Automotive 2023-09-20: Unchanged at WEAK strength rating (6th strongest of 9 levels), previous move was DOWN

TABLE OF CONTENTS

- INDUSTRY OVERVIEW

1A. Performance

1B. Background - SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

2B. Sub-Industries 10-Week Strengthening Analysis

2C. Stocks 1 Week Strongest and Weakest - STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

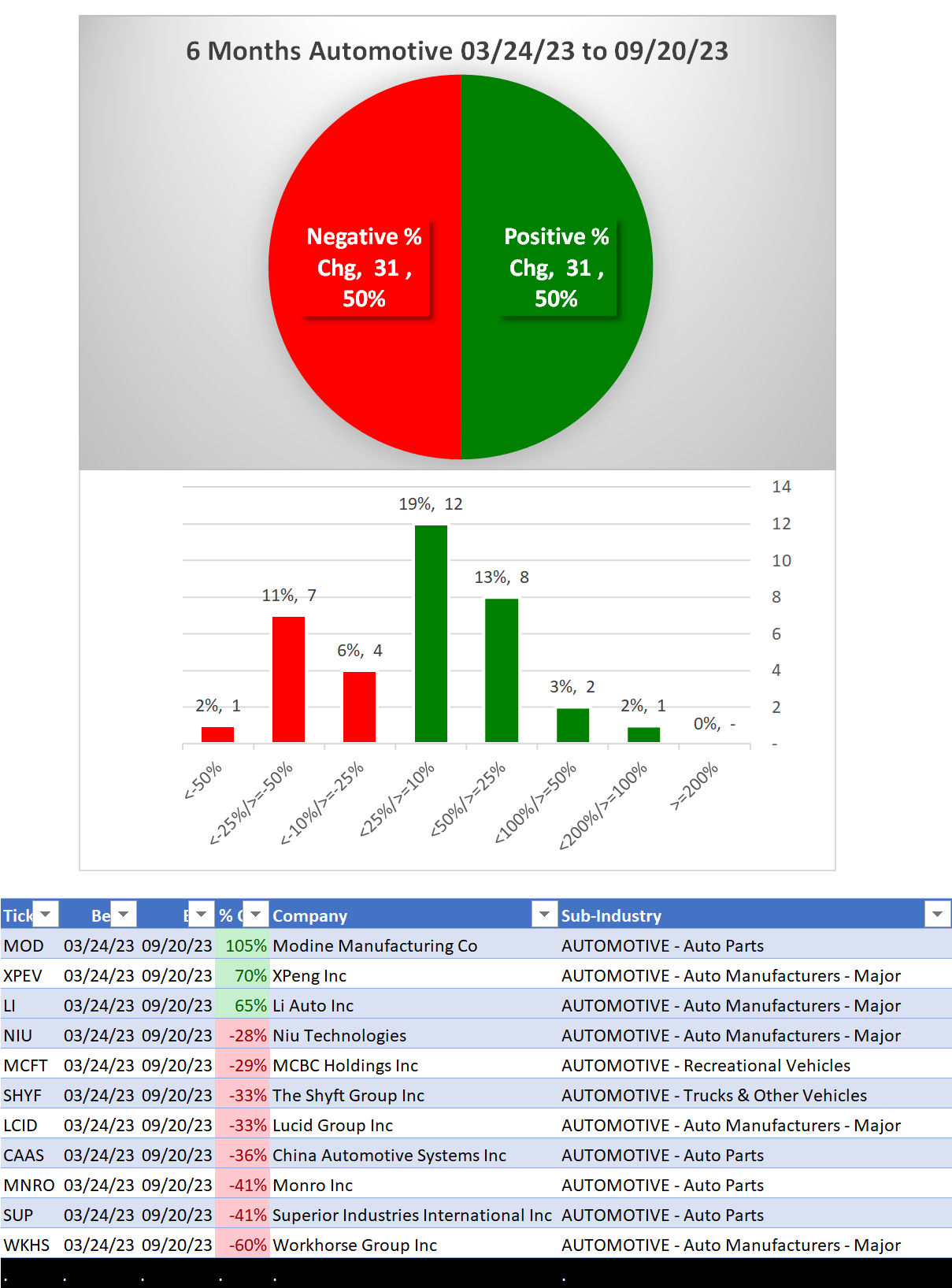

3A. Lookback 6 Months

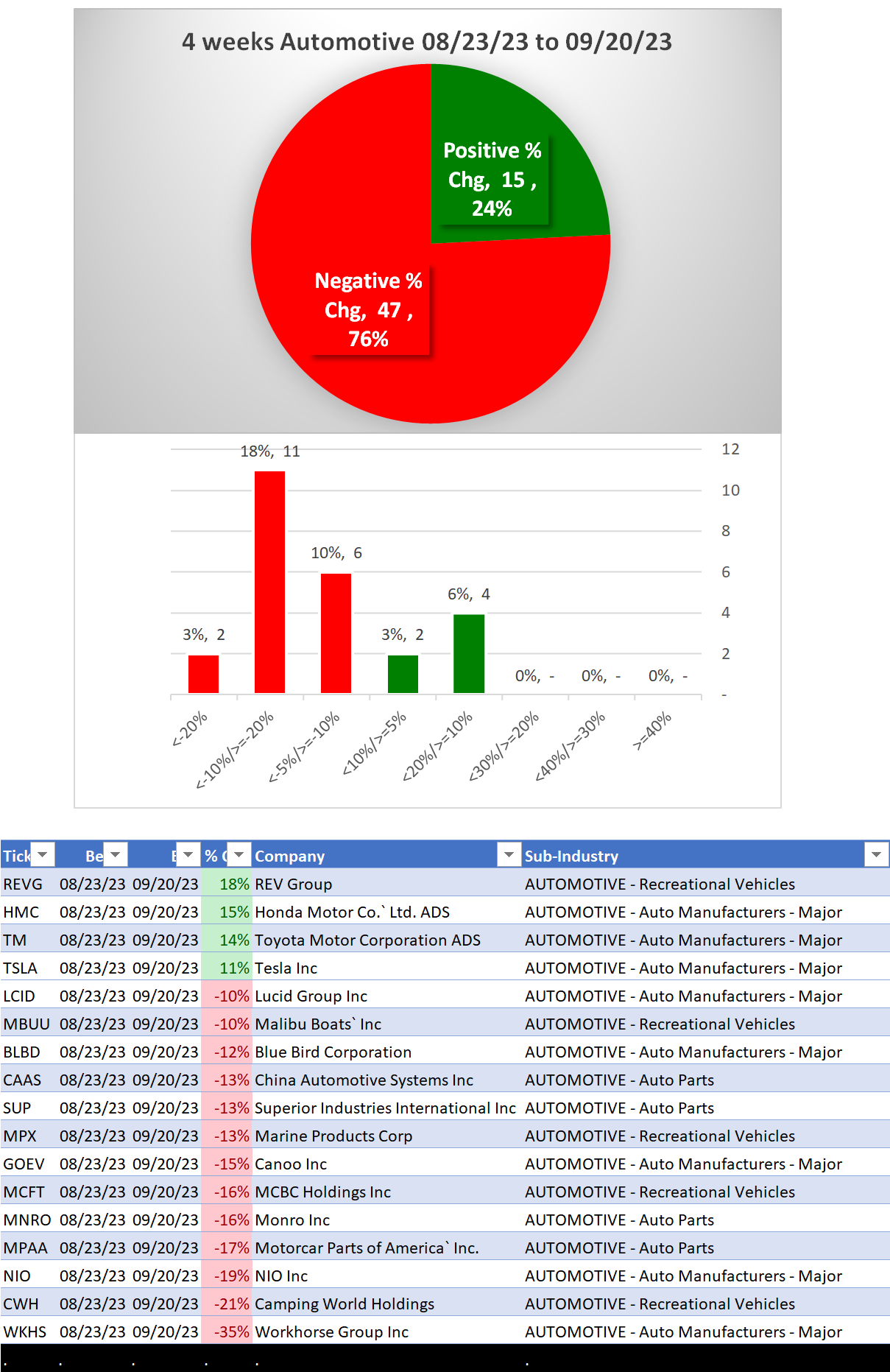

3B. Lookback 4 weeks

3C. Lookback 1 Week

1. INDUSTRY OVERVIEW

1A. Performance

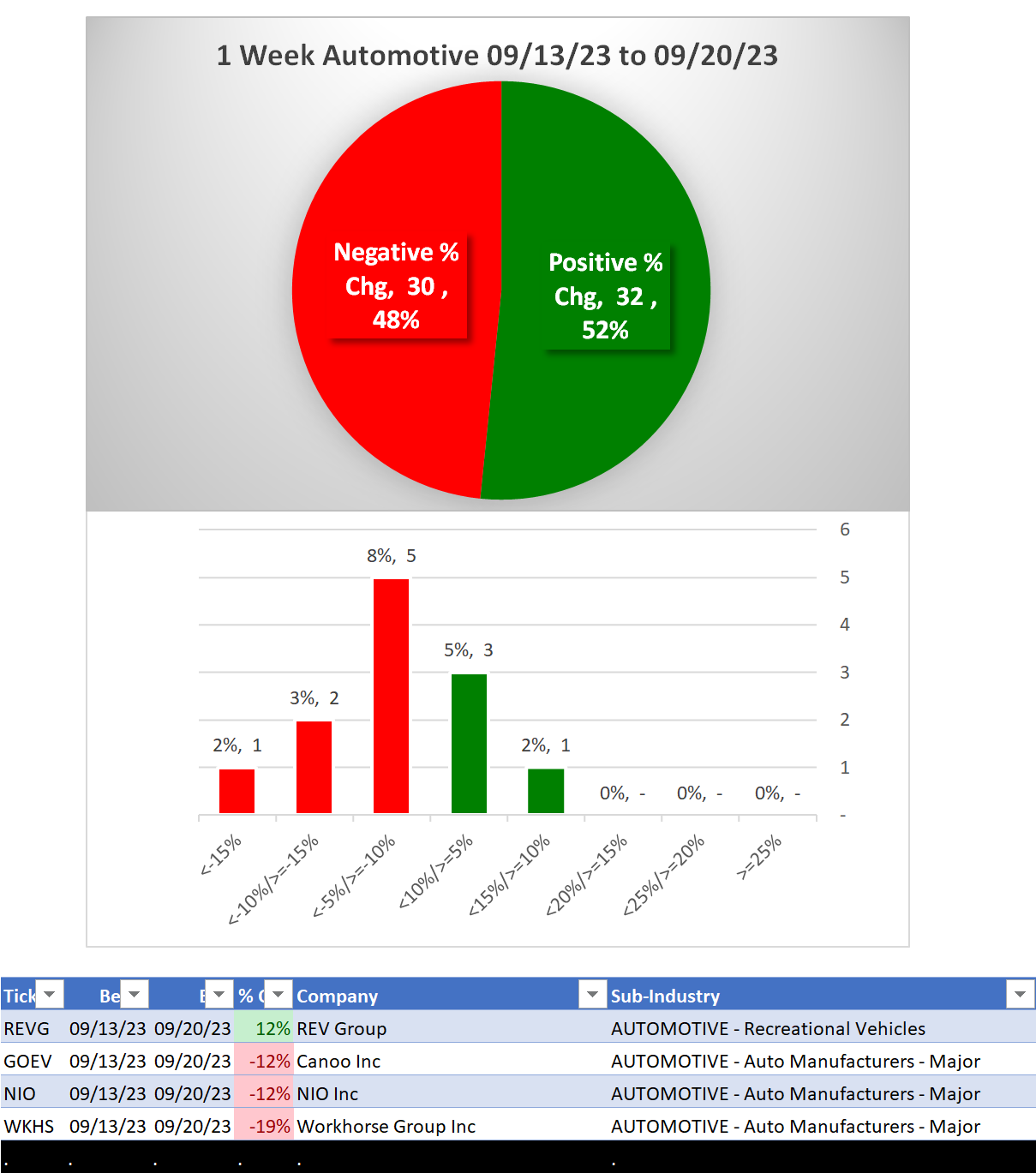

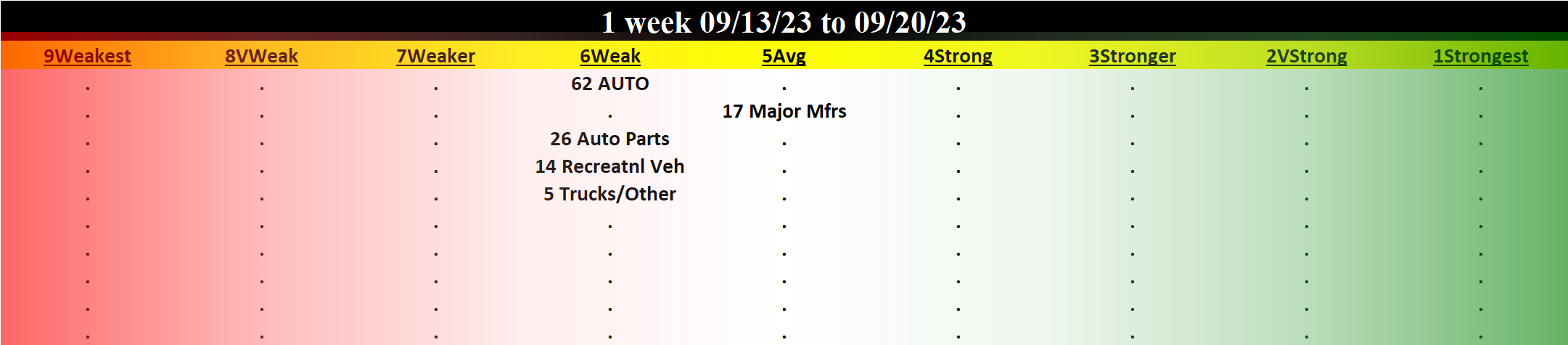

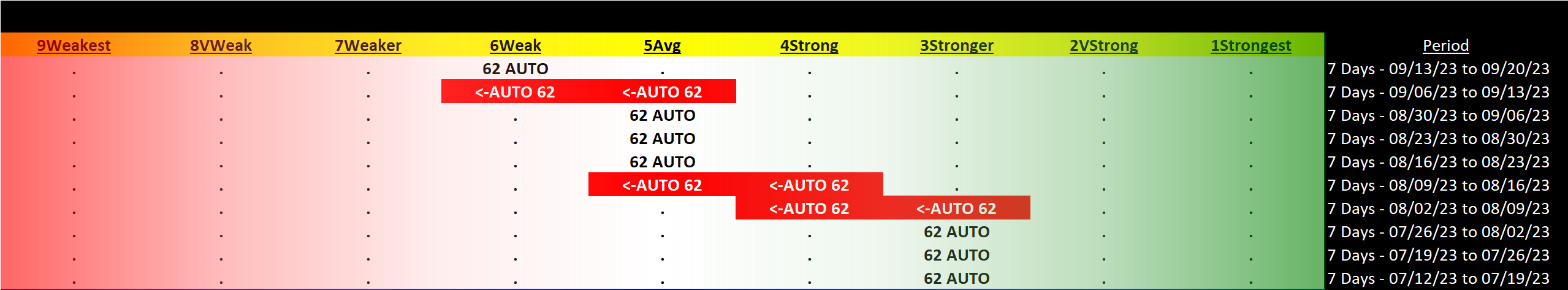

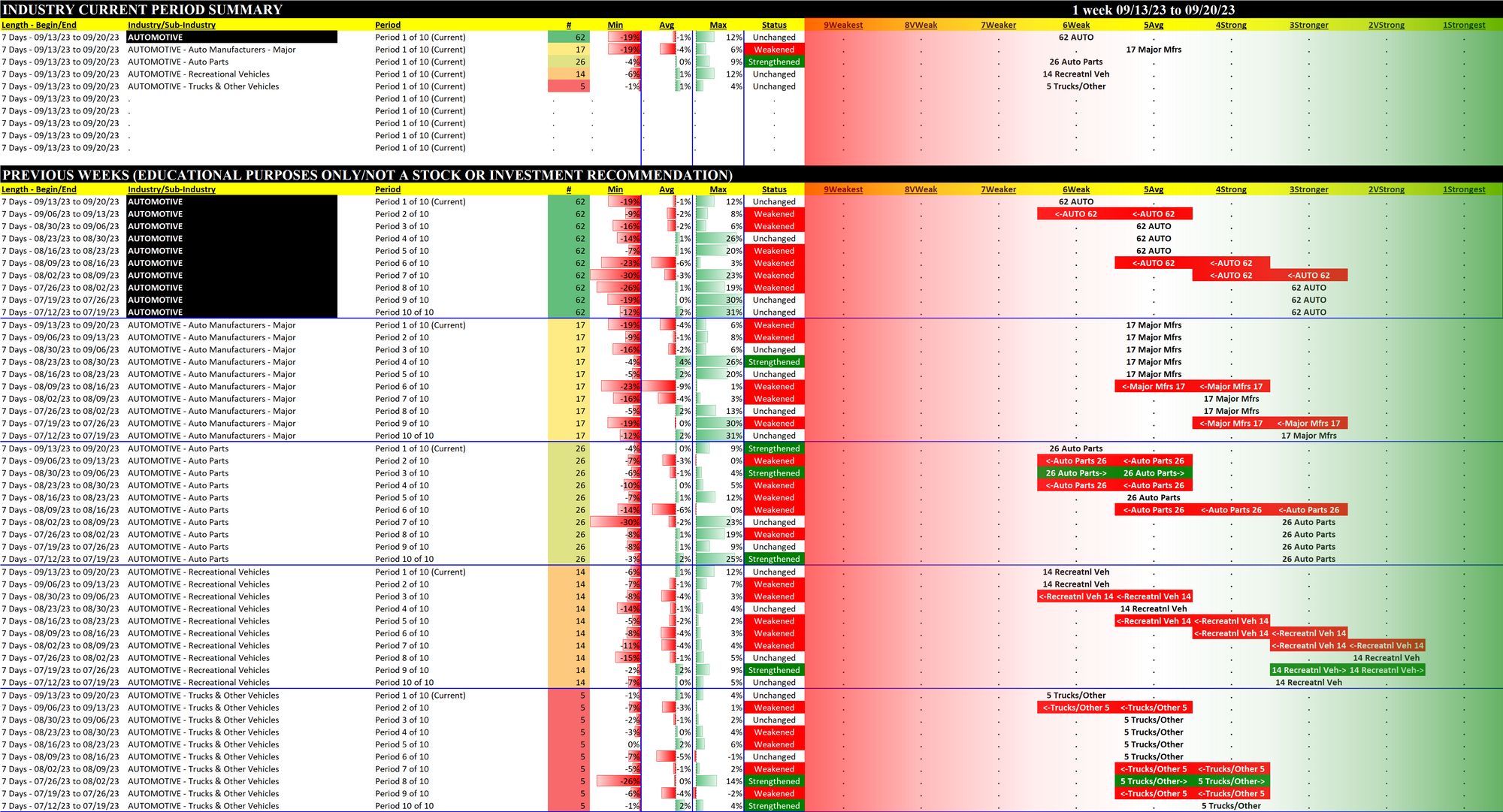

Past 10 Weeks Strengthening/Weakening week-by-week, per the following chart:

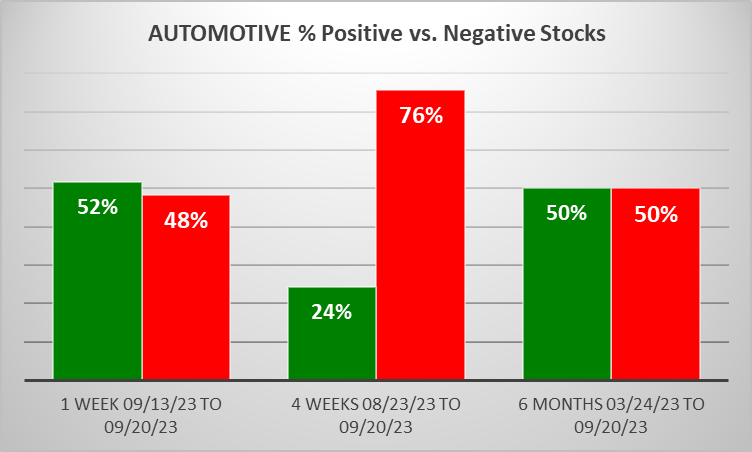

STRENGTHENING 1 Week vs. Mid- and Longer-Term // 1 week positive/negative stocks ratio is HIGHER than both 4 weeks and 6 Months, per the following chart:

Comments:

Stocks with Weakest rating are 32% of total.

1B. Background

Largest of 4 sub-industries (62 stocks, average 16):

- Auto Parts (26 stocks)

- Auto Manufacturers - Major (17 stocks)

- Recreational Vehicles (14 stocks)

Top 10 by Market Capitalization:

TSLA/Tesla Inc, TM/Toyota Motor Corporation ADS, RACE/Ferrari NV, STLA/Stellantis N.V., HMC/Honda Motor Co. Ltd. ADS, F/Ford Motor Co, GM/General Motors Company, PCAR/Paccar Inc, LI/Li Auto Inc, JCI/Johnson Controls Inc

2. SUB-INDUSTRIES AND STOCKS DETAIL

2A. Sub-Industries Overview

Strengthened: 0/4 sub-industries

Weakened: 0/4 sub-industries

STRONGEST at Average rating/5th strongest of 9 levels:

- Auto Manufacturers - Major (17 stocks)

WEAKEST at Weak rating/6th strongest of 9 levels:

- Auto Parts (26 stocks)

- Recreational Vehicles (14 stocks)

- Trucks & Other Vehicles (5 stocks)

2B. Sub-Industries 10-Week Strengthening Analysis

What: recent week-by-week strength changes for the industry and each underlying sub-industry

Why: objective measurement of strengthening and weakening enabling comparison within and across industries and sub-industries

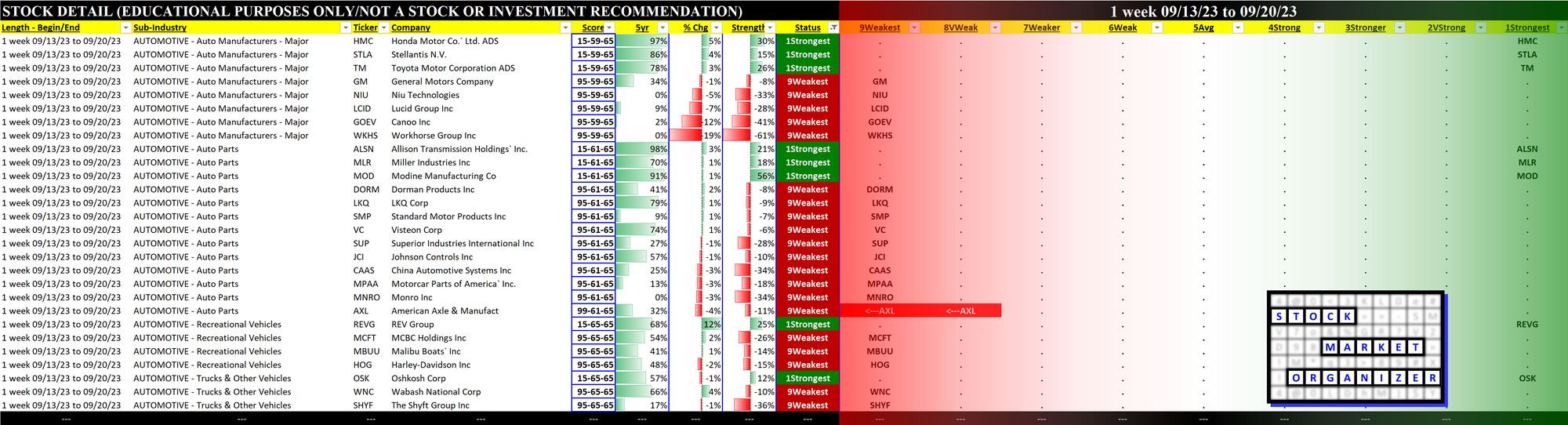

2C. Stocks 1 Week Strongest and Weakest

What: stocks currently rated Strongest/Weakest (highest/lowest of 9 strength ratings)

Why: most interesting stocks for available capital because

- the Strongest have the least amount of overhead supply to dampen breakouts while

- the Weakest may be prone to volatility, subject to big pops from bottom-fishing and short-covering BUT ALSO to bigger and faster falls.

(Not guaranteed and not a recommendation - weak stocks in weakening sub-industries may be better shorts than high-flyers.)

3. STRENGTH BY LOOKBACK PERIOD (with Best/Worst stocks)

3A. Lookback 6 Months

3B. Lookback 4 weeks

3C. Lookback 1 Week