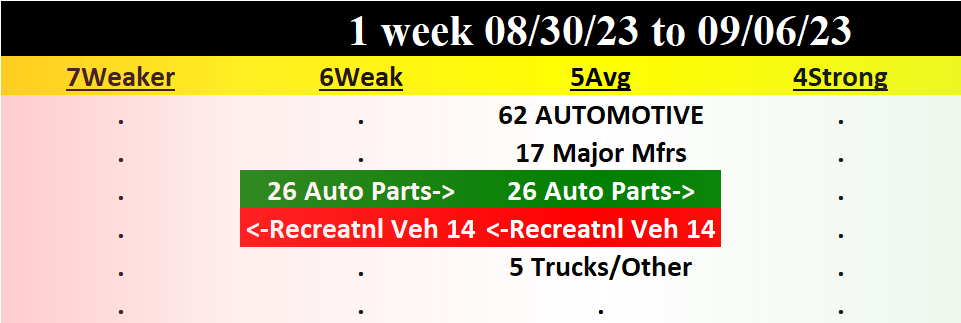

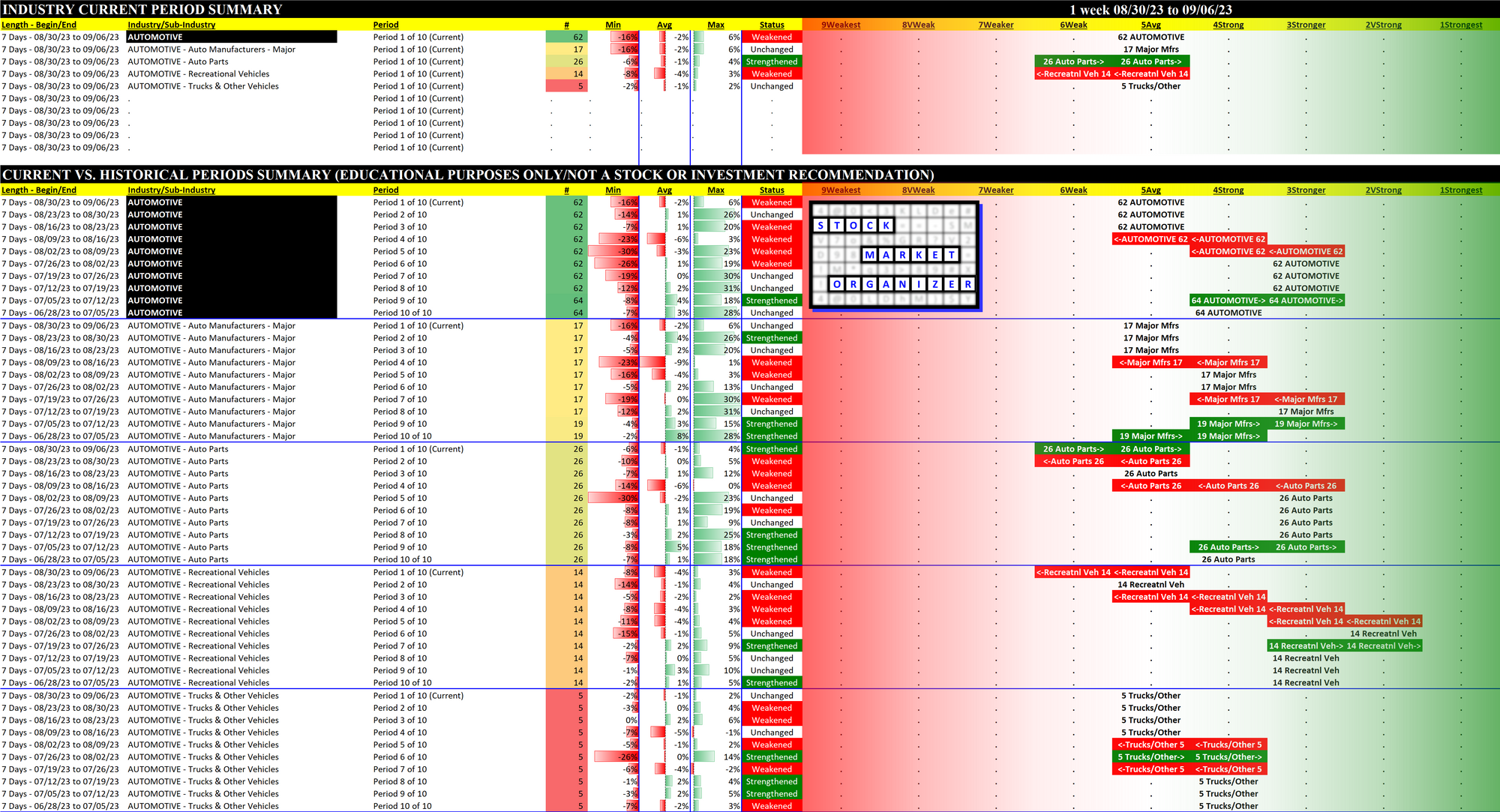

Automotive 2023-09-06: Unchanged at "AVERAGE" strength rating (5th strongest of 9 levels), previous move was DOWN

I haven't reviewed Automotive recently. Here's my July 12, 2023 review.

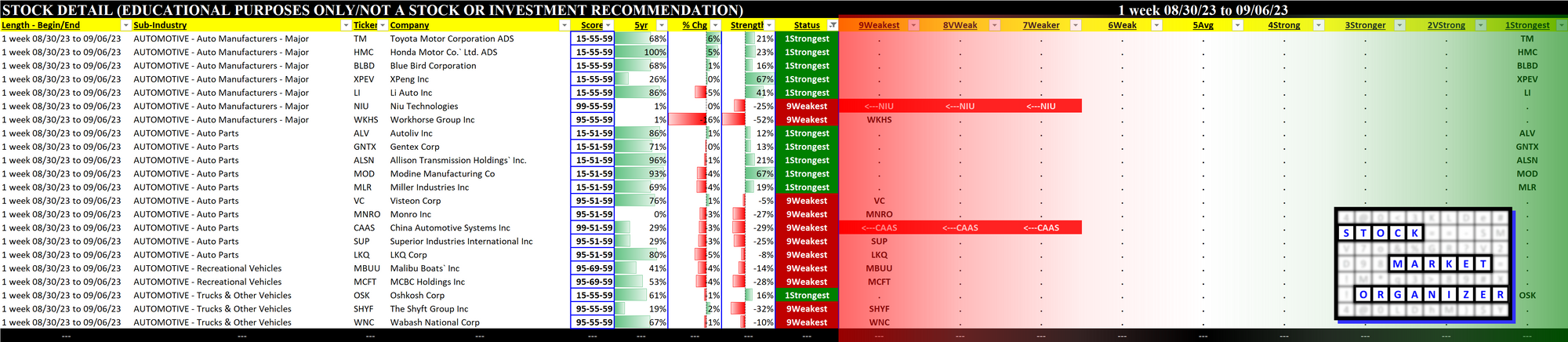

Back then, the industry had a Stronger rating, 3rd strongest of 9 levels. This is a smaller industry, with only four sub-industries and 62 stocks that I cover.

This is the home of TSLA/Tesla, GM/General Motors, F/Ford, and other well-known automotive names.

The 3 other sub-industries are Auto Parts, Recreational Vehicles, and Trucks & Other Vehicles.

For some longer term perspective, here are some YTD 2023 stats:

1. 3 stocks >100% return (MOD/Modine Manufacturing +130%, TSLA/Tesla +105%, BLBD/Bluebird Corporation +104%).

2. 16 stocks (about 1 in 4) have returned between 25% and 100%.

3. 21 stocks (about 1 in 3) are negative this year.

4. The 2 biggest losers are both <$1.00/share, not really worth mentioning, but they are WKHS/Workhorse Group and GOEV/Cahoo Inc. (-57% and -54%).

5. GM is -2% YTD, while F is +4%.

Since the beginning of August, the industry has had its troubles. 17 of 20 stocks are negative since then. Of most interest is TSLA, which is only down 6% during this period but which had to rally +17% from 8/18/23 to get to that point. TSLA was actually -27% from 7/18/23 to 8/18/23.

Leaders and Laggards

Current strongest and weakest stocks are shown below. These are of most interest as the downtrodden are prone to large (if perhaps temporary) pops while the strongest have been leading the charge for their sub-industries.