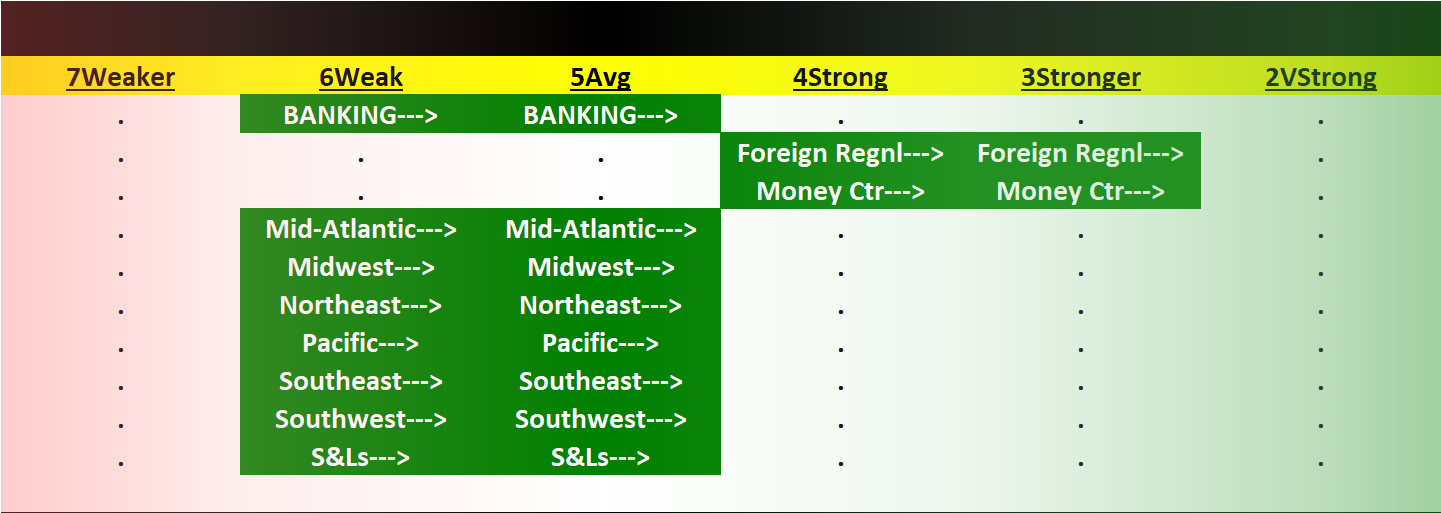

There are six geographic regions into which the country's banks are segregated for this analysis. Is it amazing or expected that all six increased in strength over the past week, and that each strengthened by one level to Average strength (5th strongest of nine levels)? "Birds of a feather" sounds right.

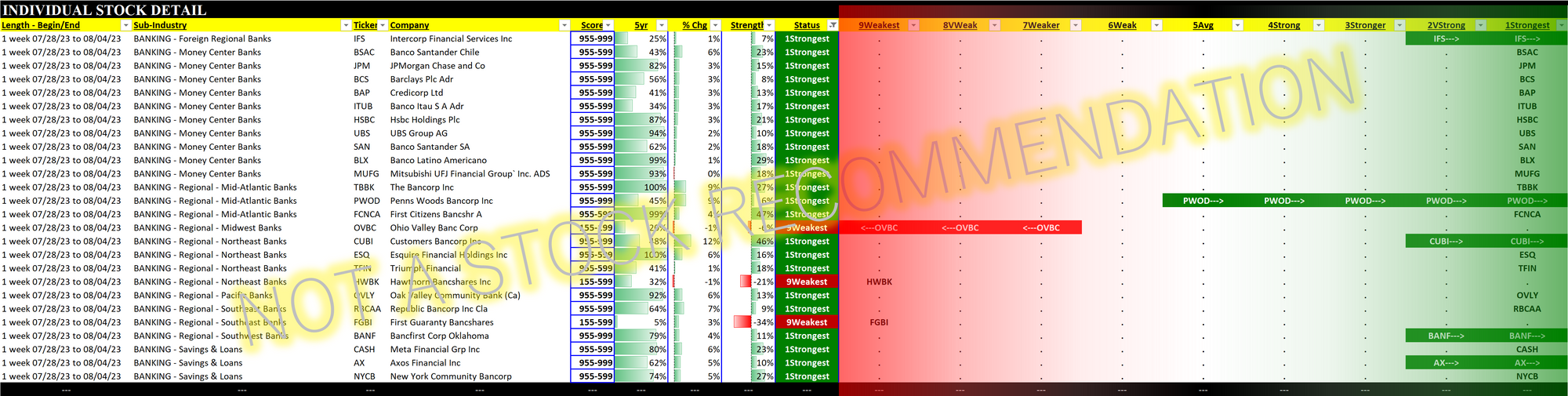

So clear performance differences between Strongest and Weakest stocks (see Leaders and Laggards below) are meaningful. Ideally one's portfolio has all the former and none of the latter.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.